Author: CoinGecko

Compiled by: TechFlow

The final quarter of 2025 witnessed a significant correction in the cryptocurrency market, with the total market capitalization plummeting by 23.7% to conclude the year at $3 trillion. This marked the first annual decline for the crypto market since 2022, representing a 10.4% year-on-year reduction. Despite briefly soaring to an all-time high of $4.4 trillion earlier in the quarter, a historic $19 billion liquidation event in October triggered a sharp price downturn. Nevertheless, this market volatility propelled the daily average trading volume to an annual peak of $161.8 billion, while the stablecoin market experienced a robust 48.9% annual growth, reaching a new all-time high of $311 billion.

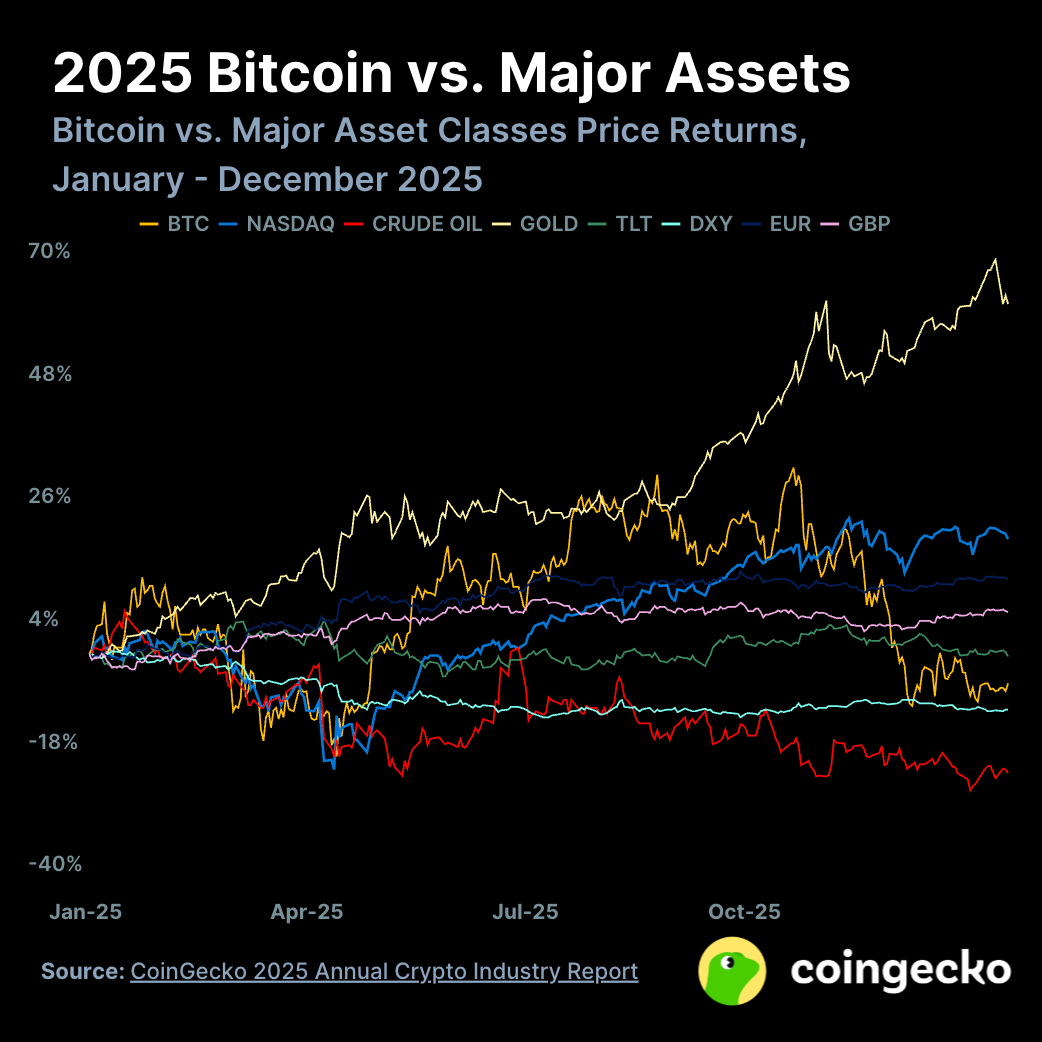

