Author: CryptoPunk

Five-Year Backtest Reveals: The Hidden Pitfalls of 3x Leveraged Bitcoin DCA

Executive Summary:

A comprehensive five-year backtest of Bitcoin (BTC) dollar-cost averaging (DCA) strategies reveals a critical insight: while 3x leverage offers a mere 3.5% additional return over 2x leverage, it introduces an unacceptable risk of near-total capital loss. When evaluating risk, reward, and practicality, spot DCA emerges as the optimal long-term strategy, with 2x leverage representing an aggressive upper limit. 3x leverage, however, proves to be an ill-advised choice, offering negligible benefit for exponentially greater risk.

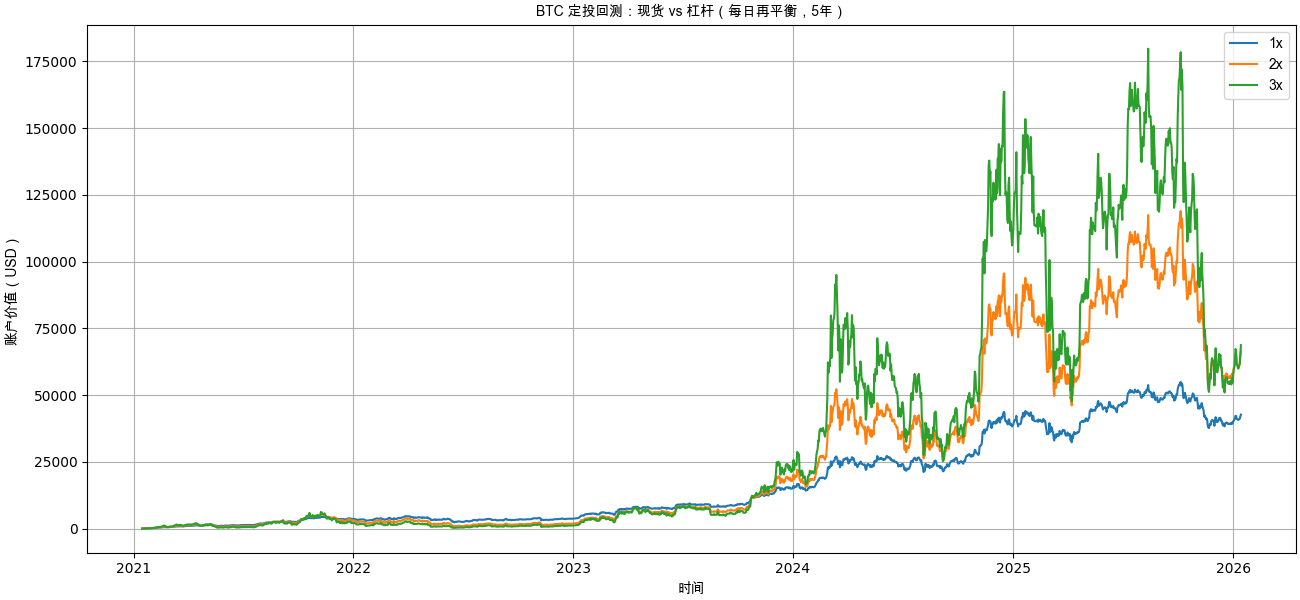

1. Net Value Curve: 3x Leverage Fails to Gain a Significant Edge

A direct visual analysis of the net value trends clearly illustrates the performance disparity:

- Spot (1x): Exhibits a smooth, upward trajectory with manageable drawdowns, indicating stable growth.

- 2x Leverage: Demonstrates amplified gains during bull markets, significantly boosting returns in favorable conditions.

- 3x Leverage: Characterized by multiple periods of “crawling on the ground” – extended periods of stagnation or severe drawdowns – indicating significant long-term erosion due to market fluctuations.

Despite a slight outperformance of 3x over 2x in the final rally towards 2025-2026, the 3x net value consistently lagged behind 2x for several years. This suggests that:

The ultimate “victory” of 3x leverage is highly contingent on a specific, favorable market surge at the very end of the investment horizon, masking years of underperformance and extreme risk.

Note: The leveraged portions of this backtest employed a daily rebalancing method, which inherently incurs volatility decay.

