By imToken

Ethereum: Evolving into a Global Yield Powerhouse

Imagine holding an Ethereum ETF that pays regular interest, much like a traditional bond. This once-distant concept is now a reality, marking a pivotal moment in the convergence of decentralized finance and traditional markets.

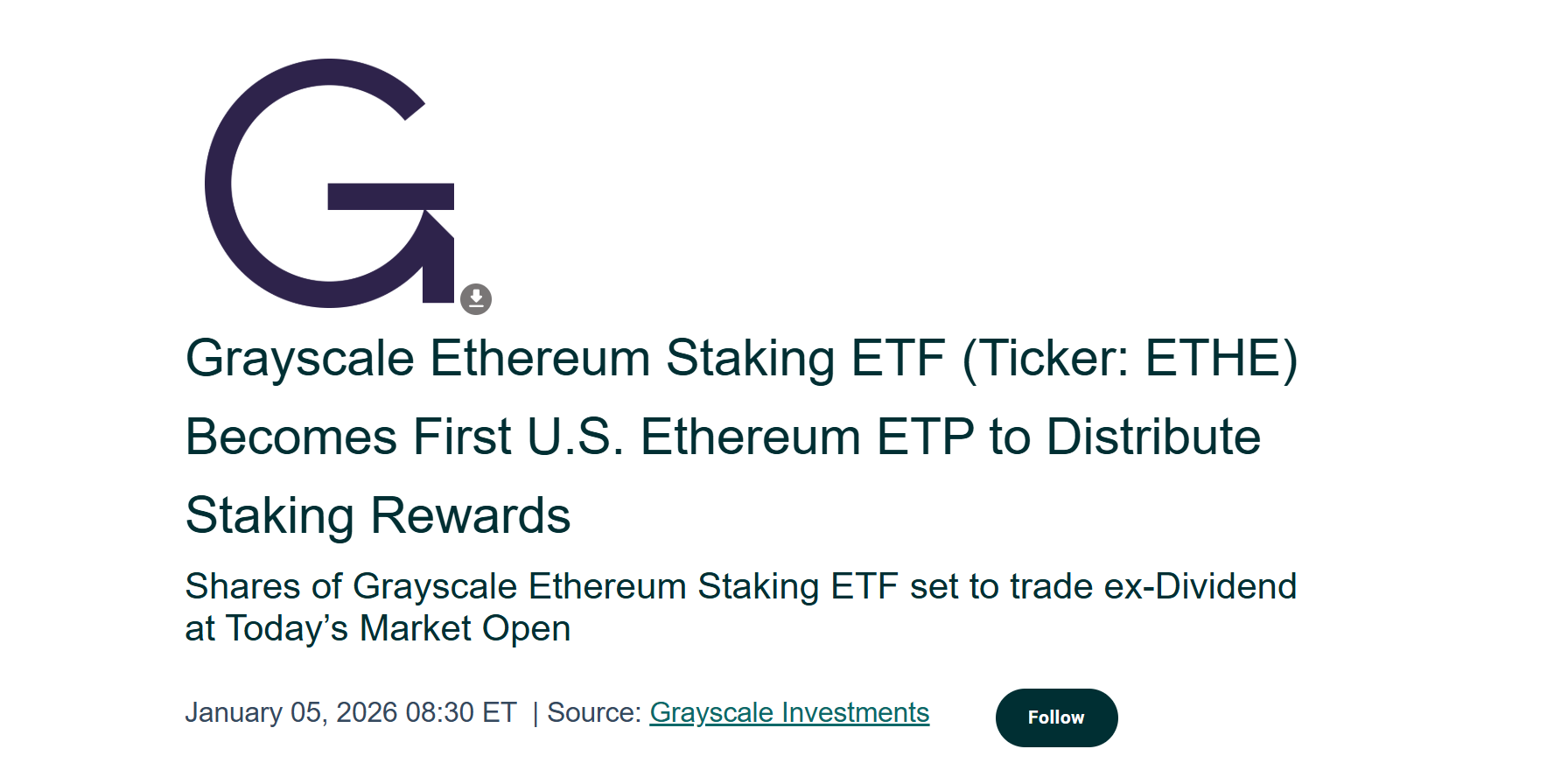

Earlier this month, Grayscale announced a groundbreaking distribution: its Grayscale Ethereum Staking ETF (ETHE) paid out staking rewards earned between October 6, 2025, and December 31, 2025, to existing shareholders. This historic move signifies the first time a spot crypto asset trading product in the U.S. has distributed staking yield to its holders.