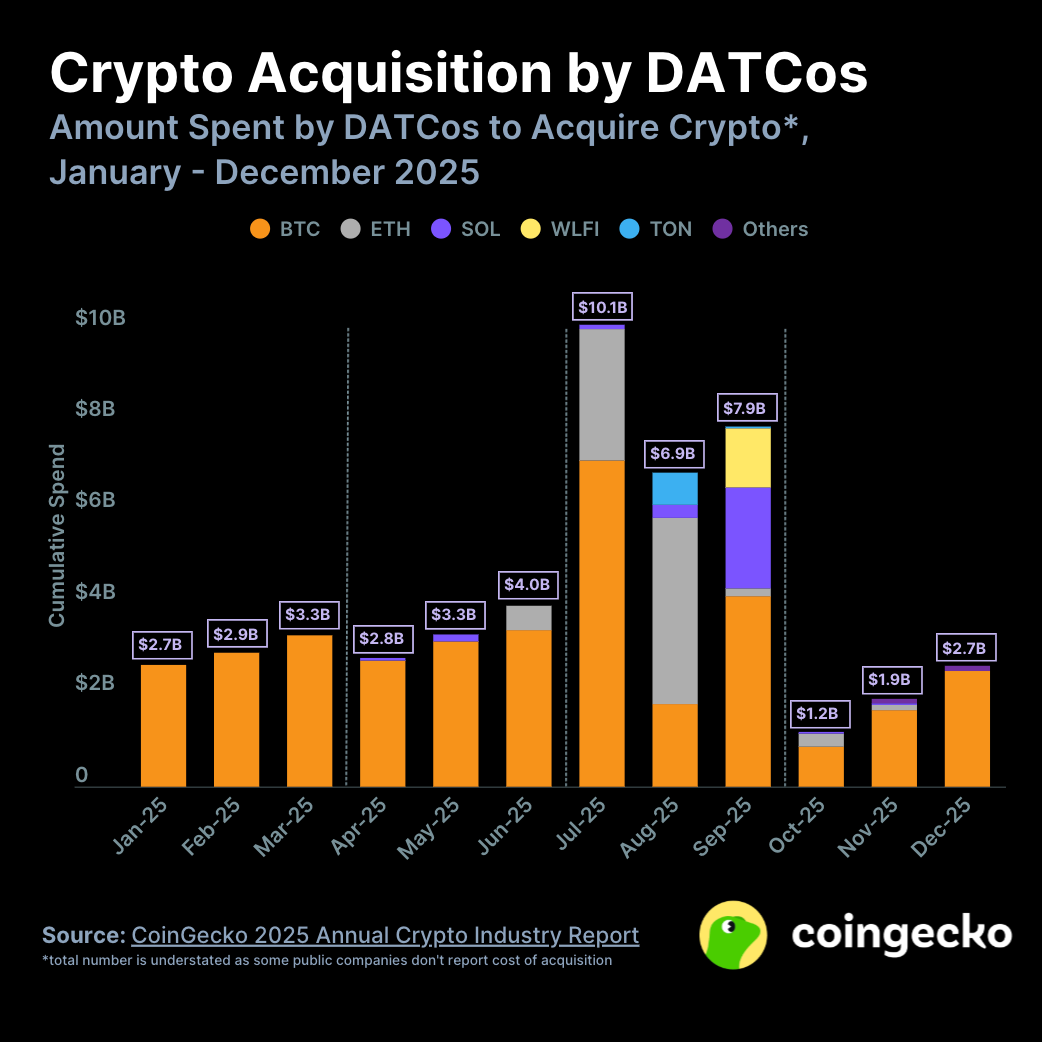

Throughout 2025, the crypto market exhibited a notable decoupling from traditional assets. Gold surged by an impressive 62.6%, and U.S. equities performed strongly, in stark contrast to Bitcoin’s 6.4% decline. Concurrently, institutional adoption deepened significantly, with Digital Asset Treasury Companies (DATCos) deploying at least $49.7 billion in 2025 to acquire over 5% of the total Bitcoin and Ethereum supply. Further highlights include a 302.7% surge in prediction market trading volume and centralized exchanges (CEX) reaching a record $86.2 trillion in annual perpetual futures trading volume. These figures underscore the continuous expansion of market infrastructure and utility, even amidst price contractions.

