Crypto’s Metamorphosis: A Deep Dive into 2025’s Structural Reshaping and the Road to 2026

The year 2025 was not merely a period of bull or bear market cycles; it marked a profound repositioning of the crypto industry across political, financial, and technological coordinates. This pivotal year laid the groundwork for a more mature, institutionalized cycle in 2026, fundamentally altering the landscape for digital assets.

The year began with significant shifts in regulatory expectations, catalyzed by the Trump inauguration and the subsequent Digital Asset Strategy Executive Order. Concurrently, the issuance of the $TRUMP token propelled cryptocurrencies into mainstream discourse, rapidly elevating market risk appetite. Bitcoin, in a historic surge, breached the $100,000 mark, completing its first major leap from a “speculative asset” to a “political and macro-economic asset.”

However, this initial euphoria was swiftly met by market realities. The decline of celebrity tokens, the Ethereum “flash crash” incident, and a monumental hack on Bybit collectively exposed vulnerabilities related to high leverage, weak risk controls, and narrative overextension. Between February and April, the crypto market gradually retreated from its frenzy. Macro-tariff policies resonated with traditional risk assets, prompting investors to re-evaluate the weight of security, liquidity, and fundamental value in asset pricing.

Ethereum’s performance during this phase was particularly illustrative: ETH faced pressure relative to Bitcoin, yet this weakness was not due to technical or infrastructural degradation. On the contrary, the first half of 2025 saw Ethereum consistently advance on key roadmap items such as gas limit increases, Blob capacity expansion, node stability, zkEVM, and PeerDAS, steadily enhancing its foundational capabilities. Despite these long-term advancements, the market did not immediately price in their significance.

Mid-year, structural repairs and institutionalization unfolded in tandem. The Ethereum Pectra upgrade and the Bitcoin 2025 conference provided technological and narrative support, while Circle’s IPO signaled a deeper integration of stablecoins with compliant finance. The formal implementation of the GENIUS Act in July emerged as the year’s most symbolic turning point—for the first time, the crypto industry received clear, systematic legislative endorsement in the United States. Against this backdrop, Bitcoin hit new annual highs. Simultaneously, on-chain derivatives platforms like Hyperliquid experienced rapid growth, and novel forms such as tokenized stocks and Equity Perps began to enter market awareness.

The second half of the year witnessed a clear divergence in capital flows and narratives. Accelerated ETF approvals, anticipation of pension fund inflows, and the commencement of interest rate cutting cycles collectively boosted mainstream asset valuations. Conversely, celebrity tokens, memes, and highly leveraged structures frequently underwent significant liquidations. October’s large-scale liquidation event served as a concentrated release of the year’s accumulated risk. In parallel, the privacy sector saw a temporary strengthening, and new narratives like AI payments and Perp DEXs quietly began to take shape in specific niches.

The year concluded with the market experiencing a gradual decline from high levels amid low liquidity. Bitcoin fell below $90,000, while traditional safe-haven assets like gold and silver performed strongly, indicating crypto’s deep integration into the global asset allocation system. At this juncture, mainstream crypto assets entered a phase of bottom formation. The core research question for 2026 will be whether the market will follow a traditional four-year cycle rebound before entering a bear market, or if sustained institutional capital inflows and a maturing regulatory framework will break the cyclical pattern and drive new all-time highs.

Macro Environment & Policy: Structural Shifts in 2025

1. A Policy Paradigm Shift: 2025’s Fundamental Departure from Past Cycles

Throughout crypto’s history, policy and regulation have consistently been crucial exogenous variables influencing market expectations. However, their modus operandi underwent a fundamental transformation in 2025. Unlike the laissez-faire growth of 2017, the loose permissiveness of 2021, or the comprehensive suppression from 2022–2024, 2025 showcased an institutional pivot from suppression to allowance, from ambiguity to standardization.

In previous cycles, regulation often intervened negatively: either disrupting risk appetite with bans, investigations, or enforcement actions at market peaks, or releasing concentrated uncertainty through accountability measures during bear markets. This approach often failed to protect investors effectively or provide long-term development clarity for the industry, instead exacerbating cyclical volatility. Entering 2025, this governance model began a structural change: executive orders took precedence, regulatory bodies converged in their messaging, and legislative frameworks steadily advanced, gradually replacing the prior case-by-case enforcement model.

