Polygon’s Ambitious Rebirth: From Sidechain to Global Payment & Tokenization Powerhouse

Once known primarily as an Ethereum “sidechain,” Polygon is undergoing a profound metamorphosis. Co-founder Sandeep Nailwal recently declared 2026 the “year of rebirth” for the POL token, a statement that immediately saw POL’s price surge over 30%. With strategic acquisitions and an ambitious technical roadmap, Polygon is rapidly evolving into a foundational layer for global payments and tokenized assets, aiming to redefine its role in the blockchain ecosystem.

Aggressive Acquisitions: Bridging the Physical and Digital Financial Worlds

Polygon is executing a bold strategy to directly integrate with real-world financial entry points. On January 13, Polygon Labs announced the acquisition of Coinme and Sequence for a combined sum exceeding $250 million. This move is a cornerstone of Polygon’s stablecoin and payment strategy, designed to bolster its infrastructure footprint.

- Coinme: A pioneer in cash-to-crypto exchanges, Coinme operates an extensive network of crypto ATMs across 49 U.S. states, including major retailers like Kroger. Crucially, this acquisition includes a comprehensive suite of U.S. Money Transmitter Licenses (MTLs), essential for any payment institution operating nationwide. This establishes a physical on/off-ramp, enabling everyday users without traditional bank accounts or centralized exchange access to convert cash directly into on-chain assets like stablecoins or POL at supermarket checkouts. This isn’t merely about hardware; it’s about acquiring vital channels, licenses, and trust, creating a significant compliance barrier to entry.

- Sequence: This acquisition strengthens Polygon’s on-chain infrastructure, providing services like crypto wallets that enhance user experience and accessibility.

Polygon Labs CEO Marc Boiron and Sandeep Nailwal view this as a strategic leap, extending Polygon’s reach from “smart contracts” into “physical infrastructure.” Nailwal explicitly stated that this positions Polygon Labs in direct competition with FinTech giants like Stripe, which has also been building out a comprehensive payment and asset storage stack. This aggressive M&A strategy places Polygon Labs on an equal footing with traditional finance powerhouses in the burgeoning stablecoin arms race.

Engineering for Scale: The Quest for 100,000 TPS

Robust technical capabilities are paramount for Polygon’s ambitions in the payment sector. Sandeep Nailwal’s revealed TPS (transactions per second) roadmap outlines a plan to elevate blockchain execution efficiency to traditional internet speeds.

- Initial Gains: Polygon’s recent Madhugiri hard fork upgrade has already boosted on-chain TPS by 40%, reaching 1,400 TPS.

- Phase One (6 months): The team aims for 5,000 TPS, addressing current congestion on the PoS chain during peak periods and enabling Polygon to handle global retail payment throughput.

- Phase Two (12-24 months): An ambitious target of 100,000 TPS across the entire ecosystem, positioning Polygon to process transaction volumes comparable to Visa.

Achieving this monumental leap relies on two key technological advancements:

- Rio Upgrade: Introducing stateless validation and recursive proofs to reduce transaction finality from minutes to approximately 5 seconds, while eliminating the risk of chain reorganizations.

- AggLayer (Aggregation Layer): Utilizing ZK proof aggregation to enable seamless multi-chain liquidity sharing. This means the 100,000 TPS target isn’t borne by a single chain but by the distributed collective power of the entire Polygon network.

In essence, Polygon is not merely upgrading a single blockchain; it’s architecting a federated network of interconnected chains.

