Author: VanEck

Compiled by: Felix, PANews

2026 Investment Outlook: Clear Signals Point to Emerging Opportunities in AI, Gold, and Beyond

As we approach 2026, the global investment landscape is marked by an unusual degree of clarity. Distinct fiscal and monetary signals are fostering a more confident risk appetite, unveiling compelling opportunities across high-growth sectors. From the transformative power of Artificial Intelligence to the enduring appeal of gold, and the dynamic markets of India and cryptocurrencies, investors are poised to navigate a period ripe with potential.

Key Investment Highlights for 2026:

- AI Revaluation: A significant market correction in late 2025 has reset valuations for AI-related stocks, presenting more attractive entry points for this revolutionary technology.

- Gold’s Ascent: The precious metal continues its structural re-emergence as a pivotal global monetary asset; strategic pullbacks offer prime accumulation opportunities.

- Private Credit Revival: Business Development Companies (BDCs), having weathered a challenging 2025, now offer enhanced yields and more favorable valuations.

- India’s Growth Trajectory: India remains a high-potential market, driven by robust structural reforms and sustained economic expansion.

- Cryptocurrency Dynamics: While long-term bullish, the short-term outlook for digital assets, particularly Bitcoin, presents complex signals following a deviation from its traditional four-year cycle.

A Landscape of Clarity: Navigating 2026

The market environment entering 2026 is characterized by a rare and welcome clarity. While judicious selection remains paramount, the distinct signals emanating from fiscal and monetary policy, coupled with well-defined investment themes, underpin a more assertive approach to risk. This newfound transparency allows investors to strategically position themselves for growth.

AI and the Tech Revaluation: A Renewed Opportunity

The latter half of 2025 saw a notable correction in certain AI-related equities, effectively recalibrating valuations. This adjustment makes the “AI trade” considerably more appealing than its previously “frothy” October highs. Crucially, this market reset occurred against a backdrop of persistently strong underlying demand for computing power, digital tokens, and productivity-enhancing solutions.

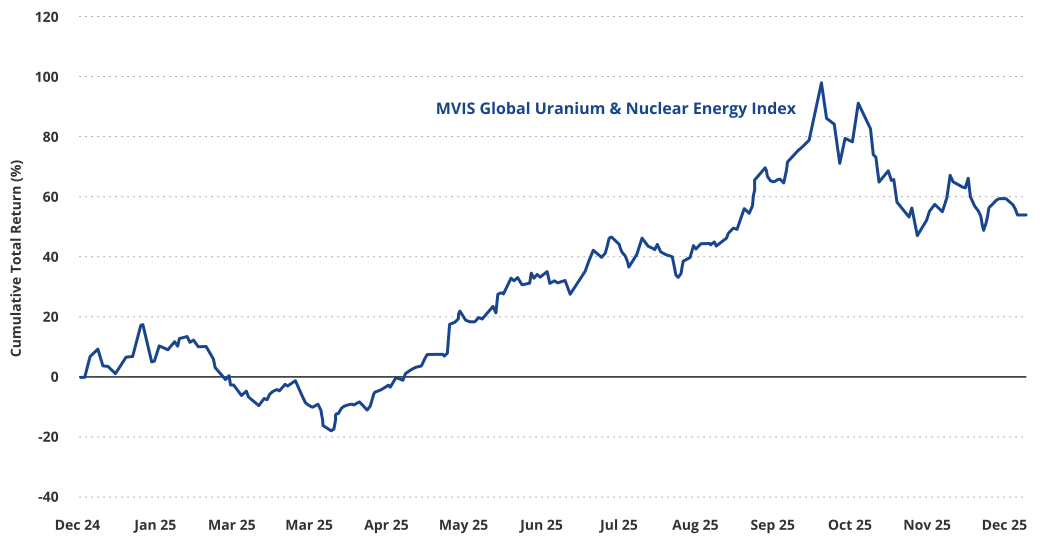

Concurrently, related sectors such as nuclear energy, which is intrinsically linked to the escalating power demands of AI infrastructure, also experienced significant price adjustments. Such corrections enhance the risk-reward profile for investors adopting a medium to long-term perspective.

