Tether’s Golden Ambition: Stablecoin Giant Emerges as a Global Gold Powerhouse

By Nancy, PANews

The global gold market is experiencing an unprecedented rally. Less than a month into the new year, capital has been aggressively pouring into precious metals, driving gold prices to repeatedly shatter historical records. Amidst this frenetic surge, an unexpected and formidable player has emerged: Tether, the stablecoin behemoth, which has quietly amassed an astonishing 140 tons of gold reserves.

Tether’s Golden Hoard: Aspiring to Be a “Gold Central Bank”

With an estimated $23 billion worth of physical gold, Tether is rapidly transforming into a pivotal force in the global gold market. Its CEO, Paolo Ardoino, recently articulated an audacious vision to Bloomberg: “We will soon become one of the world’s largest ‘gold central banks’.”

This isn’t mere rhetoric. Tether has meticulously accumulated approximately 140 tons of physical gold. These substantial acquisitions are typically made directly from esteemed Swiss refineries and leading global financial institutions, with large orders often requiring months for delivery. Once acquired, the precious metal is secured within a Cold War-era nuclear bunker in Switzerland, safeguarded by multi-layered steel doors and leveraging the nation’s unparalleled privacy infrastructure.

Quantitatively, Tether has already transcended traditional boundaries, emerging as the largest known non-sovereign or non-bank holder of physical gold globally. Its reserves now place it among the top 30 gold holders worldwide, eclipsing the holdings of several nations, including Greece, Qatar, and Australia.