Dominating Payments: Deep Integrations with Global FinTech Giants

With established on/off-ramp channels and enhanced throughput, Polygon is rapidly becoming a preferred technical backbone for global payment networks, forging deep alliances with leading FinTech players:

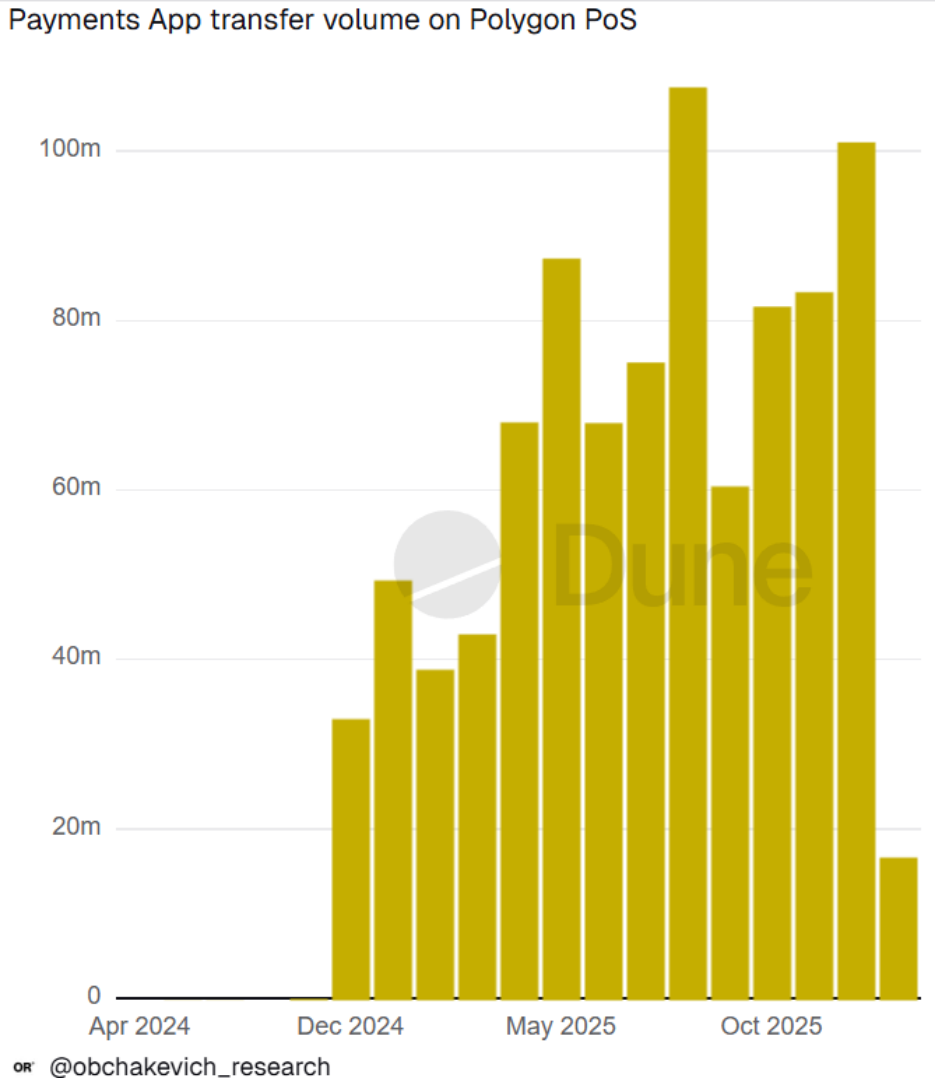

- Revolut’s Full Integration: Europe’s largest digital bank, with 65 million users, has integrated Polygon as its primary infrastructure for crypto payments, staking, and trading. Revolut users can now conduct low-cost stablecoin transfers and POL token staking directly via Polygon. By the end of 2025, cumulative transaction volume from Revolut users on Polygon neared $900 million, demonstrating a steady upward trend.

- Flutterwave’s Settlement Bridge: African payment giant Flutterwave has adopted Polygon as its default public chain for cross-border stablecoin settlements. This offers a superior alternative to costly traditional remittances in Africa, benefiting platforms like Uber for local driver payments and facilitating trade.

- Mastercard’s Identity Solution: Mastercard leverages Polygon to power its “Mastercard Crypto Credential” identity solution. This introduces verified usernames for self-custodial wallets, significantly lowering entry barriers, mitigating address identification risks during transfers, and enhancing the overall payment experience.

