Bitcoin’s Q1 2026 Outlook: Tiger Research Sets Ambitious $185,500 Target Amidst Evolving Market Dynamics

This comprehensive report, meticulously prepared by Tiger Research, unveils our market outlook for Bitcoin in Q1 2026, projecting a compelling target price of $185,500.

Key Takeaways

- Macro Resilience, Shifting Momentum: The Federal Reserve’s rate-cutting cycle and M2 money supply growth remain firmly on track. Despite this, a significant $4.57 billion in ETF outflows has impacted short-term price action. The advancement of the CLARITY Act, however, holds the potential to unlock substantial institutional engagement.

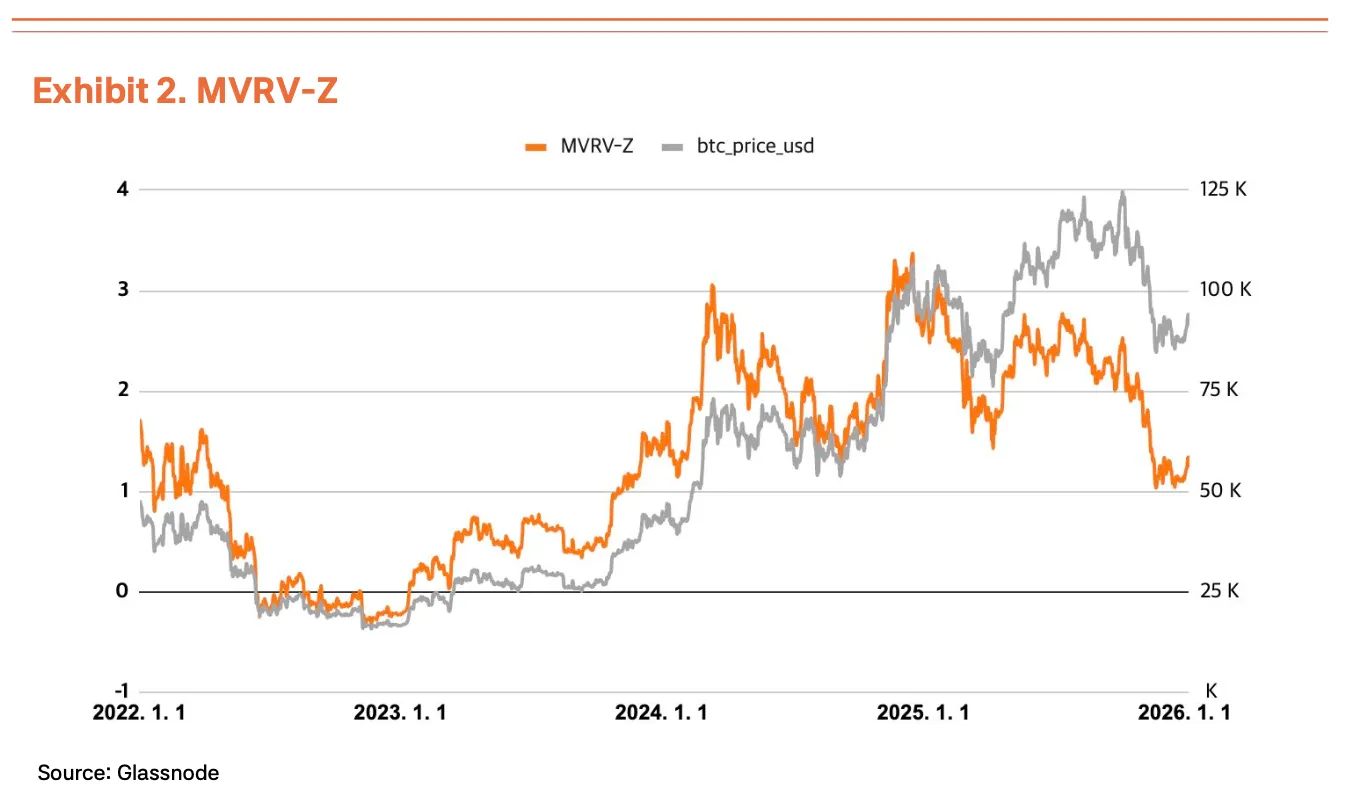

- On-Chain Metrics Signal Neutrality: Robust buying demand near $84,000 has established a critical support floor, while the $98,000 level, representing the average cost basis for short-term holders, now acts as a primary resistance. Key indicators like MVRV-Z suggest the market is currently in a fair value zone.

- $185,500 Target Price, Bullish Conviction Maintained: Based on a baseline valuation of $145,000 and a +25% macro factor adjustment, our revised target price stands at $185,500. This implies an impressive upside potential of approximately 100% from current price levels.

