Ethereum’s Resurgence: Record Transactions, Low Fees, and Evolving Staking Dynamics

Ethereum, the world’s leading smart contract platform, is demonstrating robust health, with on-chain data revealing a surge in transaction activity coupled with remarkably stable, low gas fees. This confluence of factors, alongside significant shifts in its staking ecosystem, signals a maturing network poised for sustained growth and a re-evaluation of its core value proposition.

Historic Transaction Surge and Unprecedented Network Efficiency

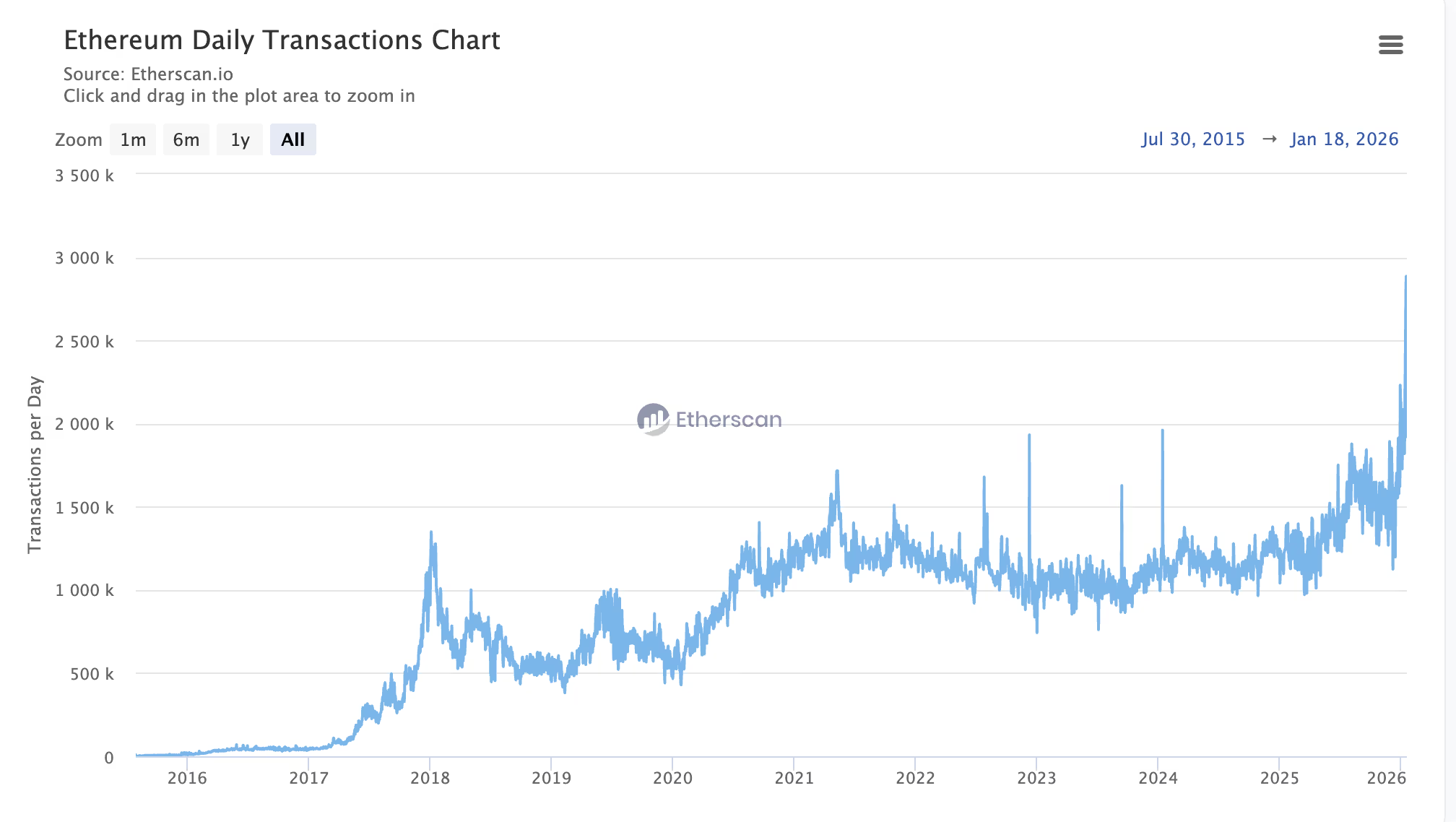

Last Friday marked a historic milestone for the Ethereum network, as on-chain data recorded an unprecedented 2.885 million transactions in a single day. This new all-time high is not just a testament to increased user engagement but also a strong indicator of strengthening fundamentals, especially considering the simultaneous rise in transaction volume and the sustained low gas fees.

