Author: Nikka / WolfDAO (X: @10xWolfdao)

Ethereum’s Defining Moment: Why 2026 Signals a Structural Bull Run and Global Dominance

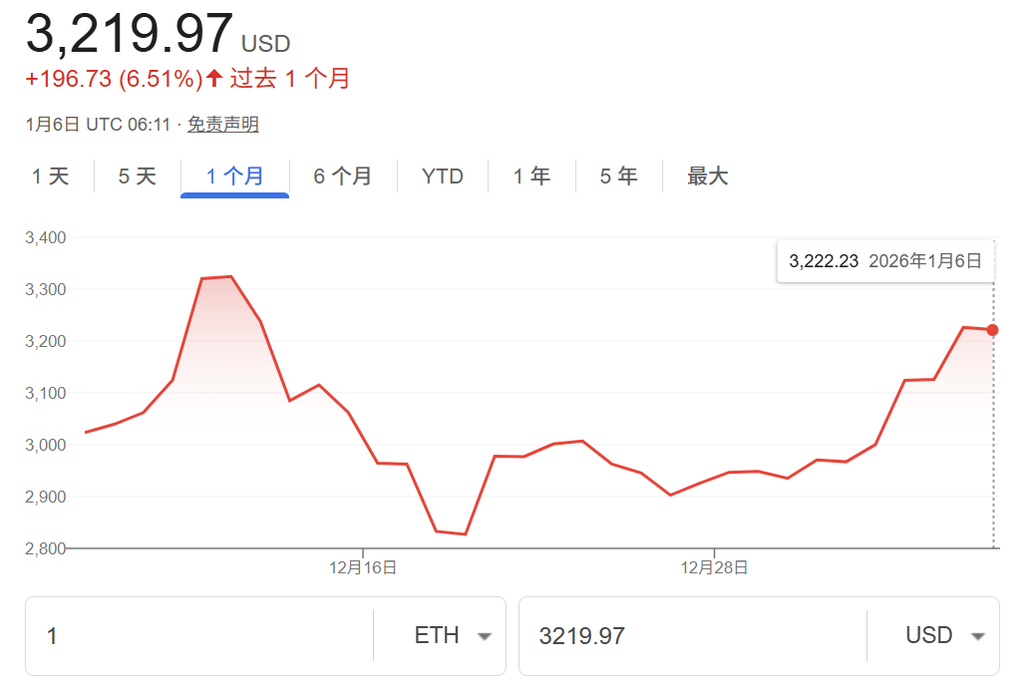

As the cryptocurrency market surges past the $3 trillion mark in early 2026, with Bitcoin’s dominance briefly dipping below 60%—a classic precursor to “altcoin season”—all eyes are on Ethereum (ETH). After a significant rebound from its late 2025 lows, breaking above $3,200, ETH stands at a critical juncture. While still 34% shy of its September 2025 peak of $4,700, a confluence of powerful, early signals suggests Ethereum is not merely experiencing a cyclical pump, but is on the cusp of a profound, structural market rally.

1. Staking Queue Reversal: A Seismic Shift in Supply Dynamics

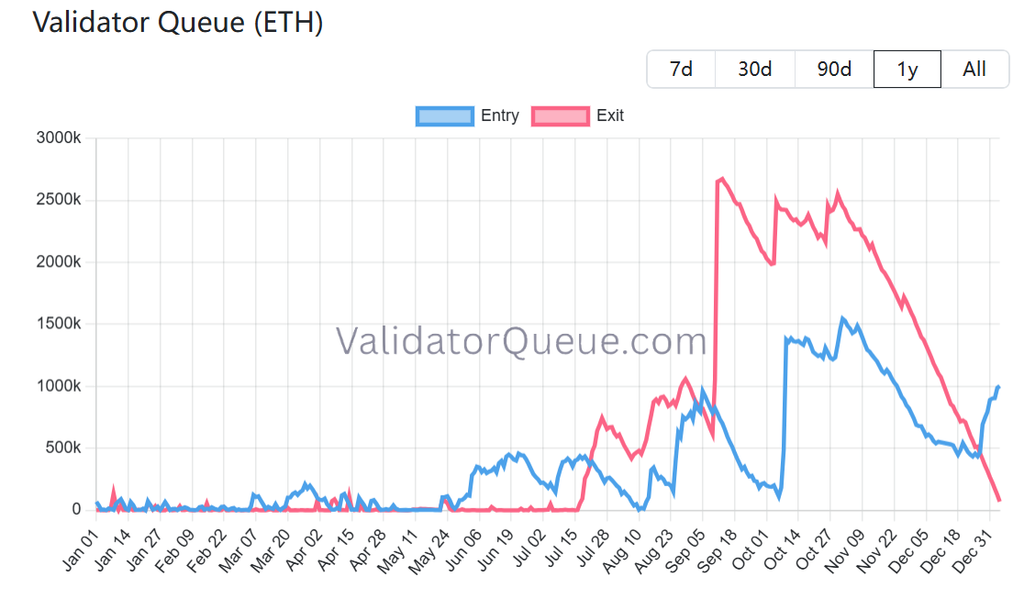

One of the most compelling catalysts for Ethereum in 2026 is the dramatic and unprecedented reversal in its staking queue. For the first time since July 2025, we are witnessing a fundamental “role reversal,” indicating a powerful shift in investor sentiment from withdrawal to long-term commitment.

