By Nikka / WolfDAO

Enterprise Crypto Strategies: A Deep Dive into Bitcoin and Ethereum Accumulation

In the wake of the cryptocurrency market’s persistent correction in early 2026, enterprise-level digital asset accumulation, often termed “hodling,” has emerged as a dominant market narrative. This article provides an in-depth analysis of the distinct strategies employed by two prominent players, Strategy (MSTR) and Bitmine Immersion Technologies (BMNR), dissecting their financial models, strategic nuances, and far-reaching implications for the broader market.

Part One: Dissecting Enterprise Digital Asset Accumulation Strategies

1.1 Strategy (MSTR): A Leveraged Conviction in Bitcoin

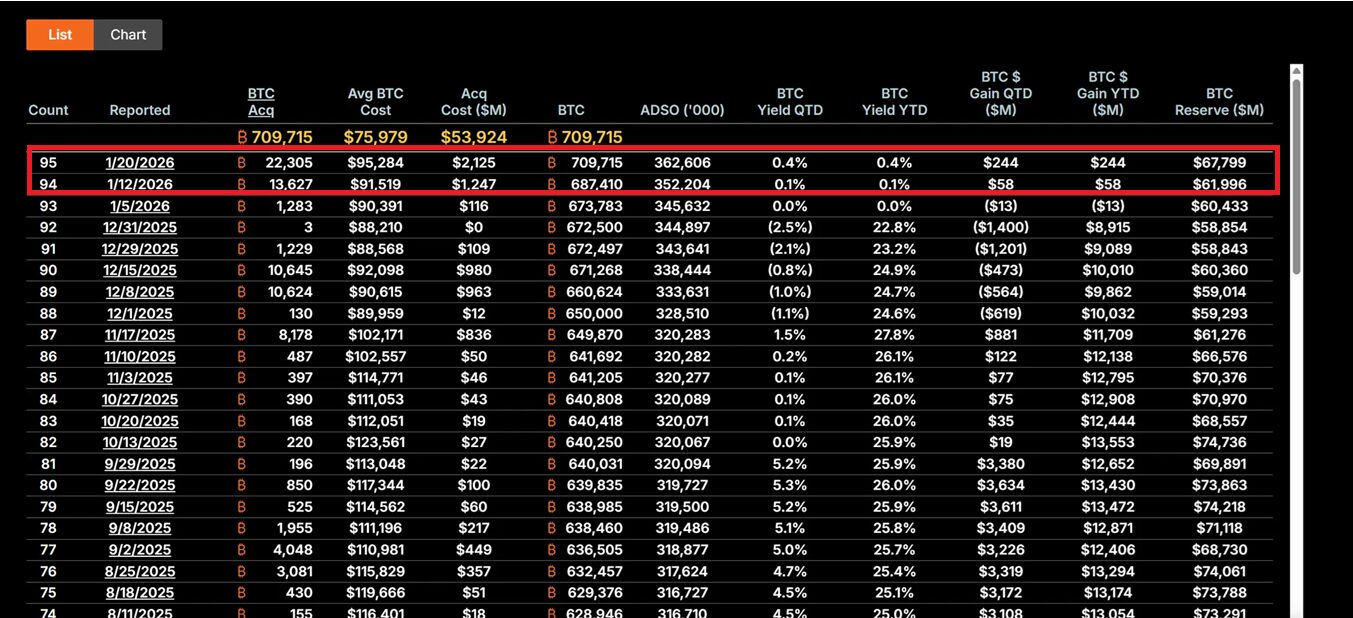

Under the visionary leadership of CEO Michael Saylor, Strategy has undergone a complete metamorphosis, transforming into a pure-play Bitcoin holding vehicle. A significant move occurred between January 12-19, 2026, when the company acquired an additional 22,305 BTC at an average price of approximately $95,500, totaling a substantial $2.13 billion. This marked their largest single Bitcoin purchase in the preceding nine months. Currently, MSTR’s impressive total holdings stand at 709,715 Bitcoins, acquired at an average cost of $75,979, representing a colossal investment of nearly $53.92 billion.

MSTR’s audacious “21/21 Plan” forms the bedrock of its strategy. This involves raising $21 billion each through meticulously structured equity financing and fixed-income instruments, specifically earmarked for continuous Bitcoin acquisitions. This model ingeniously sidesteps reliance on operational cash flow, instead harnessing the “leverage effect” of capital markets. By issuing shares, convertible bonds, and At-The-Market (ATM) instruments, MSTR effectively converts fiat-denominated debt into a stake in a deflationary digital asset. This aggressive approach typically results in MSTR’s stock price exhibiting 2-3 times the volatility of Bitcoin, solidifying its position as the market’s most potent “BTC proxy” tool.

