The cryptocurrency market is currently flashing a rare and concerning warning sign: a significant contraction in stablecoin supply. This “capital outflow” phenomenon is casting a notable shadow over Bitcoin’s immediate future and the broader digital asset landscape.

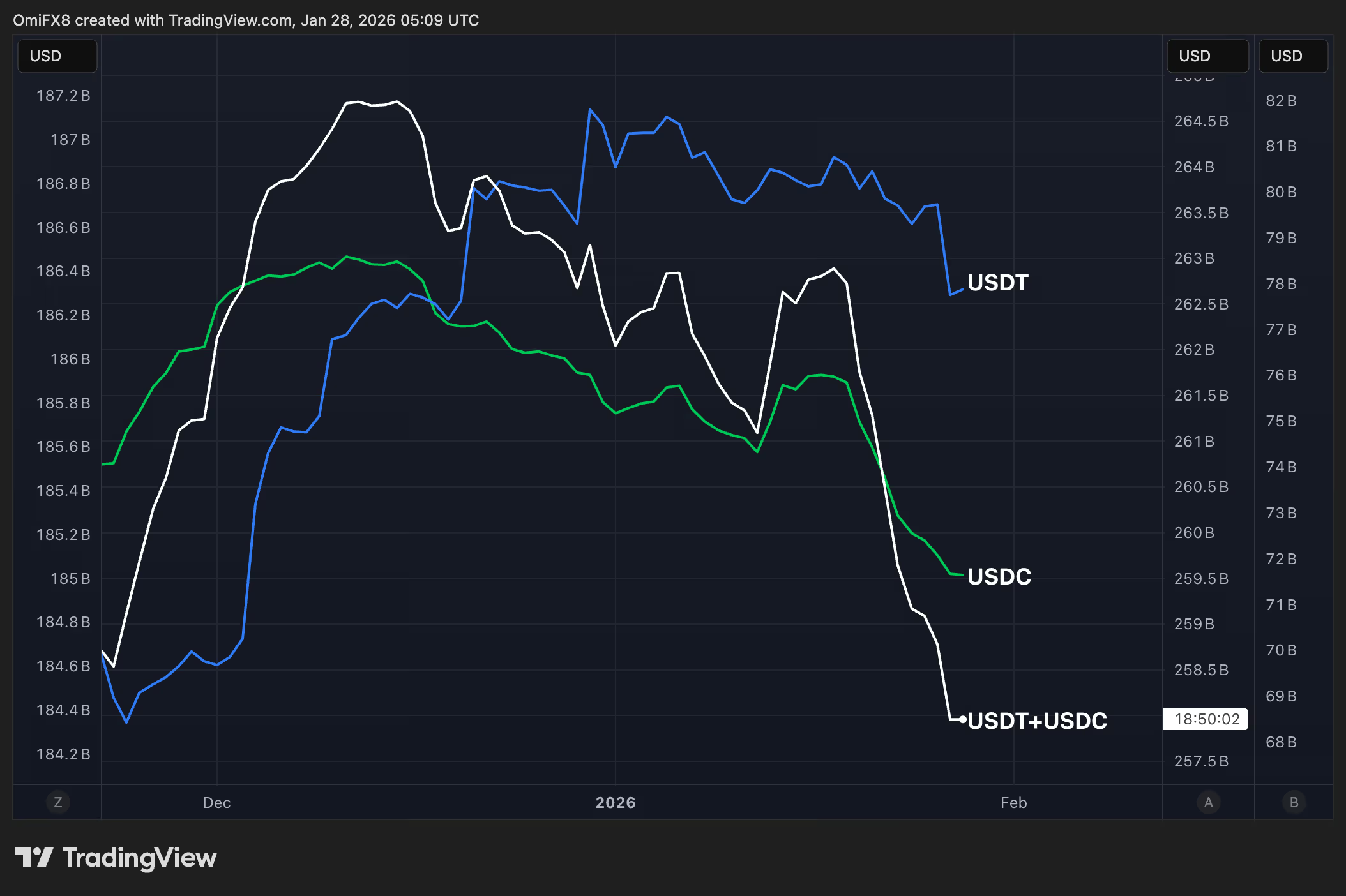

According to data from CoinDesk, the combined market capitalization of the two leading USD-pegged stablecoins, Tether (USDT) and USD Coin (USDC), has plummeted to $257.9 billion. This marks a new low since November 20 of last year. While their combined value approached a peak of $265 billion in mid-December, the past 10 days have witnessed an exceptionally rapid reduction in market capitalization.

This wave of capital withdrawal has disproportionately impacted USDC, which saw its market capitalization evaporate by over $4 billion in just 10 days. Compared to its mid-December figures, USDC has shrunk by a substantial $6 billion, bringing its current market cap to $71.65 billion. In contrast, USDT has demonstrated relative resilience, experiencing a more modest decline of approximately $1 billion over the same period, with its market cap currently standing at around $186.25 billion.

The downward trend in stablecoin market capitalization strongly indicates that traders are actively withdrawing funds from the cryptocurrency ecosystem. This trend aligns conspicuously with recent institutional outflows of billions of dollars from US Bitcoin spot Exchange Traded Funds (ETFs), suggesting a broader market deleveraging.

Stablecoins: The Lifeblood of Crypto Liquidity

Stablecoins serve as the fundamental gateway for capital entry and the cornerstone of liquidity within the cryptocurrency market. Whether investors seek to acquire digital assets or engage in decentralized finance (DeFi) protocols for yield generation, stablecoins act as the indispensable bridge between traditional finance and the crypto world.

To grasp the gravity of this phenomenon, one can envision USDT and USDC as the “chips” used in a digital casino. Typically, participants convert their fiat currency into these chips before placing their bets (investing). However, the current scenario illustrates players actively exchanging their chips back into fiat currency and “leaving the casino,” signifying a direct exit from the market rather than a mere reallocation of assets within it.

Blockchain analytics firm Santiment underscored this point, stating, “Funds are leaving the crypto market, not just sitting on the sidelines. Typically, when traders sell Bitcoin or altcoins, these funds remain in the crypto market in the form of stablecoins. The current decline in stablecoin market cap indicates that many investors are choosing to cash out directly into fiat currency, rather than preparing to ‘buy the dip’.”

Santiment further elaborated that stablecoins represent the primary source of liquidity for purchasing cryptocurrencies. When this “ammunition” (capital) diminishes, there isn’t sufficient buying power to rapidly propel asset prices upwards, consequently weakening the market’s ability to mount a sustained rebound.

Implications for Bitcoin’s Price Trajectory

In essence, the dwindling supply of stablecoins poses a significant hurdle to Bitcoin’s potential for a renewed uptrend. While Bitcoin has shown a slight recovery from a recent low of $86,000 to $89,000, the absence of robust, sustained capital inflow means the true strength and longevity of this rebound remain highly uncertain. Without fresh liquidity, any rally is likely to be short-lived and lacking in conviction, leaving the market vulnerable to further downside pressure.

Disclaimer: This article is intended solely for market information purposes. All content and views expressed are for reference only and do not constitute investment advice. They do not represent the views or positions of the author or the publishing platform. Investors are encouraged to make their own informed decisions and conduct their own due diligence. The author and the publishing platform will not be held responsible for any direct or indirect losses incurred as a result of investor transactions.