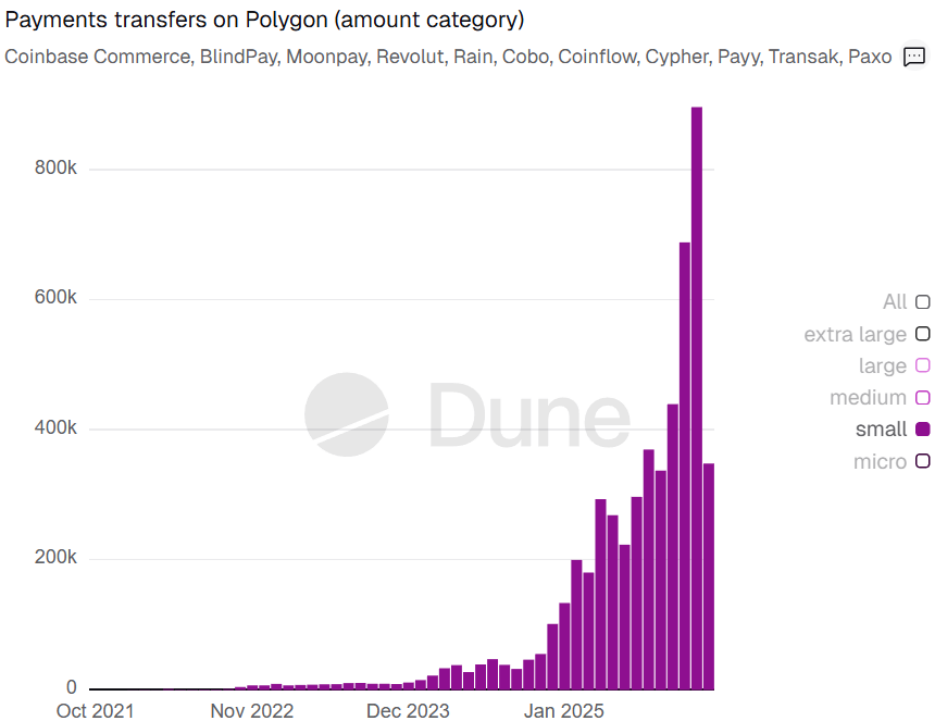

Polygon’s penetration into daily consumer spending is also evident. Dune data for late 2025 shows small-value payments (between $10 and $100) on Polygon reaching a historic high of nearly 900,000 transactions, a 30% increase from November. Leon Waidmann, Head of Onchain Research, highlights that this transaction range closely mirrors daily credit card spending, indicating Polygon’s growing role as a major payment gateway and a key player in PayFi (payment finance).

Pioneering Tokenization: Institutional Confidence and Real-World Assets (RWA)

