Authored by Nancy, PANews

“The investment landscape is rich with promising assets, yet Bitcoin, once the darling of innovation, appears to be losing its allure.”

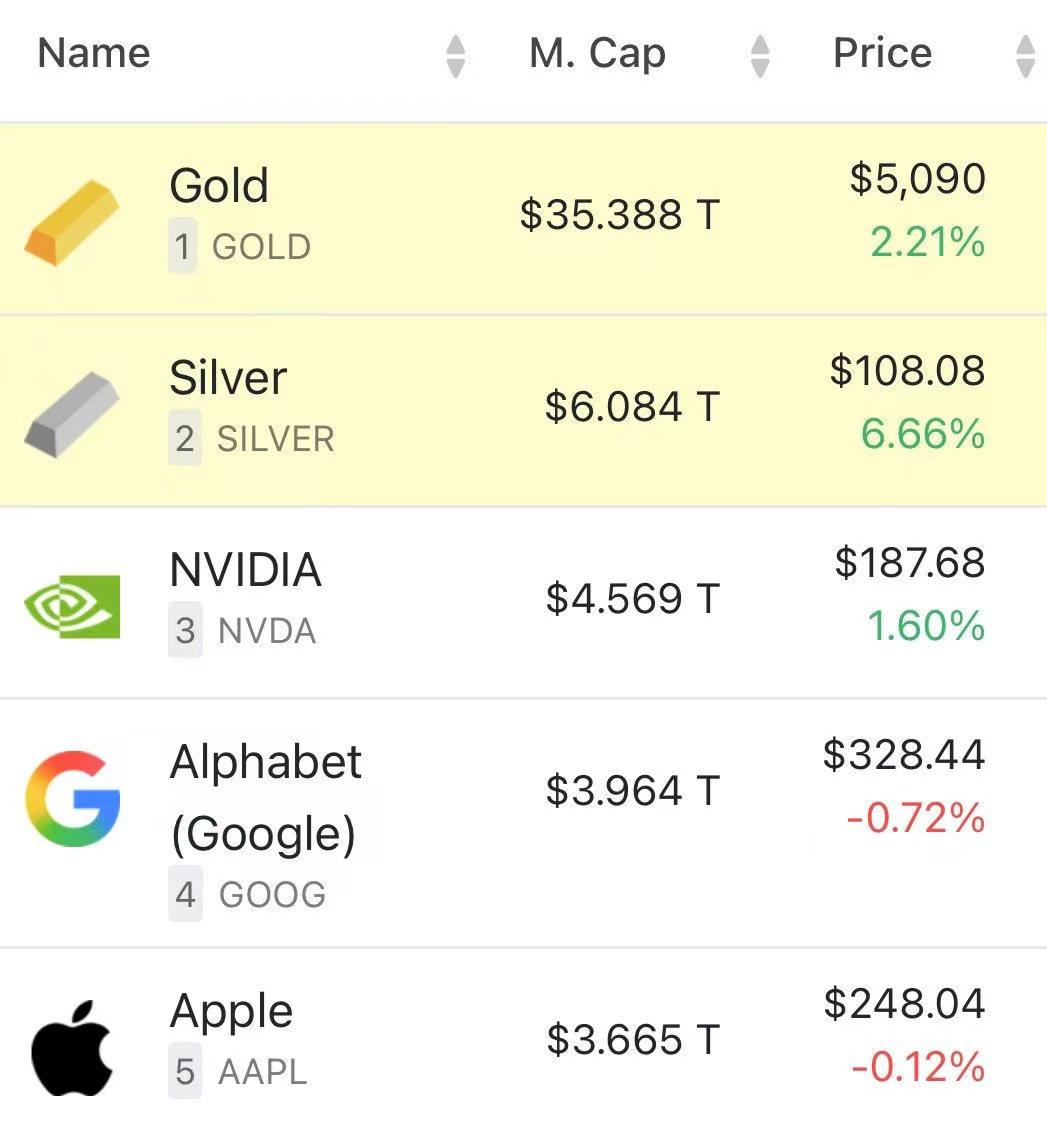

While gold achieves historic highs, breaching the $5000 mark with an unprecedented rally, Bitcoin remains largely dormant. This stark contrast has ignited a fierce debate within the cryptocurrency community: can the ‘digital gold’ narrative truly endure?

The discussion gained significant traction recently when crypto KOL @BTCdayu shared insights from a veteran Bitcoin OG who has liquidated over 80% of their holdings, asserting that Bitcoin is facing a fundamental shift in its core narrative. This perspective has quickly become a hot topic, prompting a re-evaluation of Bitcoin’s future trajectory.

New Custodians, Evolving Valuation: Wall Street’s Grip on Bitcoin

Bitcoin’s initial phase was a golden era for early adopters and infrastructure pioneers, where foresight and conviction translated into substantial gains. However, the game has fundamentally changed. The approval of Bitcoin spot ETFs, massive institutional allocations by firms like Strategy, and the U.S. government’s strategic recognition have collectively ushered Bitcoin into a new era, effectively dressing it in Wall Street’s bespoke “formal attire.”

