Authored by Frank, PANews

Unveiling the Truth Behind Polymarket’s “Smart Money”: A Deep Dive into Whale Strategies and Hidden Realities

The allure of prediction markets has surged recently, with “smart money” arbitrage strategies often hailed as the ultimate path to profit. Many aspiring traders are now attempting to replicate these tactics, sensing a new gold rush. But what are the true mechanics and effectiveness of these seemingly ingenious strategies? PANews embarked on an in-depth analysis of 27,000 operations executed by the top ten most profitable whales on Polymarket during December, aiming to uncover the real story behind their success.

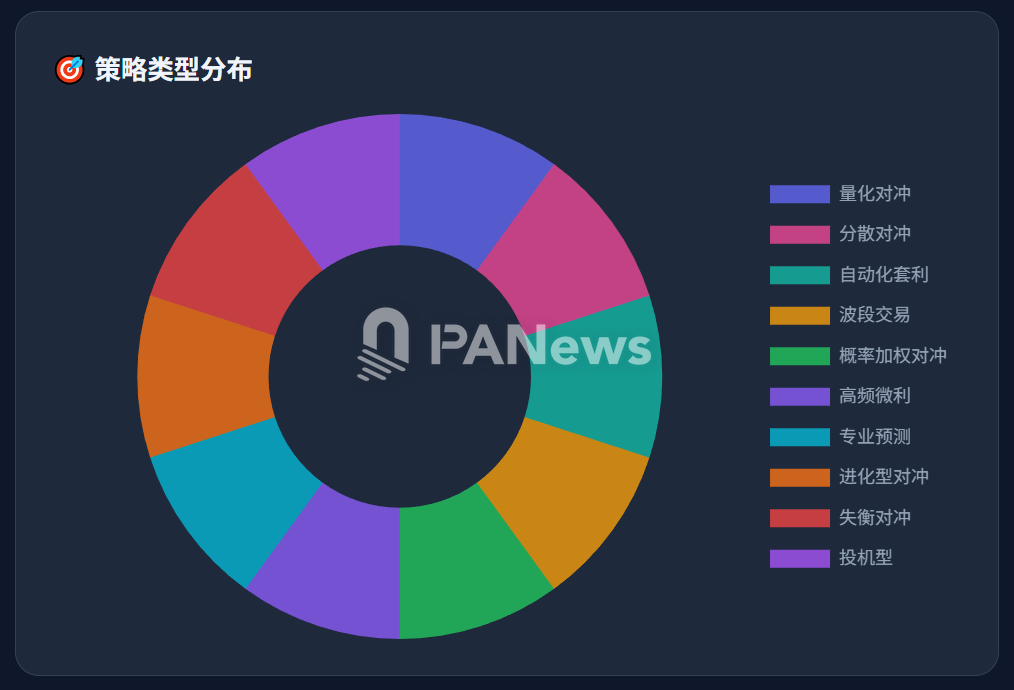

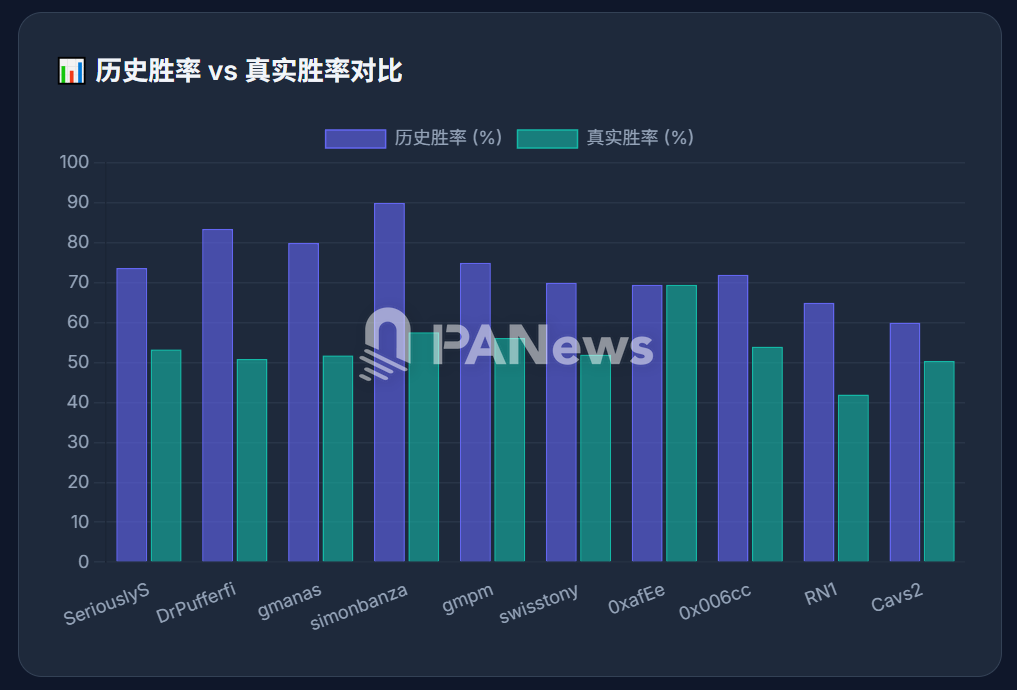

Our investigation revealed that while many of these “smart money” players do employ hedging and arbitrage, their approaches diverge significantly from the simplistic interpretations often shared on social media. Far from basic ‘yes’ or ‘no’ combinations, these sophisticated strategies leverage complex rule sets within sports events, such as ‘over/under’ and ‘win/loss’ markets. A crucial discovery was that the remarkably high historical win rates often showcased by these whales are frequently inflated by a substantial number of ‘zombie orders’ – unclosed losing positions. Once these dormant losses are factored in, their true win rates are considerably lower than publicly perceived.

Let’s delve into specific case studies to illuminate the authentic operations of these “smart money” entities.