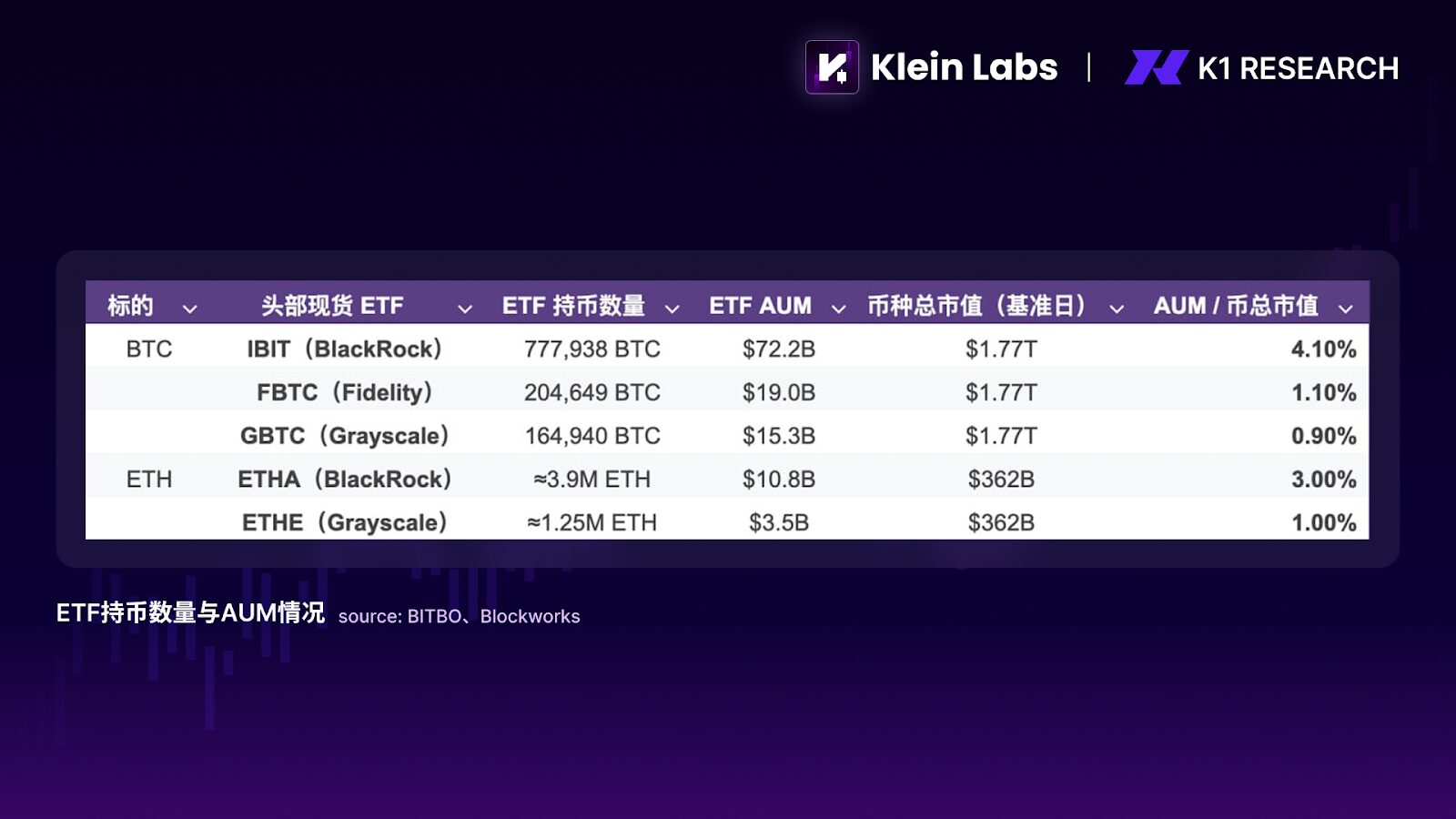

In this process, the advancement of ETFs and stablecoin legislation played a critical “expectation-anchoring” role. The approval of spot ETFs provided Bitcoin and Ethereum, among other crypto assets, with a compliant channel for long-term capital allocation through traditional financial systems. By the end of 2025, the size of ETP/ETF products related to Bitcoin and Ethereum had reached hundreds of billions of dollars, becoming the primary vehicle for institutional capital allocation into crypto assets. Concurrently, stablecoin-related legislation (e.g., the GENIUS Act) institutionally clarified the stratification of crypto assets: distinguishing which possess “financial infrastructure attributes” from those that remain high-risk speculative instruments. This distinction shattered the blanket pricing of “crypto as a whole,” prompting the market to begin differentiated valuation for various assets and sectors.

It is crucial to note that the policy environment of 2025 did not generate a “policy dividend-driven explosion” akin to previous cycles. Instead, its more significant impact was providing the market with a relatively clear lower bound: defining the boundaries of permissible activities and distinguishing assets with long-term viability from those destined for marginalization. Within this framework, the policy role shifted from “driving market rallies” to “constraining risk,” and from “creating volatility” to “stabilizing expectations.” From this perspective, the policy shift in 2025 was not a direct engine for a bull market but rather an institutional bedrock.

2. Capital First: The “Low-Risk Channels” Forged by Stablecoins, RWA, ETFs, and DATs

A counter-intuitive yet crucial phenomenon became increasingly clear in the 2025 crypto market: capital had not disappeared, but prices often failed to react. Stablecoin market capitalization and on-chain transfer volumes remained consistently high, and spot ETFs maintained net inflows during multiple periods. Yet, concurrently, most altcoin prices remained under long-term pressure, with the exception of a few mainstream assets. This divergence between capital activity and price performance forms the core entry point for understanding the market structure of 2025.

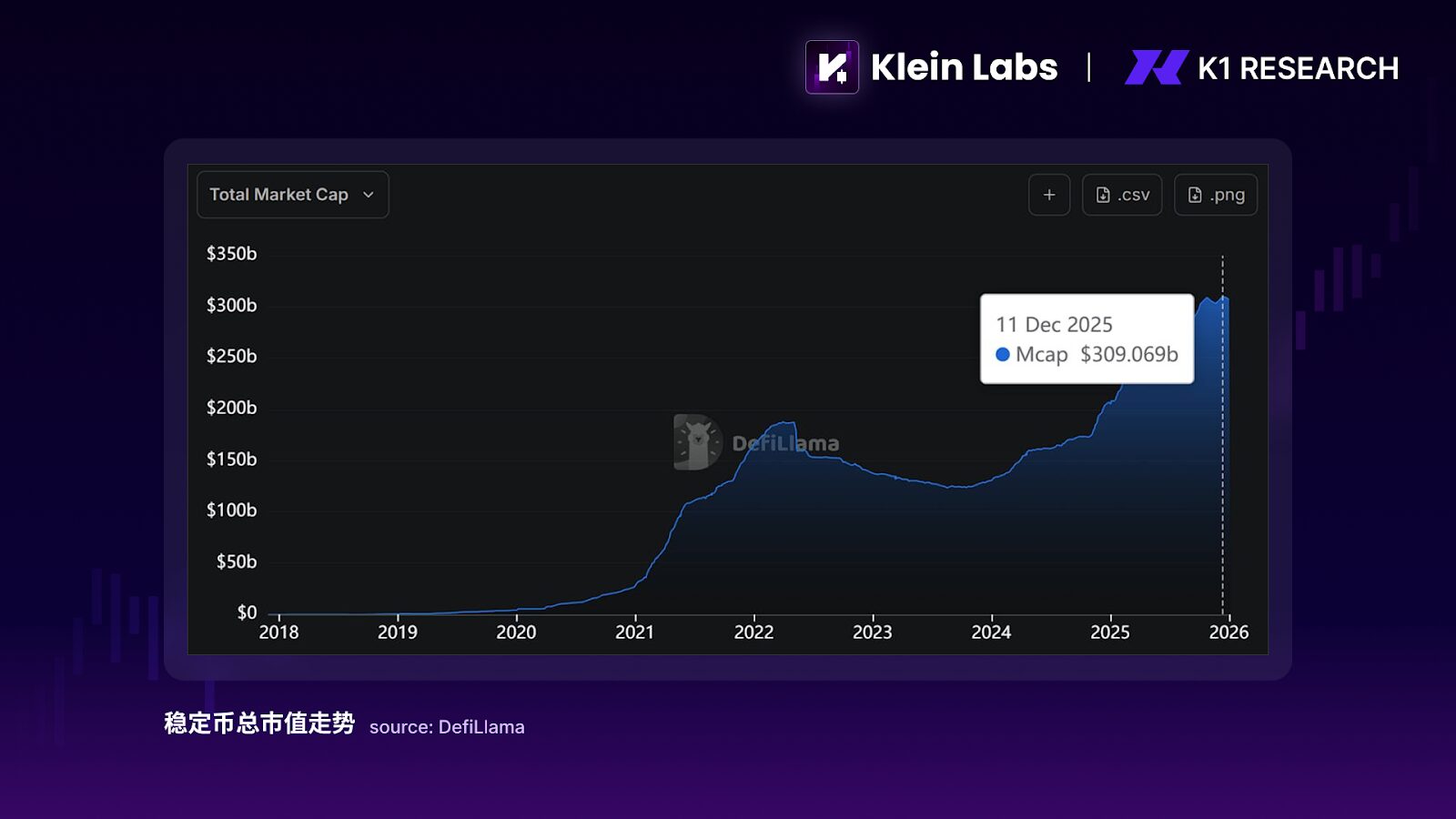

Stablecoins played a vastly different role than in previous cycles. Historically, stablecoins were often viewed as “intermediary currencies” within exchanges or leverage fuel in bull markets, with their growth highly correlated with speculative activity. In 2025, stablecoins gradually evolved into tools for capital parking and settlement. The total stablecoin market capitalization grew from approximately $200 billion at the beginning of the year to over $300 billion by year-end, an annual increase of nearly $100 billion. However, the overall altcoin market capitalization did not expand proportionally during the same period. Simultaneously, the annual on-chain settlement volume of stablecoins reached trillions of dollars, even nominally surpassing the annual transaction volume of traditional card organizations. This indicates that stablecoin growth in 2025 primarily stemmed from payment, clearing, and fund management demands, rather than speculative leverage.