This current cycle has witnessed a silent, yet significant, transfer of ownership. Early Bitcoin holders are gradually cashing out, while Wall Street institutions are making substantial inroads, transforming Bitcoin from a growth-centric asset into a portfolio allocation tool.

Crucially, this shift implies that Bitcoin’s pricing power is migrating from the decentralized, ‘offshore’ crypto wilderness to the dollar-dominated, ‘onshore’ financial establishment. From trading infrastructure and liquidity to regulatory frameworks, Bitcoin is increasingly aligning with high-volatility, high-beta assets tied to the U.S. dollar.

Meng Yan, Co-founder and CEO of Solv Protocol, articulates this transformation starkly: “The world has entered an era of imperial competition, where the most critical question is who emerges victorious.” He suggests that U.S. regulatory intent extends beyond dollarizing crypto assets; it aims to weaponize cryptocurrencies and Real World Assets (RWAs) to perpetuate dollar hegemony in the digital age. If Bitcoin merely becomes another conventional dollar-denominated asset, its long-term prospects might indeed be concerning. Yet, if crypto evolves into the “nuclear weapon system” of the dollar’s digital economy, with BTC as its “nuclear-powered aircraft carrier,” its future could still be bright. For the U.S., the primary challenge remains insufficient control over Bitcoin.

Conversely, crypto KOL @Joshua.D offers a different perspective. While Bitcoin’s heightened correlation with U.S. stocks makes it a “dollar asset,” this institutional integration might be more supportive than suppressive. The underlying interests now include ETFs, publicly traded companies, and even national strategic objectives. This “institutionalization,” paradoxically, could provide a crucial safety net, effectively raising Bitcoin’s price floor.

Despite the influx of capital through regulated channels, facilitated by mainstream players, Bitcoin currently finds itself in an awkward asset positioning dilemma.

Some argue that for those bullish on the dollar system, investing in U.S. stocks, bonds, or tech giants offers superior liquidity, tangible cash flow, and greater certainty. In this context, Bitcoin resembles a high-risk tech stock devoid of cash flow, raising questions about its value proposition. Conversely, those bearish on the dollar system would logically seek assets negatively correlated with the dollar. However, institutional “reformation” has rendered Bitcoin highly correlated with U.S. equities; when dollar liquidity contracts, Bitcoin often experiences risk-off sell-offs before traditional stocks, failing to act as a hedge.

In essence, Bitcoin is caught between the roles of a safe haven and a risk asset – it neither hedges like gold nor grows like a tech stock. Some data analysis even suggests Bitcoin’s current characteristics are a blend: 70% tech stock and 30% gold.

This evolving identity is also impacting Bitcoin’s neutrality premium in the geopolitical arena.

Amidst escalating global geopolitical risks and an uncontrolled U.S. debt deficit, non-U.S. nations are accelerating de-dollarization efforts. Gold, with its millennia of accumulated trust and inherent political neutrality, has re-emerged as a central player, repeatedly reaching new price peaks. In the eyes of many non-U.S. countries, Bitcoin is no longer perceived as a borderless currency but rather a dollar-derivative influenced by Wall Street’s pricing dominance.

Consequently, while traditional hard currencies like gold reclaim their prominence, Bitcoin is languishing in prolonged sideways trading and uninspiring volatility, steadily eroding investor confidence.

Nevertheless, crypto KOL @Pickle Cat reminds us that “a thousand people have a thousand Hamlets.” The cypherpunk ethos remains Bitcoin’s core appeal, merely diluted by its “mainstreaming and traditional financialization.” Yet, where there is weakness, there will inevitably be strength. This mirrors democracy, which fascinates precisely because of its self-correcting mechanisms. However, such corrections often only materialize after the system has reached an extreme state, prompting widespread realization.

The Great Hashrate Migration: Bitcoin Miners’ Pivot to AI

Beyond the shifting demand-side narrative, changes on the supply side are compounding market pessimism. Bitcoin miners, crucial participants in the network, are undergoing a significant capital reallocation—a “defection” from crypto mining to artificial intelligence.

Recent data from Hashrate Index reveals that Bitcoin’s 7-day moving average network hashrate has dropped to 993 EH/s, a nearly 15% decline from its historical peak last October. Adding to this concern, JPMorgan analysts project that by December 2025, Bitcoin miners’ average daily block reward revenue per EH/s will fall to an all-time low of $38,700.

The immediate cause of this hashrate decline is the persistent deterioration of Bitcoin mining economics. The halving event slashed block rewards, while mining difficulty remains historically high, pushing many mining rigs to or below their shutdown price. With profit margins severely squeezed, some miners are forced to power down to cut losses, while others are liquidating Bitcoin holdings to alleviate cash flow pressures.

A more profound crisis lies in the fact that computing power itself has become the “oil” of the new digital age, redirecting the flow of hashrate.

Many mining companies now view AI data centers as offering more stable, long-term demand and higher returns compared to Bitcoin mining’s highly cyclical, volatile, and unpredictable business model. Crucially, their extensive accumulated power infrastructure, site resources, and operational expertise are precisely the scarce assets most sought after by AI computing clusters, making this transition a realistic and attractive option.