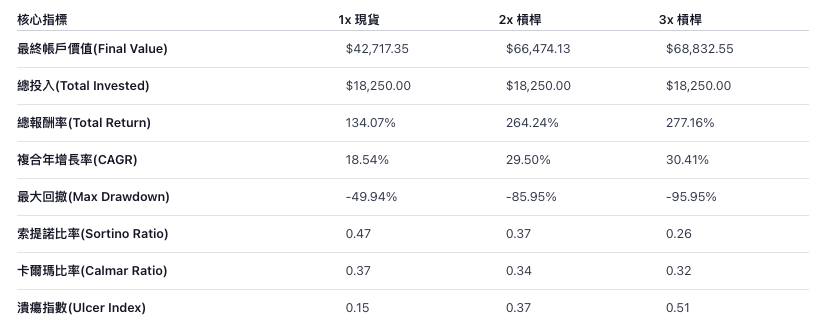

2. Final Returns Comparison: Marginal Gains Diminish Rapidly with Higher Leverage

[IMAGE-PLACEER-3]

The crucial question isn’t simply “which strategy yielded the highest return,” but rather “how much more was gained”:

- 1x → 2x: An approximate additional gain of $23,700.

- 2x → 3x: A paltry additional gain of only $2,300.

While returns barely increased from 2x to 3x, the associated risk escalated exponentially. This stark contrast highlights the rapidly diminishing marginal utility of increased leverage.

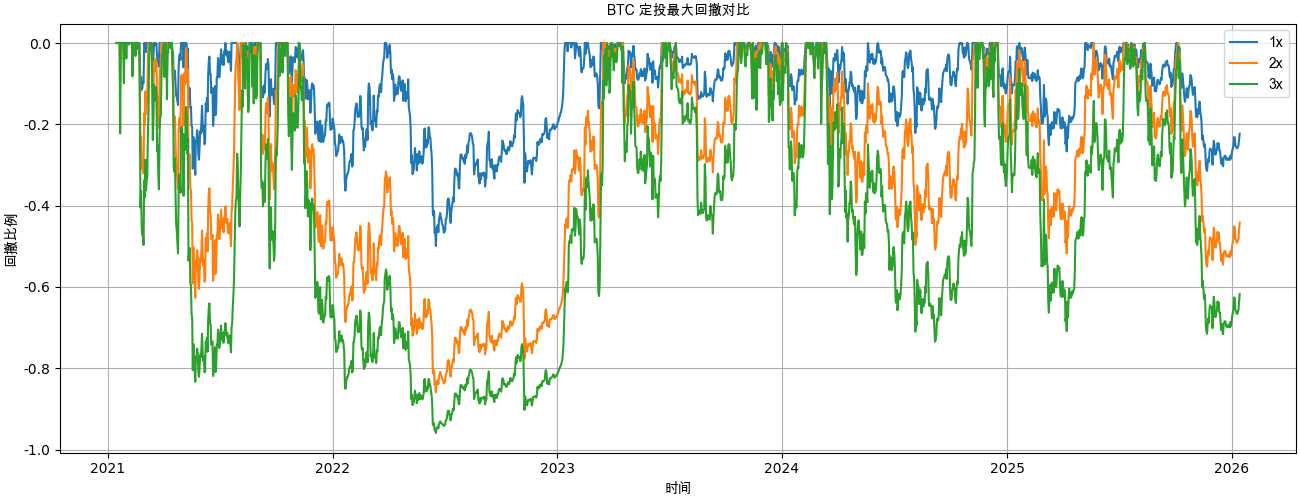

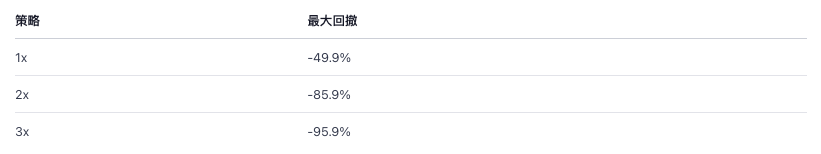

3. Maximum Drawdown: 3x Leverage Approaches Structural Failure

This section addresses a critical practical concern: the psychological and financial toll of drawdowns.

- -50%: While significant, often remains psychologically tolerable for many investors.

- -86%: Requires a staggering +614% return just to break even, a daunting and often impractical recovery.

- -96%: Demands an almost insurmountable +2400% return to recover initial capital, representing a near-total loss.

During the 2022 bear market, 3x leveraged positions were, in essence, “mathematically bankrupt.” Any subsequent profits were overwhelmingly derived from new capital injected after the market bottom, rather than a recovery of the initial investment.

