Mt. Gox Hacker’s Wallets Spark Multi-Million Dollar Bitcoin Transfers, Reigniting Laundering Fears

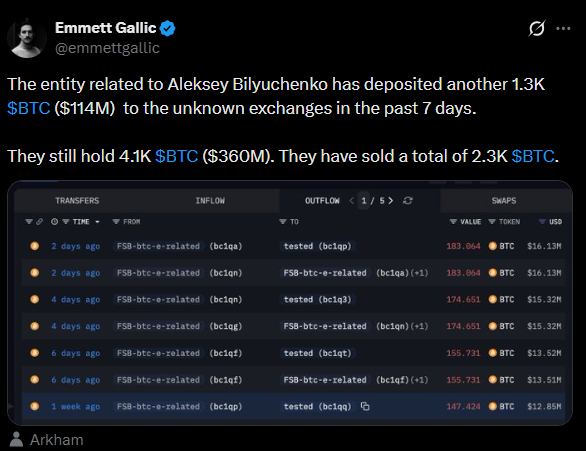

The specter of the infamous Mt. Gox hack has once again cast a long shadow over the cryptocurrency market. Recent on-chain analysis by Arkham reveals that wallets linked to Russian national Aleksey Bilyuchenko, accused by the U.S. Department of Justice of orchestrating the 2011 Mt. Gox breach and stealing an astonishing 647,000 Bitcoin (worth billions today), have recently moved 1,300 BTC – approximately $114 million – to an undisclosed exchange. These wallets reportedly still retain around 4,100 BTC, with a total of 2,300 BTC previously liquidated.

The Ghost of Mt. Gox: A Decade-Old Scandal Resurfaces

This latest activity has reignited profound concerns about potential money laundering stemming from the historic cyberattack that ultimately led to Mt. Gox’s bankruptcy in 2014. Authorities allege that Bilyuchenko, 43, alongside his accomplice Aleksandr Verner, 29, infiltrated Mt. Gox servers between September 2011 and May 2014. Their alleged scheme involved siphoning customer funds and subsequently laundering them through a network of controlled exchanges, including BTC-e, which they reportedly operated with Alexander Vinnik until its shutdown by authorities in 2017.

The Mt. Gox hack remains one of the cryptocurrency industry’s most significant scandals, a stark reminder of the extreme vulnerabilities prevalent in early trading platforms. Once handling 70% of global Bitcoin transactions, Mt. Gox’s repeated breaches exposed critical flaws. Prosecutors claim Bilyuchenko and Verner cashed out over $6.6 million via fraudulent contracts with a New York Bitcoin broker, funneling the proceeds into offshore accounts. BTC-e, under their alleged control, became a notorious hub for ransomware, hacking proceeds, and illicit drug money.

Legal Peril and Fugitive Status

Should Bilyuchenko be convicted in California on charges of money laundering and operating an unlicensed money transmitting business, he faces a potential sentence of up to 45 years in prison, in addition to charges pending in New York. Verner, his alleged co-conspirator, faces up to 20 years. Despite these severe charges, both individuals remain at large, with Bilyuchenko having reportedly fled to Moscow in 2017.

Creditor Repayments and Potential Market Pressure

The surge in activity from Mt. Gox-linked wallets is particularly noteworthy given that creditors of the defunct exchange are slated to receive repayments from recovered assets between 2024 and 2025. This impending distribution could inject a significant volume of Bitcoin into the market, potentially increasing selling pressure. A vigilant community of on-chain detectives and data tracking platforms are meticulously monitoring these wallet movements. However, despite advancements in analytical tools, vulnerabilities in cryptocurrency traceability persist, particularly for Bitcoin laundered through BTC-e years ago, making some portions notoriously difficult to trace.

Investor Vigilance Amidst Uncertainty

Investors are advised to remain highly vigilant regarding any further transfers from Mt. Gox-related wallets. Such movements could serve as a precursor to increased Bitcoin selling pressure, impacting market dynamics. The long-unfolding saga of Mt. Gox continues to underscore the complex interplay of historical hacks, legal battles, and their ongoing ripple effects on the global cryptocurrency landscape.

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views or positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.