Author: Our Crypto Talk

Translated & Compiled by: Yuliya, PANews

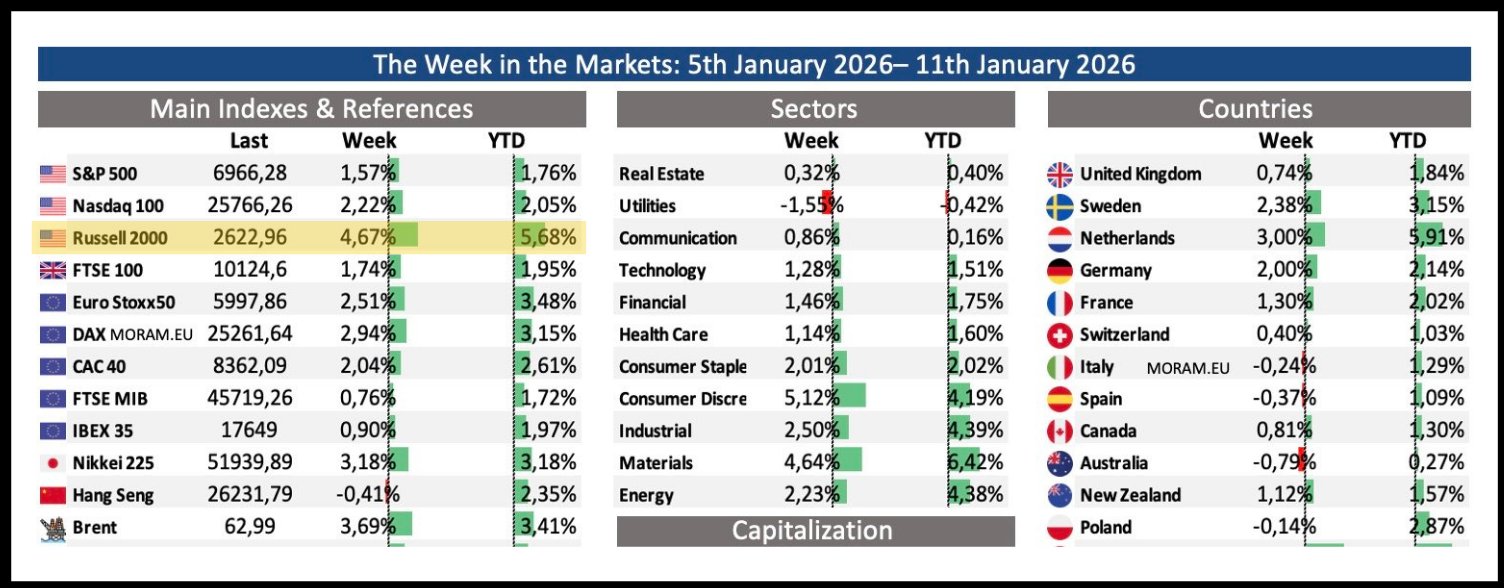

This article isn’t about a crypto chart, a meme coin narrative, or even Bitcoin for now. Instead, our focus is on the Russell 2000 Index, which is quietly achieving a feat it has only accomplished twice in its history: a significant breakout that signals a potent return of risk appetite.

If you’ve been in the markets long enough, you’ve witnessed this “movie” play out more than once.

A Pattern Consistently Overlooked by Many

History often repeats itself, and even if you don’t subscribe to cyclical theories, the undeniable recurrence of patterns demands respect.

- In 2017, the Russell 2000 Index achieved a breakout, subsequently ushering in an “altcoin season.”

- In 2021, the Russell 2000 Index broke out once more, and predictably, another “altcoin season” followed.

While the market narratives and trending tokens differed each time, the underlying driving mechanism remained consistently the same.

