Ark Invest Unveils Audacious Crypto Forecasts: Bitcoin to Hit $16 Trillion by 2030

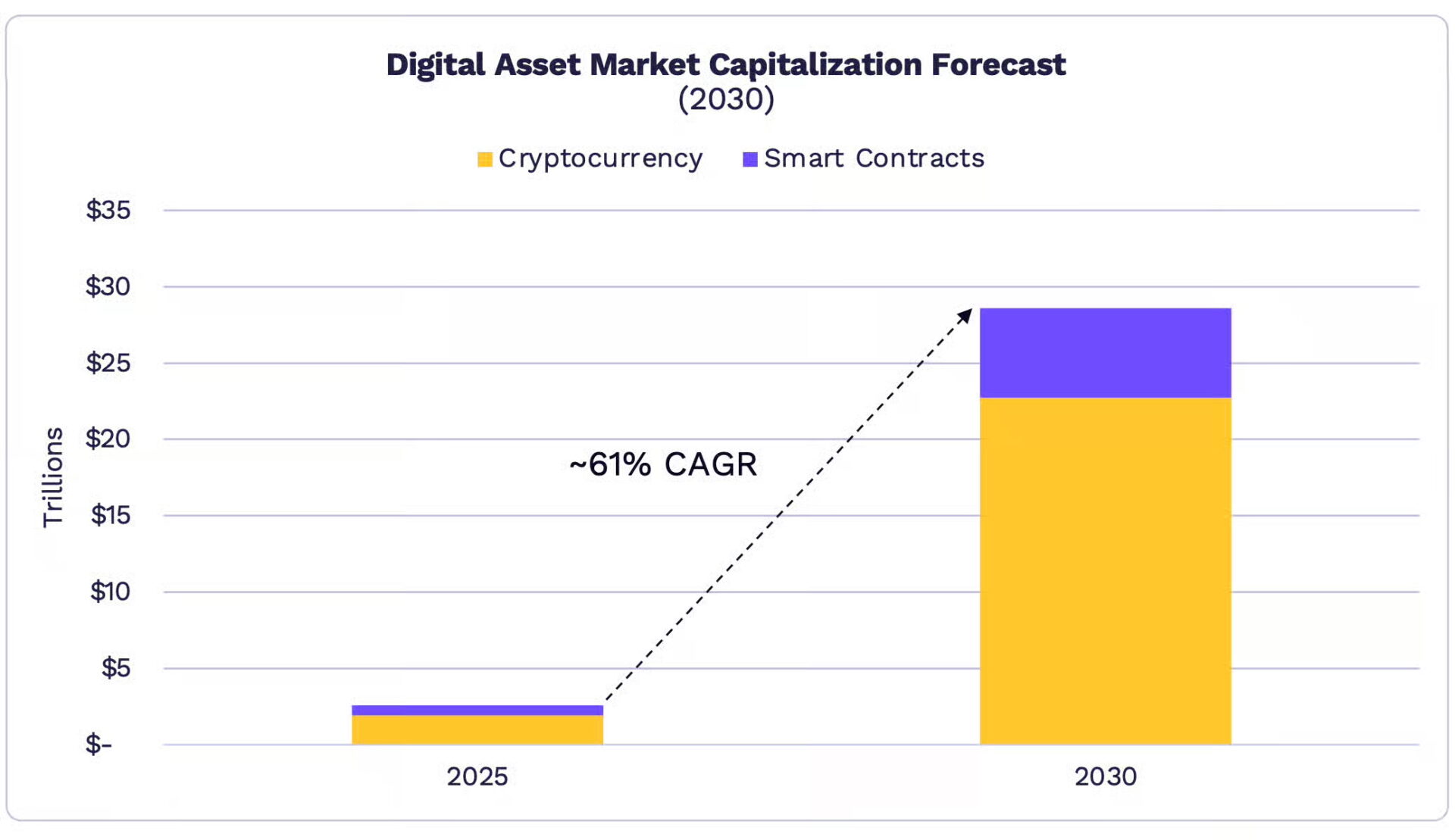

Cathie Wood’s Ark Invest has once again captured the financial world’s attention with its latest, highly ambitious predictions for the cryptocurrency market. According to their recently published annual research report, “Big Ideas 2026,” the crypto landscape is poised for explosive growth over the next four years, culminating in a staggering $28 trillion total market capitalization by 2030. At the forefront of this expansion, Bitcoin is projected to soar to a monumental $16 trillion market cap.