CoinGecko’s “2025 Annual Crypto Industry Report” offers an exhaustive analysis, spanning the broader crypto market landscape, in-depth examinations of Bitcoin and Ethereum, a deep dive into the Decentralized Finance (DeFi) and Non-Fungible Token (NFT) ecosystems, and a performance review of both Centralized and Decentralized Exchanges (CEX and DEX).

Below are the key takeaways from the comprehensive report:

Seven Key Insights from CoinGecko’s 2025 Annual Crypto Industry Report

- The total crypto market capitalization declined by 10.4% in 2025, closing the year at $3 trillion.

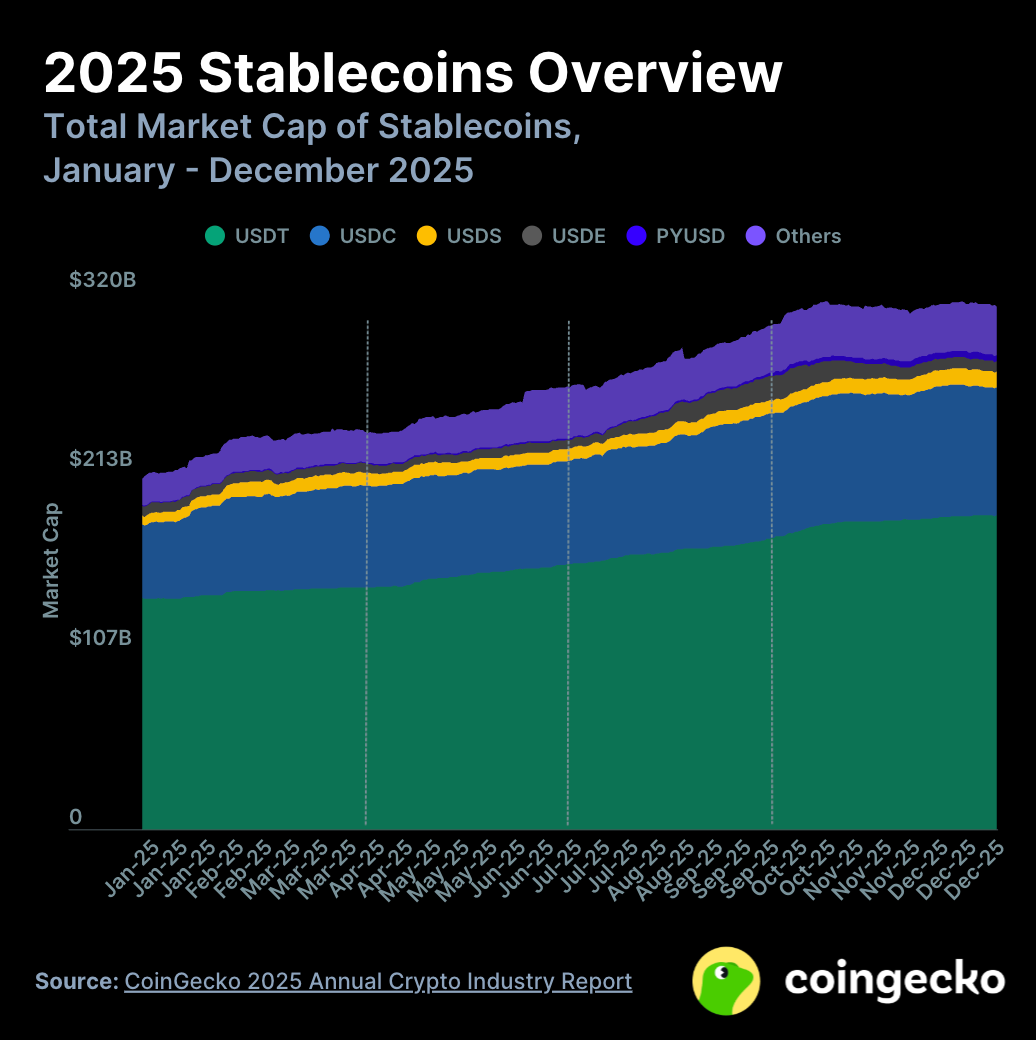

- Stablecoin market capitalization surged by $102.1 billion (+48.9%) in 2025, reaching an all-time high of $311 billion.

- Gold emerged as the top-performing asset in 2025, with a 62.6% gain, while Bitcoin lagged with a 6.4% decline, alongside weak performances from the USD and oil.

- Digital Asset Treasury Companies (DATCos) invested at least $49.7 billion in 2025, with approximately 50% of this capital deployed in Q3.

- Prediction market trading volume witnessed a remarkable 302.7% growth in 2025, reaching $63.5 billion.

- Centralized exchange perpetual futures trading volume grew by 47.4% in 2025, hitting a record $86.2 trillion.

- Decentralized exchange perpetual futures trading volume soared by 346% in 2025, establishing a new all-time high of $6.7 trillion.

1. Crypto Market Cap Plunges 23.7% in Q4 2025, Concluding the Year at $3 Trillion

The total cryptocurrency market capitalization experienced a significant downturn in Q4, shedding $946 billion (23.7%) to finish 2025 at $3 trillion. This represented a 10.4% year-on-year decrease, marking the first annual contraction for the crypto market since 2022.

The fourth quarter initially began with strong momentum, pushing the total market cap to an all-time high of $4.4 trillion. However, this peak was short-lived, as prices steadily declined towards the end of November before entering a period of consolidation until year-end. This downturn was largely triggered by a historic $19 billion liquidation event on October 10th, following the U.S. announcement of 100% tariffs on China.