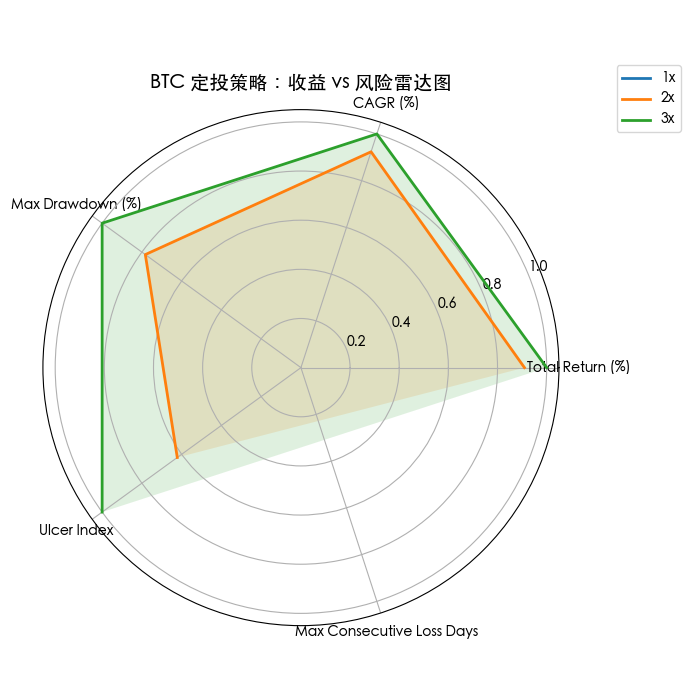

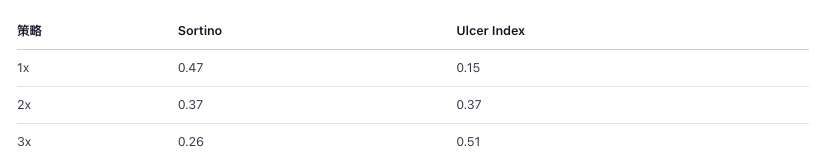

4. Risk-Adjusted Returns: Spot Bitcoin Offers the Optimal Balance

This data set provides three critical insights into the efficiency of each strategy:

- Spot BTC (1x) yields the highest return per unit of risk.

- As leverage increases, the “cost-effectiveness” of managing downside risk deteriorates significantly.

- 3x leverage consistently placed investors in deep drawdown territory for extended periods, imposing immense psychological stress and making consistent execution extremely challenging.

What does an Ulcer Index of 0.51 signify?

It means the account was persistently “underwater,” offering little to no positive reinforcement or psychological comfort for long stretches.

Why Does 3x Leverage Perform So Poorly in the Long Run? Understanding Volatility Drag

The primary reason can be encapsulated in one simple statement:

Daily Rebalancing + High Volatility = Continuous Erosion (Volatility Drag)

In volatile, oscillating market conditions, the daily rebalancing mechanism inherent in leveraged DCA strategies creates a destructive feedback loop:

- Market Rises: Positions are increased (buying high).

- Market Falls: Positions are decreased (selling low).

- Market Stagnates/Chops: The account continuously shrinks due to transaction costs and the compounding effect of rebalancing.

This phenomenon is known as Volatility Drag, and its destructive power is directly proportional to the square of the leverage multiple. Given Bitcoin’s inherently high volatility, a 3x leveraged position effectively incurs a 9x volatility penalty, severely eroding capital over time.

The Ultimate Takeaway: Bitcoin’s Inherent Volatility Demands Prudent Strategy

This five-year backtest offers unequivocal answers for long-term BTC investors:

- Spot DCA: Provides the optimal risk-reward ratio and is the most sustainable strategy for long-term execution.

- 2x Leverage: Represents an aggressive upper limit, suitable only for a select few investors with a high risk tolerance and deep understanding of market dynamics.

- 3x Leverage: Delivers extremely poor long-term value and is fundamentally unsuitable as a DCA tool due to its susceptibility to volatility drag and catastrophic drawdowns.

If you believe in Bitcoin’s long-term value proposition, the most rational approach is rarely to layer on excessive leverage. Instead, it is to allow time to work in your favor, rather than against you, through disciplined, unleveraged accumulation.

(This content has been excerpted and republished with authorization from our partner PANews. Original Article Link | Source: CryptoPunk)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.