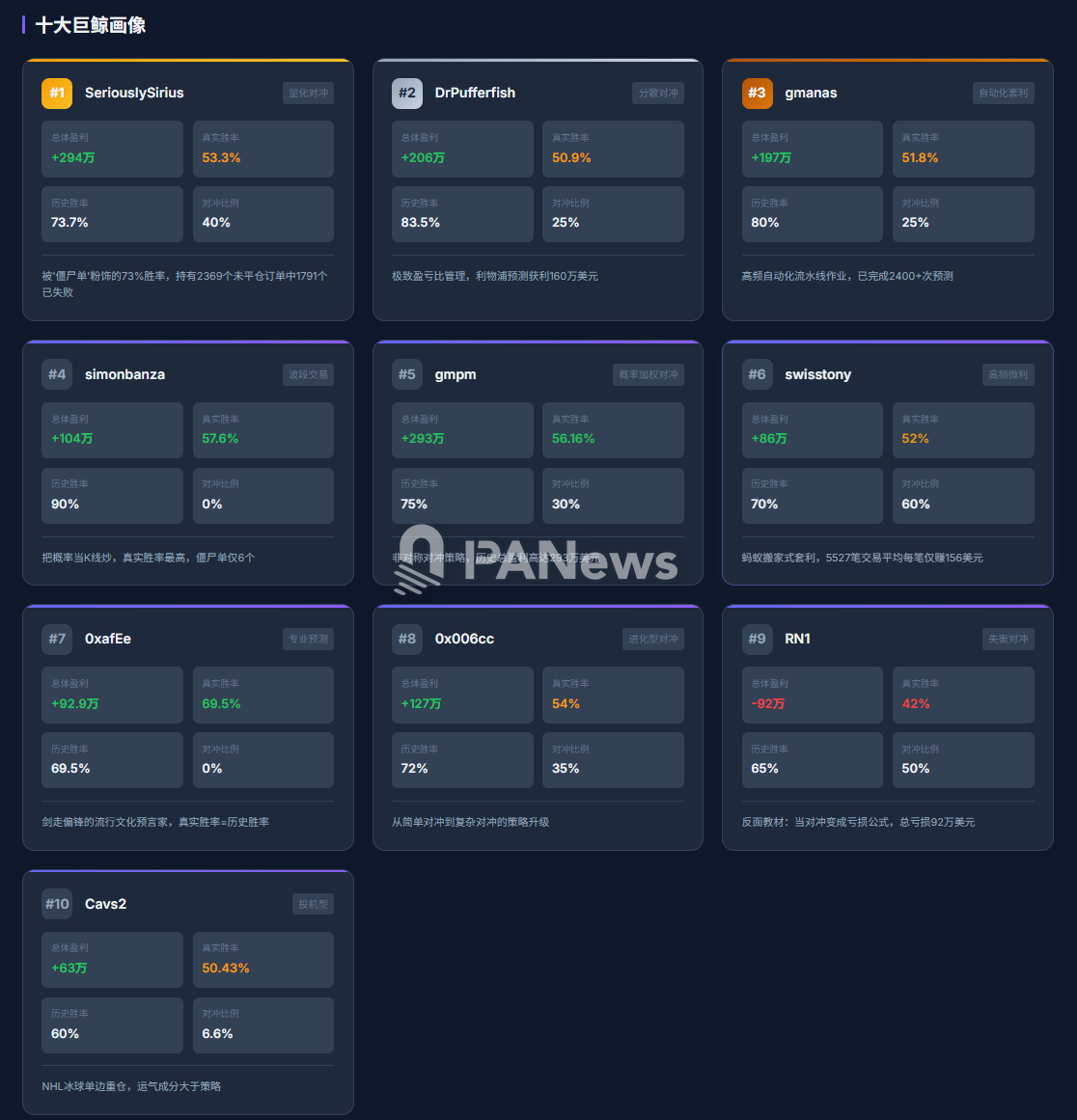

1. SeriouslySirius: The 73% Win Rate Masked by “Zombie Orders” and a Complex Hedging Network

SeriouslySirius, the top-ranked address in December, accrued approximately $3.29 million in monthly profits and $2.94 million in total historical earnings. A superficial glance at completed orders suggests an impressive 73.7% win rate. However, a deeper look exposes a different reality: this address currently holds 2,369 open orders, with 1,791 of them already representing complete losses that have not been closed. By typically closing only profitable positions, the historical data is skewed. When these ‘zombie orders’ are accounted for, SeriouslySirius’s actual win rate plummets to 53.3% – only slightly better than a coin flip.

Around 40% of SeriouslySirius’s orders involve multi-directional hedging within a single event. This isn’t simple inverse betting. For instance, in an NBA game between the 76ers and Mavericks, the whale simultaneously bet on 11 different outcomes, including ‘Under,’ ‘Over,’ ’76ers win,’ and ‘Mavericks win.’ This strategy occasionally allows for a probability-based arbitrage, where the combined cost of buying opposing outcomes (e.g., 76ers win at 56.8% and Mavericks win at 39.37%) totals less than 1 (0.962 in this case), guaranteeing a profit regardless of the outcome. This specific game yielded a $17,000 profit.

However, this strategy isn’t foolproof; a similar approach in a Celtics vs. Kings game across nine directions resulted in a $2,900 loss. Furthermore, significant imbalances in capital allocation – sometimes a tenfold difference between opposing bets – suggest that market liquidity often poses a substantial challenge. While arbitrage opportunities may arise, insufficient liquidity can prevent traders from establishing perfectly balanced hedges, potentially leading to substantial losses, especially with automated