Despite the price correction, the daily average trading volume in Q4 surged to an annual high of $161.8 billion, a 4.4% quarter-on-quarter increase. This growth was primarily fueled by the massive liquidation event and the subsequent heightened market volatility. However, trading volumes gradually tapered off as the market entered its range-bound phase.

2. Stablecoin Market Cap Soars to New Heights in 2025, Reaching $311 Billion

In Q4 2025, the total stablecoin market capitalization grew by $6.3 billion, culminating in a new all-time high of $311 billion by quarter-end. Over the entire year, the stablecoin market expanded by an impressive 48.9%, adding $102.1 billion.

The most significant shift within the stablecoin landscape during Q4 was the dramatic decline of Ethena’s USDe, an Ethereum-native stablecoin. Its market cap plummeted by 57.3% ($8.4 billion) after a rapid deleveraging in mid-October. The supply of USDe fell from a peak of nearly $15 billion to $6.3 billion following a de-peg incident on Binance, severely eroding investor confidence in its high-yield cyclical strategies.

Conversely, PayPal’s stablecoin, PYUSD, demonstrated remarkable growth, with its market cap surging by 48.4% ($1.2 billion) to reach $3.6 billion. This propelled PYUSD into the ranks of the top five stablecoins, displacing World Liberty Financial’s USD1. Its ascent was bolstered by YouTube’s integration of PYUSD for creator payout functions and the attractive ~4.25% yield offered by Spark Savings Vault.

3. Gold Dominates 2025 Performance with 62.6% Gain, Bitcoin Lags Alongside USD and Oil

In 2025, gold emerged as the standout asset, recording an exceptional 62.6% gain over the year. In stark contrast, Bitcoin underperformed, experiencing a 6.4% decline, mirroring the subdued performances of the U.S. Dollar and crude oil.