While on-chain staking is routine for Web3 natives, this event is a landmark in crypto financial history. It represents the **first instance of Ethereum’s native yield being successfully integrated into a standard traditional financial product.**

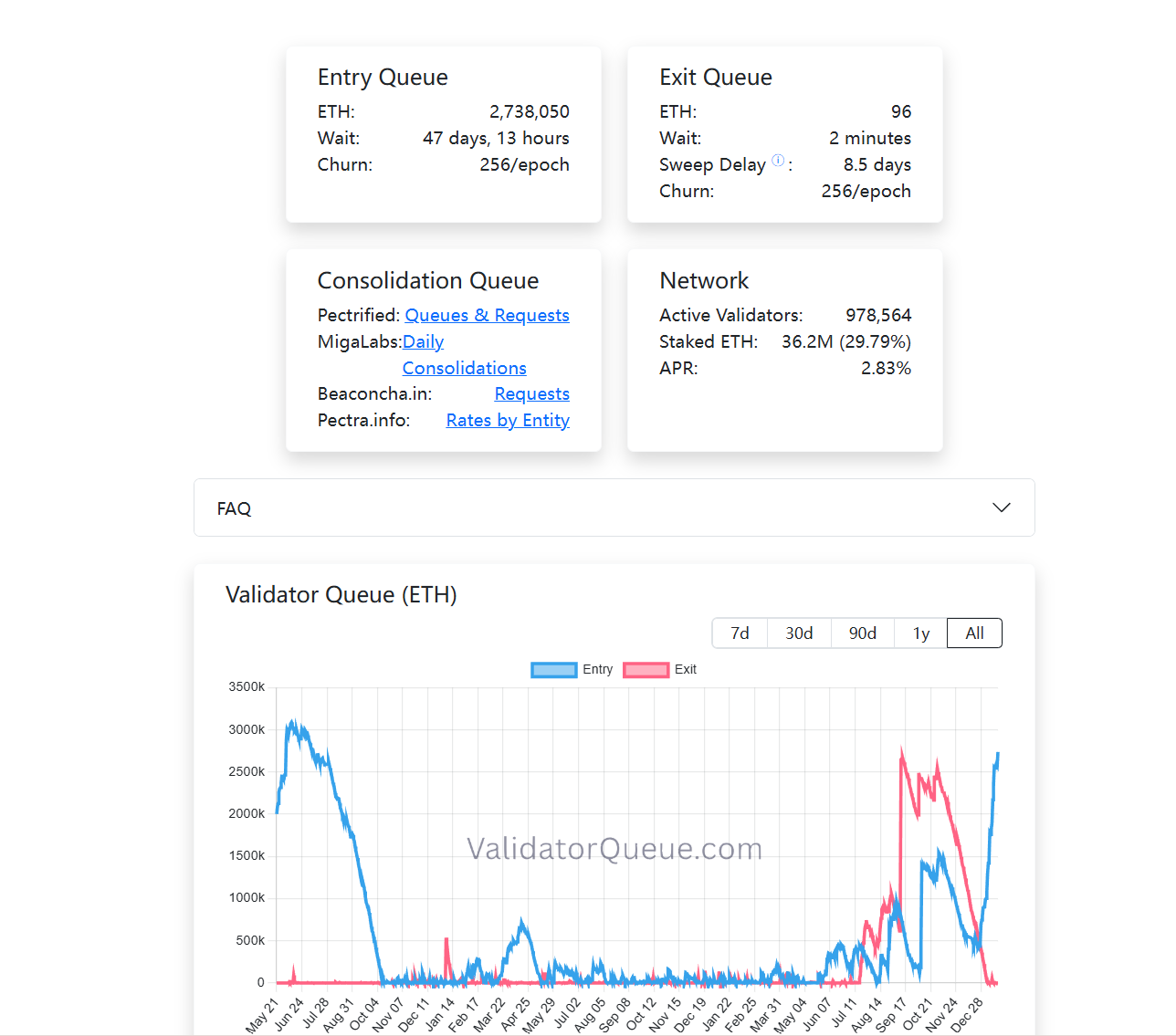

This isn’t an isolated incident. On-chain data reveals a synchronized transformation: Ethereum’s staking rate continues its ascent, validator exit queues are clearing, and entry queues are steadily growing. These seemingly disparate signals collectively point to a profound shift:

Is Ethereum transitioning from a volatile speculative asset to a stable, yield-bearing instrument, increasingly embraced by long-term institutional capital?