Sustained Macro Easing, Decelerating Momentum

Bitcoin is currently trading around $96,000, having experienced a 12% correction since our previous report published on October 23, 2025. Despite this recent pullback, the overarching macro environment supporting Bitcoin’s long-term trajectory remains robust.

Federal Reserve Maintains Dovish Trajectory

Source: Tiger Research

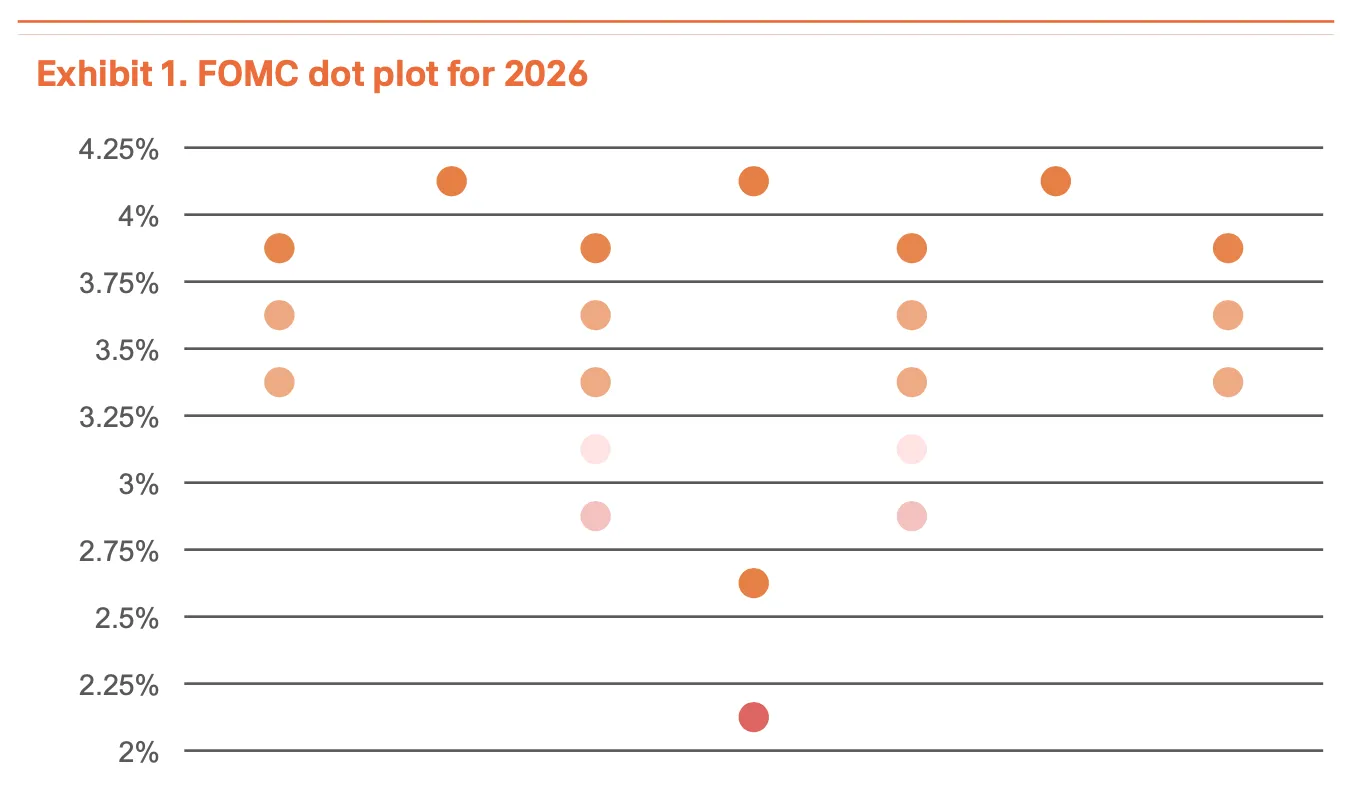

The Federal Reserve executed three consecutive rate cuts between September and December 2025, totaling 75 basis points, bringing the federal funds rate to a range of 3.50%—3.75%. The December dot plot further reinforces this dovish stance, projecting rates to decline to 3.4% by the end of 2026. While a single, aggressive 50 basis point or larger cut is improbable this year, the impending conclusion of Chairman Powell’s term in May and the potential appointment of a more dovish successor by a Trump administration could ensure the sustained continuation of monetary easing.