Gold’s stellar performance in 2025 saw it appreciate by 62.6% annually. In Q4 alone, gold climbed 11.4%, primarily driven by sustained central bank accumulation and heightened uncertainty surrounding tariffs. Trailing closely were U.S. equities, with the Nasdaq rising 20.5% and the S&P 500 gaining 16.6%, both propelled by the persistent artificial intelligence narrative.

Despite the robust performance of commodities and equities, Bitcoin (BTC) struggled, ending the year down 6.4%. Assets that performed even worse than Bitcoin included the U.S. Dollar Index (DXY), which fell 10.0% due to interest rate cuts and political shifts, and crude oil, which dropped 21.5% amidst global oversupply and record production from non-OPEC nations.

4. Digital Asset Treasury Companies (DATCos) Invest $49.7 Billion in 2025, Half in Q3

Digital Asset Treasury Companies (DATCos) solidified their role as significant market participants in 2025, collectively deploying at least $49.7 billion into cryptocurrency acquisitions throughout the year. The third quarter marked a peak in investment, accounting for approximately half of the annual total, largely due to the emergence of a new wave of altcoin-focused DATCos.

However, the pace of investment slowed considerably in Q4, with only $5.8 billion allocated. The broader crypto market downturn adversely impacted DATCo stock prices, causing many to see their adjusted net asset value (mNAV) fall below 1.0. This compelled these companies to redirect capital towards share buybacks rather than continued crypto accumulation.

As of January 1, 2026, DATCos collectively held $134 billion in crypto assets, a substantial 137.2% increase from $56.5 billion on January 1, 2025. Cumulatively, DATCos now possess over 1 million Bitcoin and 6 million Ethereum, representing more than 5% of their respective total supplies.

5. Prediction Markets Witness Explosive 302.7% Growth in 2025, Reaching $63.5 Billion

2025 proved to be a year of explosive growth for prediction markets, with trading volume surging by an astounding 302.7% year-over-year to achieve a new all-time high of $63.5 billion.

The nominal trading volume in prediction markets dramatically increased from $15.8 billion in 2024 to $63.5 billion in 2025, marking a 302.7% year-on-year expansion.

At the start of 2025, Polymarket dominated the market with an 85.6% share in Q1, but it was subsequently overtaken by Kalshi in Q4. By the fourth quarter, Kalshi commanded a 39.6% market share, with Polymarket trailing at 32.4%. Concurrently, Opinion, a BNB Chain-based platform backed by Yzi Labs, launched in November and quickly emerged as a formidable challenger. Opinion recorded $7 billion in trading volume in December, matching Kalshi, though its current volume may be influenced by ongoing airdrop activities.

