The Crypto Investment Revolution: Survival in a Selective Market

The landscape of crypto venture capital is undergoing a profound transformation. What was once a speculative “spray and pray” environment has evolved into a highly discerning arena where only the most robust projects secure funding. This dramatic shift demands a re-evaluation of strategies for both founders and investors, marking a new era where execution trumps narrative.

1. The Seismic Shift in VC Investment Logic

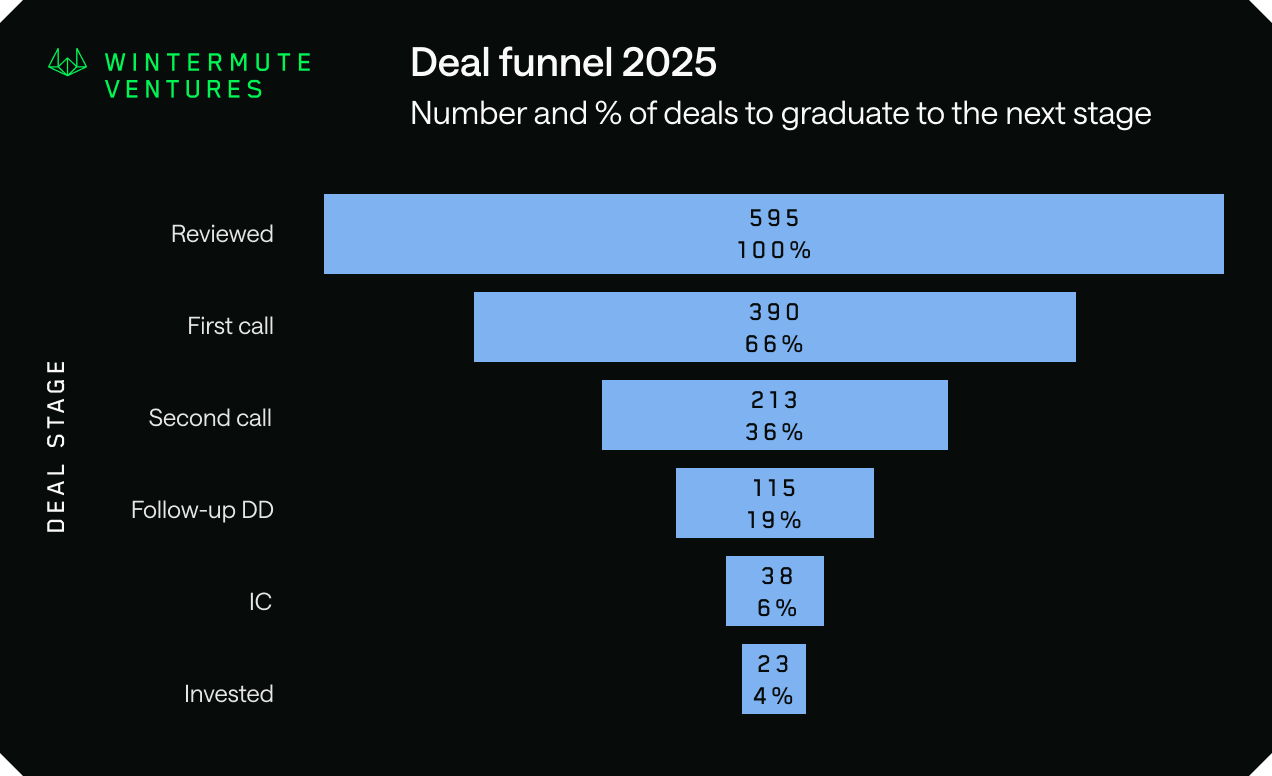

A stark revelation from Wintermute Ventures in 2025 underscores this new reality: the premier market maker and investment firm reviewed approximately 600 projects throughout the year but approved a mere 23 deals, an astonishingly low 4% acceptance rate. Even more telling, only 20% of projects advanced to the due diligence phase. Founder Evgeny Gaevoy candidly confirmed their complete departure from the expansive “spray and pray” investment model prevalent in 2021-2022.