Stabilized Foundations: Fewer Fiscal and Monetary Surprises Ahead

A cornerstone of this clearer market outlook is the gradual stabilization of the U.S. fiscal landscape. Although deficits persist, their proportion to GDP has receded from the unprecedented peaks witnessed during the pandemic. This fiscal consolidation is instrumental in anchoring long-term interest rates and mitigating potential tail risks.

On the monetary front, U.S. Treasury Secretary Scott Bessent’s characterization of current interest rate levels as “normal” is particularly insightful. It signals that market participants should not anticipate aggressive or disruptive short-term rate cuts in 2026. Instead, the prevailing outlook suggests a period of policy stability, marked by moderate adjustments and a reduction in market-jolting shocks – a key factor contributing to the overall market clarity.

Nuclear Energy Stocks Experienced a Q4 Pullback:

Private Credit’s Resurgence: The Appeal of BDCs

Business Development Companies (BDCs) endured a challenging 2025, but this period of adjustment has now paved the way for attractive opportunities. With compelling yields still available and credit concerns largely integrated into market pricing, BDCs present a more favorable investment proposition compared to a year ago.

This positive shift extends to the underlying management companies, such as Ares, whose valuations have similarly become more reasonable when assessed against their long-term profitability and proven track record.

Gold: The Enduring Global Monetary Asset

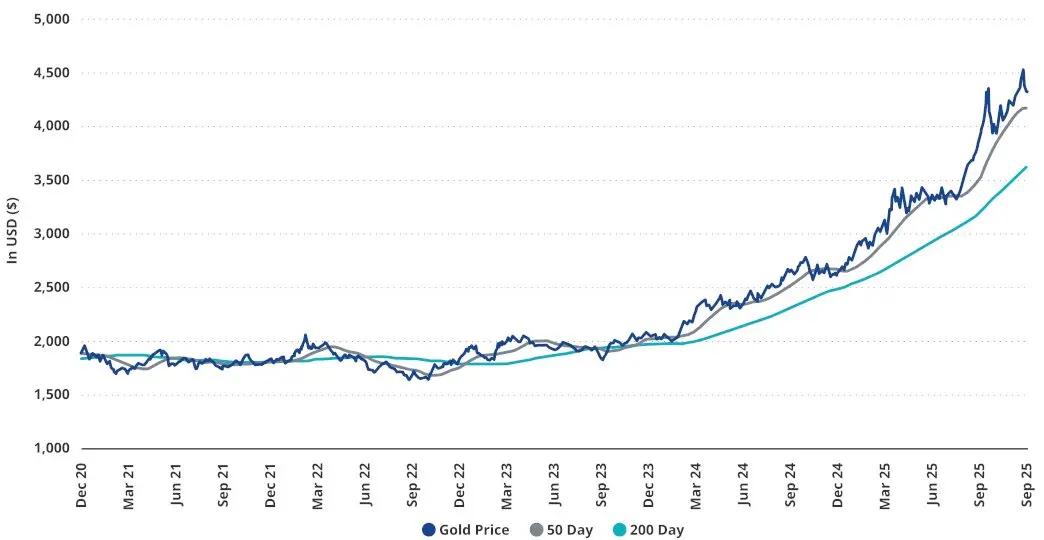

Gold continues its compelling re-emergence as a premier global monetary asset, propelled by robust central bank demand and the broader trend of global economic de-dollarization. While technical indicators might suggest gold prices appear somewhat stretched, VanEck views any market pullback as an opportune moment for accumulation. The fundamental structural advantages supporting gold’s value remain firmly in place.

Gold Price Above Support, Yet Demand Remains Strong:

Global Growth and Digital Assets: India and Cryptocurrencies

Beyond the U.S. domestic market, India stands out as a long-term investment powerhouse. Its immense potential is underscored by ongoing structural reforms and a consistently strong growth trajectory.

In the dynamic realm of cryptocurrencies, Bitcoin’s traditional four-year cycle experienced a notable deviation in 2025, introducing complexity to short-term signals. This departure suggests a more cautious outlook for the next 3 to 6 months. However, it’s worth noting that this perspective is not uniformly held within VanEck, with analysts like Matthew Sigel and David Schassler maintaining a more positive stance on the recent cycle’s implications.

(The above content is an excerpt and reproduction authorized by our partner PANews, original link)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.