Source: Zen, PANews

Avalanche’s Dual Momentum: Institutional Surge Meets Ecosystem Growth Amidst Market Flux

Since the fourth quarter of 2025, Avalanche has experienced a synchronized surge in both on-chain activity and institutional adoption. While mainnet activity metrics repeatedly hit new highs towards the end of the year and into January, a parallel narrative of institutional workflows and compliant asset distribution has rapidly unfolded. Despite challenging market conditions, the narrative of real-world assets migrating onto the blockchain continues to accelerate.

Institutional Integration Propels On-Chain Assets

January 2026 marked a significant milestone as prominent crypto investment bank Galaxy Digital successfully issued its inaugural tokenized Collateralized Loan Obligation (CLO) on the Avalanche network. Valued at $75 million, this pioneering move saw $50 million subscribed by Grove, an institutional credit protocol.

CLOs are sophisticated structured credit products that bundle corporate loans, offering them to investors across various risk tranches. For this issuance, the debt tranches were tokenized and distributed via the Avalanche network by INX, a regulated digital asset platform, making them accessible to qualified investors.

This investment represents Grove’s second major strategic deployment on Avalanche. In July of the previous year, Grove announced its launch on the platform, targeting an initial strategy to issue up to approximately $250 million in Real-World Assets (RWA) on the network. Grove allocated capital to JAAA, an asset issued natively on the multichain protocol Centrifuge, and subsequently tokenized and circulated this share on the Avalanche C-Chain.

Designed as a high-performance public blockchain for institutional-grade finance, Avalanche offers compelling advantages such as EVM compatibility, rapid deployment capabilities, and access to compliant distribution channels. A key differentiator is its emphasis on quickly deployable, customizable Avalanche L1s (Subnets), which are ideal for balancing access controls, regulatory compliance, performance, and risk management. This unique blend has positioned Avalanche as a preferred blockchain for leading financial institutions.

For instance, Balcony, a New Jersey-based real estate infrastructure company, announced in May last year its utilization of the AvaCloud platform to deploy a scalable, dedicated Avalanche L1 service. This initiative aims to digitize and tokenize property records for over 370,000 land parcels, representing an estimated total value of $240 billion. AvaCloud, a managed blockchain service provider for Avalanche L1s, empowers enterprises to build, deploy, and scale their Layer-1 networks with ease.

A Tale of Two Halves: Data Reflects Mixed Fortunes

Avalanche’s institutional-focused strategy has fueled steady growth in its on-chain assets. According to Token Terminal data, the total market capitalization of stablecoins and tokenized funds on the Avalanche mainnet has increased by approximately 70% over the two years leading up to January 2024.

As of January 21, RWA.xyz data indicates that Avalanche’s network holds over $2.2 billion in stablecoin assets and more than $1.351 billion in total RWA assets. This includes approximately $636 million in “Distributed Assets” and $715 million in “Represented Assets.” Distributed Assets refer to tokenized assets that can be transferred peer-to-peer between wallets, emphasizing market reach, financial inclusion, and platform interoperability. In contrast, Represented Assets typically restrict transfers outside the issuing platform, with the blockchain primarily serving as a shared ledger for record-keeping and settlement.

December 2025 marked a significant milestone as the total transaction volume across all Avalanche L1s surpassed 10 billion. This achievement coincided with a notable resurgence in the ecosystem towards the year’s end. During that month, the Avalanche C-Chain consecutively set new daily and weekly records for 2025, reaching 651.2 million active addresses and attracting $43 million in weekly capital inflows, briefly ranking second among all blockchains.

