1inch Sell-Off Sparks Controversy: Was It Really the Team Dumping Tokens?

By Ethan, Odaily Planet Daily

A recent large-scale sell-off, conspicuously tagged as originating from the “1inch team,” has once again ignited a storm of criticism within the crypto community.

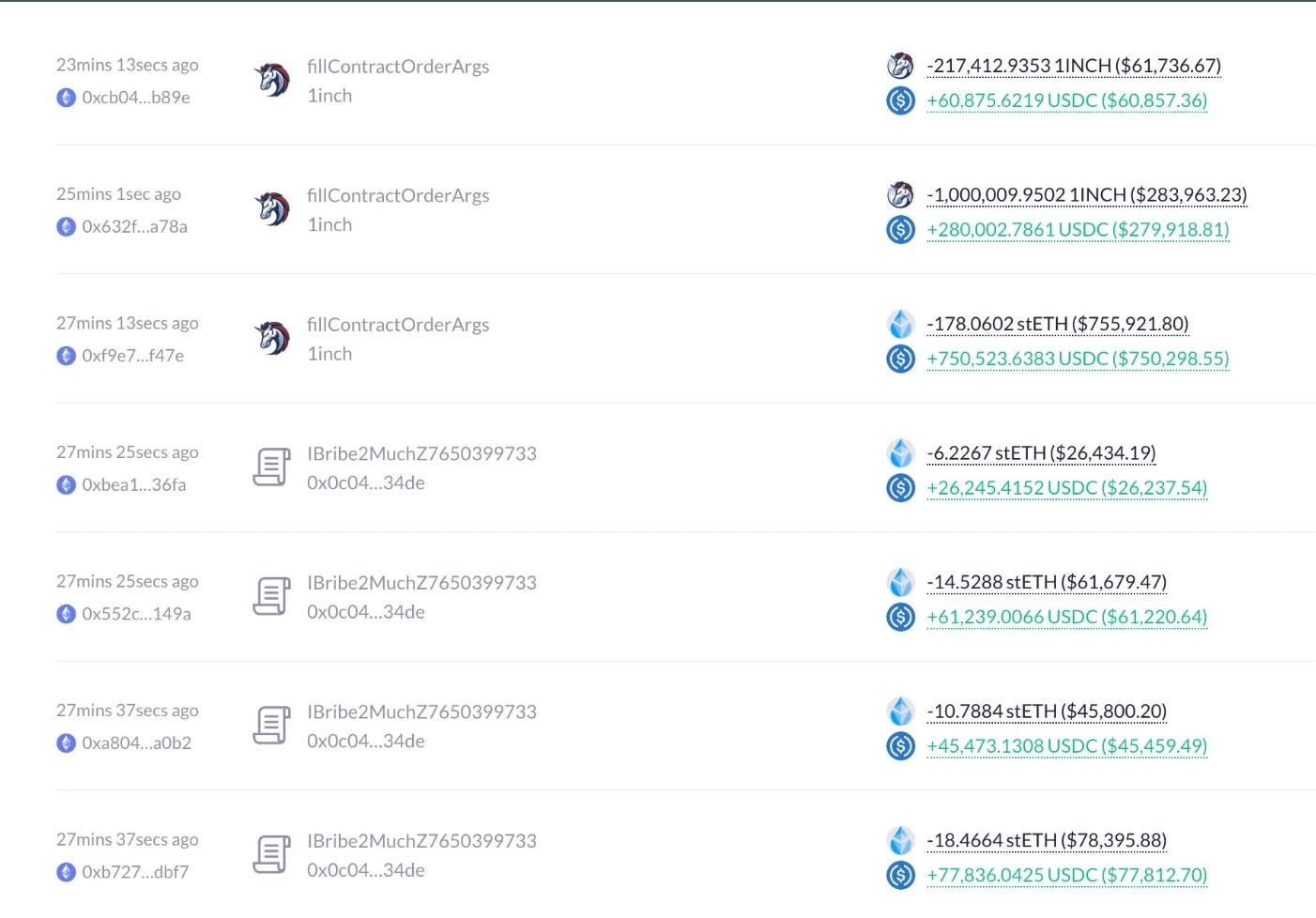

On-chain data platform ARKHAM recently revealed that three wallets, all labeled “1inch team,” collectively sold 36.36 million 1INCH tokens, valued at approximately $5.04 million. Following this significant transaction, OKX market data showed a swift 16.7% drop in the 1INCH token price, falling to $0.1155 before stabilizing around $0.1164. The incident immediately raised a critical question: Was this truly the project team orchestrating a market dump?

Analyzing the sell-off purely from a financial perspective, the outcome appears far from ideal. On-chain records indicate that the majority of these 1INCH tokens were transferred to the associated addresses in late November 2024. At the time, the estimated cost basis was around $0.42 per token, totaling approximately $15.27 million. However, leading up to the recent sale, the 1INCH price had already retreated to roughly $0.14. When factoring in the significant slippage incurred due to the large volume of the transaction, this particular position likely resulted in a realized loss exceeding $10 million.

A Contrasting Reference: The 1inch Team’s Historical Trading Acumen

Historically, the on-chain operations of the 1inch team’s investment fund have been widely regarded by the market as the actions of a “professional trading team,” adept at navigating various market fluctuations.

Between February and April, the 1inch team’s investment fund began consistently accumulating 1INCH at lower price points. During this period, market sentiment remained subdued, with 1INCH languishing around the $0.2 mark. The team collectively invested approximately $6.648 million, acquiring 33.19 million 1INCH tokens at an average cost of about $0.2.

