While Bitcoin’s recent price movements might appear subdued, a powerful wave of accumulation is surging beneath the market’s seemingly calm surface. On-chain analytics firm Glassnode reveals that over the past month, medium to large Bitcoin holders have been aggressively accumulating the cryptocurrency at a pace not seen since the dramatic collapse of FTX in 2022.

“Fish-to-Shark” Cohort Leads the Charge

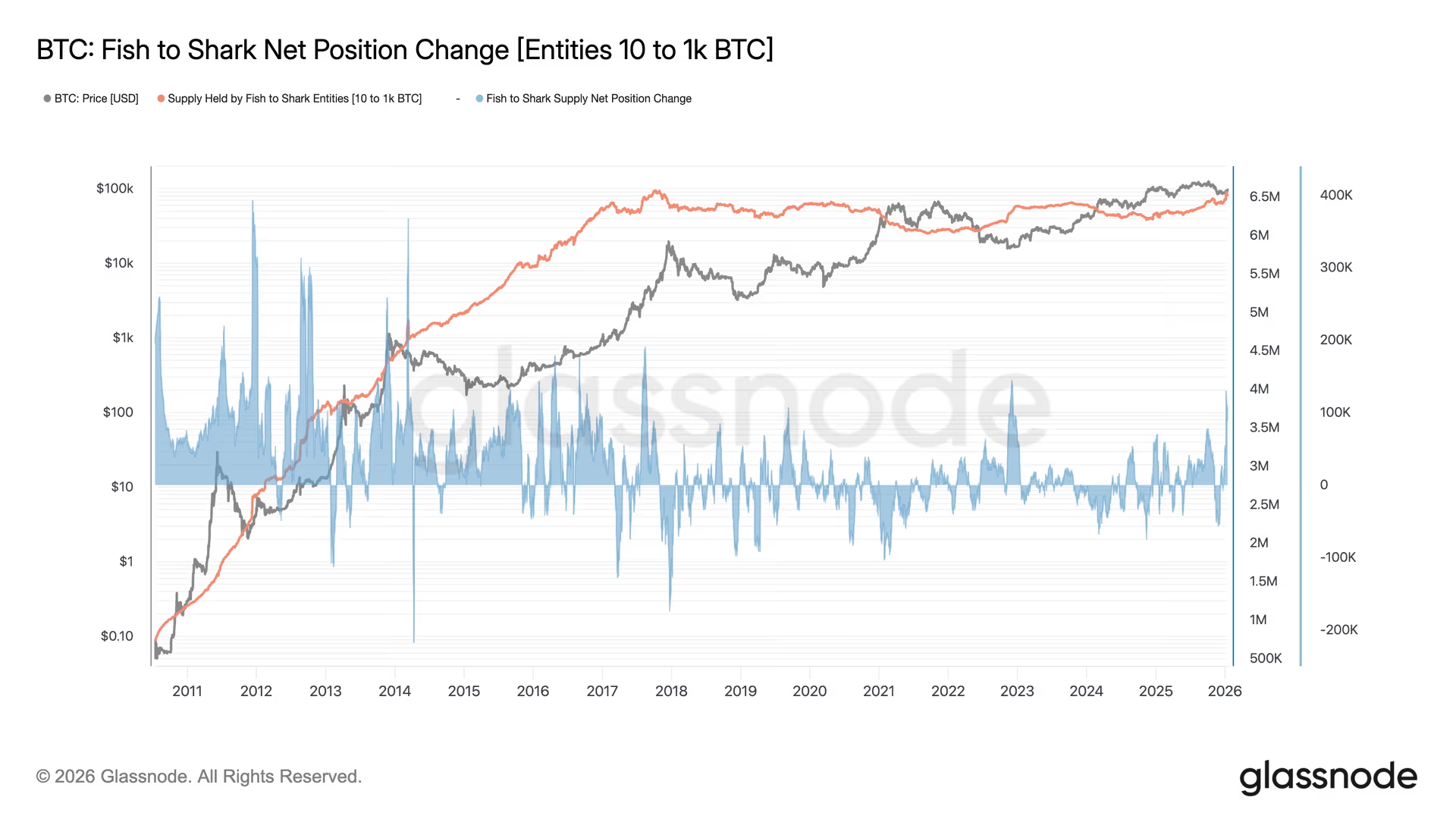

According to Glassnode’s comprehensive tracking, entities holding between 10 and 1,000 Bitcoins—a group collectively termed “Fish-to-Shark”—have collectively acquired approximately 110,000 BTC within the last 30 days. This impressive accumulation marks the strongest single-month buying spree by this cohort since Bitcoin’s price plummeted below $15,000 three years ago, following the widespread fallout from the FTX crisis.

This influential group, which includes high-net-worth individuals, crypto exchanges, and various institutional investors, now collectively commands nearly 6.6 million Bitcoins. This represents a significant increase from their holdings of 6.4 million BTC just two months prior, underscoring a persistent and growing conviction in Bitcoin’s long-term value.

Retail “Shrimp” Join the Accumulation Frenzy

The accumulation trend isn’t confined to larger players. Small-scale holders, affectionately known as “Shrimp” (those holding less than 1 Bitcoin), are also demonstrating robust demand. This segment of the market, typically highly sensitive to price fluctuations, has collectively added over 13,000 Bitcoins to their wallets in recent weeks. This surge marks a new high for retail accumulation since November 2023, pushing their total holdings to approximately 1.4 million BTC.

A Structural Shift in Demand?

The synchronized buying activity from both medium-to-large and small holders paints a compelling picture: a bottom-up structural demand for Bitcoin appears to be forming. This broad-based accumulation suggests increasing confidence across different investor segments. However, whether this sustained buying pressure will translate into the catalyst for Bitcoin’s next major price rally remains to be validated by future market developments. Investors are keenly watching to see if these hidden currents will soon break the surface.

Disclaimer: This article is provided for market information purposes only. All content and views expressed herein are for reference only and do not constitute investment advice. They do not represent the views or positions of BlockTempo. Investors are advised to make their own investment decisions and trades. The author and BlockTempo will not be held responsible for any direct or indirect losses incurred by investors as a result of their transactions.