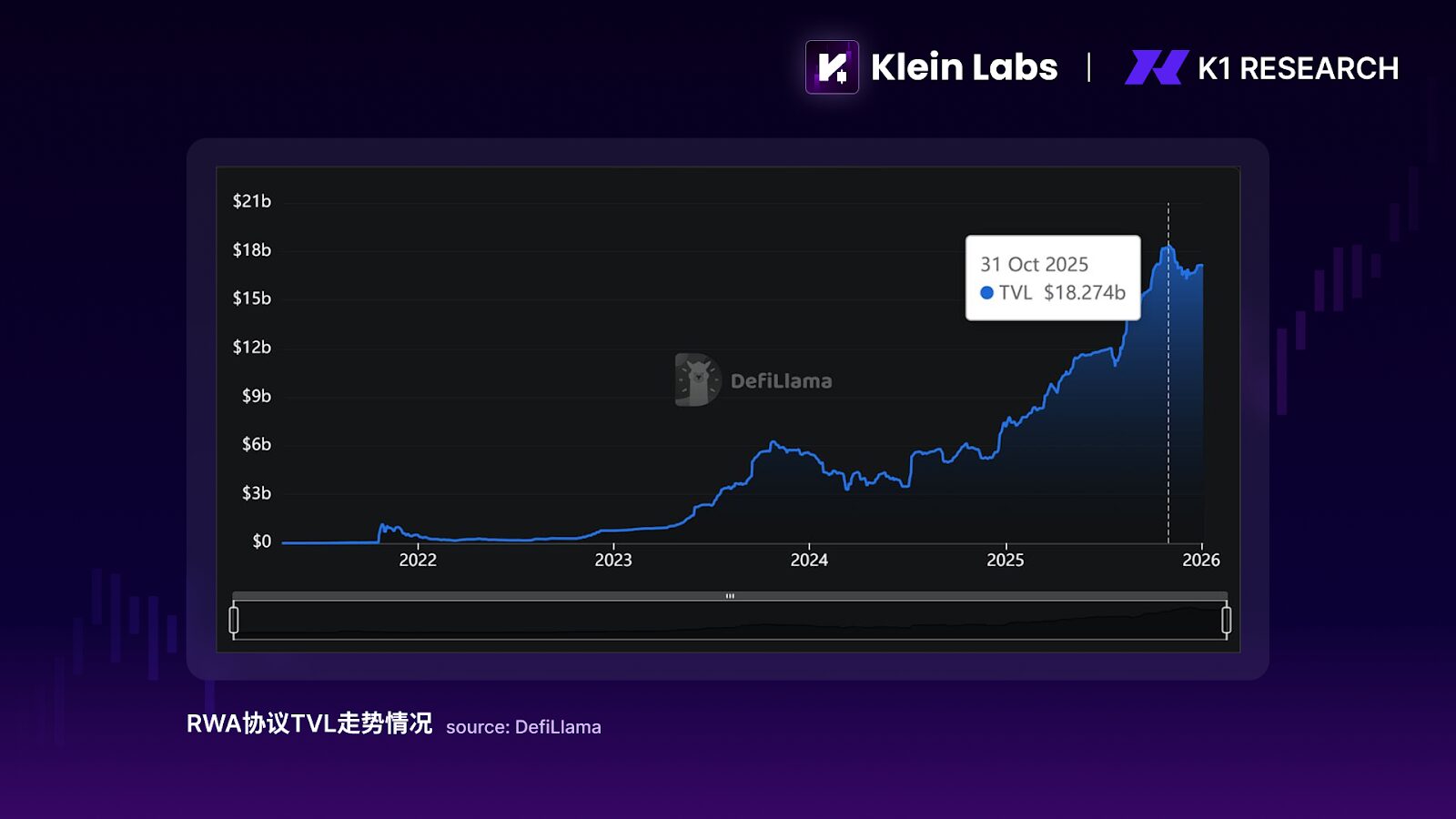

The development of Real-World Assets (RWA) further amplified this trend. The RWA projects that truly materialized in 2025 predominantly focused on low-risk assets such as government bonds, money market fund shares, and short-duration notes. Their core significance was not in generating new price elasticity but in validating the feasibility of compliant assets existing on-chain. On-chain data shows that the Total Value Locked (TVL) in RWA-related protocols began accelerating in 2024 and continued its upward trajectory in 2025—by October 2025, RWA protocol TVL had approached $18 billion, a several-fold increase from early 2024.

While this volume remains insufficient at a macro-capital level to directly drive crypto asset prices, its structural impact is clear: RWA provided on-chain capital with near-risk-free yield options, allowing some funds to “stay on-chain but not participate in crypto price volatility.” In an environment where interest rates remained attractive and regulatory boundaries gradually clarified, this option marginally weakened the traditional positive correlation between on-chain activity and token prices, further explaining the structural characteristic of “capital growth but decreased price elasticity” in 2025.

The impact of ETFs was more evident in capital stratification than widespread diffusion. Spot ETFs provided compliant, low-friction allocation channels for mainstream crypto assets like Bitcoin and Ethereum, but this capital inflow path was highly selective. In terms of actual absorbed volume, by early 2026, leading BTC/ETH spot ETFs held close to 6%/4% of the total circulating supply of their respective assets, clearly demonstrating institutional capital absorption at the mainstream asset level. However, this incremental capital did not spill over to broader asset tiers. During the ETF rollout, BTC Dominance (Bitcoin’s market cap as a percentage of total crypto market cap) did not experience the rapid decline typically seen in historical bull markets; instead, it remained in a high range, reflecting that institutionalized capital did not diffuse into long-tail assets (tokens typically ranked outside the top 100 by market capitalization). As a result, ETFs strengthened the capital-attracting power of top assets but objectively exacerbated the structural differentiation within the market.

