Decoding Bitcoin’s Recent Pullback: Miner Sales, Whale Moves, or Market Digestion?

Bitcoin’s latest price retreat has reignited a critical debate among investors: Is this a consequence of miners offloading their holdings, large “whale” investors dumping their bags, or a more intricate market dynamic at play? A deep dive into on-chain flow data suggests that the current scenario leans towards a controlled “digestion phase” typical of an early bear market, rather than an unbridled capitulation.

The Miner Perspective: De-Risking, Not Dumping

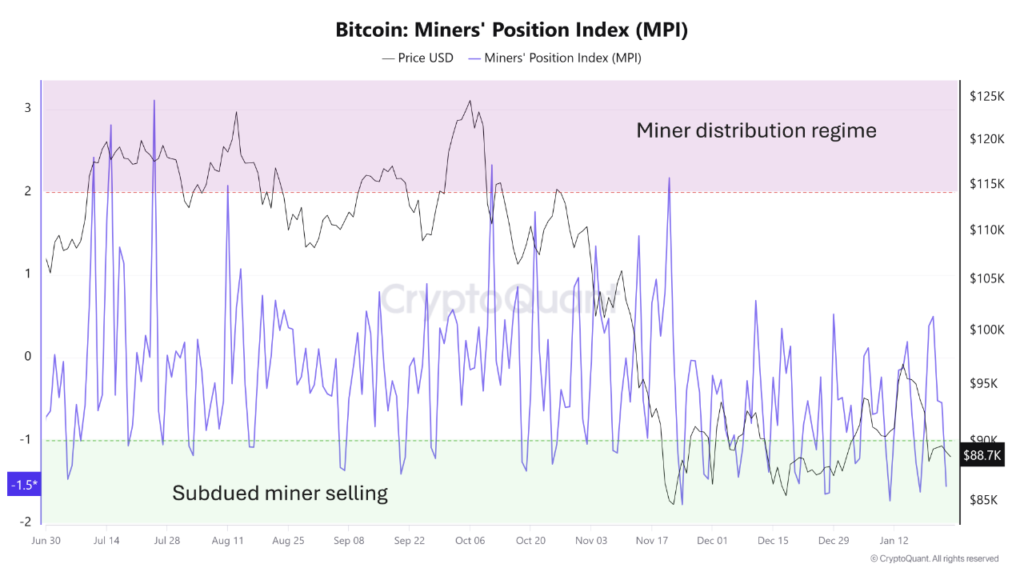

To understand the forces behind the recent price action, we first examine miner behavior. The Miner Position Index (MPI) previously soared to +2 or +3 when Bitcoin reached highs of $110,000 to $120,000, signaling aggressive liquidation of miner inventories. However, since the fourth quarter of last year, the MPI has receded to near the zero axis, recently dropping to approximately -1.5. This indicates that miners are currently selling below their one-year average, suggesting a reduction in immediate selling pressure from this cohort.

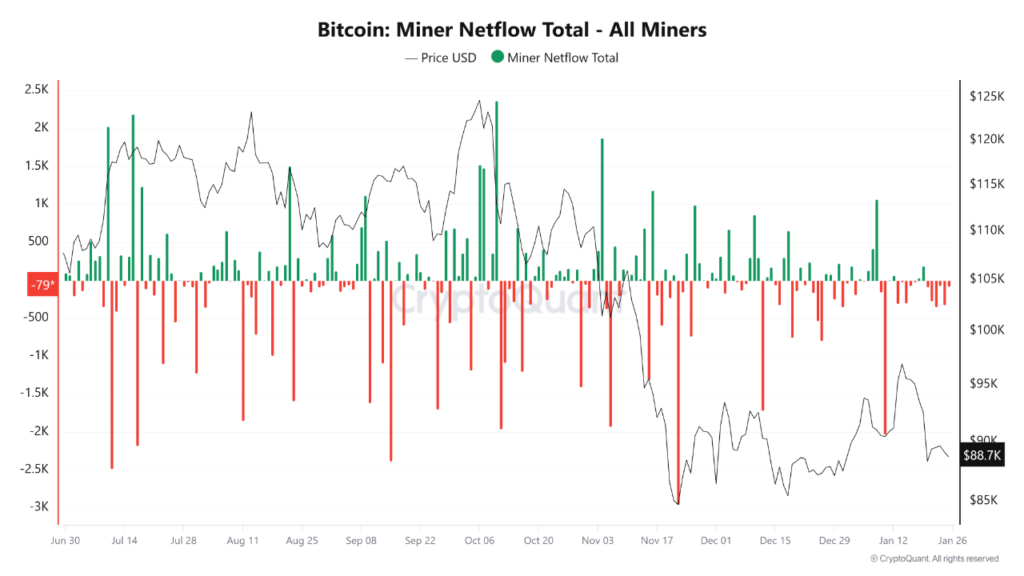

Further reinforcing this view, the Miner Netflow Total data reveals a period of significant outflow in mid-2025 (likely referring to an earlier cycle event), which subsequently stabilized into minimal, near-zero flows. This historical pattern suggests that miners have already significantly de-risked their positions and are not the primary drivers of the current selling pressure.