Consequently, prominent Bitcoin miners such as Core Scientific, Hut 8, Bitfarms, HIVE, TeraWulf, and Cipher Miner are collectively “switching allegiances.” CoinShares forecasts that by the end of 2026, the proportion of mining revenue for these companies could plummet from 85% to below 20%, as they increasingly rely on AI infrastructure.

However, this transformation is exceptionally costly. On one hand, upgrading traditional mining farms into AI data centers necessitates extensive and expensive infrastructure modifications. On the other, the sustained high prices of high-performance GPU servers demand substantial upfront capital investment to establish scalable computing clusters.

For mining firms urgently pursuing this transition, their most liquid asset—Bitcoin—naturally becomes the most direct and efficient financing mechanism. This has led to a sustained sell-off of Bitcoin in the secondary market. This continuous selling pressure from the supply side not only suppresses Bitcoin’s price but further constricts the profit margins of remaining miners, compelling more to either shut down or pivot.

This “defection,” characterized by selling Bitcoin to invest in AI infrastructure, inevitably drains liquidity and undermines overall market confidence.

Yet, Meng Yan challenges this premise, suggesting that the narrative of Bitcoin miners transitioning to AI computing infrastructure is largely a “false proposition.” He posits it’s primarily a story concocted by U.S.-listed mining companies to stabilize their stock prices amidst dwindling revenues. Beyond reusable electricity, there’s little commonality between the two, from hardware and network architecture to operational skills and software ecosystems. These mining operations offer no inherent advantage over specialized AI data centers.

Joshua.D further elaborates that most current Bitcoin mining machines are ASIC miners, designed exclusively for mining. Therefore, what can truly be repurposed are only the physical sites and power facilities. He argues that the decline in hashrate primarily reflects internal industry consolidation and the survival of the fittest. Historically, a decrease in hashrate often indicates the market “squeezing out bubbles,” thereby reducing future selling pressure rather than signaling an impending collapse. As long as the Bitcoin network continues to process blocks reliably, fluctuations in hashrate are simply normal market adjustments.

The ‘Folded’ Bitcoin: At the Crossroads of Cycles

Having officially entered the mainstream, Bitcoin is now simultaneously narrating its familiar “digital gold” story while also scripting a new chapter as a prominent mainstream financial asset.

Bitcoin is shedding its purely speculative skin, evolving into a global reservoir of liquidity. Its mainstream acceptance has unlocked the floodgates for compliant capital. This financial integration, while bolstering Bitcoin’s viability, also introduces new vulnerabilities.

Beyond the glare of Wall Street, Bitcoin adoption is surging in nations grappling with severe inflation, such as Nigeria, Argentina, and Turkey. In these regions, Bitcoin transcends mere asset status; it functions as a vital survival ark against rampant fiat debasement and a crucial tool for preserving household wealth. This organic, bottom-up demand unequivocally demonstrates Bitcoin’s enduring role as a shield for ordinary individuals.

Undeniably, a “folded” Bitcoin—a multifaceted asset—is now unfolding before us.

It has moved beyond the get-rich-quick narratives of the Western frontier era and shed its idealistic cyberpunk hues. Instead, it now exhibits the characteristics of a more stable, perhaps even slightly less exciting, mature asset.

This evolution, however, should not be mistaken for the end of “digital gold.” Rather, it signifies its entry into a new phase of maturity. Just as physical gold underwent a protracted process of value consensus building before becoming a central bank reserve, Bitcoin today may be standing at a similar historical inflection point.

Reflecting on Bitcoin’s journey, its narrative has consistently adapted. From Satoshi Nakamoto’s initial vision of a peer-to-peer electronic cash system enabling micro-payments, it transitioned to being a sovereign-free currency combating fiat inflation, then evolved into “digital gold”—a store of value and inflation hedge. Now, with Wall Street’s ascendance, Bitcoin’s next potential narrative could position it as a sovereign nation’s reserve asset. While this path is undoubtedly long, it is no longer mere fantasy.

Nevertheless, all things are cyclical, and assets are no exception. According to the Merrill Lynch Investment Clock, the global economic pendulum is currently swinging in favor of commodities. Bitcoin, which has multiplied its value by millions over the past decade, is entering a new macroeconomic cycle. Its long-term value should not be hastily dismissed solely due to temporary price consolidation or short-term underperformance against traditional precious metals.

At this pivotal crossroads of old and new cycles, both the departing OGs and the incoming institutional players are casting their votes for the future with real capital. Ultimately, time will reveal the definitive answer.

(The above content is excerpted and reproduced with authorization from our partner PANews. Original Article Link)

Disclaimer: This article is intended solely for market information purposes. All content and opinions are for reference only and do not constitute investment advice. They do not represent the views or positions of BlockBeats. Investors should make their own decisions and conduct their own transactions. The author and BlockBeats will not be held responsible for any direct or indirect losses incurred by investors’ transactions.