Moonbirds, the esteemed Ethereum blue-chip NFT project, recently made a significant leap into the Solana ecosystem with the launch of its native token, BIRB. While the token’s debut saw an impressive 90% price surge, its controversial token distribution mechanism has ignited a fierce backlash from the community, leading to a notable decline in the Moonbirds NFT floor price.

Despite the brewing discontent, BIRB’s initial market performance painted a picture of success. According to CoinGecko data, the token witnessed robust buying activity post-launch, skyrocketing from $0.20 to a peak of $0.45 before settling around $0.31 at the time of writing, marking an impressive 90.6% gain within its first day. Its circulating market capitalization quickly reached approximately $99 million, with a fully diluted valuation (FDV) soaring to an estimated $347 million. This figure notably surpassed predictions on Polymarket regarding the “FDV one day after launch,” highlighting strong initial speculative interest.

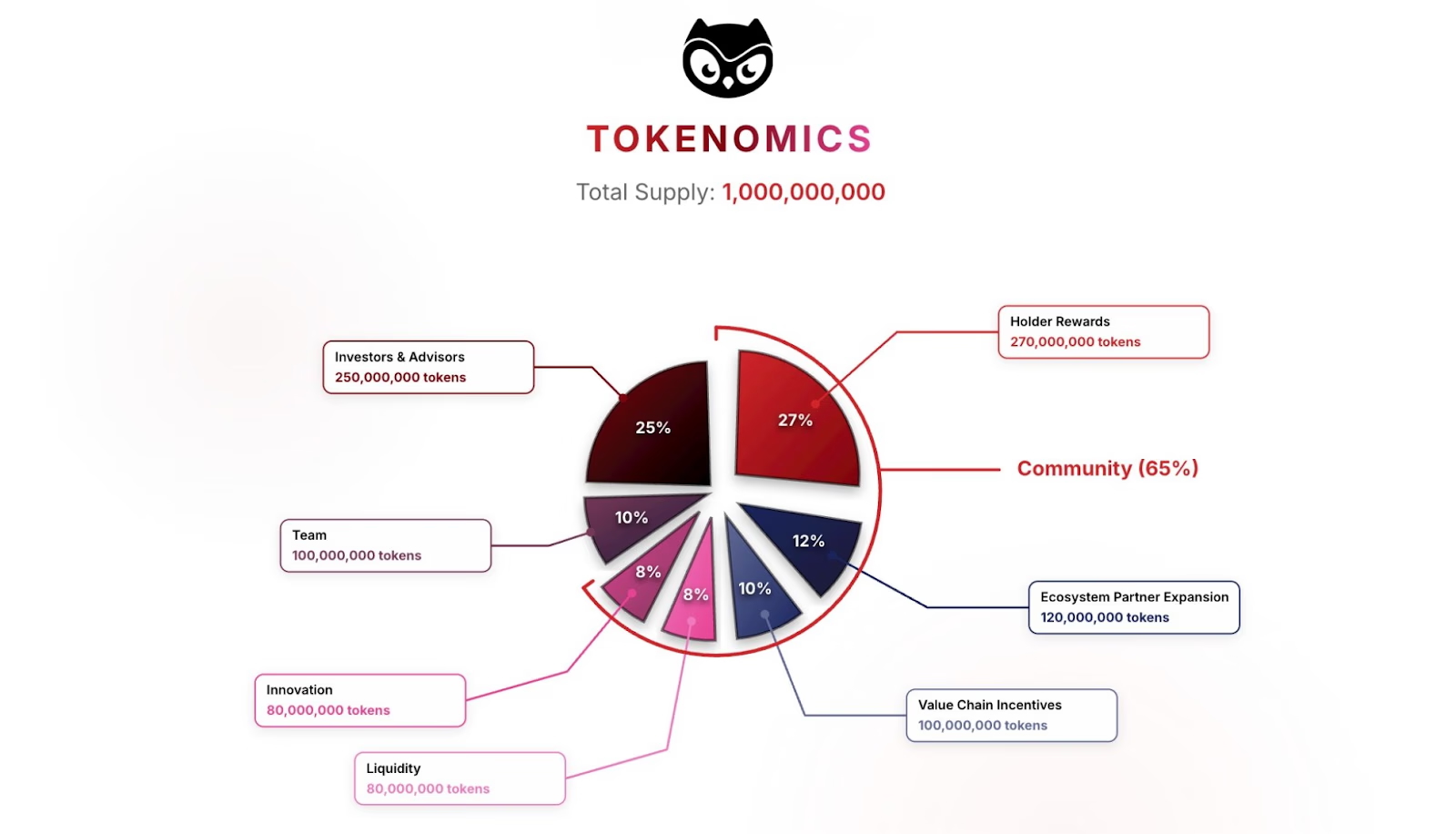

However, this glittering price action belied a deepening frustration within the community. The tokenomics model, unveiled by the team on Tuesday, was widely slammed for its perceived ‘lack of sincerity.’ While a substantial 65% of BIRB’s total supply of 1 billion tokens was earmarked for ‘community-related distribution,’ the devil, as it turned out, was in the details.

A closer inspection of this ‘generous’ allocation left many long-term Moonbirds holders feeling betrayed. Only 27% of the total supply was designated for direct rewards to NFT holders. The remaining portion of the ‘community share’ was fragmented into allocations for ecosystem partners (12%), value chain incentives (10%), liquidity (8%), and an ‘innovation fund’ (8%). Compounding the discontent, the team reserved 10% of the supply, while investors and advisors collectively secured a substantial 25%.

Adding fuel to the fire, the ‘unlock mechanism’ for BIRB rewards proved equally contentious. On January 27th, the Moonbirds team unveiled ‘Nesting 2.0,’ a new initiative designed to foster long-term user engagement. This program required users to stake eligible Moonbirds ecosystem NFTs within the protocol, rendering them untradable on the open market. In return, stakers would receive BIRB rewards.

The critical sticking point emerged with the reward distribution. While users immediately received a soul-bound token (SBT) as proof of staking – a non-transferable digital certificate permanently linked to their wallet – the actual BIRB token rewards were subjected to a lengthy 24-month linear vesting schedule.

This protracted vesting period means that NFT holders, particularly those who acquired assets with the expectation of immediate airdrop benefits, are now compelled to lock their valuable NFTs for two full years to fully realize their BIRB rewards.

The immediate fallout was severe. The floor price of Moonbirds NFTs on Ethereum reacted sharply to the news, plummeting over 30% in less than 24 hours. It briefly touched 1.10 ETH, a level not seen since mid-2025, effectively wiping out significant value for holders.

Reflecting the widespread sentiment, renowned NFT collector ‘spida’ voiced the community’s frustration: “Many people are disappointed by the small proportion of community allocation and the long unlock period. It’s really hard not to feel disheartened watching the value of your NFT shrink so much.”

Disclaimer: This article is intended solely for market information purposes. All content and opinions provided are for reference only, do not constitute investment advice, and do not represent the views or positions of BlockTempo. Investors should make their own decisions and trades, and the author and BlockTempo will not assume any responsibility for direct or indirect losses incurred by investor transactions.