Institutional Flow Divergence: ETF Outflows vs. Corporate Accumulation

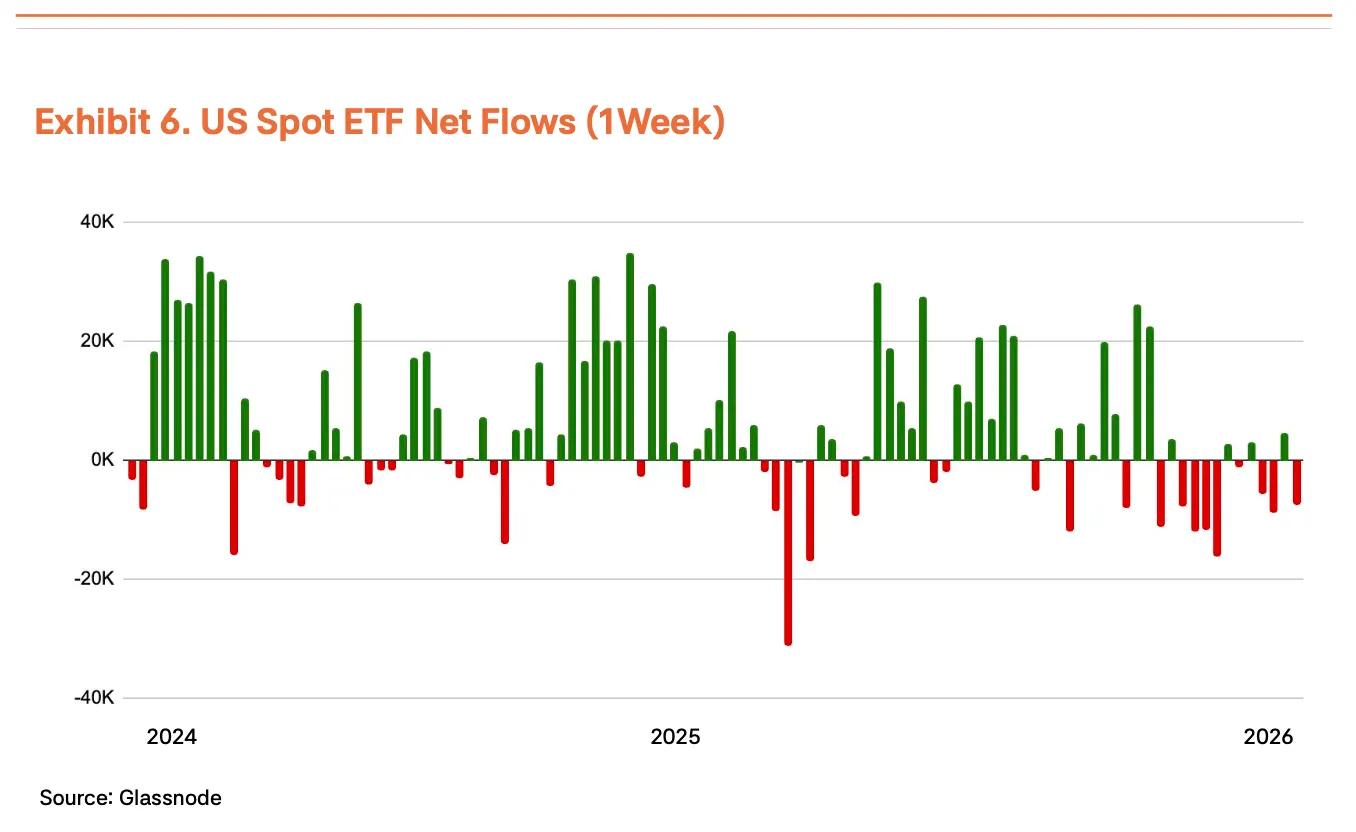

Despite the generally favorable macro backdrop, institutional demand has shown recent signs of sluggishness. Spot ETFs recorded substantial outflows of $4.57 billion during November and December, marking the largest such exodus since their inception. Annual net inflows for the year totaled $21.4 billion, a notable 39% decrease from the $35.2 billion observed in the previous year. While January saw some inflows driven by asset rebalancing, the durability of this rebound requires close monitoring. Concurrently, major corporate entities such as MicroStrategy (holding 673,783 BTC, approximately 3.2% of the total supply), Metaplanet, and Mara continue their strategic accumulation of Bitcoin, underscoring persistent conviction from long-term players.