While this initial buying spree didn’t trigger significant price movements, their concentrated accumulation in early July truly caught the market’s attention. From July 6th to 9th, the 1inch team’s investment fund made another move, injecting roughly $4.4 million within days to purchase an additional 22.99 million 1INCH. This sustained buying pressure propelled the 1INCH price from approximately $0.18 to $0.206, marking a short-term gain of about 14%. During this time, the team transferred 3 million USDC to Binance and incrementally withdrew 1INCH to their own addresses, suggesting a strategic approach rather than an immediate deployment of all funds, possibly anticipating further buying opportunities.

Post-July 10th, the operational tempo visibly accelerated. On the afternoon of July 10th, the team once again bought 4.12 million 1INCH for about $880,000, while simultaneously replenishing their Binance account with 2 million USDT, preparing for subsequent trades. By the evening of July 11th, on-chain monitoring indicated the team potentially acquired another 11.81 million 1INCH at a higher price range, with transaction prices nearing $0.28. At its peak, this address’s holdings swelled to 83.97 million 1INCH, boasting a book value exceeding $23 million. On July 13th, the team continued to withdraw 6.334 million 1INCH from Binance.

Tracing back to early February, the 1inch team’s investment fund had cumulatively invested approximately $13.64 million since the start of the year, acquiring 55.85 million 1INCH at an average cost of about $0.244. Against the backdrop of 1INCH’s price surging above $0.39 in mid-July, these positions were sitting on millions of dollars in unrealized gains.

It’s important to note that the team wasn’t solely accumulating. On the evening of July 13th, they began to incrementally realize profits, selling approximately 904,000 1INCH at $0.33, netting $298,000. Earlier, they had also sold portions of 1INCH at around $0.28.

Concurrently, the team was also taking profits on another significant position: ETH, which they had acquired in February at an average price of $2,577, began to be sold in batches above $4,200, realizing millions in profit from their ETH holdings alone.

On August 11th, on-chain analyst Ember reported that the 1inch team’s investment fund had started realizing profits from some of its earlier positions. Data showed them selling 5,000 ETH at an average price of $4,215, converting it into $21.07 million USDC. Simultaneously, they sold 6.45 million 1INCH at an average price of $0.28, converting it into approximately $1.8 million USDC.

Considering the cost basis, the aforementioned ETH was purchased by the 1inch team in February at an average price of about $2,577. The corresponding 1INCH tokens were primarily accumulated in July, with an average cost of around $0.253. Based solely on these recently sold ETH and 1INCH positions, the 1inch team’s investment fund had realized approximately $8.36 million in book profits.

Delving further back, the 1inch team’s “contrarian buying, trend-following selling” strategy for BTC is equally clear. Between February and March, during a BTC pullback, they acquired 160.8 WBTC at an average price of about $88,000. By May, when BTC neared the $100,000 mark again, they completed their liquidation, realizing nearly $1 million in overall profit.

Considering the BTC, ETH, and 1INCH asset lines collectively, the on-chain operations of the 1inch team’s investment fund resemble a well-rehearsed capital strategy: establish positions during market corrections, continuously add to positions during upward trends, and incrementally realize profits as prices enter higher ranges.

But This Time, Was It Really the Team’s Doing?

It’s crucial to highlight that when comparing this recent large-scale sell-off, which occurred around $0.14, with the 1inch team’s past on-chain activities, a significant discrepancy emerges: if this sale was indeed directly orchestrated by the team, its execution method fundamentally deviates from their historical trading logic. Whether in their past BTC, ETH, or 1INCH operations, the team’s typical approach has been to realize profits in batches after price trends are confirmed, rather than consolidating a massive sell-off in a clearly low-liquidity environment.

Consequently, some market participants began to question whether this sell-off, tagged as “1inch team,” truly originated from the team or wallets directly under their control.

Subsequently, 1inch officially responded to the controversy. In their statement, they unequivocally declared that the sale did not originate from any wallet controlled by the 1inch team, entity, or multi-sig treasury. The team also stated that it cannot interfere with the asset allocation and trading decisions of third-party holders.

In other words, the association indicated by on-chain tags does not necessarily equate to actual control. Judging by the execution pace and price range, this sell-off is more likely from a third-party holder who has disengaged from project control, rather than a shift in the 1inch team’s core trading philosophy.

In a phase where liquidity is already constrained, a single large sell-off being immediately equated with “team dumping” is an oversimplified interpretation. It overlooks the natural disconnect that can form between address tags and true control after tokens have been in circulation for an extended period.

Returning to 1inch itself: The official statement emphasized that this market fluctuation has not altered its core business or long-term direction. Since 2019, 1inch has facilitated a cumulative trading volume nearing $800 billion, maintaining daily transaction volumes in the hundreds of millions even during market downturns. The team also announced plans to re-evaluate its tokenomics model this year to enhance overall resilience during periods of low liquidity and market downturns. In this context, the debate surrounding “whether the 1inch team dumped tokens” appears to be a misinterpretation amplified by on-chain tags, prevailing liquidity conditions, and emotional market reactions.

However, even if ultimately proven to be a misinterpretation, this sell-off still constitutes a tangible secondary impact on 1INCH’s already weakening price. Since its last cycle high of $6, 1INCH has endured a prolonged unilateral decline, now hovering around $0.11.

Against such a trend, the market clearly lacks sufficient buffer space to absorb any sudden sell-off signals. The emotional brunt of such amplified selling events is often borne by those with the lowest risk tolerance—retail investors.

(The above content is an authorized excerpt and reprint from our partner PANews, original link | Source: Odaily Planet Daily)

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only and do not constitute investment advice, nor do they represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.