6. Centralized Exchange Perpetual Futures Trading Volume Hits Record $86.2 Trillion in 2025

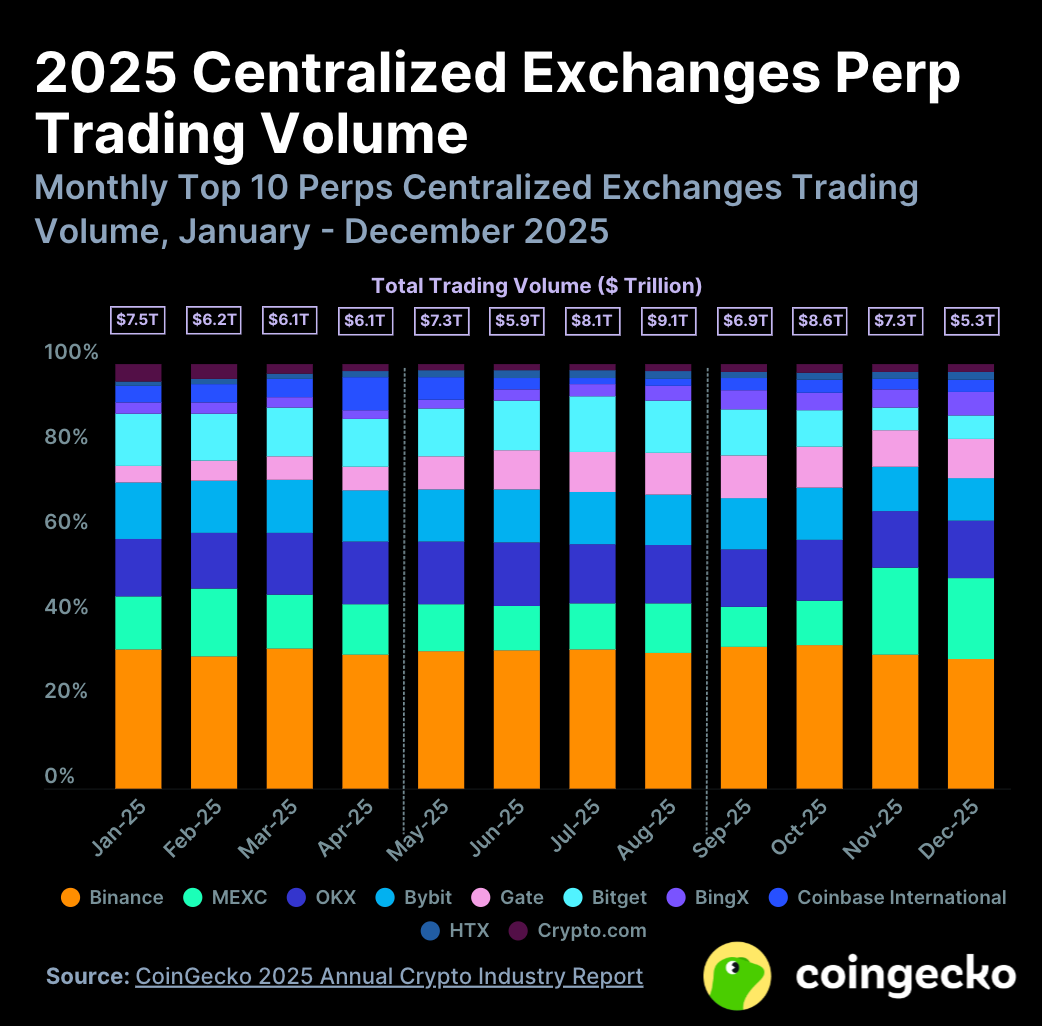

In Q4 2025, the top ten Centralized Perpetual Futures Exchanges (Perp CEXes) registered $21.2 trillion in trading volume, a 12.0% decrease from Q3’s $24.0 trillion. However, the full-year volume reached an impressive $86.2 trillion, representing a 47.4% increase from 2024 and setting a new all-time high.

October 2025 stood out as the second-highest trading month ever, surpassed only by August when Bitcoin achieved its most recent all-time high. In contrast, December proved to be the quietest month of the year, with trading volume totaling just $5.3 trillion.

Throughout 2025, the market share among the top ten Perp CEXes remained relatively stable. The only notable shift was MEXC’s significant surge in trading volume during November and December, propelling it past OKX, Bybit, and Bitget to secure the second position. Outside the top ten, KuCoin delivered a strong performance in 2025, becoming the only non-top-tier Perp CEX to break the $1 trillion trading volume mark.

