Sui’s Wall Street Ambitions: Growth, Innovation, and the Road Ahead

Sui kicked off 2026 with a remarkable surge, experiencing a 30% increase in just one week. While many Layer 1 public chains are still fiercely competing over transaction per second (TPS) and ecosystem size, Sui is setting its sights on Wall Street. Major crypto asset managers Grayscale and Bitwise have recently filed applications with the U.S. SEC for a spot Sui ETF. This significant development suggests that the SUI token is poised to be evaluated within the same institutional asset class as Bitcoin (BTC) and Ethereum (ETH). However, beneath the captivating narrative of a ‘Silicon Valley darling’ transforming into a ‘Wall Street newcomer,’ Sui faces a critical challenge: can it embrace traditional capital while simultaneously establishing itself as a trustworthy and robust foundational ecosystem?

Exponential Growth and Surging User Adoption

Over the past two and a half years, the Sui ecosystem has demonstrated remarkable exponential growth and strong user retention. Since its mainnet launch in May 2023, Sui’s Total Value Locked (TVL) skyrocketed by approximately 32 times, peaking at $2.6 billion in October 2025. However, following the ‘10.11 flash crash,’ Sui’s TVL experienced a decline, currently resting around $1 billion, less than half its peak. Concurrently, public chain fees have seen an impressive 11.5-fold increase, climbing from an initial $2 million to approximately $23 million.

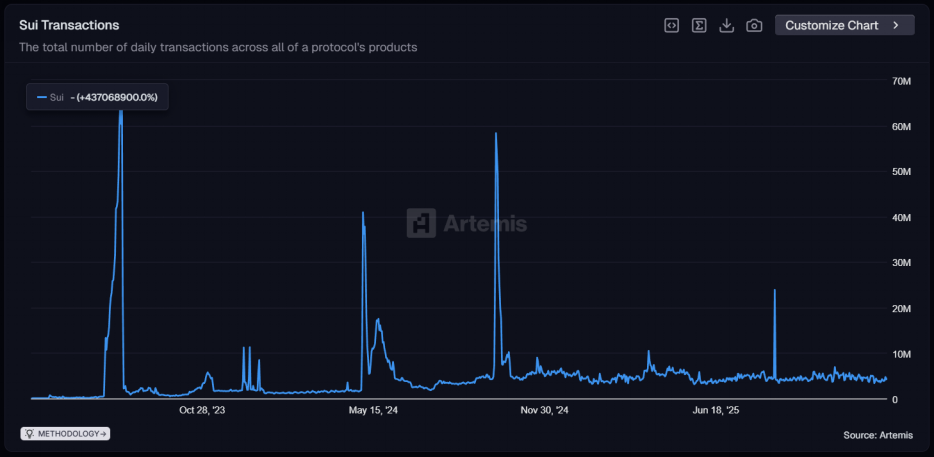

Sui’s throughput metrics further underscore its robust infrastructure. The network has achieved a peak single-day throughput of 66.2 million transactions, with daily transaction volumes consistently exceeding 4 million over the past year. This substantial throughput confirms Sui’s successful implementation of horizontal scaling, demonstrating its capability to support high-intensity, large-scale user and application demands.

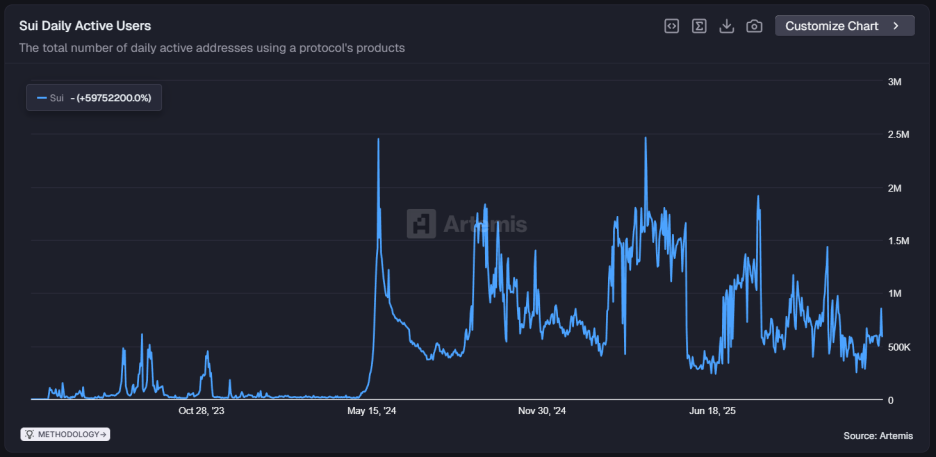

User activity on Sui has also seen a dramatic rise. Daily active users (DAU) initially numbered in the tens of thousands but rapidly climbed to a peak of 2.5 million in April 2025. While there has been a recent slight pullback, monthly average data remains healthy, with an average DAU currently around 600,000.