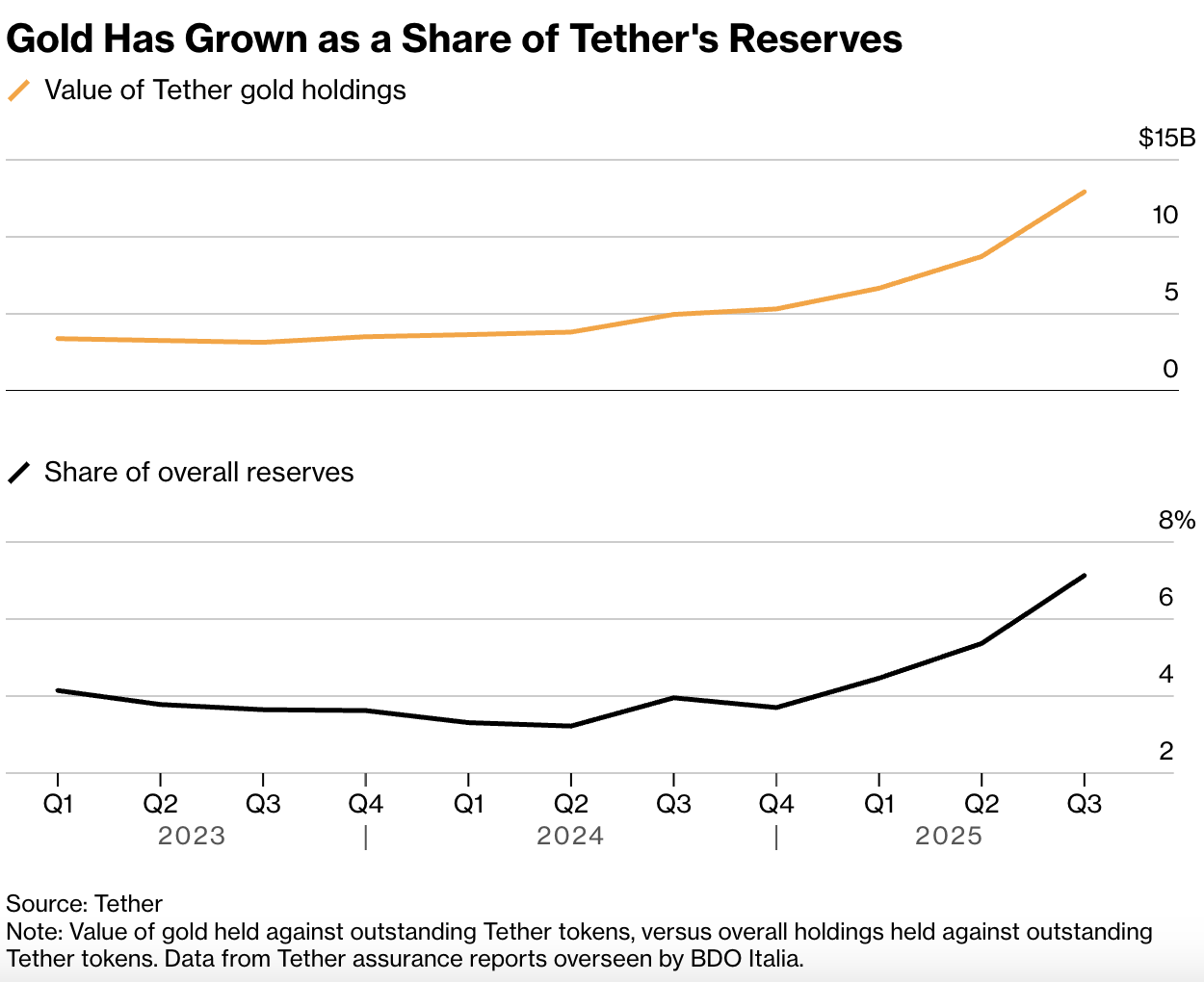

While Tether initiated its gold strategy years ago, a significant acceleration occurred in the past year. In 2023 alone, Tether procured over 70 tons of gold, positioning it as one of the top three global gold buyers for the year. This aggressive purchasing spree surpassed almost every individual central bank (barring Poland’s National Bank) and numerous major gold ETFs, undeniably contributing to the upward trajectory of gold prices in the current market cycle.

Ardoino revealed that Tether’s current acquisition pace averages 1 to 2 tons of gold weekly, a rhythm they intend to maintain for the foreseeable future, with quarterly evaluations of demand to inform any adjustments.

Beyond Hoarding: A Comprehensive Gold Strategy

Tether’s ambition extends far beyond simple accumulation. Ardoino disclosed plans to actively trade its gold reserves, leveraging sophisticated market strategies to capitalize on arbitrage opportunities. The company is also in the process of establishing “the world’s best gold trading desk,” aiming to forge stable, long-term gold acquisition channels and directly challenge established giants like JPMorgan and HSBC in the global precious metals arena.

To bolster this strategic expansion, Tether made high-profile hires last year, bringing in two seasoned trading veterans: Vincent Domien, former Global Head of Metals Trading at HSBC, and Mathew O’Neill, HSBC’s former Head of Precious Metals Procurement for EMEA. Their mandate is clear: to significantly broaden Tether’s gold business footprint.

Furthermore, Tether is strategically embedding itself in the upstream supply chain. Through equity investments, it has acquired stakes in several Canadian mid-sized gold mining royalty companies, including Elemental Royalty, Metalla Royalty & Streaming, Versamet Royalties, and Gold Royalty. These investments secure future production and revenue sharing, solidifying Tether’s long-term position.

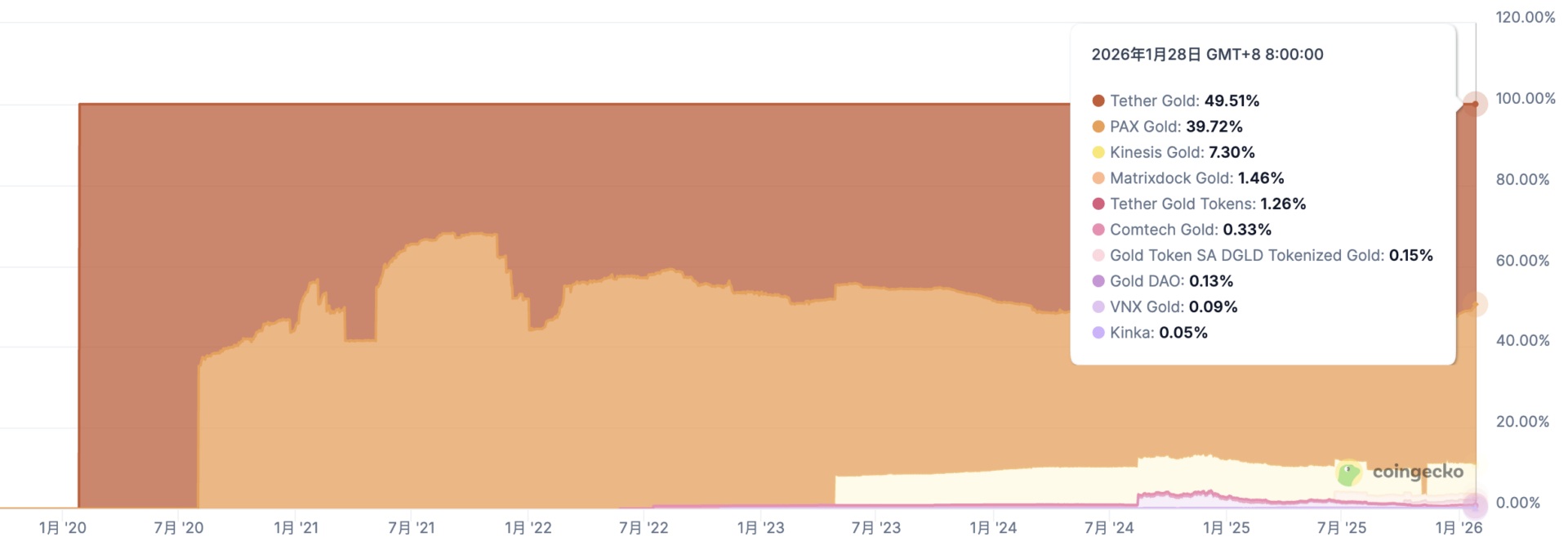

On the financial product front, Tether pioneered the gold-backed stablecoin, Tether Gold (XAU₮), back in 2020. By the end of last year, XAU₮ was backed by 16.2 tons of physical gold. Recently, Tether introduced Scudo, a new denomination for XAU₮, where 1 Scudo represents one-thousandth of a troy ounce of gold, enhancing gold’s utility as a payment method.