Saylor’s investment philosophy is deeply rooted in an unwavering conviction in Bitcoin’s intrinsic scarcity. He champions BTC as “digital gold” and a crucial inflation hedge, especially pertinent amidst the prevailing macro uncertainties, including fluctuating Fed interest rate policies, escalating tariff trade wars, and persistent geopolitical risks. Such counter-cyclical accumulation underscores a profound institutional long-term perspective. Despite a significant 62% retraction from its peak stock price, MSTR is still perceived by astute value investors as a compelling “extreme discount” buying opportunity.

Should Bitcoin’s price ascend to $150,000, MSTR’s holdings would surge past $106.4 billion, potentially triggering a 5-10 fold appreciation in its stock price due to the amplified leverage. However, the inherent risks are equally pronounced: a decline in BTC below $80,000 could lead to liquidity pressures from debt servicing costs (annual interest rates of 5-7%), potentially forcing strategic adjustments or even a complete liquidation scenario.

1.2 Bitmine Immersion Technologies (BMNR): A Staking-Driven Productivity Model

Under the stewardship of Tom Lee, Bitmine Immersion Technologies (BMNR) has charted a distinctly divergent course. Positioning itself as the “world’s largest Ethereum Treasury company,” BMNR reported holdings of 4.203 million ETH as of January 19, valued at approximately $13.45 billion. Crucially, a significant portion—1,838,003 ETH—is actively engaged in staking. At an annualized yield of 4-5%, this generates an estimated annual cash flow revenue of $590 million, highlighting a robust, yield-generating model.

This “staking-first” strategy endows BMNR with an intrinsic value buffer. Unlike MSTR’s direct price exposure, BMNR secures continuous income through active network participation, akin to holding high-yield bonds but with the added upside of Ethereum’s burgeoning ecosystem growth. The company’s commitment to this strategy is evident in its substantial increase of 581,920 ETH to its staked holdings between Q4 2025 and Q1 2026, reinforcing its long-term belief in Ethereum’s network value.

BMNR’s ambitious ecosystem expansion strategy further differentiates it. The company is slated to launch its MAVAN staking solution in Q1 2026, designed to offer comprehensive ETH management services to institutional investors, thereby cultivating an “ETH per share” growth model. Furthermore, a $200 million investment in Beast Industries on January 15, coupled with shareholder-approved share limit expansion, strategically positions BMNR for potential mergers and acquisitions, particularly targeting smaller ETH holding entities. The company also diversifies its digital asset portfolio with 193 BTC and a $22 million equity stake in Eightco Holdings, bringing its total crypto and cash assets to $14.5 billion.

From a risk management perspective, BMNR’s staking yields provide a vital layer of downside protection. Even amidst ETH price fluctuations around the $3,000 mark, staking revenue can offset a portion of opportunity costs. However, sustained sluggish Ethereum network activity leading to a decline in staking APY, or a breach of critical support levels for ETH, could exacerbate the company’s Net Asset Value (NAV) discount (currently, its stock price of approximately $28.85 reflects a more than 50% drop from its peak).

1.3 Strategic Contrasts and Market Evolution

These two corporate titans exemplify two distinct paradigms within the enterprise digital asset accumulation landscape. MSTR embodies an aggressive, high-risk, high-reward leveraged model, intrinsically tied to Bitcoin’s price appreciation for shareholder value creation. Its success hinges on an unwavering belief in BTC’s long-term scarcity and the macro trend of monetary debasement. Conversely, BMNR presents a more defensive, yield-oriented ecosystem model, meticulously building diversified revenue streams through staking and specialized services, thereby mitigating reliance on singular price volatility.

Crucially, both companies have internalized the lessons learned from 2025, pivoting towards more sustainable financing frameworks. MSTR has prudently avoided excessive equity dilution, while BMNR has leveraged its staking yields to reduce dependence on external capital. This strategic evolution signifies a profound shift in corporate digital asset allocation, transitioning from “experimental” to a “core financial strategy.” It also heralds the dawn of a new era in 2026, characterized by “institution-led growth rather than retail FOMO.”