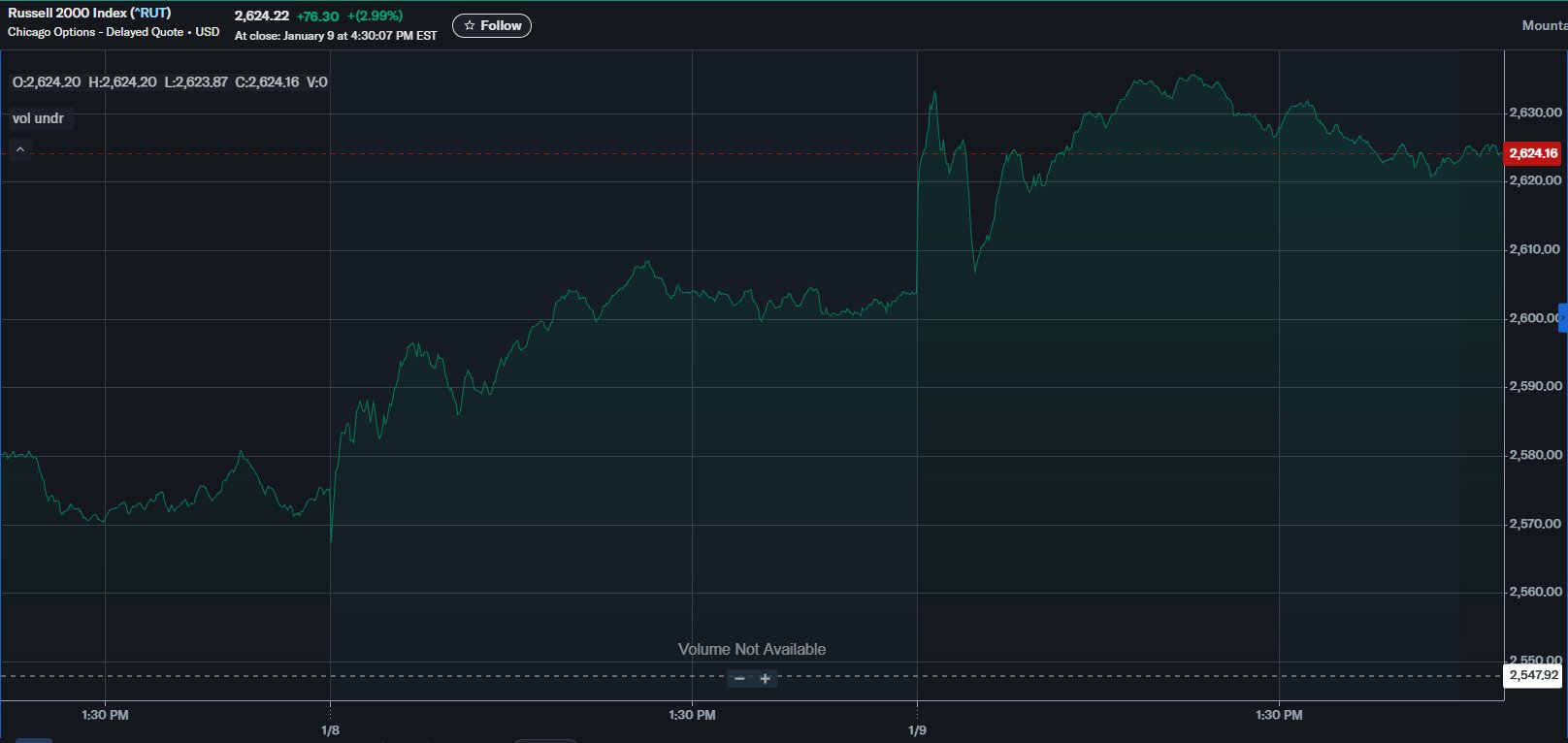

Now, in January 2026, the Russell Index has broken above 2,600 points for the first time in its history.

This isn’t a false breakout, nor a fleeting surge driven by thin holiday trading. Instead, it’s a comprehensive, broad-based rally backed by substantial volume, pushing the index’s year-to-date gains to approximately 15%.

What the Russell Index Truly Represents

Trading in small-cap stocks isn’t driven by fleeting market sentiment or gut feelings; it’s fundamentally a play on liquidity.

The Russell Index tracks approximately 2,000 smaller U.S. companies, encompassing regional banks, industrial enterprises, biotechnology firms, and more. The survival and growth of these businesses are intricately linked to the borrowing environment and growth expectations.

- When liquidity tightens, these companies bear the brunt.

- Conversely, when liquidity is abundant, they often lead the broader market charge.

This explains why the Russell never spearheads a defensive market but frequently becomes the vanguard when risk appetite returns. Therefore, its breakout isn’t merely a technical event; it’s an unequivocal signal that capital is moving down the risk curve, actively seeking higher returns.

This Is Not an Isolated Case: Supported by Macro Context

Broaden your perspective, and you’ll find that the current macroeconomic backdrop aligns disturbingly well with this trend.

- The Federal Reserve is discreetly bolstering market reserves by purchasing Treasury bills. While not a full-blown quantitative easing (QE), these actions are sufficient to alleviate funding pressures and lubricate credit markets.

- The U.S. Treasury is reducing its General Account (TGA) balance, which means pushing cash back into market circulation rather than withdrawing it.

- Fiscal policy is gradually loosening at the margins, evidenced by larger tax refunds, potential consumer subsidies, and efforts to depress interest rates through mortgage-backed security purchases, thereby freeing up household and corporate balance sheets.