CoinGecko data as of January 28, 2024, reveals XAU₮’s circulating market capitalization has soared to $2.7 billion, marking a remarkable 91.3% growth over the past year. It commands an impressive 49.5% market share in the tokenized gold sector, firmly cementing its leadership.

This multifaceted approach—from physical accumulation and supply chain integration to innovative financial products—has left even seasoned commodity veterans perplexed, with some dubbing Tether “the strangest company I’ve ever encountered.” Yet, as gold prices continue their relentless climb, Tether’s bold gambit is yielding extraordinary returns.

The Engine of Growth: Tether’s $15 Billion Profit & Strategic Capital Deployment

Tether’s audacious gold accumulation strategy is underpinned by an incredibly efficient “money printing machine.” Recent reports indicate that Tether generated approximately $15 billion in net profit in the past year, a substantial leap from $13 billion the year prior. Remarkably, this multi-billion dollar enterprise operates with a lean global workforce of only around 200 individuals, translating to an astonishing per capita profit of $75 million—a figure that dwarfs the efficiency of many traditional financial behemoths.

At the heart of this formidable profitability lies the vast capital pool accumulated through its stablecoin operations.

Dominance in Stablecoins and Expansion into Regulated Markets

Tether’s USD-pegged stablecoin, USDT, reigns supreme as the most widely adopted stablecoin globally, boasting over half a billion users. According to CoinGecko data as of January 28, 2024, USDT’s circulating supply neared $187 billion, firmly securing its position at the forefront of the stablecoin market. Its transactional activity is equally dominant; Artemis Analytics data shows that while total stablecoin transaction volume surged by 72% to $33 trillion in 2023, USDT alone accounted for $13.3 trillion, representing over a third of the total.

Building on this foundation, Tether is strategically expanding its capital base through enhanced regulatory compliance. On January 27, Tether unveiled USAT, a US federally regulated stablecoin. Issued by Anchorage Digital Bank, the first federally chartered crypto bank in the US, and with Cantor Fitzgerald serving as the designated reserve custodian and primary dealer, USAT is spearheaded by former White House advisor Bo Hines as CEO. This move is widely regarded as a critical step for Tether’s full-scale entry into the lucrative US domestic market.

Simultaneously, Tether is leveraging investments in content platforms like Rumble to integrate USAT into burgeoning digital ecosystems, aiming to swiftly reach 100 million US users. With an ambitious target of a $1 trillion market capitalization within five years, USAT is poised to become a significant challenger to USDC in the US market.

Diversified Revenue Streams and Strategic Investments

Having secured an almost zero-cost liability base through its stablecoin issuance, Tether adeptly generates interest rate differentials by strategically deploying its reserves into highly liquid, low-risk assets.

A primary driver of Tether’s revenue is interest from US Treasury bonds. In the prevailing high-interest rate environment, these holdings significantly amplify Tether’s profitability. Currently, Tether’s portfolio includes approximately $135 billion in US government bonds, a sum that surpasses the holdings of several sovereign nations, placing it as the 17th largest holder of US government debt globally.

Beyond traditional assets, Tether is also a formidable player in the Bitcoin ecosystem. Since 2023, the company has committed up to 15% of its monthly net profit to dollar-cost averaging into Bitcoin. Its current holdings exceed 96,000 BTC, establishing it as one of the world’s largest institutional Bitcoin holders, with an enviable average cost basis of approximately $51,000, significantly below current market prices. Tether’s influence within the Bitcoin ecosystem extends further through its self-built mining farms, investments in mining companies, and strategic ventures into decentralized autonomous organizations (DAOs) and crypto treasuries, fueling speculation (and even conspiracy theories overseas) about its role as an “invisible BTC manipulator.”

Furthermore, to unlock additional potential returns, Tether has embarked on a broad investment spree in recent years. Its diversified portfolio now spans satellite communications, AI data centers, agriculture, telecommunications, and media, showcasing a wide-ranging strategic vision.

In essence, Tether has meticulously constructed an arbitrage engine that seamlessly bridges traditional finance and the crypto world. This powerful mechanism continuously fuels its capital arsenal, enabling its aggressive and strategic bets across various high-potential sectors, including its burgeoning gold empire.

(The above content is an authorized excerpt and reproduction from our partner PANews. Original article here.)

Disclaimer: This article is for informational purposes only. All content and opinions are for reference and do not constitute investment advice. It does not represent the views or positions of BlockBeats. Investors should make their own decisions and transactions. The author and BlockBeats will not be held responsible for any direct or indirect losses incurred by investors.