Bitcoin’s Muted 2025 Christmas: A Reality Check for Crypto Investors

As the Christmas bells chimed in 2025, cryptocurrency investors found Santa’s sack filled with unexpected realities rather than the anticipated festive cheer. In stark contrast to traditional stock markets, where the S&P 500 soared to new year-end highs, Bitcoin (BTC) displayed a notable period of weakness and divergence.

The world’s largest cryptocurrency by market capitalization, Bitcoin, closed Christmas Day 2025 at approximately $87,800, registering a modest 0.75% gain amidst thin trading volumes and prevailing market caution. Its price oscillated within a tight range of $85,000 to $90,000, signaling low volatility. This subdued performance was compounded by significant risk-off sentiment towards year-end, with spot Bitcoin and Ethereum ETFs experiencing hundreds of millions of dollars in outflows on December 24th alone.

This marked the culmination of a challenging year for Bitcoin. Despite a fleeting surge to an all-time high of $126,198 in October, BTC’s price had retreated by approximately 7% from its January 1st level near $92,000.

While Bitcoin’s value remained elevated compared to its cycle lows, the much-hoped-for “Santa Rally” failed to materialize. Instead, the market was digesting a correction following its October peak in the $120,000 range. By December 25th, Bitcoin traded between $87,000 and $96,000, representing a slight year-over-year decrease from Christmas 2024’s $99,000. This period signaled a rare “cooling-off” phase for the volatile asset.

2025 Christmas Market Analysis: From Mania to Pragmatism

The 2025 crypto market showcased an extreme “binary opposition,” particularly evident during the holiday season:

- Bitcoin’s Year-End Fatigue: Bitcoin’s brief breach of the $120,000 mark in October sparked a short-lived frenzy. However, the subsequent “October flash crash” and year-end liquidity tightening pushed prices back below $90,000. Compared to Christmas 2024’s $98,000-$99,000, Bitcoin’s price on Christmas 2025 was actually down year-over-year (YoY). This performance shattered the common belief that the second year after a halving event inevitably brings a major bull market.

- The Great Divide: Infrastructure vs. Tokens: Despite sluggish token prices, mining stocks deeply integrated with computing power and AI (such as IREN, Cipher, and BitMine) bucked the trend and strengthened significantly towards year-end. This indicated a clear shift in capital allocation: investors were “voting with their feet,” favoring “pick-and-shovel stocks” that generate tangible cash flow over purely speculative tokens.

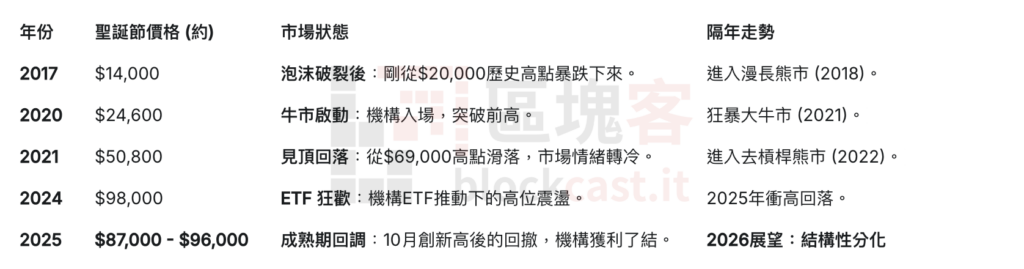

Historical Context: Where Does 2025 Stand?

Bitcoin’s Christmas Day performance has historically been a mixed bag, influenced by factors like year-end tax planning, decreased liquidity, and post-halving cycles. A review of historical data reveals no consistent “Santa Rally” pattern. While Bitcoin showed upward momentum around Christmas in eight of the past ten years (gains between 0.33% and 10.86%), a distinct “Santa Rally” has largely been absent. Nevertheless, Bitcoin’s holiday performance often sets the tone for the coming year.

The trajectory of 2025 bore striking resemblances to 2021 and 2017, characterized not by a crash, but by “high-level consolidation.” Unlike those earlier years, however, 2025 saw no panic selling. Instead, it was dominated by institutional balance sheet adjustments, with funds strategically reallocating from high-volatility crypto assets towards AI and leading US tech giants.

