After an extended period of lucrative gains, the dynamics of Bitcoin’s on-chain profitability have undergone a significant transformation. Leading on-chain analytics firm CryptoQuant reports that Bitcoin holders are now experiencing “net realized losses”—meaning they are selling their BTC at substantial losses. This marks the first such occurrence since October 2023, signaling a crucial shift in market sentiment and potentially indicating the twilight of the current bull market.

According to CryptoQuant’s latest report, investor behavior has dramatically shifted over the past 30 days, moving from a phase of “profit-taking” to “cutting losses.” This reversal underscores a weakening conviction among holders.

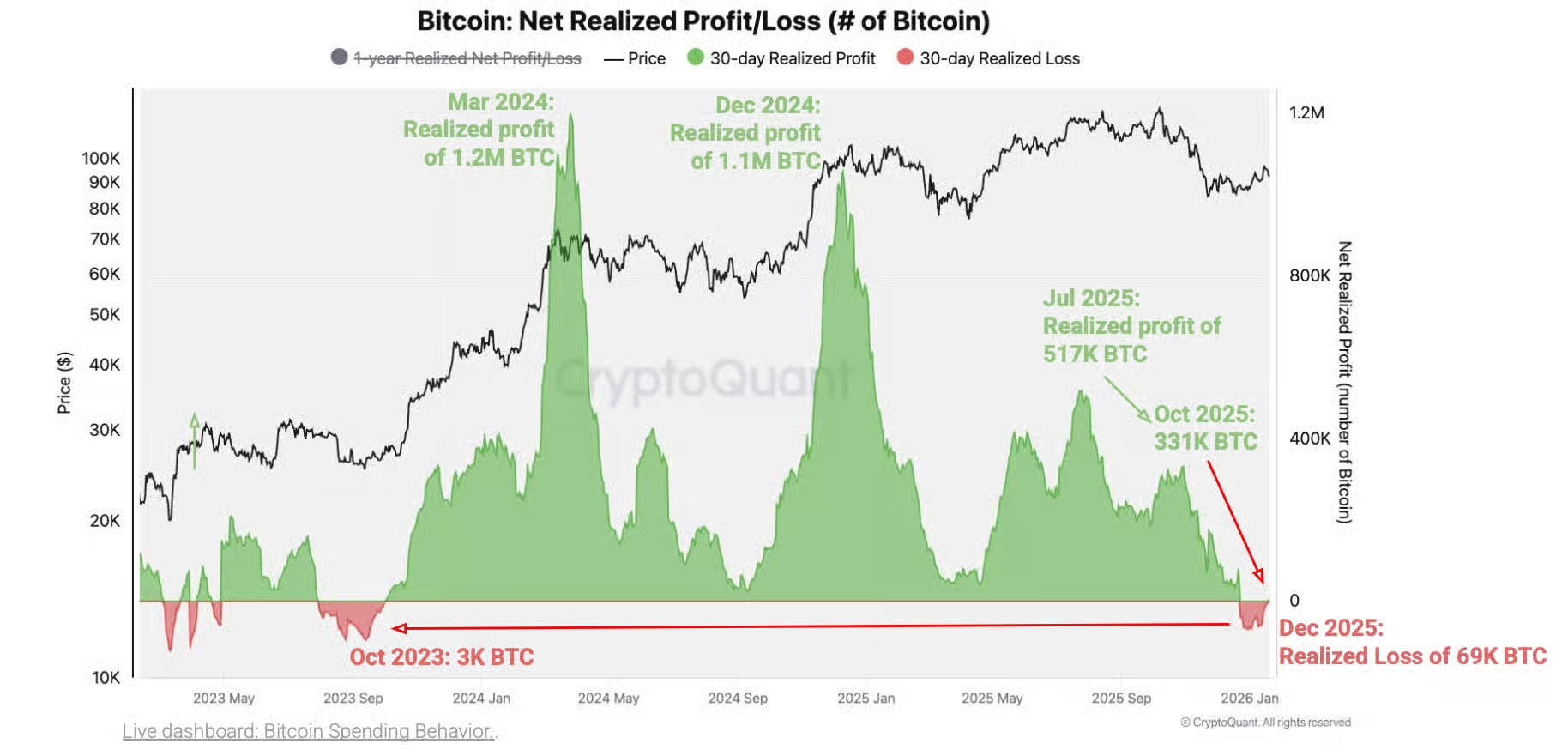

The report further elaborates that the market’s profit momentum has been on a gradual, step-like decline since early 2024. Analysis of data points from January 2024, December 2024, July 2025, and October 2025 reveals a consistent trend of “successively lower profit peaks.” This suggests that while nominal asset prices may have remained elevated, the underlying strength supporting these valuations has been steadily eroding.

Data indicates that since December 23, 2025, Bitcoin holders have accumulated realized losses equivalent to approximately 69,000 Bitcoins. CryptoQuant views this prolonged weakening of profit momentum as a classic precursor to the “end of a bull market.”

To clarify how these insights are derived, Julio Moreno, CryptoQuant’s Head of Research, explains that the indicator is calculated by cross-referencing “on-chain transfer behavior” with “market prices.”

Essentially, when Bitcoin is transferred or spent on the blockchain, analysts compare the price at which it was last moved against its current transfer price. This comparison, alongside the volume of BTC transferred, allows for precise calculation of realized gains or losses.

CryptoQuant issues a stark warning, highlighting the striking resemblance between the current transition from “net profit” to “net loss” and the pivotal shift observed during the 2021-2022 period, which marked the downturn from a bull to a bear market.

During that cycle, Bitcoin’s realized profits peaked in January 2021 before a steady decline, culminating in loss-dominated on-chain activity just before the official onset of the 2022 bear market.

From a longer-term perspective, CryptoQuant points out that Bitcoin’s “annual net realized profit” has also weakened considerably, now standing at approximately 2.5 million Bitcoins. This figure is not only significantly lower than the 4.4 million Bitcoins recorded last October but also represents a new low since March 2024. The firm interprets this decline in net realized profit as clear evidence of dissipating support for Bitcoin’s price.

Furthermore, CryptoQuant notes that the current levels and trajectory of Bitcoin’s net realized losses mirror the conditions seen in March 2022, which was the initial phase of the previous bear market.

Disclaimer: This article is for informational purposes only. All content and opinions are for reference and do not constitute investment advice, nor do they represent the views and positions of BlockTempo. Investors should make their own decisions and trades, and the author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.