Post-Christmas Ethereum Inflows on Binance Hit Record High: A Deep Dive into Market Implications

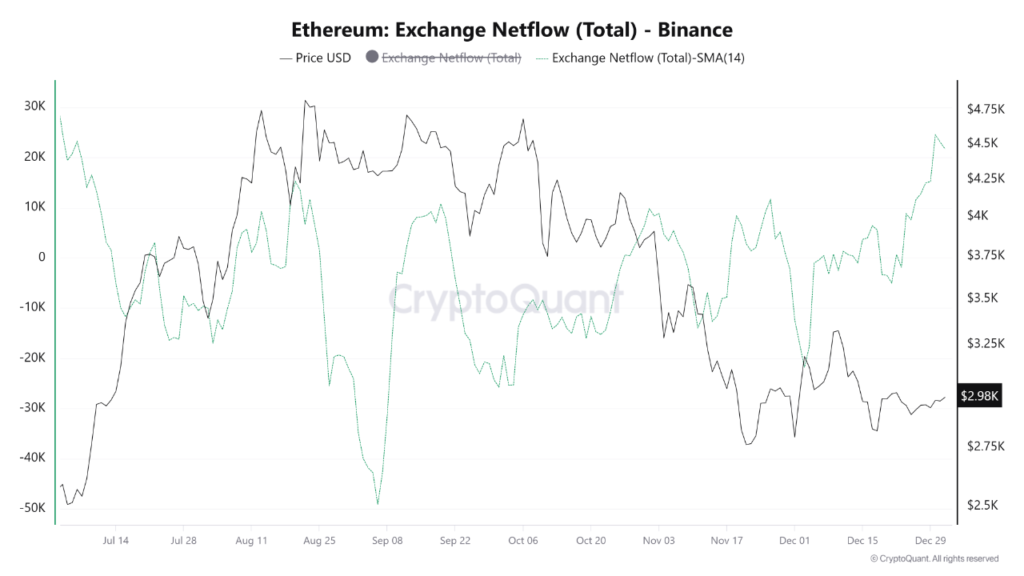

Ethereum (ETH) is experiencing a significant shift in its on-chain dynamics, particularly on the Binance exchange. Following the Christmas holiday, net inflows of ETH into Binance have surged dramatically, reaching an impressive 245,000 ETH based on a 14-day moving average. This figure represents a substantial increase from the 140,000 ETH observed pre-holiday and marks the highest net inflow recorded since early July.

Such a robust positive net inflow indicates that the volume of ETH being deposited onto Binance significantly outweighs withdrawals. This substantial transfer of assets from cold storage to exchange wallets suggests a notable change in investor behavior and market sentiment.

Historically, a sharp rise in positive net inflows has often coincided with increased selling pressure or heightened market volatility. Currently, ETH’s price is consolidating just below the psychological $3,000 mark, having recently pulled back from its local highs. This $3,000 level appears to be acting as a short-term resistance, potentially making it an attractive target for investors looking to offload fixed amounts of their holdings.

This sudden influx of liquidity into exchange wallets could signal two primary scenarios:

- Preparation for a Major Sell-off: A substantial portion of holders might be losing confidence in ETH’s immediate price trajectory and are positioning themselves to sell their assets.

- Strategic Hedging: Savvy traders could be depositing ETH onto the exchange to use as collateral for derivative positions, aiming to hedge against potential price movements or capitalize on market fluctuations.

Considering that ETH has been on a general downtrend since November, this abrupt increase in exchange reserves is widely interpreted as a short-term bearish signal. Investors actively trading ETH should exercise heightened caution. The augmented supply in the order book could potentially suppress any immediate price rebound. Furthermore, with the holiday season recently concluded and overall market liquidity still recovering, ETH prices may be particularly susceptible to increased volatility.

Disclaimer: This article is for market information purposes only. All content and views are for reference only, do not constitute investment advice, and do not represent the views and positions of BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not be held responsible for any direct or indirect losses incurred by investors’ transactions.