I. ETF Yield Distribution: A Gateway for Traditional Investors to Staking

For a considerable period, Ethereum staking remained a somewhat niche, “geeky” technical endeavor confined to the on-chain world. It demanded a foundational understanding of crypto wallets, private keys, validator mechanisms, consensus rules, lock-up periods, and slashing risks. While Liquid Staking Derivatives (LSD) protocols like Lido Finance significantly lowered the barrier to entry, staking rewards largely stayed within the crypto-native ecosystem (e.g., wrapped tokens like stETH).

For most Web2 investors, this system was neither intuitive nor directly accessible—a formidable chasm.

Now, ETFs are bridging this gap. Grayscale’s distribution plan will provide ETHE holders with $0.083178 per share, reflecting the fund’s staking rewards earned and sold during the specified period. The payment date is set for January 6, 2026, for investors holding ETHE shares as of January 5, 2026.

Crucially, this yield doesn’t stem from corporate operations but from the fundamental security and consensus participation of the Ethereum network itself. Previously confined to the crypto industry, this native yield is now accessible through familiar financial wrappers. Traditional 401(k) or mutual fund investors can now receive Ethereum’s native yield in USD, via their existing brokerage accounts, without ever needing to manage private keys.

It’s important to note that this doesn’t imply full regulatory compliance for all Ethereum staking, nor does it signal a unified regulatory stance on ETF staking services. However, from an economic standpoint, a critical shift has occurred: **non-crypto-native users are, for the first time, indirectly accessing the native yield generated by the Ethereum network’s consensus, without needing to grasp the intricacies of nodes, private keys, or on-chain operations.**

Thus, ETF yield distribution is not an isolated event; it’s the crucial first step for Ethereum staking to enter the broader capital markets.