Individually, none of these measures might scream “stimulus.” But when they converge, they create a powerful cascade of liquidity. And liquidity, by its very nature, never stands still.

The True Path of Liquidity Transmission

This is where many often misunderstand. Liquidity doesn’t magically ‘teleport’ from cash directly into altcoins. Instead, it follows a distinct sequence and hierarchy:

- First, it stabilizes bond and funding markets.

- Then, it propels equity markets higher.

- Subsequently, it seeks higher-beta (higher risk, higher reward) assets within the stock market.

- Only after these stages does it spill over into alternative asset classes.

Small-cap stocks occupy a crucial middle link in this chain. They are riskier than mega-cap stocks but present a clear, understandable logic for institutional investors. When small caps begin to outperform larger counterparts, it typically signifies that capital’s gaze has moved beyond “safety” and is now actively chasing “growth.”

This is precisely why a Russell Index breakout has historically heralded a broader expansion across risk assets. It’s not a coincidence; it’s a mechanical and inevitable transmission process.

Cryptocurrency’s Place in This Dynamic

The cryptocurrency market isn’t a leader in the liquidity cycle; it’s an amplifier.

When the Russell Index enters a sustained uptrend, higher-beta assets tend to follow with a lag. Historical data repeatedly shows that ETH and altcoins typically respond with a lag of one to three months.

This isn’t because traders are fixated on the Russell Index on their TradingView charts, but because the very same wave of liquidity propelling capital into small caps eventually seeks assets with higher ‘convexity’ – the potential for outsized returns with relatively contained risk.

And the crypto market, especially one that has endured capitulation-level selling, thin order books, and exhausted sellers, is precisely the destination for this search. This perfectly describes the landscape of the crypto market in early 2026.

Why This Time Feels Different, But the Essence Remains Unchanged?

Every cycle presents its own set of “this time is different” arguments.

- In 2017, it was the ICO frenzy and excessive speculation.

- In 2021, it was over-leveraged positions and market exuberance.

- In 2026, it’s regulatory uncertainty, macroeconomic anxieties, and pervasive market fatigue.

While these superficial explanations evolve, the fundamental laws of capital flow remain constant.

What *is* different this time is the significantly improved market “plumbing” or infrastructure: clearer regulatory frameworks, institutional-grade custody standards, spot ETFs continuously absorbing market supply, and a reduction in excessive speculative leverage at the market’s fringes.

Even industry insiders are now openly discussing perspectives that were once whispered behind closed doors. When figures like CZ speak of a potential “supercycle,” they’re not merely hyping; they’re pointing to a rare confluence of factors: liquidity, regulation, and market structure finally aligning and moving in the same direction. Such synergy is exceptionally rare.

The Mistake Crypto-Native Traders Are Making

Most crypto traders remain fixated on crypto charts, waiting for confirmation signals from the market itself. By then, it’s often too late.

When altcoins begin their price surges, the capital rotation has already completed its journey through other markets. The signal for returning risk appetite first appears in markets that don’t rely on hype to ascend. Small caps are precisely such a market. They don’t rally on memes; they rise because borrowing becomes easier and capital regains confidence.

Therefore, to dismiss the Russell Index breakout as “irrelevant to crypto” is to entirely miss the crucial point.

The True Meaning of a ‘Supercycle’

A ‘supercycle’ doesn’t imply that all assets will appreciate indefinitely. Instead, it signifies:

- Structural Support: The rally endures longer than expected because it’s driven by market structure, not fleeting euphoria.

- Dips Are Absorbed: Market pullbacks are met with buying demand, preventing them from cascading into full-blown crashes.

- Capital Rotation, Not Exit: Capital rotates between different sectors and assets rather than entirely withdrawing from the market.

- High-Beta Assets Revitalized: After years of suppression, high-risk, high-reward assets finally find room to breathe and appreciate.

This is precisely the environment where altcoins historically cease their “bleeding” and begin their value re-assessment. Not all altcoins will rise, nor will their gains be uniform, but the overarching trend will be decisive.

The Signal Is On the Table

The Russell Index breaking to new all-time highs is no accident. It occurs when liquidity loosens, risk tolerance returns, and capital decides to deploy once again.

- It did so in 2017.

- It repeated in 2021.

- And it is doing so once again, right now.

You don’t need to predict specific price targets or precisely time the rotation. You merely need to recognize that when small caps lead the market, they are signaling what’s coming next.

The crypto market has historically ignored this signal, often to its regret just a few months later.

(The above content is excerpted and reproduced with authorization from our partner PANews. Original Article Link)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses resulting from investor trades.