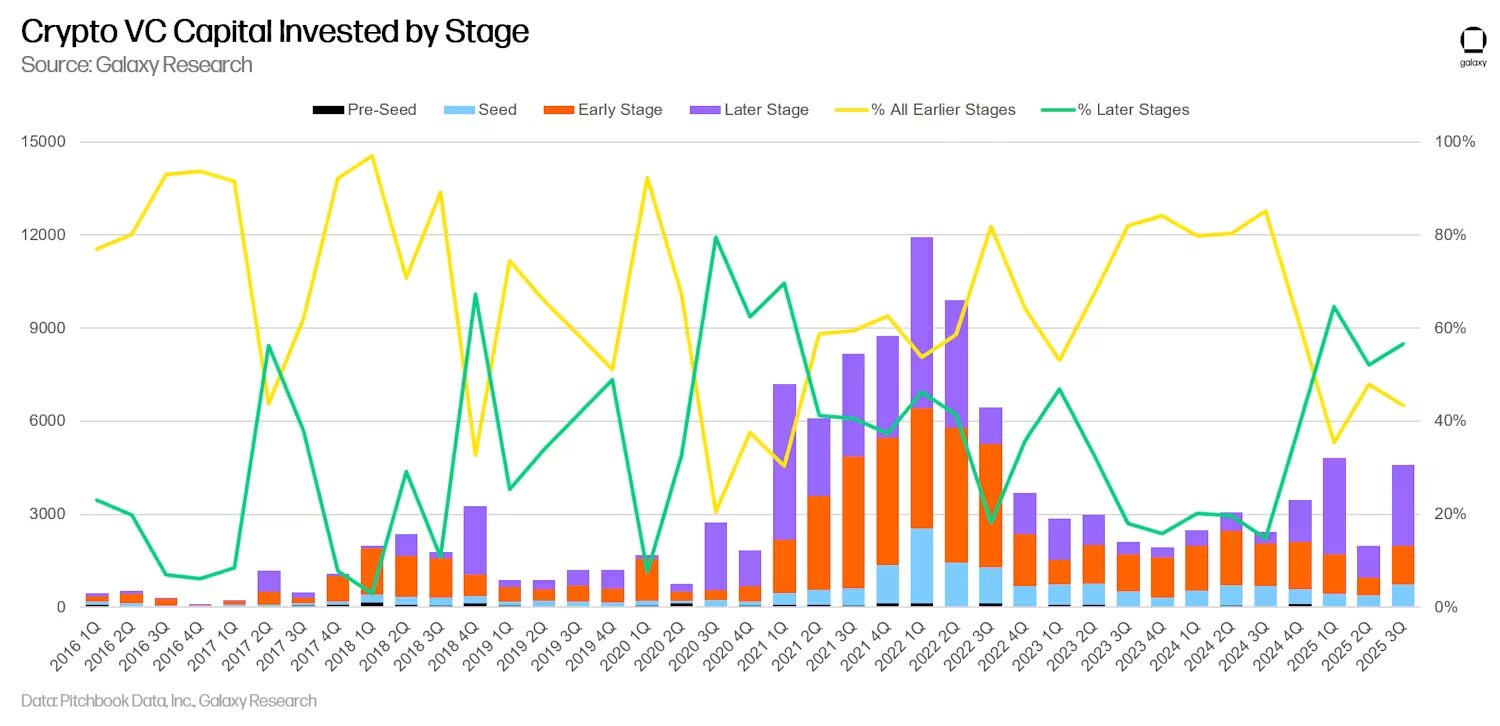

This isn’t an isolated incident; it reflects a systemic change across the entire crypto VC ecosystem. In 2025, the number of crypto VC deals plummeted by 60%, from over 2,900 in 2024 to roughly 1,200. While global crypto VC investment still totaled an impressive $4.975 billion, this capital became increasingly concentrated in fewer, more established projects. Late-stage investments accounted for a significant 56% of total funding, while early-stage seed rounds were squeezed to historical lows. Data from the U.S. market further highlights this trend: deal count dropped by 33%, yet the median investment amount surged 1.5 times to $5 million. This indicates a clear preference among VCs to place substantial bets on a select few rather than spreading capital thinly across many.