After a period of moderate activity throughout much of 2025, Ethereum’s on-chain metrics began to accelerate sharply in mid-December, culminating in this recent surge. What makes this growth particularly noteworthy is the absence of the exorbitant gas fee spikes that characterized previous bull markets. Despite the dramatic increase in network usage, transaction costs have remained remarkably stable and low.

This efficiency is a direct outcome of Ethereum’s continuous technical upgrades and the successful adoption of Layer 2 scaling solutions. These advancements have enabled the network to absorb burgeoning user demand more smoothly and cost-effectively, demonstrating its enhanced capacity and scalability.

Evolving Staking Dynamics and Investor Confidence

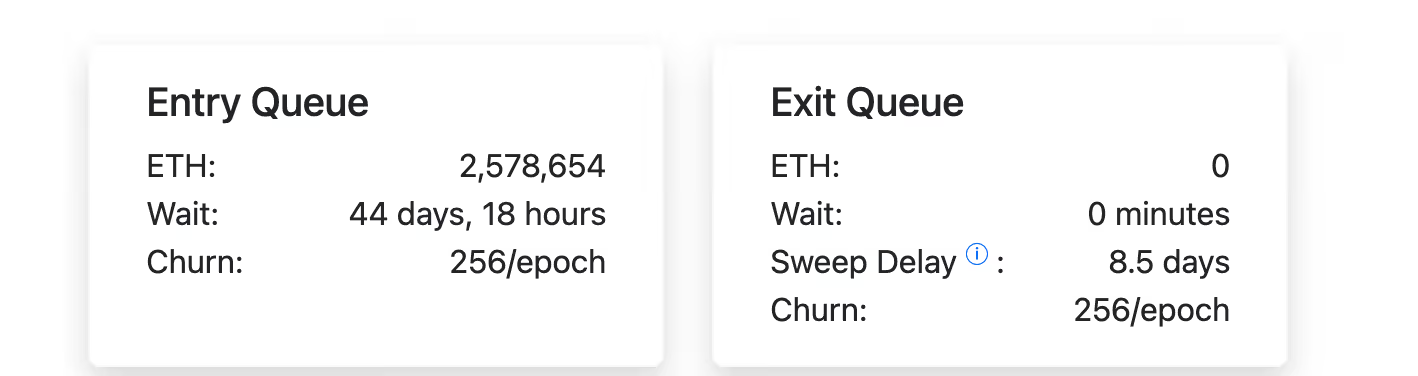

Beyond transaction activity, the Ethereum staking landscape is also undergoing a significant transformation. The validator ‘exit queue,’ which previously saw wait times for stakers wishing to withdraw their ETH, has now dwindled to zero.

This means that investors looking to unstake and redeem their Ether can now do so almost instantaneously, without any waiting period. This immediate liquidity for withdrawals stands in stark contrast to the persistent, substantial queue of those eager to enter the staking ecosystem.

Data from ValidatorQueue underscores this trend, revealing that over 36 million ETH — approximately 30% of the circulating supply — are currently locked in staking contracts. Furthermore, an impressive 2.5 million ETH are actively waiting to be staked, marking the highest level observed since August 2023.

This robust inflow into staking, coupled with the zero exit queue, strongly suggests a lack of panic withdrawals. It indicates that ETH holders are confident in the network’s stability and their decision to secure their assets within the staking mechanism.

Implications for Ethereum’s Future: Beyond Deflationary Narratives

The current trifecta of high transaction volumes, low gas fees, and a quiescent staking exit queue represents a significant victory for user experience. However, for investors, this paradigm shift carries deeper implications. The once prominent ‘deflationary narrative’ — where surging gas fees lead to substantial ETH burning and subsequent supply scarcity — may begin to recede in 2026. Instead, the focus is likely to shift towards Ethereum’s foundational utility as a ‘global settlement layer,’ emphasizing its real-world application value over purely scarcity-driven investment theses.

Disclaimer: This article is intended for market information purposes only. All content and views are for reference and do not constitute investment advice. They do not represent the views or positions of Blockcast. Investors should make their own decisions and trades, and the author and Blockcast will not be liable for any direct or indirect losses resulting from investor transactions.