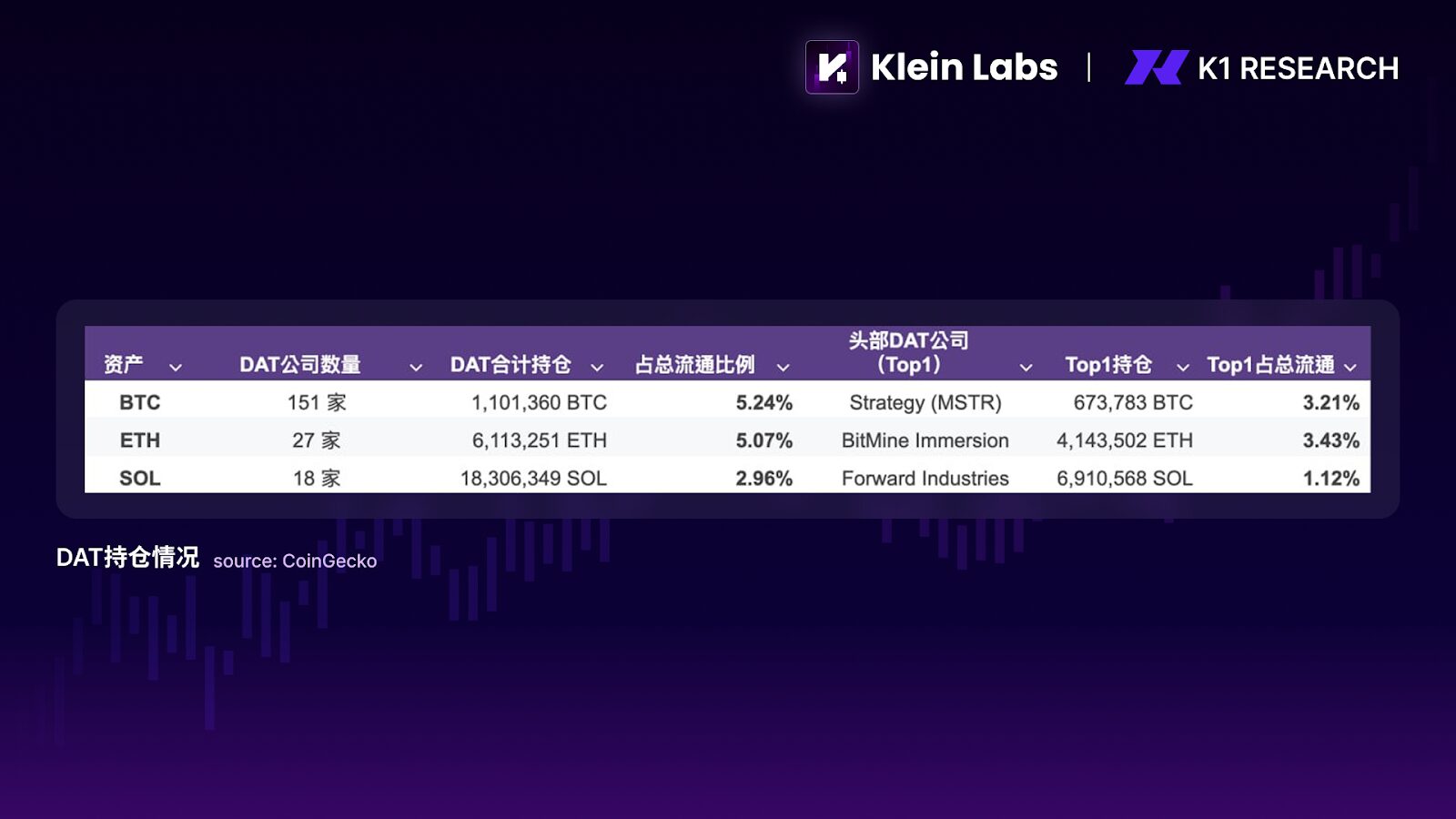

Equally noteworthy alongside ETFs was the rapid emergence of “Digital Asset Treasury Companies” (DATs) in 2025. Publicly traded companies began incorporating digital assets like BTC, ETH, and even SOL into their balance sheets. Through capital market tools such as new share issuance, convertible bonds, buybacks, and yield staking, they effectively transformed their stock into a “financially viable, acquirable crypto equity proxy.” In terms of scale, nearly 200 companies disclosed adopting similar DAT strategies, collectively holding over $130 billion in digital assets. DATs evolved from isolated cases into a recognizable capital market structure. The structural significance of DATs lies in their similar effect to ETFs: reinforcing capital attraction to mainstream assets, but with a more “equity-centric” transmission mechanism. Capital enters the stock valuation and financing cycle, rather than directly into the secondary liquidity of long-tail tokens, further intensifying the capital stratification between mainstream assets and altcoins.

Overall, incremental capital in 2025 was not absent; it systematically flowed into channels that were “compliant, low-volatility, and suitable for long-term parking.”