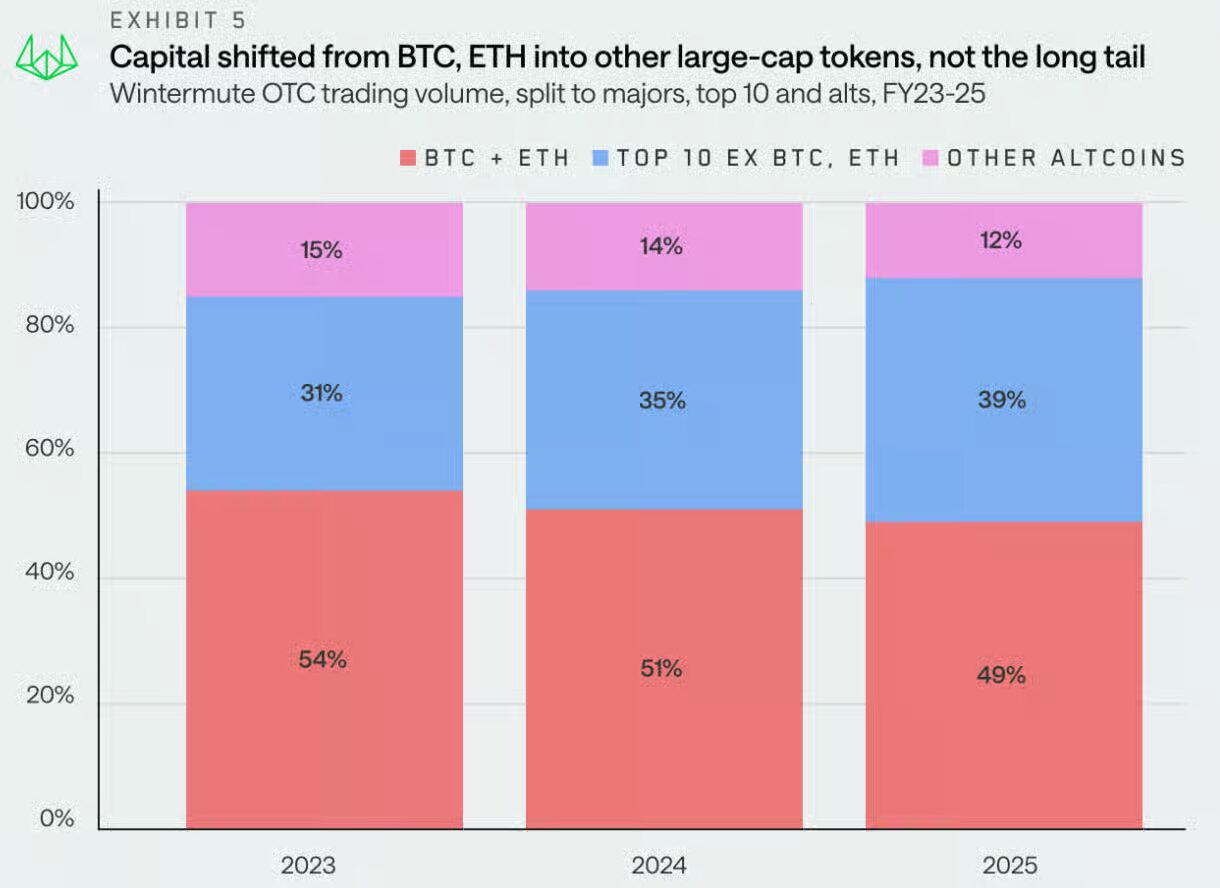

The root cause of this paradigm shift is the extreme concentration of market liquidity. The 2025 crypto market was characterized by its “narrowness,” with institutional funds comprising a staggering 75% of capital. However, this capital was predominantly locked into large-cap assets like Bitcoin (BTC) and Ethereum (ETH). OTC trading data revealed that while BTC and ETH’s market share slightly decreased from 54% to 49%, the overall share of blue-chip assets grew by 8%. More critically, the narrative cycle for altcoins collapsed from 61 days in 2024 to a mere 19-20 days in 2025, leaving insufficient time for funds to trickle down to small and medium-sized projects. Retail investors, once a significant driver, have largely shifted their focus to AI and tech stocks, depriving the crypto market of incremental capital.