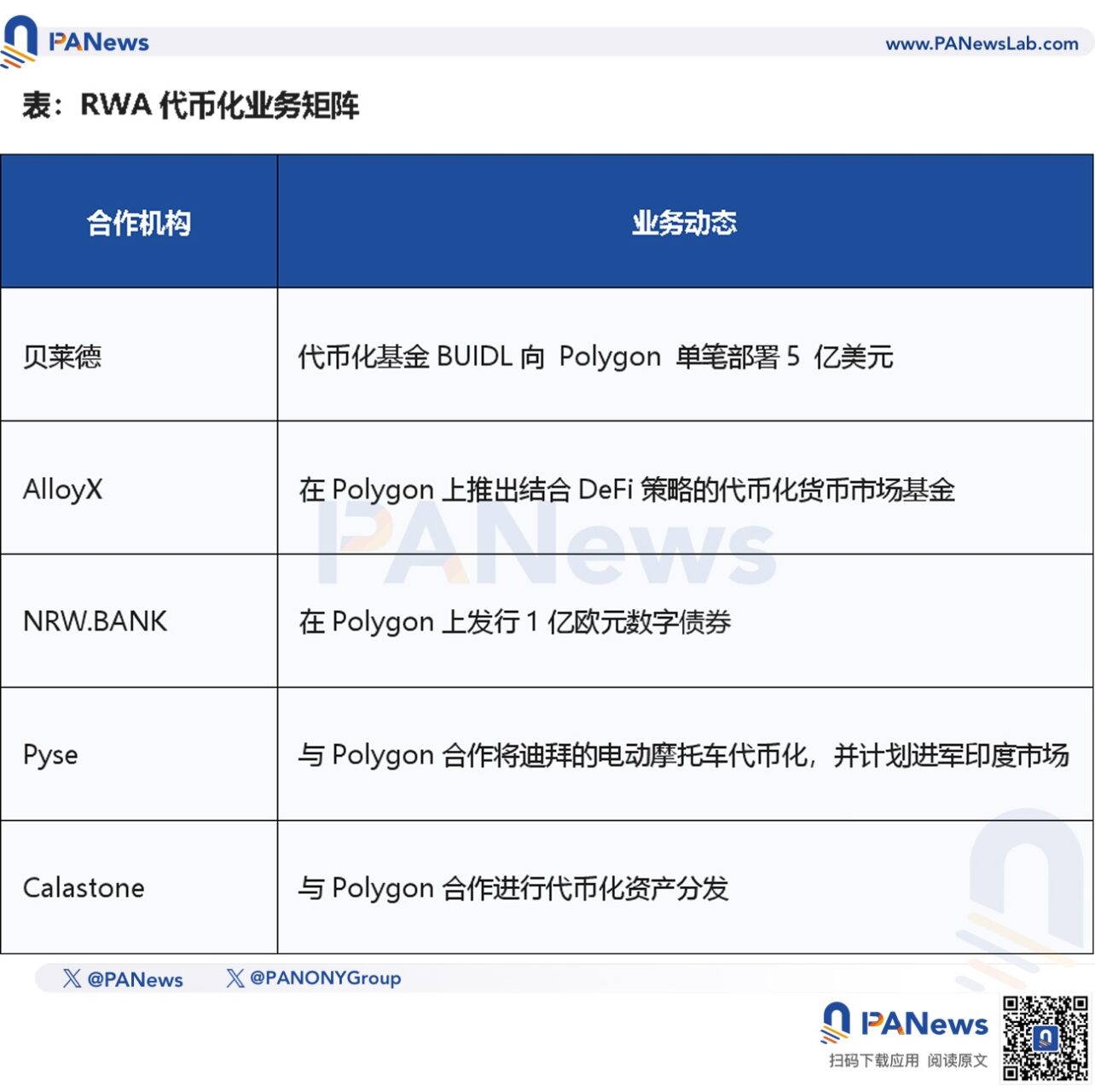

While payments drive user adoption, tokenization solidifies Polygon’s position as institutional-grade infrastructure. In the realm of Real-World Asset (RWA) distribution, Polygon has become a preferred platform for top global asset management firms, owing to its low interaction costs and seamless compatibility with the Ethereum ecosystem.

- BlackRock’s Strategic Bet: In October 2025, BlackRock, the world’s largest asset manager, deployed approximately $500 million in assets on the Polygon network via its BUIDL tokenization fund. This significant move serves as a high-level endorsement of Polygon 2.0’s architectural security, signaling potential for substantial increases in Polygon’s Total Value Locked (TVL) and liquidity.

- AlloyX’s Real Yield Token (RYT): Launched on Polygon, RYT exemplifies the convergence of traditional finance and DeFi. This fund invests in short-term, low-risk instruments like U.S. Treasury bonds, uniquely supporting looping strategies where investors can use RYT as collateral in DeFi protocols to borrow and reinvest, amplifying returns.

- NRW.BANK’s Digital Bonds: The German NRW.BANK’s issuance of digital bonds on Polygon represents a major breakthrough in European regulated capital markets. Operating under Germany’s Electronic Securities Act (eWpG), this demonstrates Polygon’s capacity to support not only standard crypto tokens but also highly regulated, compliant assets.