execution. Ultimately, SeriouslySirius’s significant profits stem from robust position management and an impressive profit-to-loss (P/L) ratio of approximately 2.52, compensating for a modest true win rate. It’s also worth noting that prior to December, this address experienced considerable losses, at one point reaching $1.8 million, highlighting the dynamic and evolving nature of these strategies.

2. DrPufferfish: Turning Small Probabilities into Big Wins Through Masterful Risk/Reward Management

DrPufferfish secured the second-highest profits in December, netting around $2.06 million, with a reported historical win rate of 83.5%. Factoring in their extensive ‘zombie orders,’ the actual win rate normalizes to 50.9%. DrPufferfish’s strategy, however, differs markedly from SeriouslySirius. While roughly 25% of their orders are hedges, these are not inverse bets but rather diversified wagers. For example, in an MLB championship market, they simultaneously bought into 27 lower-probability teams, whose combined probabilities exceeded 54%, effectively transforming a collection of small-probability events into a high-probability outcome.

A core driver of DrPufferfish’s substantial earnings is their masterful control over the profit-to-loss ratio. Taking Liverpool FC as an example – a team they frequently predict (123 times) – they’ve generated approximately $1.6 million. Profitable predictions averaged $37,200, while losing predictions averaged $11,000. Many losing positions are closed prematurely to mitigate losses, resulting in an exceptional overall P/L ratio of 8.62. This indicates that DrPufferfish’s success is less about simple arbitrage and more about professional predictive analysis combined with stringent position management. Intriguingly, their hedging trades often result in losses, totaling -$2.09 million, suggesting these are primarily employed as a form of insurance rather than direct profit generation.