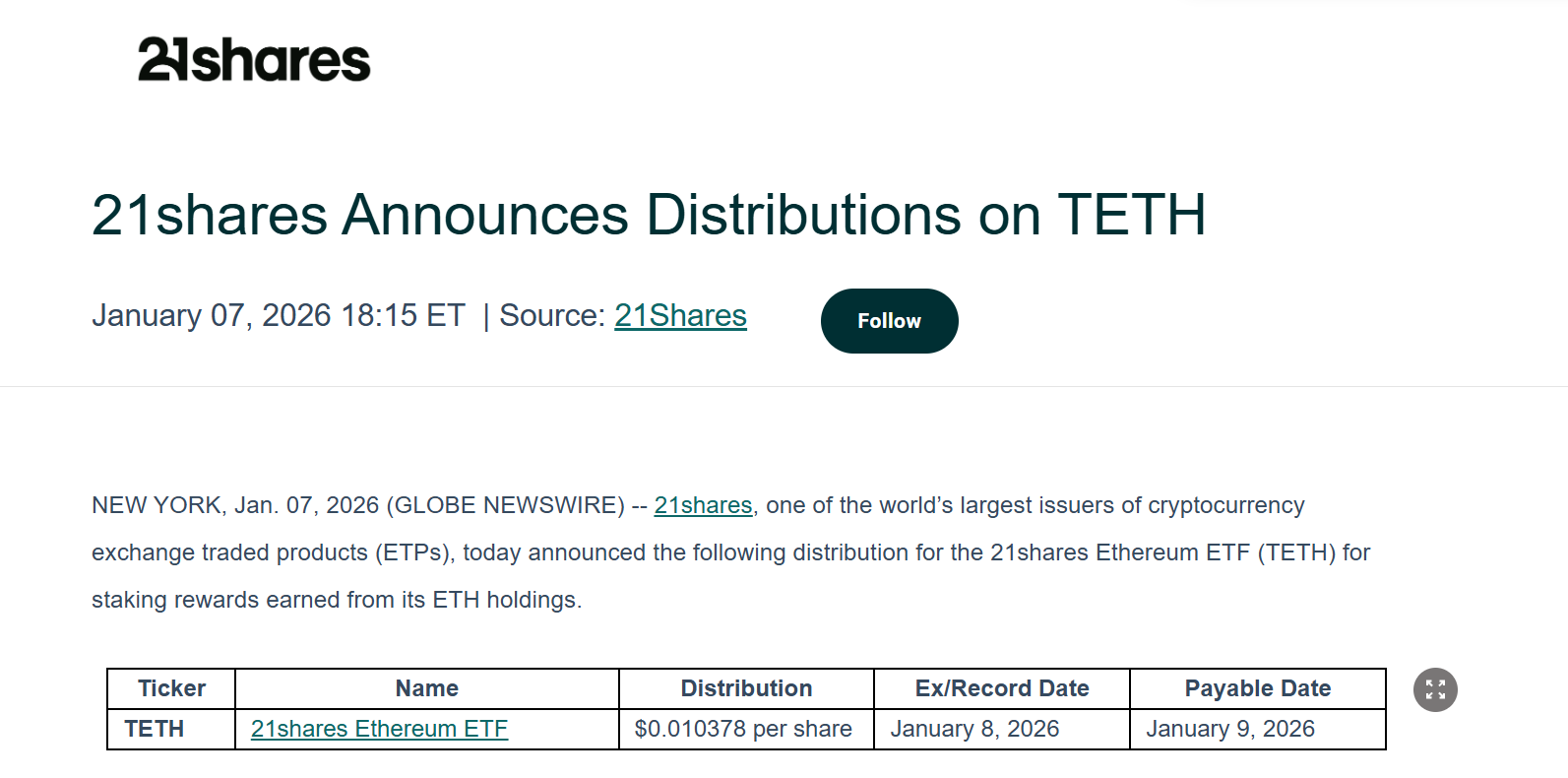

Grayscale is not alone. 21Shares’ Ethereum ETF has also announced its intention to distribute ETH staking rewards to existing shareholders, with a proposed amount of $0.010378 per share and corresponding ex-dividend and payment procedures disclosed.

This sets a powerful precedent, particularly for influential institutions like Grayscale and 21Shares, who operate in both TradFi and Web3. Their demonstration effect extends far beyond a single dividend. It will undoubtedly accelerate the **de facto adoption and popularization of institutional Ethereum staking and yield distribution, signifying that ETH ETFs are evolving beyond mere price speculation.**

Looking ahead, as this model gains validation, it’s highly probable that traditional asset management giants like BlackRock and Fidelity will follow suit, potentially channeling hundreds of billions in long-term capital into Ethereum.

II. Record-High Staking Rates and the Vanishing Exit Queue

While ETF yield distributions represent a narrative breakthrough, changes in the total staking rate and queue dynamics offer a more direct reflection of capital movement.