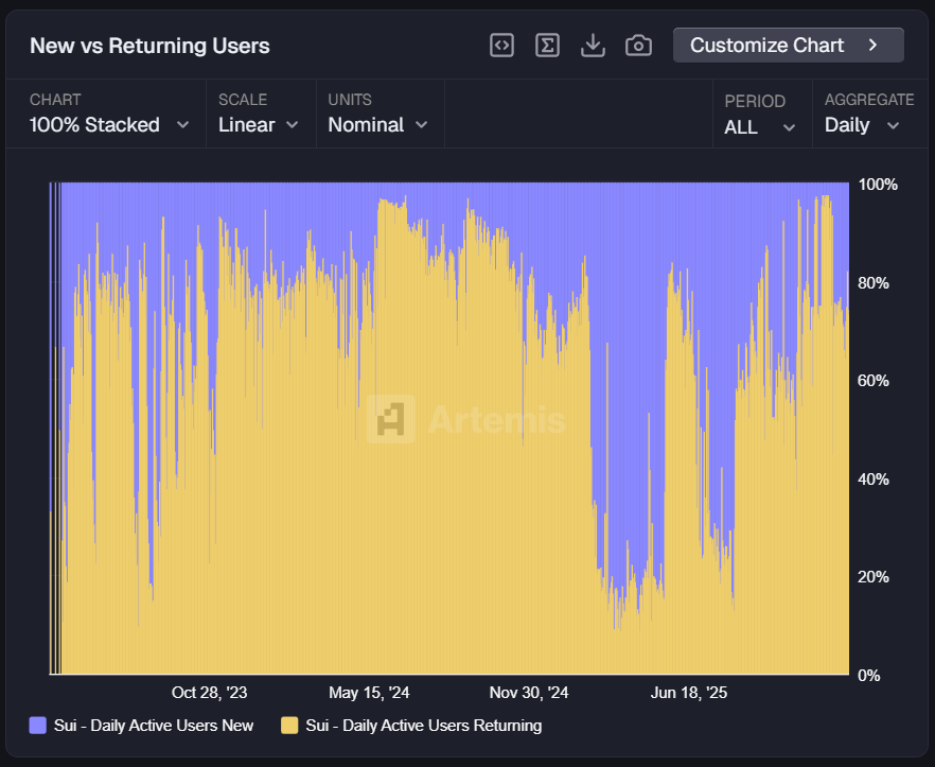

Notably, the ratio of returning users has consistently stayed above 20%, indicating strong user stickiness. Furthermore, the Sui ecosystem has experienced a continuous influx of new users since 2025.

These compelling statistics form the bedrock of Sui’s appeal to institutional capital. They paint a picture of a network that is no longer merely a technically capable public chain but a mature economic entity, actively processing real traffic and assets.

SUI Spot ETFs: Paving the Way for Institutional Capital

The applications for SUI spot ETFs are set to significantly broaden the entry pathways for compliant capital into Sui, simultaneously bolstering its institutional recognition.

On December 5, 2025, Grayscale officially submitted an S-1 registration statement to the SEC, seeking to convert its existing Sui Trust into a spot ETF. According to the disclosed documents, the Grayscale Sui Trust (SUI) ETF intends to list on the NYSE Arca, with the fund directly holding SUI tokens to peg its net asset value to the market price of SUI. Crucially, this application incorporates a staking mechanism, meaning the ETF would not only offer investors price exposure but also generate additional intrinsic yield through the underlying blockchain’s validator rewards. This feature is particularly attractive to institutional investors focused on cash flow.

Bitwise quickly followed suit, filing its Bitwise SUI ETF registration statement with the SEC on December 19, 2025. This ETF plans to list on Nasdaq, with Coinbase selected as its custodian. Having previously included SUI in its ‘Bitwise 10 Crypto Index ETF,’ Bitwise’s independent spot ETF filing signifies SUI’s formal ascent into the institutional-grade asset basket, alongside established cryptocurrencies like BTC, ETH, and SOL.

