Bitcoin Navigates Critical $97K Resistance Amid Shifting Market Dynamics and Geopolitical Tensions

After a two-day rally, Bitcoin (BTC) is currently facing a significant challenge, hovering just below the crucial $97,000 mark. This level is particularly noteworthy as it aligns with a long-term downtrend line, making a decisive breakthrough a formidable task. While consolidating at this position before a successful breach would strengthen BTC’s trajectory towards higher price targets, the cryptocurrency remains vulnerable to a potential pullback.

The most probable downside scenario sees BTC retreating to $93,000, a level strategically positioned just above a key short-term trend line. Should Bitcoin find robust support and stabilize at $93,000, it could significantly bolster its long-term bullish outlook. Investors are therefore advised to closely monitor this pivotal price point for potential entry or confirmation of trend continuation.

Whale Accumulation Signals Potential Upside

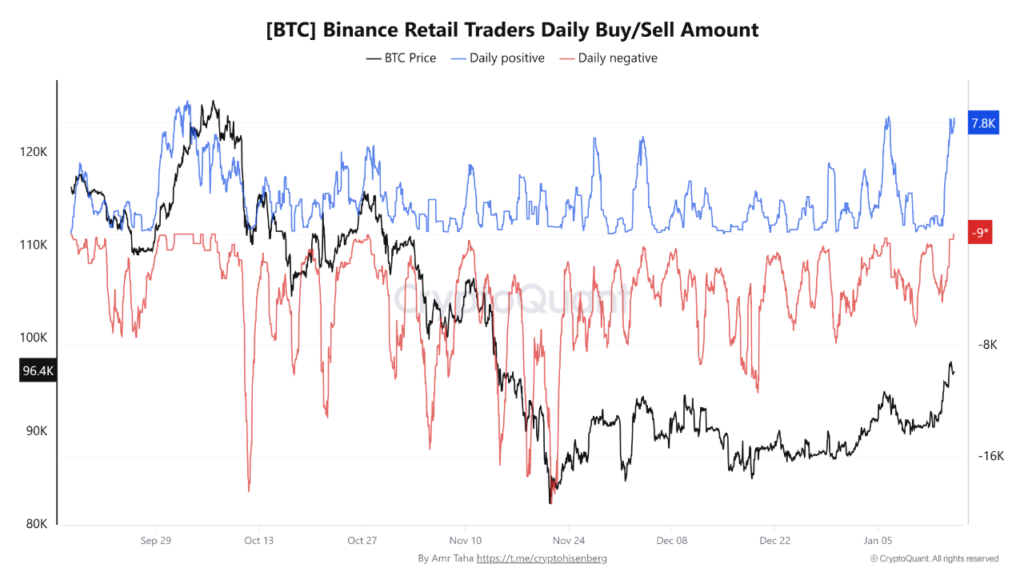

Adding another layer to the market’s complexity, recent on-chain data from Binance reveals intriguing investor behavior. As BTC momentarily pushed past the $97,000 threshold, a notable increase in retail buying was observed. Simultaneously, the exchange experienced a massive net outflow of nearly $3 billion in BTC. This dramatic shift saw net outflows escalate from -$1 billion to -$3 billion in a mere 15 days.

Historically, such substantial outflows of Bitcoin from exchanges are often interpreted as a strong indicator of “whale” accumulation – large institutional or individual investors moving their holdings off exchanges for long-term storage. This pattern typically precedes upward price movements, suggesting a potential supply squeeze and renewed confidence among major players.

Geopolitical Easing, But Caution Remains

The broader market also reacted to a perceived de-escalation in geopolitical tensions. Yesterday, statements from President Trump indicated no immediate plans for military action against Iran, which spurred a rebound in US stock indices. However, the cryptocurrency market, having already registered two consecutive days of gains and with BTC confronting a significant resistance level, did not sustain its upward momentum.

While the immediate situation appears calmer, market participants are urged to remain cautious. Given past patterns, there’s a possibility that Trump’s statements could be a strategic delay, with potential actions slated for after the US stock market closes on Friday. Consequently, vigilance regarding developments in the Middle East throughout the weekend is highly recommended.

Disclaimer: This article is provided for market information purposes only. All content and views expressed herein are for reference only and do not constitute investment advice. They do not necessarily represent the views or positions of the author or publisher. Investors are solely responsible for their own investment decisions and transactions. The author and publisher shall not be held liable for any direct or indirect losses incurred by investors as a result of their transactions.