Bitcoin’s Path to $761,900: The Rise of a Digital Gold Standard

Should Ark Invest’s forecast materialize, Bitcoin’s price per coin would reach an astonishing $761,900, based on its total supply of 21 million. This represents a potential increase of nearly 765% from its current price levels, signaling an unprecedented bull run for the flagship cryptocurrency.

Ark’s analysis posits that Bitcoin is rapidly maturing into a sophisticated “institutional-grade asset class.” This transformation is primarily fueled by the widespread adoption of public blockchains and a fundamental shift in how capital is allocated globally. At its core, Bitcoin is solidifying its position as a “digital store of value,” a narrative widely recognized as “digital gold.” This powerful story is gaining momentum from several key factors:

- Soaring Institutional Participation: A continuous influx of institutional investors seeking exposure to the crypto space.

- Explosive ETF Growth: The rapid expansion and adoption of Bitcoin Exchange-Traded Funds (ETFs), democratizing access for a broader investor base.

- Diminishing Volatility: A gradual reduction in Bitcoin’s price fluctuations, making it a more attractive and stable asset.

- Increasing Corporate Buying: A growing trend of corporations adding Bitcoin to their balance sheets as a treasury reserve asset.

Supporting this trend, data indicates a significant surge in Bitcoin holdings by ETFs and publicly listed companies in 2025. ETF holdings are estimated to have grown by approximately 20%, while corporate treasuries saw an impressive 73% increase. Together, these two powerful forces now command an estimated 12% of Bitcoin’s total circulating supply.

The report further predicts that Bitcoin will maintain its market dominance over the next five years, with its market capitalization surging at an impressive compound annual growth rate (CAGR) of approximately 63%, propelling it from its current multi-trillion-dollar valuation to the projected $16 trillion mark.

Ark’s Evolving Outlook: Stablecoins, Gold, and Market Adjustments

It’s worth noting that Ark Invest has periodically fine-tuned its 2030 predictions. While last year’s bullish target briefly touched $1.5 million per Bitcoin, subsequent revisions have led to the current forecast. Ark attributes these adjustments to the unexpectedly rapid proliferation of stablecoins in emerging markets, which have absorbed some of the hedging functions initially anticipated for Bitcoin. Simultaneously, the firm has upwardly revised Bitcoin’s “digital gold” Total Addressable Market (TAM) by 37%, acknowledging the rising market capitalization of physical gold.

Beyond Bitcoin: The $6 Trillion Future of Smart Contract Platforms

Beyond Bitcoin, Ark Invest projects that the remaining significant portion of the cryptocurrency market will be dominated by smart contract platforms, primarily led by Ethereum. Driven by the widespread adoption of on-chain finance and security tokenization, these platforms are expected to reach a collective market capitalization of $6 trillion by 2030. This growth would be fueled by a CAGR of approximately 54% and generate an impressive annualized revenue of around $192 billion.

Ark anticipates a “winner-takes-all” dynamic within the smart contract market, with 2 to 3 leading Layer 1 blockchains capturing the vast majority of market share. These dominant platforms are not only expected to generate substantial cash flow but also command a premium valuation due to their inherent “reserve asset” characteristics.

Disclaimer: This article is for informational purposes only. All content and opinions are for reference only and do not constitute investment advice. They do not represent the views or positions of the author or publisher. Investors should make their own decisions and trades. The author and publisher will not be held responsible for any direct or indirect losses incurred by investors’ trading activities.