3. gmanas: The Automated, High-Frequency Pipeline Operator

The third-ranked address, gmanas, generated $1.97 million in December, exhibiting a style similar to DrPufferfish. With a true win rate of 51.8%, their notable characteristic is high-frequency trading, having completed over 2,400 predictions. This suggests an automated execution program is at play, mirroring the diversified betting approach seen in DrPufferfish’s strategy.

4. simonbanza, The Hunter: Trading Probability Fluctuations Like a Stock Market

Simonbanza, ranked fourth, operates as a specialized prediction ‘hunter.’ Unlike the preceding whales, their strategy contains no hedging orders. They achieved approximately $1.04 million in realized profits with a minimal $130,000 in ‘zombie order’ losses. Despite a smaller capital base and trading volume, simonbanza boasts the highest true win rate among the analyzed whales at 57.6%. While their average profit ($32,000) and average loss ($36,500) result in a modest P/L ratio, their superior win rate drives excellent returns. Crucially, simonbanza holds very few ‘zombie orders’ (only six) because they typically don’t wait for event conclusions. Instead, they capitalize on fluctuations in probability, essentially treating probability shifts like price movements in financial markets – ‘taking profit and running’ rather than holding out for the final outcome. The specific logic behind their consistently high win rate remains their unique, undisclosed secret.

5. gmpm, The Whale: Asymmetric Hedging for Certainty with Large Positions

Ranked fifth in December, gmpm holds a higher historical total profit of $2.93 million than many top-ranked addresses. Their true win rate of 56.16% is also notably high. While sharing similarities with simonbanza’s approach, gmpm employs a distinct core strategy: asymmetric hedging. This involves allocating significantly more capital to the higher-probability outcome of a given event and less to the lower-probability side. This advanced hedging technique doesn’t solely rely on the mathematical arbitrage of ‘yes’ + ‘no’ < 1, but rather combines a comprehensive judgment of the event with a strategy to minimize losses, ensuring a larger position wins when the high-probability event occurs, while limiting losses if the unexpected happens.

6. swisstony, The Diligent Worker: High-Frequency “Ant-Moving-House” Arbitrage

Swisstony, the sixth-ranked address, is a hyper-frequency arbitrage trader, executing 5,527 trades – the highest volume among the analyzed whales. While accumulating over $860,000 in profits, their average profit per trade is a modest $156. This ‘ant-moving-house’ style strategy involves buying into all available markets for a single event; for example, in a Jazz vs. Clippers game, this address entered 23 different market directions. Due to smaller individual investment amounts, capital allocation is relatively balanced, providing a degree of hedging. However, the strategy demands meticulous execution; sometimes, the combined total of ‘yes’ + ‘no’ bets exceeds 1, leading to guaranteed losses. Despite these occasional missteps, a reasonable P/L ratio and win rate ensure a positive expected return.

7. 0xafEe, The Maverick: A Pop Culture Prophet with Niche Predictions

The seventh address, 0xafEe, stands out as a low-frequency, high-win-rate specialist, averaging only 0.4 trades per day. With an impressive true win rate of 69.5%, they have generated approximately $929,000 in profits from completed orders, with minimal ‘zombie order’ losses (only $8,800 unrealized). Uniquely, 0xafEe avoids hedging orders entirely, focusing instead on specialized predictions. Their expertise lies in Google search trends and popular culture, tackling questions like ‘Will Pope Leo XIV be the most searched person on Google this year?’ or ‘Will Gemini 3.0 be released before October 31st?’ Their success in these niche areas suggests a distinct analytical methodology, making them a ‘maverick’ among the top-ranked whales and the sole address focusing outside of sports.

8. 0x006cc, The Manual Hedger: Evolving from Simple to Complex Strategies

Ranked eighth, 0x006cc mirrors the complex hedging strategies of some other addresses, with a net profit of approximately $1.27 million and a true win rate of 54%. Notably, their operation frequency is low, averaging only 0.7 trades per day, suggesting manual execution rather than automation. Early trading patterns indicate that 0x006cc may have started with simpler hedging strategies, progressively upgrading to more sophisticated approaches by December. This evolution reflects the increasing complexity and competitive landscape of the prediction market.