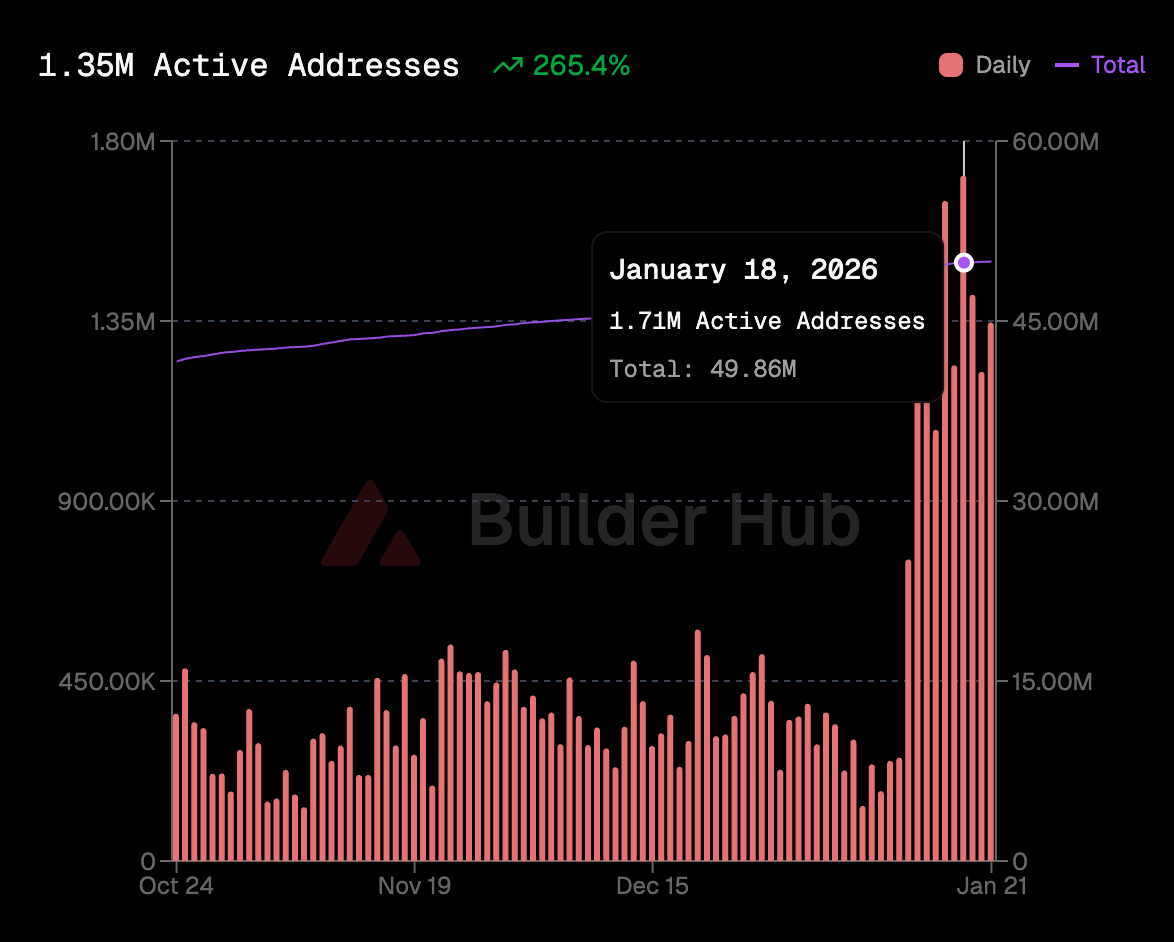

Entering the new year, Avalanche continued its impressive growth trajectory from late last year, with its mainnet (primarily the C-Chain, alongside the P-Chain and X-Chain) consistently hitting new daily active address highs, peaking at 1.71 million on January 18.

However, shifting focus from on-chain activity to asset pricing and DeFi engagement reveals a less pronounced “recovery curve.” CoinGecko market data shows AVAX’s closing price fluctuating roughly between $12-$15 from mid-January to present, closing at approximately $12.09 on January 20, its lowest value since November 2023.

DeFiLlama’s chain-level metrics further illustrate this disparity: Avalanche’s native TVL stands at approximately $1.66 billion, with bridged TVL at around $3.62 billion. Concurrently, daily on-chain fees and revenue remain relatively low. This suggests that while transaction counts and address numbers are rising, they don’t necessarily translate into commensurate protocol-level value capture.

Nevertheless, it’s crucial to consider the broader macroeconomic context. Cryptocurrencies, particularly L1 tokens, have generally faced downward pressure over the past year. Even with ecosystem-specific institutional partnerships or technological advancements, these positive developments can be overshadowed by stronger market beta and the persistent challenge of lacking widespread application adoption. Thus, Avalanche’s pricing issues are not unique to its platform.

Building the Nest to Attract Phoenixes: A Million-Dollar Builder Competition

For core infrastructure, market downturns often present prime opportunities for foundational growth, allowing teams to focus wholeheartedly on ecosystem development without distractions.

Capitalizing on the recent surge in on-chain activity, Avalanche has significantly intensified its initiatives on the developer supply side. On January 21, the Avalanche Foundation announced the launch of “BuildGames,” a builder competition offering a total prize pool of $1 million. This six-week event, with immediate and rolling registrations, is open-ended, without specific directions or limitations on project types or tracks. Exceptional teams will also have the opportunity to receive subsequent mentorship and funding from Avalanche’s official incubation program.

Beyond single competitions, the Foundation’s established framework for developer support is multi-faceted:

- Codebase Accelerator: This official accelerator focuses on rapid mentorship and non-dilutive financial support for early-stage teams. Selected teams receive a $50,000 grant and practical assistance spanning product and token design, validator/infrastructure strategies, growth, and compliance.

- Grants System: The Foundation’s grants system primarily allocates funds to infrastructure and AI-related projects, fostering innovation in critical areas.

- Retro9000: With an official funding pool of up to $40 million, Retro9000 rewards teams that have already demonstrated tangible delivery and impact on Avalanche L1 or key toolchains. This initiative aims to lower the barrier of “fund first, then deliver,” directing resources towards builders with proven value.

On the infrastructure development front, Avalanche completed its “Granite” network upgrade late last year. Comprising three Avalanche Improvement Proposals (ACPs-181/204/226), Granite introduced dynamic block times, biometric authentication, and a more stable validator view, enhancing cross-chain message reliability and performance.

Overall, the past month has seen the Avalanche ecosystem embrace institutional scalability. Coupled with ongoing infrastructure development and robust developer incentives, these efforts have laid a strong foundation for significant growth throughout 2026.

(The above content is an authorized excerpt and reprint from our partner PANews. Original Article Link)

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.