The traditional “four-year bull market” cycle has effectively disintegrated. Wintermute’s report explicitly states that a 2026 recovery will not be organic; it demands a powerful catalyst. This could be the expansion of ETFs to assets like Solana (SOL) or XRP, BTC breaking the $100,000 psychological barrier to ignite FOMO, or a new compelling narrative reigniting retail enthusiasm. In such an environment, VCs are no longer willing to gamble on projects that merely “tell stories.” They now seek projects that can demonstrate, from the seed stage, a clear path to exchange listing and access to institutional liquidity.

This fundamental shift has redefined investment logic: from “investing in 100 to find one 100x return” to “investing in only 4 projects that can survive to listing.” Risk aversion is no longer a conservative stance but a prerequisite for survival. Top-tier funds like a16z and Paradigm are actively reducing early-stage investments, favoring mid-to-late-stage rounds. The dramatic collapses of high-profile projects funded in 2025—Fuel Network’s valuation plummeting from $1 billion to $11 million, Berachain’s 93% peak-to-trough decline, and Camp Network’s 96% market cap evaporation—serve as brutal reminders: narratives are dead, execution is king.

2. Seed Stage: The New Battleground for Self-Sufficiency

Under this new paradigm of extreme precision, the most formidable challenge for startup teams is that the seed round is no longer a starting point for burning cash. Instead, it has become a critical lifeline where projects must unequivocally prove their ability to generate revenue and sustain themselves.

This self-sufficiency is first and foremost demonstrated through rigorous Product-Market Fit (PMF) validation. VCs are no longer swayed by polished business plans or grand visions; they demand concrete data. This includes a minimum of 1,000 active users or monthly revenue exceeding $100,000. Crucially, user retention is paramount: a DAU/MAU ratio below 50% signals a fundamental lack of user engagement. Many projects falter here, possessing elegant whitepapers and sophisticated technical architectures but failing to provide tangible evidence of genuine user adoption and willingness to pay. A significant number of the 580 projects rejected by Wintermute reportedly failed this critical PMF test.

Capital efficiency presents the second existential hurdle. VCs predict a surge of “profitable zombies” in 2026—companies with a meager $2 million in Annual Recurring Revenue (ARR) and only 50% annual growth, rendering them unattractive for Series B funding. This mandates that seed-stage teams achieve a “default alive” state: their monthly burn rate must not exceed 30% of their revenue, or they must achieve profitability early on. While seemingly stringent, this is the sole path to survival in a liquidity-constrained market. Teams must operate lean, ideally under 10 members, prioritize open-source tools to minimize costs, and even explore supplementary revenue streams like consulting services. Projects with large teams and exorbitant burn rates are highly unlikely to secure follow-on funding in 2026.

Technical requirements are also escalating rapidly. 2025 data indicates that for every dollar VCs invested, 40 cents flowed into crypto projects that also integrated AI—a doubling from 2024. AI is no longer a luxury but a necessity. Seed-stage projects must illustrate how AI integration shortens development cycles from six months to two, or how AI agents drive capital transactions and optimize DeFi liquidity management. Concurrently, compliance and privacy protection must be architected into the codebase from day one. With the rise of Real World Assets (RWA) tokenization, projects need to leverage technologies like zero-knowledge proofs to ensure privacy and reduce trust costs. Projects neglecting these critical technical and regulatory demands will be deemed “a generation behind.”