3. Market Outcomes: Structural Stratification of Mainstream Assets and Altcoins

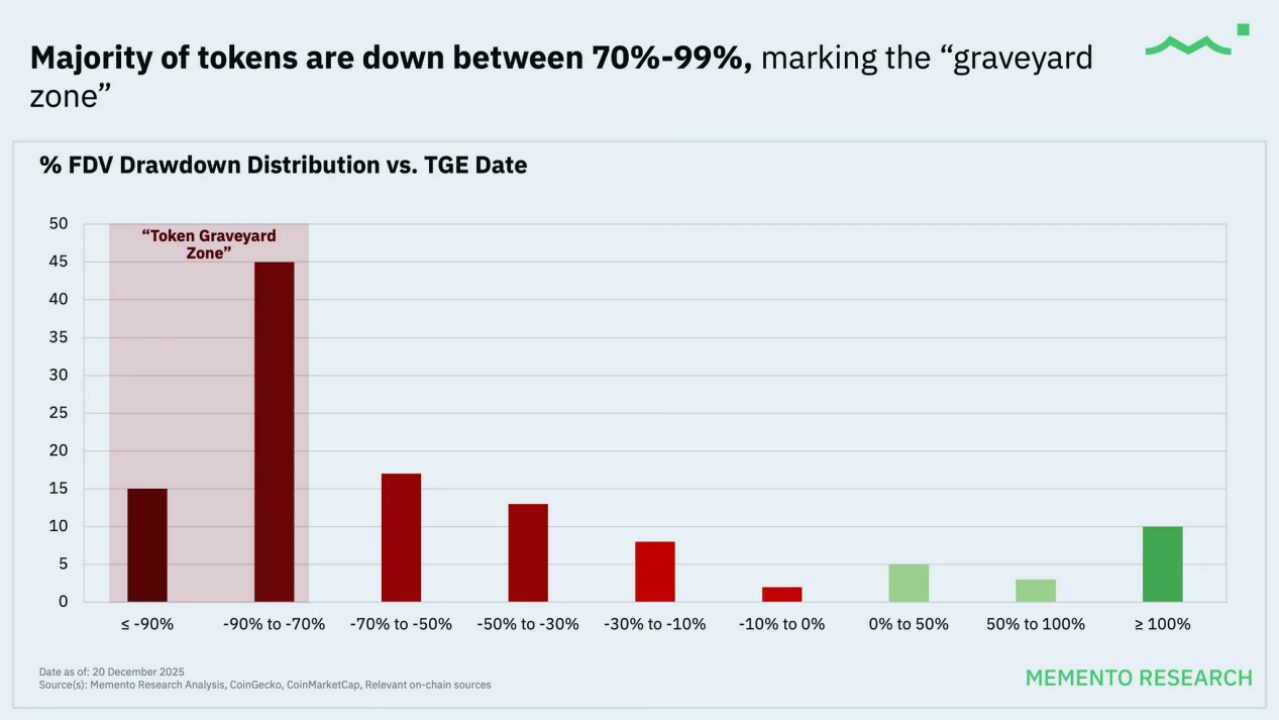

From the perspective of final price outcomes, the 2025 crypto market presented a highly counter-intuitive yet logically consistent state: the market did not collapse, but the vast majority of projects experienced continuous decline. According to Memento Research’s statistics on 118 token launches in 2025, approximately 85% of tokens traded below their Token Generation Event (TGE) price on the secondary market, with a median Fully Diluted Valuation (FDV) drawdown exceeding 70%. This performance did not significantly improve during subsequent market recovery phases.

This phenomenon was not limited to long-tail projects but encompassed most small to mid-cap assets, with even some highly valued and widely anticipated projects significantly underperforming Bitcoin and Ethereum. Notably, even when calculated using FDV weighting, the overall performance remained significantly negative, implying that larger, higher-valued projects had a greater drag on the market. This outcome clearly indicates that the issue in 2025 was not a “disappearance of demand” but a “directional migration of demand.”

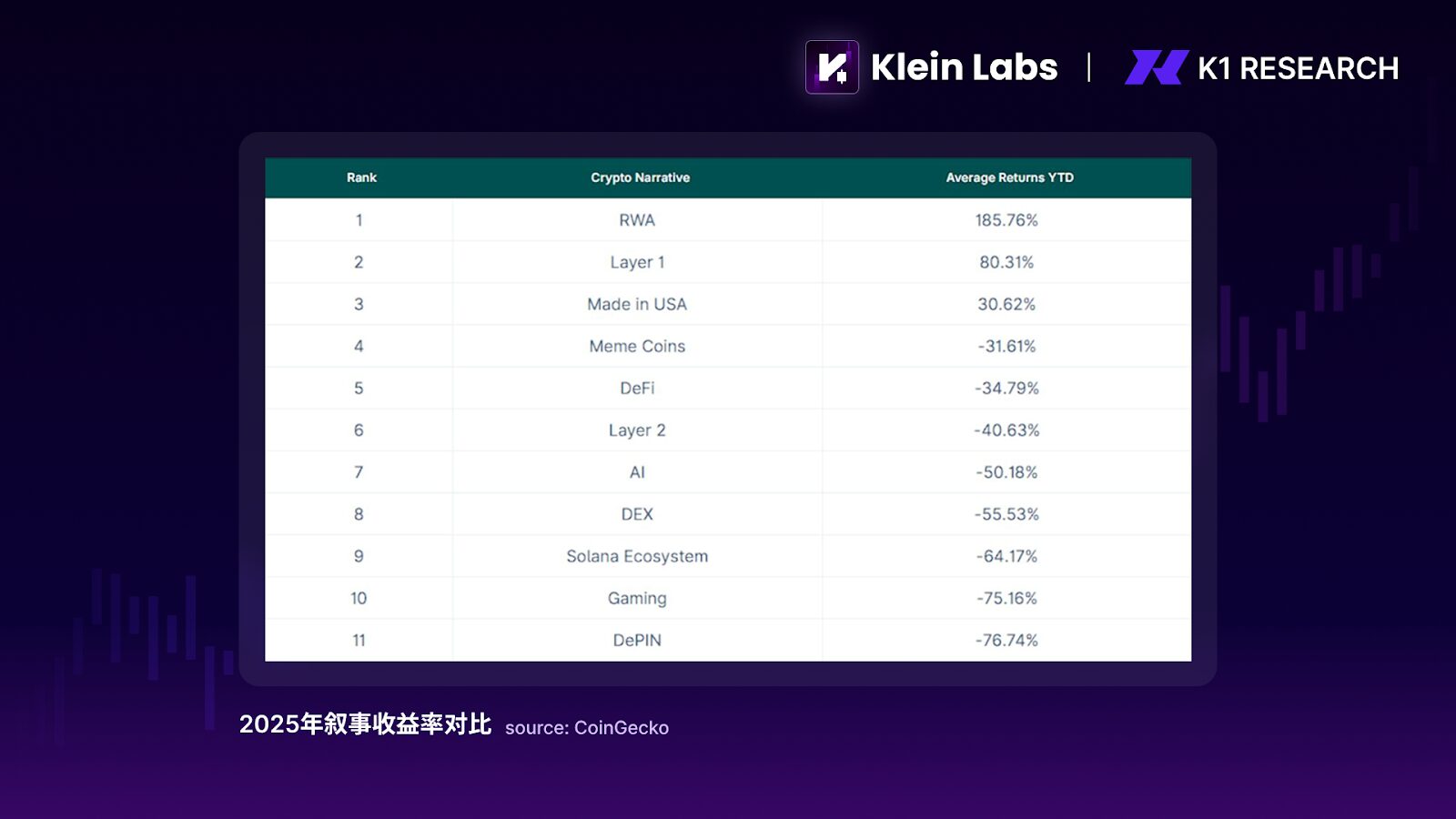

Against a backdrop of increasingly clear policy and regulatory environments, the capital structure of the crypto market is evolving. However, this change is not yet sufficient to completely supersede the short-term dominance of narratives and sentiment on prices. Compared to previous cycles, long-term and institutional capital began to selectively enter assets and channels with compliant attributes and deep liquidity, such as mainstream cryptocurrencies, ETFs, stablecoins, and certain low-risk RWA. Yet, this capital primarily acted as “underlying support” rather than a short-term price catalyst.

Simultaneously, primary market trading behavior continued to be driven by high-frequency capital and sentiment, while the token supply side largely adhered to old-cycle issuance logic, continuously expanding under the assumption of a “broad-based bull market.” As a result, the systemic “altcoin season” that the market anticipated never fully materialized. New narratives could still generate short-term price feedback driven by sentiment, but they lacked the capital support to bridge volatile cycles. Price corrections often occurred faster than narrative realization, leading to a distinct cyclical and structural mismatch in supply and demand.