Exchange Dynamics: Low Inventories and Hedging

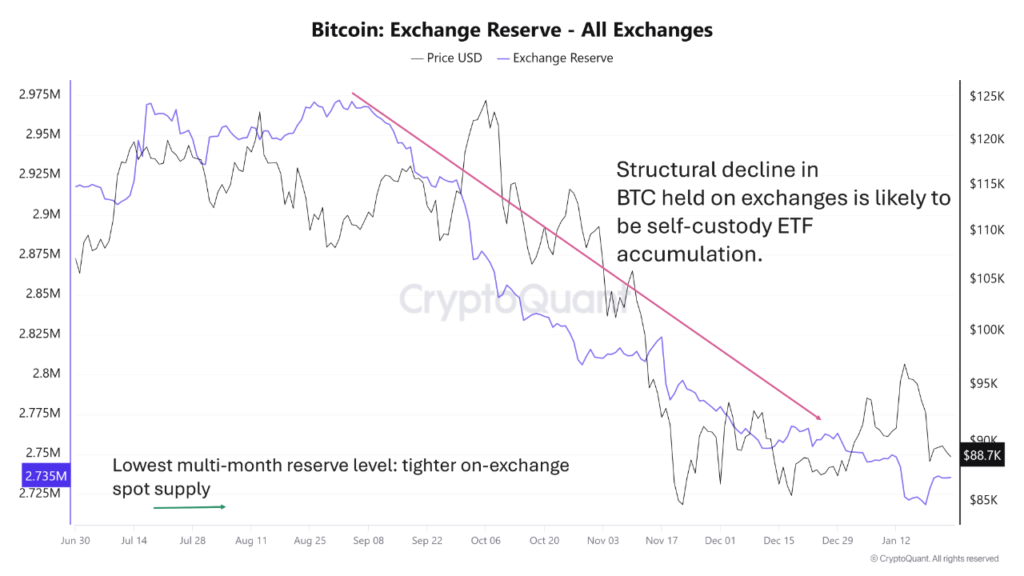

Shifting our focus to centralized exchanges, the total Exchange Reserve has seen a continuous decline, dropping from roughly 2.95 million BTC to around 2.73 million BTC. Even amidst the recent price correction, exchange spot inventories remain structurally low. The Exchange Netflow, which previously showed consistent outflows, has now transitioned to occasional small inflows. This pattern points towards risk-averse positioning and hedging strategies being employed by market participants, rather than widespread panic selling or a mass exodus from the market.

Decoding Whale Activity: Tactical Distribution, Not Capitulation

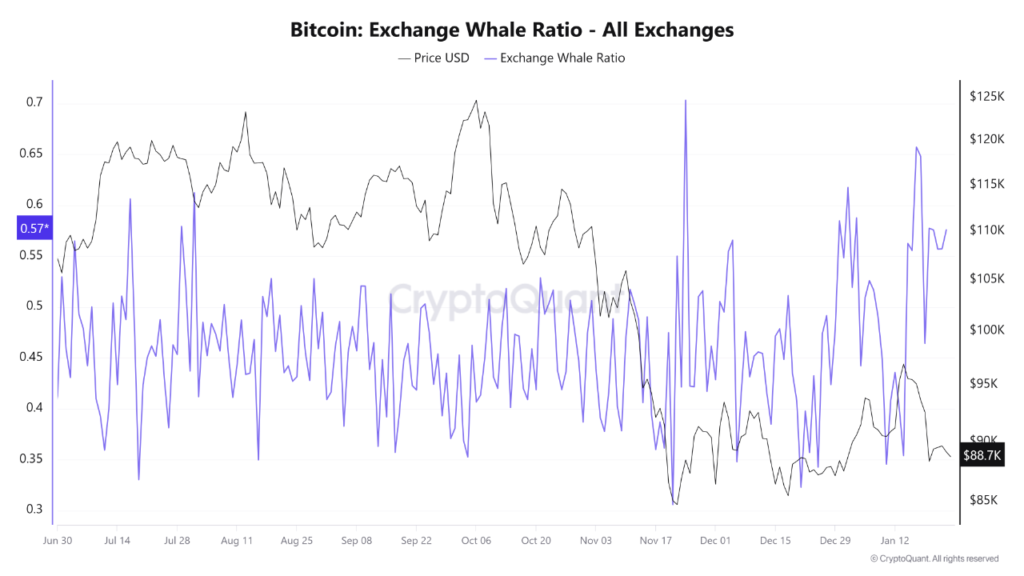

Finally, we analyze the movements of large investors, often referred to as “whales.” The Exchange Whale Ratio is currently situated at the higher end of its recent 0.4 to 0.6 range. While whales are indeed dominating the smaller inflows observed, the absolute volume of their deposits pales in comparison to previous market peaks. This data implies a strategic, price-sensitive “distribution” of assets by whales, rather than a full-blown capitulation sell-off driven by fear.

Conclusion: A Coordinated Dance of Digestion

In summary, the aggregated on-chain data paints a clear picture: no single market cohort is solely responsible for the current downturn. Instead, a confluence of factors is at play. Miners, who had prudently de-risked earlier, and opportunistic whales are capitalizing on tight exchange inventories to sell into price bounces. This combined activity suggests that the market is likely to experience volatile rallies met with persistent selling pressure—a characteristic pattern of an early bear market phase.

Disclaimer: This article is provided for market information purposes only. All content and views are for reference and do not constitute investment advice. It does not represent the views or positions of BlockTempo. Investors should conduct their own research and make independent trading decisions. The author and BlockTempo will not be held responsible for any direct or indirect losses incurred from investor transactions.