The most critical requirement is liquidity and ecosystem compatibility. Crypto projects must meticulously plan their exchange listing pathway from the seed round, clearly outlining how they will connect to institutional liquidity channels such as ETFs or Digital Asset Trusts (DATs). The data is unequivocal: institutional capital constituted 75% of the market in 2025, and the stablecoin market surged from $206 billion to over $300 billion, while narrative-driven altcoin projects faced exponentially increasing fundraising difficulties. Projects must focus on ETF-compatible assets, forge early partnerships with exchanges, and proactively build liquidity pools. Teams operating with the mindset of “secure funding first, worry about listing later” are unlikely to survive beyond 2026.

Collectively, these demands transform the seed round from a preliminary exploration into a comprehensive examination. Teams require multidisciplinary expertise—engineers, AI specialists, financial experts, and compliance advisors are all indispensable. They must employ agile development for rapid iteration, rely on data rather than narratives, and build sustainable business models instead of depending on continuous fundraising for survival. The sobering statistics speak volumes: 45% of VC-backed crypto projects have failed, 77% generate less than $1,000 in monthly revenue, and 85% of tokens launched in 2025 are currently underwater. These figures unequivocally demonstrate that projects lacking inherent self-sufficiency will not secure subsequent funding, let alone achieve exchange listings and successful exits.

3. A Wake-Up Call for Investors: Adapting to the New Crypto Landscape

For strategic investors and VC firms, 2026 represents a critical juncture: adapt to the new rules or face market obsolescence. Wintermute’s 4% approval rate is not a boast of selectivity but a stark warning to the industry—institutions still clinging to the outdated “spray and pray” model are destined for severe losses.

At the heart of this issue is the market’s transition from speculation-driven to institution-driven. When 75% of capital is channeled through institutional avenues like pension and hedge funds, when retail investors flock to AI stocks, and when altcoin rotation cycles shrink from 60 days to 20 days, VCs who continue to cast a wide net on narrative-centric projects are essentially squandering capital. The dramatic downturns in 2025—GameFi and DePIN narratives falling over 75%, AI-related projects dropping an average of 50%, and $19 billion in leveraged liquidations during the October cascading event—all underscore a singular truth: the market no longer rewards narratives; it demands execution and sustainable value.

Investment institutions must fundamentally recalibrate their strategies. This begins with a complete overhaul of investment criteria: shifting from “how grand can this story be?” to “can this project prove self-sufficiency at the seed stage?” The era of scattering large amounts of capital in early stages is over. Instead, VCs must either make concentrated, high-conviction bets on a few high-quality seed projects or pivot towards mid-to-late-stage rounds to mitigate risk. The data from 2025, showing late-stage investments accounting for 56% of total funding, is not coincidental but a direct reflection of market sentiment.

Even more critical is the repositioning of investment sectors. The convergence of AI and crypto is not a nascent trend but a present reality—investments in the AI-crypto cross-domain are projected to exceed 50% in 2026. Institutions that continue to invest solely in narrative-driven altcoins, neglect compliance and privacy, or disregard AI integration will find their portfolio projects unable to access liquidity, secure listings on major exchanges, let alone achieve successful exits.

Finally, investment methodologies must evolve. Proactive outbound sourcing must replace passive waiting for business plans. Accelerated due diligence must supplant protracted evaluation processes, and swift responsiveness must overcome bureaucratic inertia. Simultaneously, VCs must actively explore structural opportunities in emerging markets—such as AI Rollups, RWA 2.0, stablecoin applications for cross-border payments, and fintech innovations. The investor mindset must transition from a “gambler seeking 100x returns” to a “hunter selecting survivors,” screening projects with a long-term 5-10 year vision rather than short-term speculative logic.

Wintermute’s report is a critical alarm bell for the entire industry: 2026 is not a natural continuation of a bull market but a winner-take-all battlefield. Those who proactively embrace this aesthetic of precision—be they entrepreneurs or investors—will seize the high ground when liquidity eventually returns. Conversely, participants who cling to outdated models, antiquated thinking, and old standards will witness their invested projects fail, their held tokens devalue to zero, and their exit pathways close one by one. The market has changed, the rules of the game have changed, and one truth remains immutable: only projects with genuine self-sufficiency and a clear path to exchange listing are truly worthy of this era’s capital.