7. Decentralized Exchange Perpetual Futures Trading Volume Skyrockets 346% to $6.7 Trillion in 2025

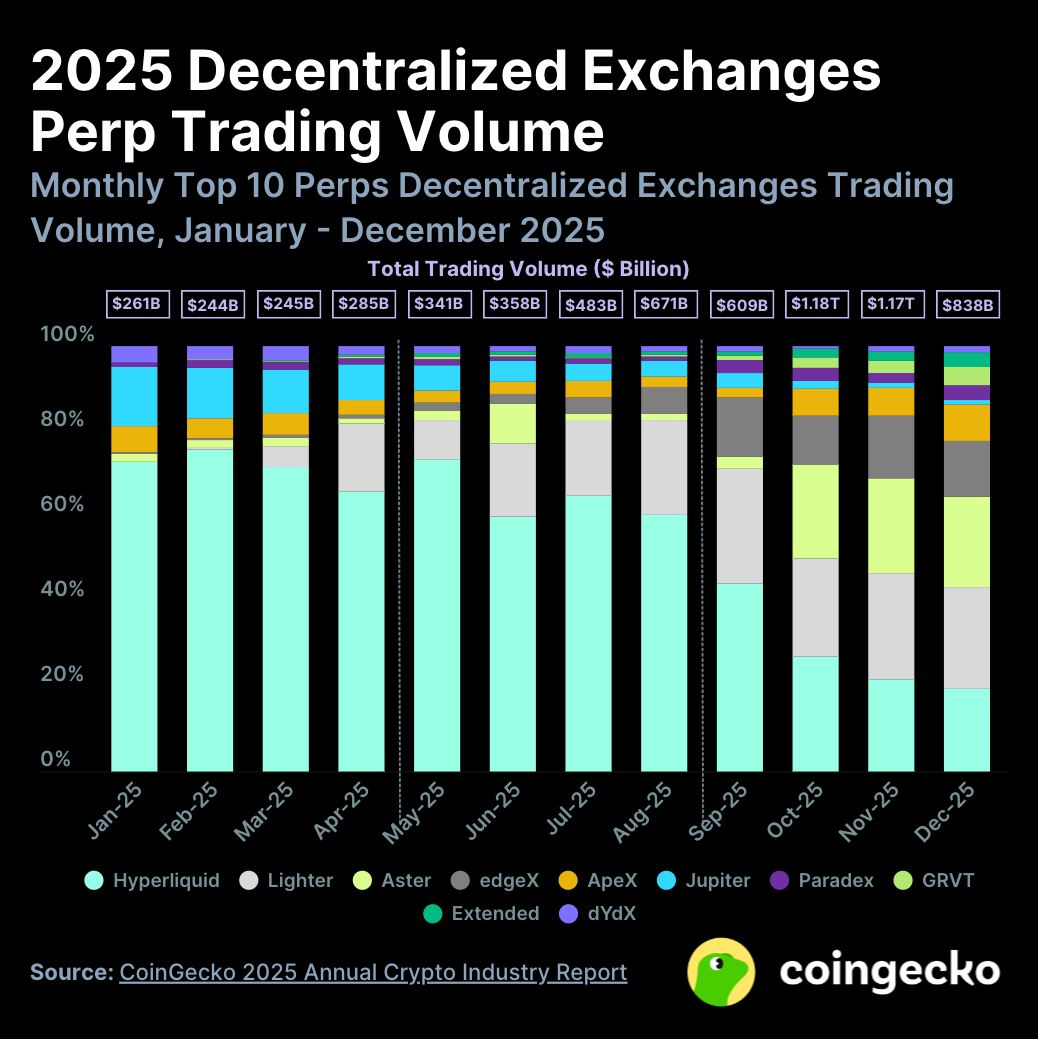

Decentralized Perpetual Futures Exchanges (Perp DEXes) experienced an 80.8% surge in trading volume in Q4 2025, climbing from $1.8 trillion in Q3 to $3.2 trillion.

For the entirety of 2025, the top ten Perp DEXes collectively recorded an annual trading volume of $6.7 trillion, marking a staggering 346% increase from $1.5 trillion in 2024. This impressive growth saw the Perp DEX to CEX volume ratio jump from 2.5% a year ago to 7.8%.

This surge in volume was primarily driven by attractive incentive programs and airdrop campaigns offered by platforms such as Lighter, Aster, edgeX, GRVT, and Paradex. While Hyperliquid remained the most active Perp DEX overall in 2025, it was surpassed by Lighter in Q4. Both Hyperliquid and Lighter have now secured positions among the top ten Perp DEXes by annual volume, recording $2.9 trillion and $1.3 trillion in trading volume, respectively.

(The above content is an authorized excerpt and reprint from our partner PANews. Original link | Source: TechFlow)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views or positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not be liable for any direct or indirect losses incurred by investors’ transactions.