It is within this dual structure that 2025 presented a new market state: at the macro-cycle level, allocation logic began to concentrate on mainstream cryptocurrencies and assets capable of institutional absorption; at the micro-cycle level, the crypto market remained a trading-driven arena fueled by narratives and sentiment. Narratives did not become obsolete, but their scope of influence was significantly compressed—they became more suitable for capturing emotional fluctuations rather than sustaining long-term valuations.

Therefore, 2025 was not the end of narrative-driven pricing but rather the beginning of narratives being filtered by capital structures. Prices continued to react to sentiment and stories, but only those assets capable of attracting long-term capital retention after volatility could achieve true value accretion. In this sense, 2025 was more a “transition period for pricing power” than a final destination.

Industry & Narratives: Key Directions Under Structural Stratification

1. Yield-Bearing Tokens: The First Sector to Adapt to Evolving Capital Structures

1.1 2025 Review: Yielding Assets Become Capital Anchors

In an environment where narratives still influenced short-term prices, but long-term capital began establishing entry barriers, yield-bearing tokens were among the first to adapt to the changing capital structure. This sector demonstrated relative resilience in 2025, not because its narrative was inherently more appealing, but because it offered capital a participation path that didn’t rely on sustained emotional uplift—even if prices stagnated, holding itself provided a clear return logic. This shift was first evident in the market’s acceptance of yield-bearing stablecoins. Represented by USDe, it rapidly gained capital recognition not through complex narratives, but via a clear, explainable yield structure. In 2025, USDe’s market capitalization briefly surpassed $10 billion, becoming the third-largest stablecoin after USDT and USDC, with its growth rate and scale significantly outpacing most risk assets during the same period. This outcome indicates that a portion of capital began viewing stablecoins as cash management tools rather than trading intermediaries, choosing to hold them on-chain long-term in a high-interest rate environment with increasingly clear regulatory boundaries. Its pricing logic consequently shifted from “does it have narrative elasticity” to “is the yield genuine and sustainable?” This doesn’t imply that the crypto market has fully entered a cash flow pricing stage, but it clearly illustrates that when narrative space is compressed, capital prioritizes asset forms that are viable without relying on storytelling.

1.2 2026 Outlook: Capital to Further Concentrate in Core Value Assets

As the market enters phases of rapid decline or liquidity contraction, “noteworthy” assets are fundamentally defined not by their narrative, but by their two stress-resistant capabilities: first, whether the protocol layer can genuinely generate fees/revenue in a low-risk appetite environment; second, whether these revenues can form “weak support” for the token through mechanisms like buybacks, burn-to-earn, fee switches, or staking yields. Therefore, assets with “more direct value capture mechanisms” such as BNB, SKY, HYPE, PUMP, ASTER, RAY, tend to be prioritized by capital for recovery during panic periods. Meanwhile, assets with “clear functional positioning but greater divergence in value capture strength and stability,” such as ENA, PENDLE, ONDO, VIRTUAL, are better suited for structural screening during emotional recovery phases after a downturn: only those that can convert functional usage into sustained revenue and verifiable token support will qualify to evolve from “trading narratives” to “allocatable assets.”

DePIN (Decentralized Physical Infrastructure Networks) represents a longer-term extension of the real yield logic. Unlike yield-bearing stablecoins and mature DeFi, DePIN’s core lies not in financial structures, but in whether it can transform highly capital-intensive or inefficient real-world infrastructure demands into sustainable decentralized supply networks through tokenized incentives. The 2025 market completed an initial screening: projects that couldn’t demonstrate a cost advantage or heavily relied on subsidies quickly lost capital patience. Conversely, DePIN projects capable of meeting genuine demands (compute, storage, communication, AI inference, etc.) began to be seen as potential “revenue-generating infrastructure.” At this stage, DePIN is more of a direction closely observed by capital amidst accelerating AI demand but not yet fully priced. Its ability to enter the mainstream pricing range in 2026 will depend on whether real demand can translate into scalable, sustainable on-chain revenue.

Overall, yield-bearing tokens became the first preserved sector not because they entered a mature value investment phase, but because in an environment where narratives were filtered by capital structures and the altcoin season was absent, they were the first to meet an extremely pragmatic condition: providing capital a reason to stay without relying on continuous price appreciation. This also defines the key question for this sector in 2026: no longer “is there a narrative,” but “does the yield still hold after scaling?”

2. AI & Robotics × Crypto: Critical Variables for Productivity Transformation

2.1 2025 Review: AI and Robotics Narratives Cool Down

If there was one sector in 2025 that “failed” at the price level but became even more important in the long run, AI & Robotics × Crypto is undoubtedly the most representative. Over the past year, DeAI’s investment fervor in both primary and secondary markets significantly cooled compared to 2024. Related tokens generally underperformed mainstream assets, and narrative premiums were rapidly compressed. However, this cooling did not stem from the invalidation of the direction itself, but because the productivity changes brought by AI are more reflected in systemic efficiency improvements, leading to a temporary misalignment between its pricing logic and crypto market pricing mechanisms.

Between 2024 and 2025, a series of structural changes occurred within the AI industry: inference demand rapidly outpaced training demand, the importance of post-training and data quality significantly increased, competition among open-source models intensified, and the Agent economy began transitioning from concept to practical application. These changes collectively point to one fact—AI is moving from a “model capability race” to a “system engineering phase” focused on compute, data, collaboration, and settlement efficiency. These are precisely the areas where blockchain could play a long-term role: decentralized compute and data markets, composable incentive mechanisms, and native value settlement and permission management.

2.2 2026 Outlook: Productivity Revolution Remains Key to Unlocking Narrative Ceiling

Looking ahead to 2026, the significance of AI × Crypto is shifting. It is no longer a short-term narrative of “AI projects issuing tokens,” but rather providing complementary infrastructure and coordination tools for the AI industry. The same applies to Robotics × Crypto; its true value lies not in the robots themselves, but in how to achieve automated management of identity, permissions, incentives, and settlement within multi-agent systems. As AI Agents and robotic systems gradually acquire autonomous execution and collaboration capabilities, the friction in traditional centralized systems regarding permission allocation and cross-entity settlement begins to emerge, and on-chain mechanisms offer a potential solution path.

However, this sector did not receive systemic pricing in 2025 precisely because its productivity value realization cycle is too long. Unlike DeFi or trading protocols, the commercial closed-loop for AI and Robotics has not fully formed. While real demand is growing, it is difficult to translate into scalable, predictable on-chain revenue in the short term. Therefore, in the current market structure of “compressed narratives and capital preference for absorbable assets,” AI × Crypto is more of a direction continuously tracked but not yet entering the mainstream allocation range.

AI, Robotics × Crypto should be understood as a layered narrative: in the long term, DeAI is a potential infrastructure for productivity transformation; in the medium to short term, protocol-level innovations represented by x402 may first become high-elasticity narratives repeatedly validated by sentiment and capital. The core value of this sector is not whether it is immediately priced, but rather that once it enters the pricing range, the ceiling it can open is significantly higher than traditional application-driven narratives.