9. RN1, The Cautionary Tale: When “Hedging” Becomes a “Loss Formula”

RN1, the ninth-ranked address, serves as a cautionary tale – the only address in the top ten that is currently in an overall loss position. While realizing $1.76 million in profits, their unrealized losses amount to $2.68 million, culminating in a total deficit of $920,000. Their true win rate is the lowest among the analyzed addresses at 42%, and their P/L ratio is a mere 1.62, indicating a negative expected return. A closer look reveals that while RN1 employs an arbitrage strategy, they frequently allocate more capital to the lower-probability side and less to the higher-probability side, creating an imbalance that leads to significant losses when the more likely outcome occurs. This highlights how even seemingly sound arbitrage principles can become a ‘loss formula’ without precise execution and balanced position sizing.

10. Cavs2, The Gambler: High-Stakes Single Bets in Ice Hockey

Cavs2, ranked tenth, is a prediction ‘gambler’ favoring single-sided, heavy bets, particularly in NHL ice hockey. Their overall actual profit stands at approximately $630,000, with a true win rate of 50.43% and a low risk-hedging ratio of 6.6%. The data suggests a moderate performance heavily influenced by luck, as they successfully bet on several high-payout single-game outcomes. From a strategic perspective, their approach offers limited actionable insights for others.

The Unvarnished Truth: 5 Realities of Prediction Market Trading

Our deep dive into these “smart money” operations on Polymarket dispels common myths and reveals five crucial realities behind the prediction market “wealth story”:

-

Arbitrage is Not Simple: The ‘hedging arbitrage strategy’ is far more intricate than merely meeting probability conditions. In a fiercely competitive market with limited liquidity, it can easily transform into a self-defeating ‘loss formula.’ Blind imitation is highly inadvisable.

-

Copy Trading is Flawed: Copy trading in prediction markets appears ineffective for several reasons. Firstly, publicly displayed rankings and win rates are often ‘distorted’ by historical realized profits, ignoring substantial unrealized losses from ‘zombie orders.’ The true win rates of many ‘smart money’ players are not exceptionally high, often hovering around a coin flip. Secondly, prediction markets currently suffer from relatively poor trading depth. Identical arbitrage opportunities can only accommodate small amounts of capital, meaning copy traders are likely to be squeezed out.

-

P/L Ratio Trumps Win Rate: Managing the profit-to-loss ratio and position sizing is ultimately more critical than chasing a high win rate. The most successful addresses consistently demonstrate exceptional skill in P/L management. Whales like gmpm and DrPufferfish actively exit positions based on probability shifts to minimize losses and enhance their P/L ratio.

-

The Real Edge Lies Beyond Formulas: Social media abounds with interpretations of ‘arbitrage formulas’ that, at first glance, seem perfectly logical. However, the true capabilities of these ‘smart money’ players often extend beyond mere mathematical equations. They possess either exceptional judgment for specific events or unique analytical models for niche areas like popular culture. These unseen ‘decision algorithms’ are their actual keys to victory. For users without such sophisticated algorithms, the prediction market remains a cold, ‘dark forest.’

-

Limited Profit Scale: The profit potential in prediction markets is currently modest. Even the top-earning address in December generated only around $3 million. Compared to the vast crypto derivatives market, the profit ceiling here is noticeably lower. For those dreaming of overnight riches, the market’s current scale is simply insufficient. This combination of specialized expertise and limited scale likely makes prediction markets less appealing to institutional players, potentially hindering their long-term growth.

Conclusion

In the seemingly gold-laden landscape of Polymarket, the so-called ‘god-tier whales’ are, for the most part, either fortunate gamblers or diligent manual laborers. The genuine keys to wealth are not found in inflated win-rate leaderboards but in the sophisticated, often hidden algorithms that a select few top players employ with real capital, after all the market noise has been filtered out.

(The above content is excerpted and reproduced with authorization from partner PANews, original link)

Disclaimer: This article is intended solely to provide market information. All content and opinions are for reference purposes only and do not constitute investment advice. Investors are solely responsible for their own decisions and transactions. Neither the author nor the publisher will bear any responsibility for direct or indirect losses incurred by investors’ trading activities.