During ETH’s September 2025 rally to $4,700, a staggering 2.66 million ETH were queued for unstaking, creating persistent selling pressure for months. However, after a three-and-a-half-month digestion period, the pending unstake queue has dwindled to approximately 80,000 ETH, effectively neutralizing this significant source of market supply. Concurrently, the queue for new ETH staking has exploded, soaring to between 900,000 and 1,000,000 ETH—a remarkable 120% increase from late December’s 410,000. This influx, now 15 times larger than the exit queue, has extended validator activation wait times to 17 days.

Currently, Ethereum boasts a total staked supply of 35.5 million ETH, representing 28.91% of its circulating supply, with an attractive annualized yield of 3-3.5%. Historically, a dominant entry queue has been a strong precursor to price appreciation. This substantial lock-up of ETH, coupled with continuous whale accumulation exceeding $3.1 billion since July 2025, forms an exceptionally robust foundation for a sustained upward trend.

2. Institutional Onslaught: From Passive Holdings to Active Yield Generation

While the staking reversal signals a tightening supply, the aggressive entry of institutional capital is the primary demand-side engine. Leading this charge is BitMine Immersion Technologies, the world’s largest Ethereum treasury company, which is fundamentally reshaping institutional engagement. Holding over 4.11 million ETH (3.41% of total supply), BitMine is transitioning from a passive holder to an active, yield-generating participant.

In just the last eight days, BitMine staked over 590,000 ETH, valued at more than $1.8 billion. A single transaction on January 3 saw them stake 82,560 ETH, worth approximately $259 million. The company’s ambitious plan involves staking 5% of Ethereum’s total supply through its proprietary MAVAN validator network in Q1, projecting an annualized return of $374 million. This aggressive strategy has not only fueled the staking queue but also propelled BMNR stock price by 14%.

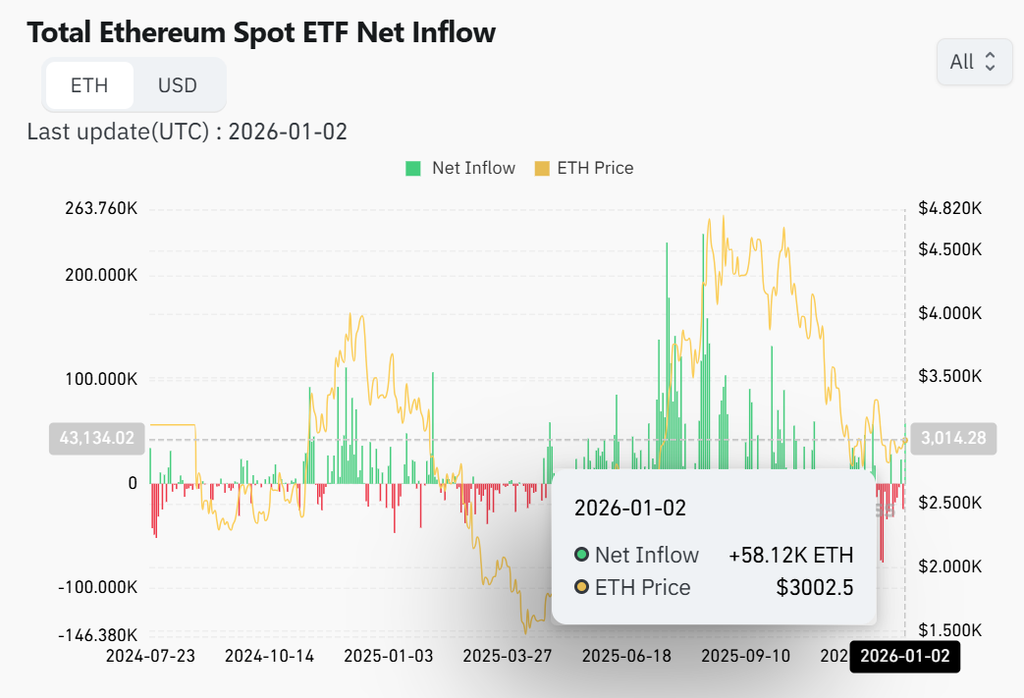

The broader institutional landscape mirrors this fervor. ETH spot ETFs recorded over $9.6 billion in inflows in 2025, contributing to a historical total exceeding $125 billion. The start of 2026 alone witnessed a single-day net inflow of $1.74 billion. Giants like BlackRock’s ETHA fund now hold roughly 3 million ETH, valued at nearly $9 billion. Predictions from Coinbase and Grayscale point to 2026 as the dawn of an “institutional era,” with a proliferation of ETP products and on-chain treasuries expected to double assets under management.