In a notable shift from its previously cautious stance, a change in SEC leadership has fostered a more accommodating regulatory environment for altcoin ETF approvals. This shift has accelerated the review process for several altcoin ETFs, transforming the prospect of a Sui ETF from a market aspiration into a tangible timeline. Institutions’ preference for Sui is not coincidental; its core competitive advantage, enabling it to stand out among numerous Layer 1s, lies in its rich application scenarios and exceptional scalability, particularly across payments, gaming, and DeFi protocols.

Beyond its technical merits, market consensus regarding the SUI token’s value is evolving from short-term speculation to long-term strategic allocation. As of January 7, SUI’s market capitalization exceeded $7 billion, with a fully diluted valuation (FDV) nearing $19 billion. Despite approximately 62% of tokens remaining locked, the market smoothly absorbed over $60 million in token unlocks in early 2026 without significant price volatility. The advent of a Sui ETF is expected to lower entry barriers for traditional wealth management firms, substantially deepening SUI token liquidity, and consequently reshaping its valuation paradigm.

Introducing Native Private Transactions: A Catalyst for Commercial Adoption

As institutional capital flows in, Sui is also addressing another critical hurdle for public chains in the B2B payment sector. While most public chains champion transparent and auditable on-chain data, Sui is taking a contrarian approach.

With privacy regaining prominence in the crypto landscape, Adeniyi Abiodun, co-founder and Chief Product Officer of Mysten Labs, announced on December 30, 2025, that the Sui network would launch native private transaction functionality in 2026. This isn’t an optional plugin but a foundational capability integrated directly into the consensus layer and object model. The core intent is “privacy by default,” meaning that when users make payments or transfers, the transaction amount and counterparty information will, by default, only be visible to the sender and receiver, remaining hidden from observers.

This feature has the potential to unlock immense commercial demand. Traditional public chain transparency, while ensuring fairness, has significantly hindered entities requiring the protection of trade secrets and individuals seeking privacy. Sui’s privacy solution aims to provide end-to-end confidentiality through zero-knowledge proof technology, all while maintaining high throughput.

A distinctive characteristic of Sui’s private transaction feature is its compliance-friendly design. Unlike privacy coins such as Monero, Sui introduces a selective transparency mechanism:

- Audit Hooks: The protocol allows specific transaction details to be disclosed to regulators or authorized auditors under defined compliance procedures.

- KYC/AML Integration: Financial institutions can perform necessary anti-money laundering checks while still upholding privacy protection.

- Quantum-Resistant Primitives: Acknowledging the potential threat of quantum computing to elliptic curve cryptography, Sui’s 2026 upgrade plans to incorporate post-quantum cryptography standards like CRYSTALS-Dilithium and FALCON, ensuring that private data stored on-chain remains uncrackable for decades to come.

These technical components position Sui as a “regulated private financial network,” designed to attract banks and commercial entities with high data sensitivity.

However, this positioning presents a double-edged sword. While it aims to appeal to data-sensitive traditional financial institutions, it might also raise questions among crypto purists who advocate for absolute transparency. A more formidable challenge also lies on the technical front: integrating zero-knowledge proofs and quantum-resistant cryptographic algorithms while sustaining high TPS.

Ecosystem Engineering: Upgrading Liquidity Infrastructure

In the fierce competition among Layer 1 blockchains, liquidity depth consistently serves as a core indicator of a public chain’s vitality. In recent months, projects within the Sui ecosystem have made significant strides in optimizing liquidity efficiency and architecture.

NAVI Protocol’s Evolution with PRE DEX

NAVI Protocol, a long-standing leader in Sui’s TVL rankings, officially launched its Premium Exchange (PRE DEX) on December 29, 2025. This move signals NAVI’s evolution from a singular lending protocol into a comprehensive DeFi infrastructure.

PRE DEX is specifically designed to establish a premium discovery mechanism. In the current crypto market, many protocol tokens exhibit significant price dislocations across different stages. PRE DEX aims to provide a robust pricing platform for these assets through market-driven algorithms.