The POL Token Rebirth: A New Economic Paradigm

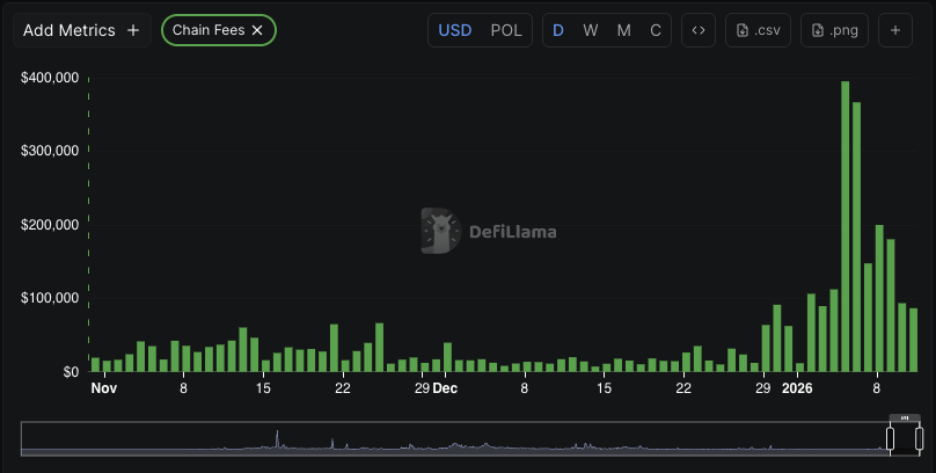

The transition from MATIC to POL signifies more than just a symbol change; it represents a fundamental restructuring of Polygon’s economic logic. Since early 2026, Polygon has generated over $1.7 million in fees and burned more than 12.5 million POL tokens (approximately $1.5 million).

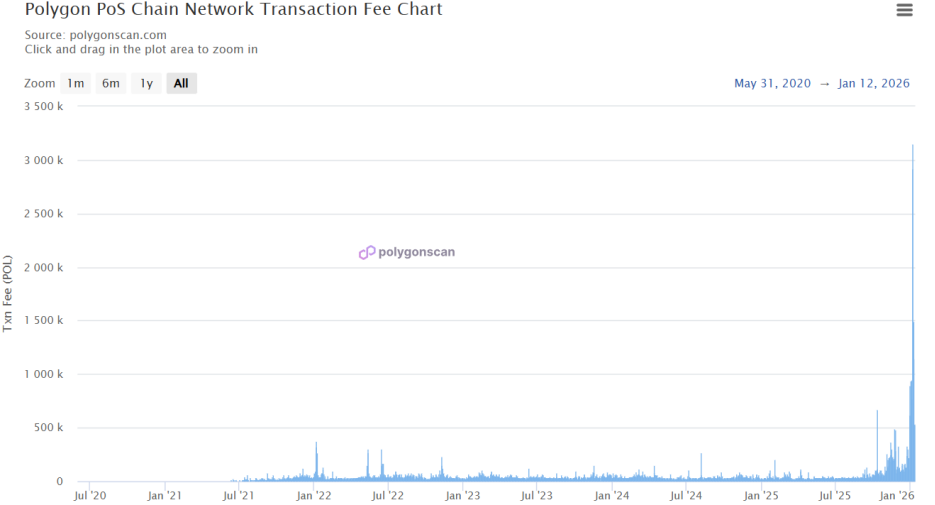

Castle Labs attributes a significant portion of this fee surge to Polymarket’s introduction of 15-minute prediction market fees, generating over $100,000 in single-day revenue for Polygon. The Polygon PoS network also set a record by burning 3 million POL in a single day, roughly 0.03% of the total supply—a natural consequence of the ecosystem entering a phase of high-frequency usage.