Furthermore, on-chain accumulation by large holders reached an all-time high in 2025, with over 10 million ETH purchased. These indicators collectively affirm a pivotal shift: institutions are no longer viewing ETH as a mere speculative asset, but as a foundational infrastructure asset capable of generating significant yield.

3. Technical Evolution: Ethereum’s Ascent as a Global Settlement Layer

2025 was a landmark year for Ethereum’s technical evolution, with the successful deployment of the Pectra and Fusaka upgrades. These aren’t just incremental improvements; they represent a strategic transformation, positioning Ethereum as a high-throughput, low-cost global settlement layer, setting the stage for an explosive 2026.

The Pectra upgrade, completed in H1 2025, was a game-changer. Its core innovation, EIP-7251, dramatically increased the validator staking cap from 32 ETH to 2048 ETH, significantly easing large-scale institutional staking. This, combined with enhanced blob capacity and optimized validator mechanisms, reduced network congestion and cleared technical hurdles for major players like BitMine.

Even more critical was the Fusaka upgrade, launched in December 2025. Introducing PeerDAS (Peer-to-Peer Data Availability Sampling), Fusaka revolutionized Layer 2 data storage, eliminating the need for full nodes to download all blob data. This innovation theoretically supports an 8x+ increase in blob capacity, with Layer 2 transaction fees projected to fall by an additional 40-90% in 2026. EIP-7892 further guarantees long-term scalability by allowing dynamic adjustment of blob parameters without requiring hard forks.

The roadmap for 2026 is even more ambitious. The anticipated Glamsterdam upgrade will introduce Verkle Trees, enshrined proposer-builder separation (ePBS), and block-level access lists. These advancements are expected to push Layer 1 TPS beyond 12,000+ and enhance MEV extraction, significantly boosting network efficiency and revenue capture. These are not theoretical promises; smart contract deployments and call counts have already reached historic highs, reflecting unprecedented on-chain activity.

4. RWA Dominance: Monopolizing a Trillion-Dollar Opportunity

Ethereum’s undeniable dominance in the tokenization of Real World Assets (RWA) is rapidly emerging as the most powerful narrative driver for 2026. This isn’t mere crypto hype; it’s a resounding vote of confidence from traditional financial institutions, backed by substantial capital.

According to the latest RWA.xyz statistics, Ethereum’s on-chain tokenized asset Total Value Locked (TVL) stands at an impressive $12.5 billion, capturing a commanding 65.5% market share. This dwarfs competitors like BNB Chain ($2 billion) and Solana/Arbitrum (each less than $1 billion). Wall Street titans such as BlackRock and JPMorgan are already leveraging Ethereum to tokenize treasuries, private credit, and fund products on a massive scale. The RWA market surged over 212% in 2025, exceeding $12.5 billion, with institutional surveys indicating that 76% of asset management firms plan to invest in tokenized assets before 2026.

Experts predict a tenfold or greater expansion of the RWA market in 2026. As the most mature, secure, and robust settlement layer, Ethereum is uniquely positioned to capture the vast majority of value from this trillion-dollar opportunity. Further regulatory clarity, particularly with the expected passage of the CLARITY Act and stablecoin legislation in H1, will accelerate this trajectory.

The stablecoin landscape further underscores Ethereum’s supremacy. It hosts over $62 billion in circulating stablecoins, accounting for over 62% of the total market and 68% of DeFi TVL. Institutional-grade applications, including B2B payments and cross-border settlements, are increasingly migrating to Ethereum. Reports from Artemis confirm consistent growth in Ethereum-based stablecoin B2B payment volumes between 2024-2025. This signifies not speculative capital, but genuine demand from the real economy.

Conclusion: Ethereum’s Ascendancy from Follower to Frontrunner

The convergence of powerful supply-side dynamics, overwhelming institutional demand, and relentless technical innovation positions Ethereum for a profound narrative flip in 2026—from a “follower” to a definitive “leader.” This marks the dawn of an institution-driven structural bull market, fundamentally different from the retail-fueled speculative frenzies of the past.

For those who have steadfastly supported Ethereum through its challenges, 2026 may indeed be the year their patience is richly rewarded. However, in this rapidly evolving and often unforgiving market, continued prudence and a rational perspective remain indispensable.

(This content has been excerpted and republished with permission from our partner PANews. Original Article Link | Source: WolfDAO)

Disclaimer: This article is provided for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views or positions of BlockBeats. Investors should make their own decisions and conduct their own transactions. The author and BlockBeats will not be held liable for any direct or indirect losses incurred by investors as a result of their transactions.