For institutional investors and multi-wallet users, PRE DEX promises a substantial boost in management efficiency. The system enables users to efficiently configure and consolidate multi-chain and multi-protocol assets within a single interface, thereby reducing the friction costs associated with cross-protocol operations. With the launch of PRE DEX, asset pricing within the Sui ecosystem is expected to become more efficient, particularly when dealing with high-value or low-liquidity assets, potentially establishing PRE DEX as a pivotal liquidity relay station.

AI-Driven and Dynamic Liquidity Management

Two significant financing events at the close of 2025 suggest that Sui’s ecosystem liquidity management is entering an AI-driven and dynamic phase.

In December 2025, Magma Finance announced the completion of a $6 million strategic funding round led by HashKey Capital. Magma is dedicated to resolving issues of liquidity fragmentation and inefficient capital utilization within the Sui ecosystem.

The protocol’s technical architecture introduces an Adaptive Liquidity Market Maker (ALMM) model. Unlike traditional Concentrated Liquidity Market Maker (CLMM) models, ALMM will leverage an AI strategy layer to analyze market volatility in real-time. During periods of significant market fluctuation, the AI automatically adjusts the distribution of asset prices and rebalances liquidity providers’ (LPs) capital into active trading ranges. Through this innovative approach, Magma will not only offer traders lower slippage but also generate higher real yields for LPs. Concurrently, the AI will monitor the mempool to proactively prevent MEV (Maximal Extractable Value) attacks.

Ferra Protocol, which secured a $2 million Pre-Seed funding round led by Comma3 Ventures in October 2025, launched the first Dynamic Liquidity Market Maker (DLMM) DEX on the Sui mainnet. Its innovation lies in its high degree of modularity and composability.

Ferra not only integrates CLMM and Dynamic Adjustment Market Maker (DAMM) models but also introduces dynamic bonding curves. This will further empower fair launches and efficient liquidity bootstrapping for new tokens. Ferra’s vision is to become Sui’s dynamic liquidity layer, transforming capital from static deposits into “living water” that flows freely with market sentiment and demand.

DeFi Ecosystem Challenges: A Crisis of Governance and Trust

However, Sui’s public chain expansion has not been without its hurdles. SuiLend, once the largest lending protocol on Sui, recently faced accusations of buyback fraud, casting a shadow over its DeFi ecosystem and prompting community reflection on potential misaligned incentives within public chains.

SuiLend, as a premier lending protocol on Sui, saw its TVL approach $750 million, accounting for 25% of the entire chain’s share. Yet, despite these impressive figures, its native token, SEND, consistently underperformed. Although the protocol generated an annualized revenue of $7.65 million in 2025 and claimed 100% of protocol fees would be used for token buybacks, SEND’s price plummeted by over 90% in the past year.

While SuiLend did execute $3.47 million in buybacks since February 2025 (representing approximately 9% of the circulating supply), this proved insufficient to provide the anticipated price support for SEND, a small-cap asset with a market capitalization of just over $13 million.

KOL “Crypto Fearless” highlighted that Bybit flagged SuiLend with an ST (Special Treatment) tag, and the community raised concerns about potential insider trading during buybacks, suggesting they served as a disguised method for the team to offload tokens. Furthermore, during the IKA liquidation event, SuiLend opted not to utilize its insurance fund but instead forcibly deducted 6% of users’ principal, severely eroding community trust. Compounding these issues, the protocol’s ongoing operations heavily relied on millions of dollars in monthly subsidies from the Sui Foundation.

These circumstances fueled accusations of buyback fraud from the community. The prevailing sentiment was that the buyback strategy was merely a “drop in the bucket” – while superficially reducing token supply, it failed to offset substantial token emissions and selling pressure from early venture capitalists.

This case serves as a stark warning for the Sui DeFi ecosystem: without genuine user growth and a sustainable operational model, token buybacks can become a mere house of cards, masking underlying emptiness. Beyond metrics like TVL and revenue, the market must also scrutinize aspects such as a protocol’s community governance and incentive structures.

Conclusion: Balancing Ambition with Foundation

For Sui, the path to Wall Street is undeniably alluring, yet ensuring a robust and trustworthy foundation for its own ecosystem may prove to be a more protracted journey. While its explosive data growth unequivocally demonstrates its technical potential, trust remains the bedrock of its survival. Sui must navigate the challenging metamorphosis from a technological experiment to a mature economic entity, integrating trust as a core piece of its value growth puzzle while simultaneously maintaining its innovative edge and a reasonable valuation.