Part Two: Multi-Dimensional Market Impact

2.1 Short-Term Impact: Bottom Signals and Sentiment Revival

MSTR’s colossal Bitcoin acquisitions are frequently interpreted by the market as a definitive signal of a Bitcoin bottom. The $2.13 billion purchase in mid-January notably coincided with an $8.44 million single-day inflow into Bitcoin ETFs, indicating a clear trend of institutional capital mirroring corporate accumulation. This “corporate anchoring” effect is particularly potent during periods of fragile retail investor confidence. When the Fear & Greed Index signals “extreme fear,” MSTR’s consistent buying provides crucial psychological reassurance to the market.

Similarly, BMNR’s substantial Ethereum accumulation acts as a significant catalyst. The company’s proactive strategy resonates with the bullish outlook of traditional financial behemoths like BlackRock, who anticipate Ethereum’s dominant role in the burgeoning Real World Asset (RWA) tokenization sector. This could ignite a “second wave of ETH Treasury” adoption, with companies like SharpLink Gaming and Bit Digital already following suit, accelerating both staking adoption and ecosystem-focused mergers and acquisitions.

Collectively, these actions are fostering a shift in investor sentiment from widespread panic to cautious optimism. This sentiment repair possesses self-reinforcing properties within the crypto market, potentially laying the groundwork for the next major upward cycle.

2.2 Mid-Term Impact: Volatility Amplification and Narrative Divergence

However, the leveraged nature of enterprise digital asset accumulation inherently amplifies market risks. MSTR’s high-leverage model poses a significant systemic risk, capable of triggering a cascading reaction should Bitcoin experience a further correction. Given that its stock’s beta coefficient is more than double that of BTC, any downward price movement in Bitcoin is magnified in MSTR’s share price, potentially leading to forced selling or a liquidity crunch. This “leverage transmission” effect was painfully evident in 2025, when numerous leveraged holders faced involuntary liquidations during sharp market downturns.

While BMNR benefits from the cushioning effect of staking yields, it is not immune to challenges. A sustained period of low Ethereum network activity could depress staking Annual Percentage Yields (APYs), thereby diminishing its core “productivity asset” advantage. Furthermore, a continued weakening of the ETH/BTC ratio could exacerbate BMNR’s NAV discount, creating an adverse feedback loop.

A more profound mid-term impact lies in the increasing narrative divergence between Bitcoin and Ethereum. MSTR’s strategy fortifies Bitcoin’s position as a “scarce safe-haven asset,” appealing to conservative investors seeking macro hedges. BMNR, conversely, champions Ethereum’s narrative as a “productivity platform,” underscoring its expansive utility in DeFi, staking, and tokenization. This divergence could lead to a decoupling of BTC and ETH performance under varying macro scenarios. For instance, in a liquidity-tightening environment, BTC might exhibit greater resilience due to its “digital gold” attributes, whereas during periods of technological innovation, ETH could command a premium driven by ecosystem expansion.

2.3 Long-Term Impact: Reshaping Financial Paradigms and Regulatory Adaptation

From a long-term perspective, the pioneering actions of MSTR and BMNR are poised to fundamentally reshape corporate financial management paradigms. The successful enactment of legislative initiatives like the US CLARITY Act, which aims to clarify accounting treatments and regulatory classifications for digital assets, would drastically reduce compliance burdens for corporations integrating crypto assets. Such legislation could catalyze Fortune 500 companies to allocate over $1 trillion into digital assets, ushering in a transformative shift in corporate balance sheets from traditional “cash + bonds” portfolios to “digital productivity assets.”

MSTR has undeniably become a quintessential “BTC proxy,” with its market capitalization often commanding a premium over its Net Asset Value (NAV). This mechanism, dubbed the “reflexive flywheel,” involves issuing shares at a premium to acquire more Bitcoin, thereby increasing the Bitcoin per share metric, which in turn propels the stock price higher, creating a powerful positive feedback loop. BMNR, meanwhile, offers a scalable and replicable blueprint for an ETH Treasury, vividly demonstrating how consistent staking yields can generate sustainable shareholder value.

This evolving landscape is also likely to trigger a wave of industry consolidation. BMNR, having secured shareholder approval for share expansion earmarked for M&A, is well-positioned to acquire smaller ETH holding companies, potentially leading to the formation of “Treasury giants.” Conversely, weaker digital asset accumulators may be compelled to sell off holdings or seek mergers under macro pressures, fostering a “survival of the fittest” dynamic. This signifies a structural metamorphosis of the crypto market, transitioning from its “retail-dominated” origins to an “institution-dominated” future.