Under the EIP-1559 mechanism, gas fees accelerate when block utilization consistently exceeds 50%. Currently, Polygon’s daily burn rate is stable at around 1 million POL, equating to an annualized burn rate of approximately 3.5%—more than double its annual staking reward rate (around 1.5%). This means that, through on-chain activity alone, POL’s circulating supply is being “physically removed” at a considerable pace, creating significant deflationary pressure. This high-density value capture could be the engine behind Sandeep Nailwal’s vision of a “token rebirth.”

Navigating the Future: Opportunities and Fourfold Risks

While Polygon’s trajectory appears promising, it faces several critical challenges:

- Regulatory Double-Edged Sword: The acquisition of Coinme, while providing crucial licenses, also directly exposes Polygon to the complex and evolving regulatory landscape across U.S. states. Any unresolved compliance issues from Coinme’s past could impact the POL token’s 2026 “rebirth” plan.

- Fragmented Technical Architecture: Polygon 2.0’s multi-component architecture, encompassing PoS, zkEVM, AggLayer, and Miden, promises immense power but introduces significant engineering complexity and security risks. A vulnerability in AggLayer’s cross-chain interaction, for instance, could trigger a systemic disaster.

- Intense Competition in the Public Chain Market:

- The Rise of Base: Backed by Coinbase, Base has captured significant user growth, encroaching on Polygon’s market share in social and payment applications.

- High-Performance L1s: Leading Layer 1 blockchains like Solana still hold an advantage in raw transaction speed and developer experience, meaning Polygon’s 100,000 TPS target requires time and validation to prove its competitive edge.

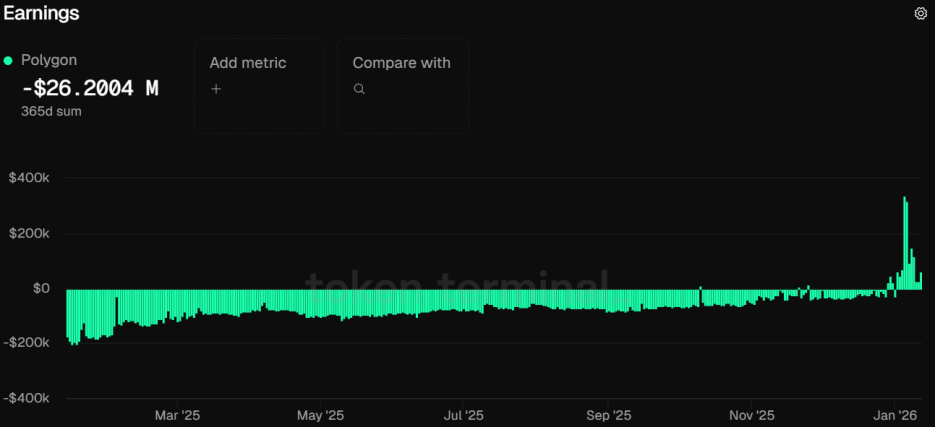

- Financial Sustainability Concerns: Token Terminal data reveals Polygon incurred a net loss exceeding $26 million in the past year, with fee revenue insufficient to cover validator costs. This reliance on ecosystem incentives suggests Polygon is still in a “cash-burn for market share” phase. While profitability by 2026 is projected, the long-term sustainability of its revenue generation remains a key area to monitor.

Clearly, Polygon is no longer content to be merely an “Ethereum plugin.” Its transformation strategy is meticulously crafted: breaking performance bottlenecks through technical scaling, lowering entry barriers through strategic M&A, securing credibility via top-tier institutional adoption, and finally, strengthening user loyalty through high-frequency use cases. For investors, tracking the technical implementation of Polygon 2.0, capital inflows, turnover rates, and financial performance will be crucial indicators of whether Polygon can successfully achieve its phoenix-like rebirth in 2026 and beyond.

Disclaimer: This article is for market information purposes only. All content and views are for reference only, do not constitute investment advice, and do not represent the views and positions of BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not bear any responsibility for direct or indirect losses incurred by investor transactions.