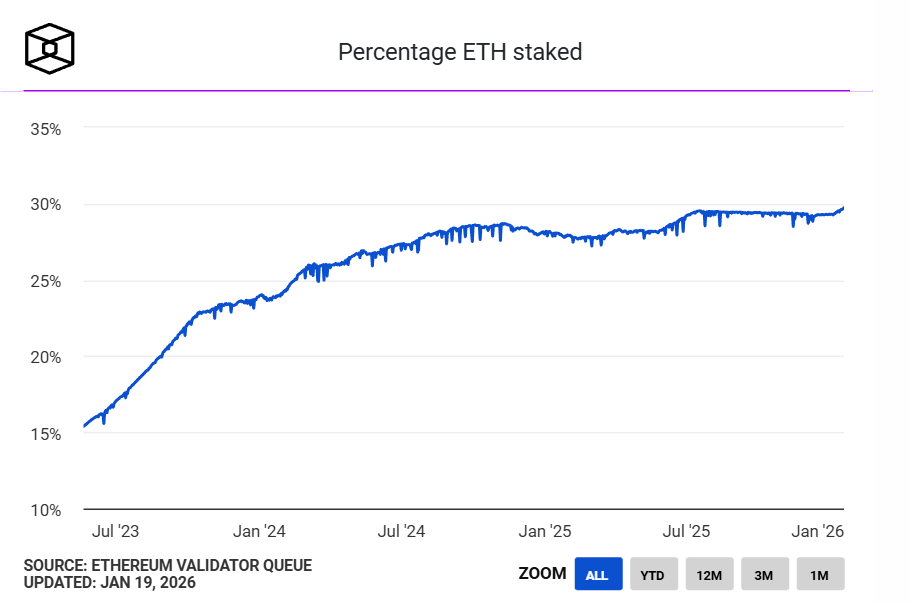

Ethereum’s staking rate has reached an all-time high. Statistics from The Block reveal that **over 36 million ETH are now staked on the Ethereum Beacon Chain, representing nearly 30% of the network’s circulating supply, with a staking market value exceeding $118 billion.** This surpasses the previous peak of 29.54% of circulating supply recorded in July 2023.

Source: The Block

From a supply-demand perspective, this massive amount of staked ETH means it has temporarily exited the free circulating market. It indicates that **a significant portion of circulating ETH is transitioning from a high-frequency trading asset to a long-term allocation asset, fulfilling a vital functional role.**

In essence, ETH is no longer solely gas, a medium of exchange, or a speculative tool. It is increasingly acting as a “means of production”—participating in network operations through staking and continuously generating yield.

Concurrently, the validator queues exhibit intriguing changes. As of writing, Ethereum’s Proof-of-Stake exit queue is nearly empty, while the entry queue for new stakers continues to swell, now exceeding 2.73 million ETH. This signifies a strong preference for long-term commitment to the system. (For further reading, see “Piercing Through the ‘Degeneracy’ Noise: Why ‘Ethereum’s Values’ Are the Widest Moat?”)

Unlike speculative trading, staking is a low-liquidity, long-cycle allocation method focused on stable returns. The willingness of capital to re-enter the staking queue underscores a crucial point: **an increasing number of participants are prepared to accept the opportunity cost associated with this long-term lock-up.**

When we synthesize the institutional ETF yield distributions, record-high staking rates, and the evolving queue structures, a clear trend emerges: **Ethereum staking is evolving beyond an early adopter bonus, transforming into a TradFi-compatible structural yield layer that is progressively being embraced by the traditional financial system and re-evaluated by long-term capital.**

No single factor alone can define this trend, but together, they meticulously outline the maturing landscape of Ethereum’s staking economy.

III. The Future of an Acceleratingly Maturing Staking Market

It’s crucial to clarify that staking does not render ETH a “risk-free asset.” On the contrary, as the participant structure evolves, the types of risks associated with staking are shifting. While technical risks are gradually being mitigated, structural risks, liquidity risks, and the cost of understanding the underlying mechanisms are becoming more prominent.

During the previous regulatory cycle, the U.S. Securities and Exchange Commission (SEC) frequently took enforcement actions against various liquid staking-related projects. This included filing unregistered securities charges against MetaMask/Consensys, Lido/stETH, and Rocket Pool/rETH, which at one point cast uncertainty over the long-term development of Ethereum ETFs.

However, from a practical standpoint, the question of whether and how ETFs participate in staking is fundamentally a matter of product design and compliance structure, rather than a negation of the Ethereum network itself. As more institutions explore these boundaries through practical application, the market is casting its vote with real capital.

For instance, BitMine has staked over 1 million ETH on Ethereum PoS, reaching 1.032 million ETH, valued at approximately $3.215 billion. This represents a quarter of its total ETH holdings (4.143 million).

In summary, Ethereum staking is no longer a niche pursuit for crypto enthusiasts.

As ETFs begin to reliably distribute yield, as long-term capital patiently waits 45 days to enter the consensus layer, and as nearly 30% of ETH transforms into a robust security barrier, we are witnessing **Ethereum formally establish a native yield system accepted by global capital markets.**

Understanding this profound transformation, perhaps, is as vital as active participation itself.

(The above content is an authorized excerpt and reproduction from our partner PANews. Original Link | Source: imToken)

Disclaimer: This article provides market information only. All content and views are for reference and do not constitute investment advice. It does not represent the views or positions of BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not be held responsible for any direct or indirect losses resulting from investor transactions.