However, this transformative journey is not without its inherent risks. A deterioration in the regulatory environment (e.g., aggressive stances by the SEC on digital asset classification) or an unexpected worsening of macroeconomic conditions (e.g., the Fed raising interest rates due to resurgent inflation) could transform enterprise digital asset accumulation from a “paradigm shift” into a perilous “leverage trap.” Historically, similar financial innovations have often precipitated systemic crises during periods of intense regulatory scrutiny or abrupt market reversals.

Part Three: Addressing the Core Question

3.1 Enterprise Hodling: A New Gold Era or a Leveraged Bubble?

The answer to this pivotal question hinges on one’s perspective and time horizon. From the vantage point of institutional investors, enterprise digital asset accumulation represents a rational and evolving approach to capital allocation. In an era characterized by escalating global debt and mounting concerns over currency debasement, strategically allocating a portion of assets to scarce digital assets possesses undeniable strategic merit. MSTR’s “intelligent leverage” should not be conflated with mere gambling; rather, it’s a sophisticated utilization of capital market instruments to convert equity premium into digital asset accumulation, a strategy sustainable as long as the equity market continues to recognize its underlying value.

BMNR’s innovative staking model further substantiates the “productivity” attribute of digital assets. The projected $590 million in annual staking yields not only provides a robust cash flow stream but also fortifies the company’s financial resilience amidst price volatility. This model is akin to holding high-interest bonds, but with the added potential for exponential network growth, thereby showcasing crypto assets’ profound potential beyond purely speculative instruments.

Nevertheless, the concerns articulated by critics are not unfounded. The current leverage ratios within corporate digital asset accumulation are indeed at historical highs. The combined financing of $9.48 billion in debt and $3.35 billion in preferred stock could become a significant burden under adverse macro conditions. The sobering lessons of the 2021 retail bubble, where numerous highly leveraged participants faced severe losses during rapid deleveraging events, remain a stark reminder. If the current wave of enterprise digital asset accumulation merely reallocates leverage from retail investors to the corporate level without fundamentally altering the underlying risk structure, the ultimate repercussions could be equally devastating.

A more balanced perspective posits that enterprise digital asset accumulation is currently navigating an “institutionalization transition period.” It is neither a simplistic bubble (given its fundamental underpinnings and long-term strategic rationale) nor an immediate golden era (as significant regulatory, macroeconomic, and technical risks persist). The ultimate success hinges on impeccable execution: Can sufficient market recognition be firmly established before regulatory clarity fully materializes? Can stringent financial discipline be maintained amidst macro pressures? And critically, can the enduring long-term value of digital assets be unequivocally proven through continuous technological and ecological innovation?

Conclusion and Outlook

The pioneering digital asset accumulation strategies of Strategy (MSTR) and Bitmine Immersion Technologies (BMNR) signify a pivotal new phase for the cryptocurrency market. This era is no longer characterized by retail-driven speculative frenzies but by deliberate, long-term strategic allocations orchestrated by institutional entities. While MSTR’s leveraged conviction in Bitcoin and BMNR’s staking-driven productivity model represent fundamentally different approaches, both unequivocally demonstrate a profound commitment to the enduring value proposition of digital assets.

At its core, enterprise digital asset accumulation is a strategic wager on “time.” It bets on regulatory clarity outpacing liquidity constraints, price appreciation preceding debt maturities, and market conviction triumphing over macro headwinds. In this high-stakes game, there is no middle ground: it will either unequivocally validate digital asset allocation as the paradigm-shifting financial strategy of the 21st century or serve as another cautionary tale of excessive financialization.

The market stands at a critical juncture. One path leads to a mature, institution-dominated landscape; the other, to a deep abyss of leveraged collapse. The definitive answers are anticipated to unfold within the next 12-24 months, and we are all privileged witnesses to this unfolding experiment.

(This content is an authorized excerpt and reproduction from our partner PANews. Original Source Link | Provided by: WolfDAO)

Disclaimer: This article is provided for market information purposes only. All content and views expressed herein are for reference only and do not constitute investment advice. They do not necessarily reflect the opinions or positions of the author’s affiliated entities. Investors are solely responsible for their own decisions and transactions. The author and affiliated entities shall not bear any responsibility for direct or indirect losses incurred by investors as a result of their transactions.