3. Prediction Markets & Perp DEX: Speculative Demand Reshaped by Institutions and Technology

3.1 2025 Review: Sustained Speculative Demand

Against a backdrop of compressed narratives and cautious long-term capital, prediction markets and decentralized perpetual exchanges (Perp DEX) were among the few sectors that achieved counter-cyclical growth in 2025. The reason is straightforward: they cater to the most native and enduring demands of the crypto market—the pricing of uncertainty and the need for leveraged trading. Unlike most application narratives, these products do not “create new demand” but rather migrate existing demand.

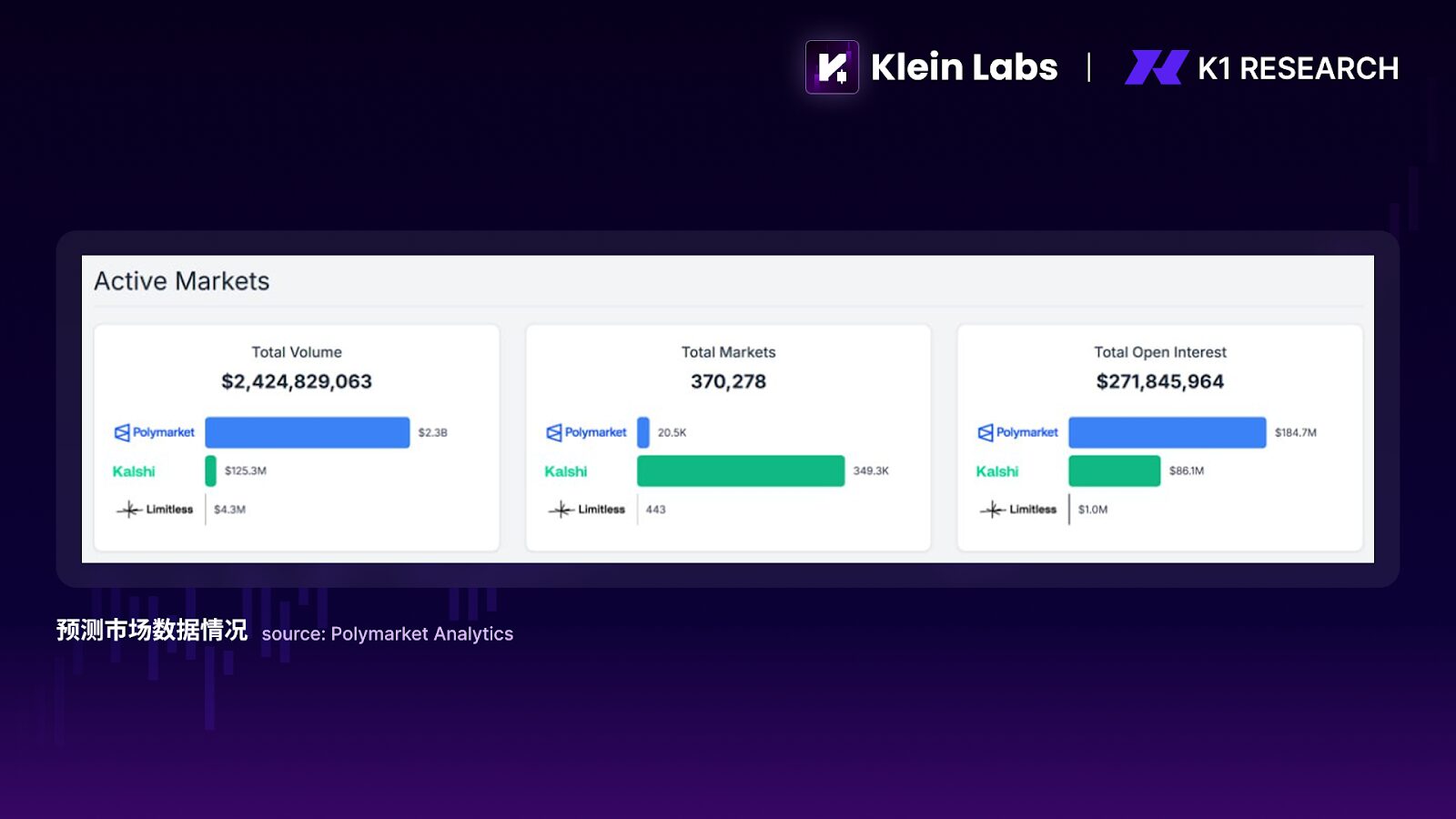

The essence of prediction markets is information aggregation; capital “votes” on future events through betting, and prices converge towards collective consensus through continuous adjustments. Structurally, this is a naturally occurring, relatively more compliant “casino model”: there’s no house manipulating odds, results are determined by real-world events, and the platform profits solely through transaction fees. This sector’s first high-profile appearance occurred during the US presidential election. Prediction markets surrounding election outcomes rapidly gathered liquidity and public attention on-chain, elevating them from niche DeFi products to a narrative direction with real-world impact. In 2025, this narrative did not fade but continued to ferment with improving infrastructure maturity and expectations of multiple protocols issuing tokens. From a data perspective, prediction markets in 2025 were no longer a niche experiment. Cumulative transaction volume exceeded $2.4 billion, while market-wide Open Interest maintained around $270 million, indicating not merely short-term speculative traffic but genuine capital continuously taking on event outcome risk.