Notably, halving years (2016, 2020, 2024) typically foreshadow strong Christmas rallies, with Bitcoin’s annual average gains exceeding 100% as mining rewards halve and scarcity narratives intensify. In stark contrast, 2025 marked Bitcoin’s worst fourth-quarter performance in seven years, with December alone seeing a 22.54% drop. This year’s Bitcoin price fell 12% from its Christmas 2024 high of $99,299, underscoring a significant cooling-off period. The Fear & Greed Index plummeted to 27, signaling “extreme fear” among retail investors.

The Reality Check: Predictions vs. Performance

From late 2024 to early 2025, a chorus of industry leaders, Wall Street analysts, and crypto key opinion leaders (KOLs) issued highly optimistic price predictions for Bitcoin by the end of 2025. Their hopes were buoyed by anticipated regulatory tailwinds, including SEC reforms, Federal Reserve interest rate cuts, and substantial institutional capital inflows.

However, Bitcoin’s ultimate close near $87,000 rendered most of these forecasts overly optimistic, starkly highlighting the inherent risks of extrapolation in a notoriously volatile market. The prevailing market conditions revealed that most predictions missed the mark, largely due to analysts underestimating the “siphon effect.” In 2025, groundbreaking advancements in AI technology diverted significant capital that might otherwise have flowed into the blockchain sector. When industry titans like NVIDIA and other AI infrastructure stocks offered annual returns of 50%-100%, Bitcoin’s allure as a “high-beta tech stock” significantly diminished.

Christmas 2025 saw Bitcoin neither soar past $200,000 as many extreme bulls had wished, nor crash to zero as bears predicted. We found ourselves in an awkward yet undeniable “middle ground”: hovering around the $90,000 level—a figure that brought comfort to conservatives but disappointment to fervent optimists.

Prominent optimists, including venture capitalist Tim Draper, S2F model creator PlanB, Tom Lee, Robert Kiyosaki, Cathie Wood, Bernstein, and Standard Chartered’s Head of Digital Asset Research Geoff Kendrick, had all projected Bitcoin’s 2025 performance to exceed $150,000. Their collective miscalculation pointed to overly high expectations, largely based on a linear assumption that ETF inflows and halving effects would simply stack up. They critically underestimated the powerful capital-siphoning effect of AI and the mounting stagflationary pressures within the broader macroeconomy.

Why did so many get it wrong? Perhaps, as the saying goes, “Wall Street can’t find new continents with old maps.” Most prediction models, such as S2F and gold market cap ratios, were built on the premise that “Bitcoin is the sole reservoir for capital.” However, the reality of 2025 demonstrated that AI emerged as the new primary reservoir. Capital didn’t vanish; it merely flowed from “virtual currency” to “physical computing power.”

What Should Investors Expect in 2026?

Bitcoin’s subdued Christmas performance in 2025 delivered a clear message to the market: the era of speculative “narrative-driven” crypto is waning, and the “fundamentals era” has arrived.

- Law of Diminishing Returns: Bitcoin is evolving beyond an asset that casually delivers 10x returns. It is maturing into a “digital gold” increasingly tethered to macroeconomic forces. This implies lower volatility but also a reduction in outsized excess returns.

- ETFs: A Double-Edged Sword: While spot ETFs successfully attracted institutional capital, they also inadvertently tethered Bitcoin’s price action to Wall Street’s trading hours and macro-economic logic. During the Christmas period, with US stock markets closed or trading lightly, Bitcoin consequently lost its momentum for independent rallies.

- Seeking New Growth Vectors: The true winners of 2025 were not merely “hodlers” but “builders.” Companies like BitMine and IREN, which strategically pivoted towards AI computing power, saw their stock prices surge. This unequivocally demonstrated that the market’s appetite is for tangible “computing power” rather than just abstract “hash rate.”

This Christmas, Bitcoin didn’t deliver a surprise gift; instead, it offered a sobering health report. For 2026, investors should perhaps abandon the linear, get-rich-quick fantasies perpetuated by models like S2F. The focus should shift towards practical applications that deeply integrate blockchain technology with burgeoning sectors like AI and the energy industry. Bitcoin remains a king, but its stride has become more measured—perhaps even a little slower.

As 2025 concludes, Bitcoin’s holiday stagnation serves as a potent reminder of the asset’s ongoing maturation. It is less influenced by hype-driven frenzies and increasingly grounded in fundamental analysis. Investors looking towards 2026 might discover opportunities in the current undervaluation, but the history of holiday markets cautions against relying solely on festive magic.

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not be held responsible for any direct or indirect losses incurred by investors’ transactions.