Decoding Bitcoin’s Price Action: The Influence of Miner Exchange Flow

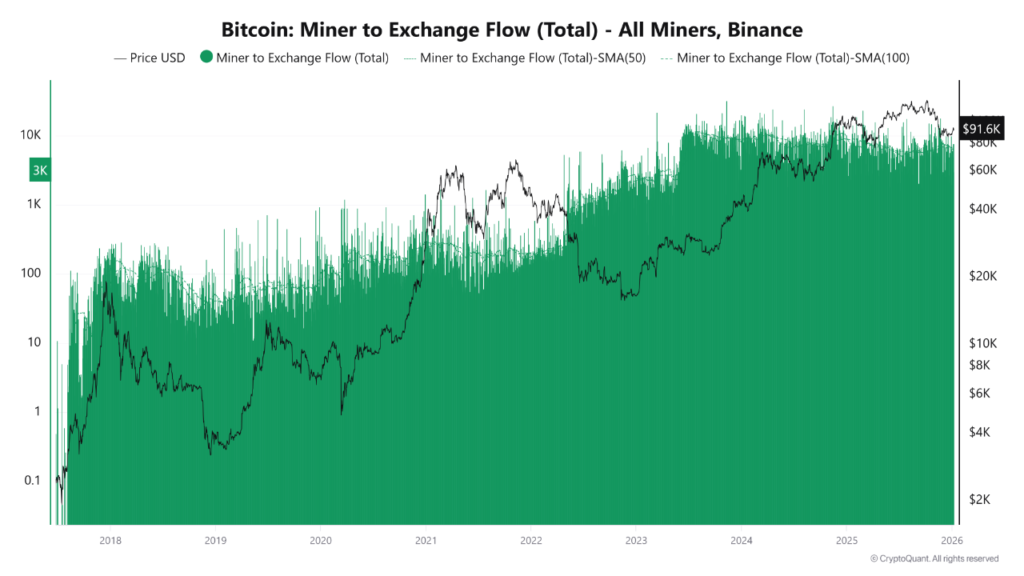

Understanding the flow of Bitcoin from miners to exchanges is crucial for anticipating market movements. According to comprehensive data analysis from CryptoQuant, the “Miner Exchange Flow” has shown a consistent increase throughout 2023-2025. This trend typically signals that Bitcoin miners are transferring their holdings to exchanges, often with the intent to sell, thereby creating potential selling pressure on the market. A closer examination of key technical indicators, such as the 50-day Simple Moving Average (SMA 50) and the 100-day Simple Moving Average (SMA 100) for this metric, reveals that these averages remain at relatively high levels, without any sharp downward breaks.

Historical Perspective: Miner Behavior Across Market Cycles

To fully grasp the current situation, it’s essential to look at historical miner behavior. During the period from 2017 to 2020, miner exchange inflows remained at moderate to low levels. In this phase, miner selling did not significantly derail price rallies; instead, miners typically engaged in gradual profit-taking as Bitcoin’s price ascended. Fast forward to the peak of the 2021 bull market, and we observed an increase in miner exchange inflows. Yet, despite this selling, Bitcoin continued to achieve new all-time highs. This indicated a robust demand side, powerful enough to absorb the increased supply from miners. This dynamic bears a striking resemblance to the early 2024-2025 period, where miner selling alone has not been sufficient to reverse the overall uptrend, signaling a strong market capable of absorbing this supply.

The Bear Market Contrast: Forced Selling in 2022

The narrative shifts dramatically when examining the 2022 bear market. During this downturn, miners consistently transferred substantial amounts of Bitcoin to exchanges, particularly Binance. This sustained influx coincided with a severe price decline, strongly suggesting that miners were compelled to sell their holdings due to escalating cost pressures. Considering that the average breakeven cost for miners currently hovers around $50,000, it’s unlikely that miners would turn extremely bearish unless Bitcoin’s price approaches this critical threshold.

Historically, aggressive miner selling has often exacerbated bear market trends. The year 2022 stands out as a prime example where miner selling pressure exerted a profound influence on market direction. Unlike 2021, where buyer demand readily absorbed miner supply, 2022 saw this supply largely unabsorbed, leading to significant price corrections. This scenario can be likened to a hypothetical price drop from $122,000 to $80,000 in the absence of adequate demand support.

Current Dynamics and Future Outlook: 2023-2026

In the more recent period, from 2023 to 2025, miner exchange inflows have reached historical highs. This phenomenon offers a compelling explanation for why the current bull cycle has not witnessed the explosive, parabolic rallies seen in previous cycles. While miner selling has not yet managed to break the prevailing upward trend, it is undeniably acting as a “balancing force,” tempering rapid price increases. As we move into 2026, should prices begin a steady decline, this gradually accumulating downward pressure from miners could persist, potentially exerting long-term pressure on Bitcoin’s price.

Disclaimer: This article is intended solely to provide market information. All content and views expressed are for reference only and do not constitute investment advice. They do not represent the views or positions of the author or BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not be held responsible for any direct or indirect losses incurred by investors’ trading activities.