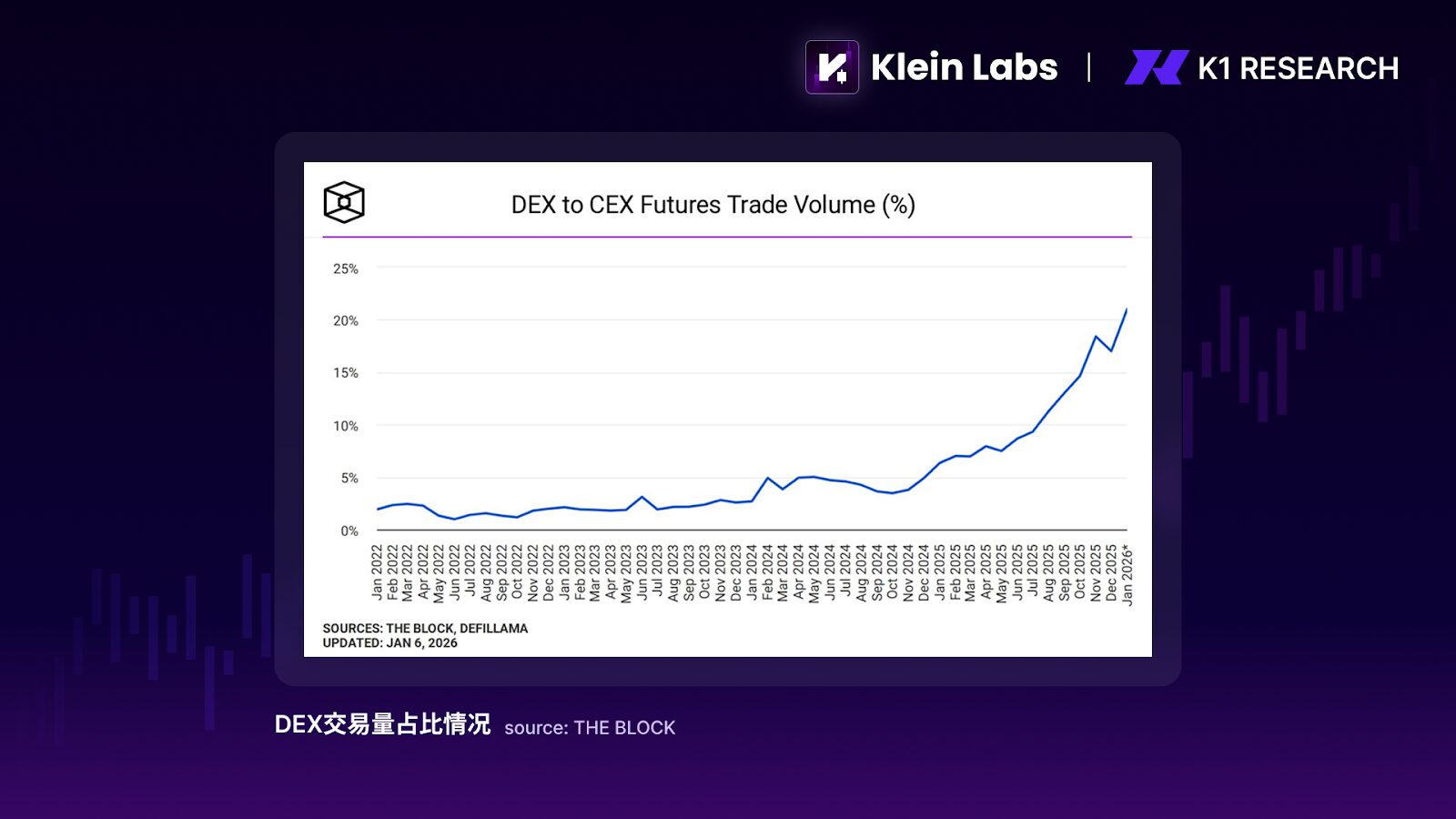

The rise of Perp DEXs points more directly to a core product form of the crypto industry—futures trading. Its significance is not whether “on-chain is faster than off-chain,” but rather in bringing opaque, high-counterparty-risk futures markets into a verifiable, liquidatable, trustless environment. Transparent positions, liquidation rules, and liquidity pool structures enable Perp DEXs to exhibit security attributes distinct from centralized exchanges. However, it must be acknowledged that in 2025, the vast majority of futures trading volume still concentrated on CEXs, which was a result of efficiency and user experience issues, rather than solely a matter of trust.

3.2 2026 Outlook: Institutions and Technology Determine Cross-Cycle Viability

Looking ahead to 2026, collaborations such as Polymarket and Parcl launching real estate prediction markets offer prediction markets an opportunity to reach a broader non-crypto user base, becoming breakthrough applications. Furthermore, the World Cup, a global event inherently involving speculation, is highly likely to become the next inflection point for prediction market traffic. Moreover, a more critical variable lies in the improved maturity of the infrastructure layer: continuous enhancement of liquidity depth, including market-making mechanisms, cross-event capital reuse capabilities, and price absorption capacity for large orders; as well as the refinement of result adjudication and dispute resolution mechanisms. These two factors will determine whether prediction markets can evolve from “event-driven gambling products” into a probability-pricing infrastructure capable of long-term handling macro, political, financial, and social uncertainties. If these conditions gradually mature, the upside for prediction markets will extend beyond short-term traffic, lying in their potential to become one of the few core application forms with cross-cycle vitality within the crypto ecosystem.

Whether Perp DEXs can continue to expand hinges not on “being decentralized,” but on whether they can offer incremental value on the demand side that centralized platforms currently cannot. For example, further improving capital efficiency: by deeply integrating unoccupied collateral with DeFi protocols, allowing it to participate in lending, market-making, or yield strategies without significantly increasing liquidation risk, thereby boosting overall capital utilization. If Perp DEXs can unlock such structural innovations on top of security and transparency, their competitiveness will no longer merely be “safer,” but “more efficient.”

From a broader perspective, the commonality of prediction markets and Perp DEXs is that they do not rely on long-term narrative premiums but on repeatable, scalable speculative and trading demand. In an environment where narratives are filtered and the altcoin season is absent, these sectors are more likely to attract sustained attention. They may not be the first choice for long-term allocative capital but are highly likely to become the core stage where emotional capital, trading capital, and technological innovation repeatedly converge in 2026.

Conclusion

In retrospect, 2025 was not a “failed bull market,” but rather a profound reshaping centered on the crypto market’s pricing power, participant structure, and sources of value. On the policy front, regulatory logic gradually shifted from a state of high uncertainty and suppression to clear boundary and function delineation. In terms of capital, long-term funds did not directly flow back into high-volatility assets but instead established compliant, auditable, low-volatility absorption channels through structural tools like ETFs, DATs, stablecoins, and low-risk RWA. At the market level, pricing mechanisms underwent substantial changes; narrative diffusion no longer automatically triggered linear upward feedback, the broad-based altcoin season gradually became ineffective, and structural differentiation became the norm.

However, this does not mean that narratives themselves have exited the market. On the contrary, within shorter timeframes and more localized sectors, narratives and sentiment remain the most crucial trading drivers. The repeated activity in prediction markets, Perp DEXs, AI payments, and memes indicates that the crypto market is still a highly speculative, decentralized arena for information and risk arbitrage. The difference is that these narratives are increasingly unable to transcend cycles and solidify into long-term valuation foundations. They are more like transient opportunities, constantly filtered by capital structures, quickly validated, and rapidly cleared, revolving around real-world use cases, trading demand, or risk expression.

Therefore, entering 2026, a more pragmatic and actionable framework is taking shape: at the macro-cycle level, the market will continue to concentrate on mainstream assets and infrastructure possessing genuine utility, distribution capabilities, and institutional absorption capacity. At the micro-cycle level, narratives are still worth engaging with, but no longer worth blindly believing in. For investors, the key is no longer to bet on the arrival of “the next full-blown bull market,” but to more pragmatically assess which assets and sectors can not only survive in an environment of market contraction, regulatory constraints, and intensified competition, but also be among the first to gain elasticity and pricing power when sentiment recovers and risk appetite is temporarily released.