The CLARITY Act: A Pivotal Regulatory Catalyst

Amidst a period of plateauing institutional demand, regulatory advancements are emerging as a crucial potential catalyst. The House-passed CLARITY Act is set to significantly clarify jurisdictional boundaries between the SEC and CFTC, while also explicitly permitting banks to offer digital asset custody and staking services. Furthermore, this landmark legislation grants the CFTC regulatory oversight over the digital commodity spot market, providing a much-needed clear legal framework for exchanges and brokers. With the Senate Banking Committee slated for review on January 15, its potential passage could unlock the floodgates for traditional financial institutions (TradFi) that have long remained on the sidelines, awaiting regulatory certainty.

Ample Liquidity Underpins Bitcoin’s Long-Term Potential

Beyond regulatory clarity, global liquidity remains a critical variable. The global M2 money supply reached an all-time high in Q4 2024 and continues its upward trajectory. Historically, Bitcoin has often acted as a leading indicator for liquidity cycles, typically appreciating before M2 peaks and consolidating during peak phases. Current indicators strongly suggest further expansion in liquidity, signaling continued upside potential for Bitcoin. Should equity market valuations become stretched, a significant rotation of capital into Bitcoin is a highly probable scenario.

Macro Factor Adjustment: A Prudent Revision to +25%

Overall, the overarching macro direction of rate cuts and liquidity expansion remains unchanged. However, in light of the slowdown in institutional inflows, uncertainties surrounding potential Federal Reserve leadership transitions, and rising geopolitical risks, we have prudently adjusted our macro adjustment factor from +35% to +25%. Despite this recalibration, this weighting remains firmly within a positive range. We firmly believe that ongoing regulatory progress and sustained M2 expansion will provide fundamental support for Bitcoin’s mid-to-long-term appreciation.

On-Chain Insights: Navigating Key Support and Resistance Levels

On-chain indicators provide valuable supplementary signals to our macro analysis. During the November 2025 correction, concentrated dip-buying activity around $84,000 established a robust support zone, which Bitcoin has now successfully surpassed. Conversely, the $98,000 level, representing the average cost basis for short-term holders, currently presents a significant psychological and technical resistance point.

On-chain data further reveals a notable shift in market sentiment from short-term panic towards a more neutral stance. Key metrics such as MVRV-Z (1.25), NUPL (0.39), and aSOPR (1.00) have all moved out of previously undervalued territories and into a more balanced equilibrium range. This suggests that while the likelihood of panic-driven, explosive rallies may be diminished, the underlying market structure remains healthy and resilient. When combined with the compelling macro and regulatory backdrop, the statistical basis for higher prices in the mid-to-long term remains robust.

Market Structure Evolution: Maturation Beyond Retail-Driven Volatility

It is crucial to recognize that the current market structure for Bitcoin differs significantly from previous cycles. The increasing proportional representation of institutional and long-term capital has substantially reduced the probability of panic-driven sell-offs predominantly fueled by retail investors. The recent market pullback is more indicative of a gradual, healthy rebalancing process rather than a capitulation event. While short-term volatility is an inherent characteristic of the asset, the overall upward structural integrity of Bitcoin remains intact.

Target Price Reaffirmed: $185,500 Bitcoin by Q1 2026

Applying our proprietary TVM valuation framework, we have derived a neutral baseline valuation for Q1 2026 of $145,000. This is a slight adjustment from the $154,000 presented in our previous report. Incorporating a 0% fundamental adjustment and a +25% macro adjustment, we have set our revised, firm target price for Bitcoin at $185,500.

We have adjusted the fundamental adjustment factor upwards from -2% to 0%. While network activity has remained relatively stable, a renewed market focus on the burgeoning BTCFi ecosystem has effectively counterbalanced some previously observed bearish signals. Concurrently, as detailed earlier, the slowdown in institutional inflows and persistent geopolitical factors necessitated a downward adjustment of our macro adjustment factor from +35% to +25%.

A Bullish Conviction Despite Near-Term Adjustments

It is imperative that this target price adjustment is not misconstrued as a bearish signal. Even after these prudent adjustments, our model continues to indicate approximately 100% potential upside from current levels. The slightly lower baseline price primarily reflects recent market volatility and rebalancing, while Bitcoin’s intrinsic value is projected to continue its upward ascent over the mid-to-long term. We interpret the recent pullback as a healthy and necessary rebalancing process, and our unwavering mid-to-long-term bullish outlook for Bitcoin remains firmly in place.

(The above content is excerpted and reproduced with authorization from our partner PANews, original link | Source: Tiger Research)

Disclaimer: This article is intended solely for the provision of market information. All content and views expressed herein are for reference purposes only and do not constitute investment advice. They do not necessarily represent the views or positions of the publisher. Investors are solely responsible for their own decisions and transactions, and neither the author nor the publisher shall bear any responsibility for direct or indirect losses incurred by investors’ transactions.