The Crypto Market: A Call for Fundamental Reassessment Amid Macro Obsession

Is the crypto market losing its vibrancy? Jeff Dorman, Chief Investment Officer at Arca, provocatively argues that despite the strongest underlying infrastructure and regulatory progress to date, the current investment landscape is at its “worst ever.”

Dorman sharply criticizes the industry’s leaders for their failed attempts to force crypto into a “macro trading tool,” resulting in an unprecedented convergence of asset correlations. He advocates for a return to the fundamental nature of “tokens as securities wrappers,” emphasizing a focus on cash-flow-generating, quasi-equity assets like DePIN and DeFi.

At a time when gold is soaring and Bitcoin appears relatively subdued, this deep-dive reflection offers a crucial perspective for re-evaluating Web3 investment logic.

Bitcoin’s Unfortunate Predicament: A Tale of Time Horizons

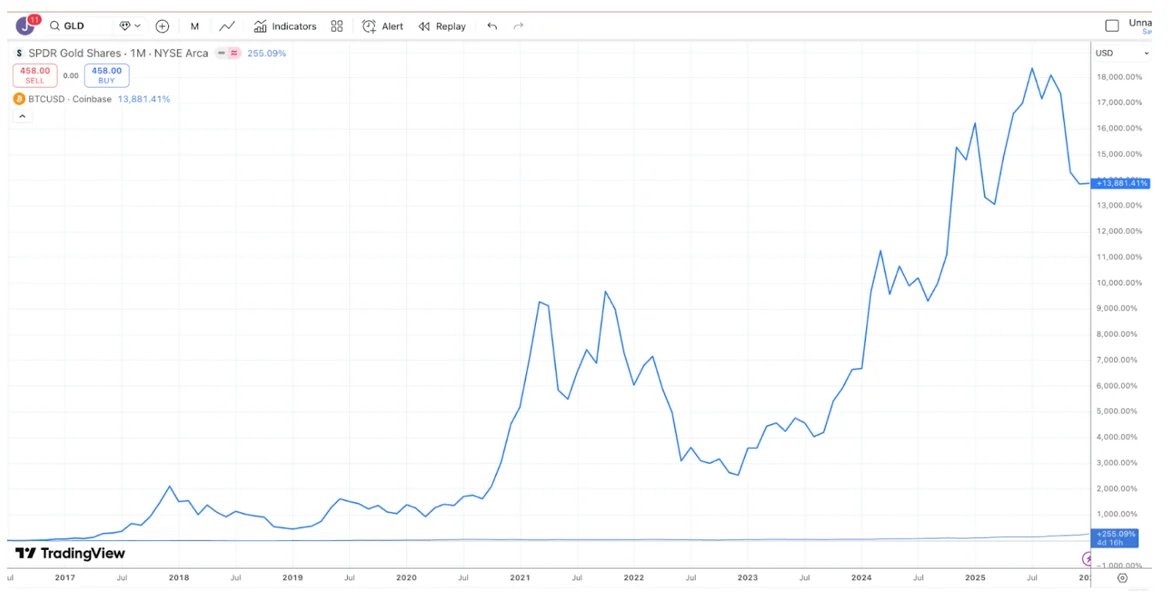

Many investment debates persist because participants often operate on different time horizons, leading to seemingly contradictory yet technically correct arguments. Consider the ongoing debate between gold and Bitcoin:

- Bitcoin enthusiasts often champion it as the superior investment, citing its massive outperformance over gold in the past decade.

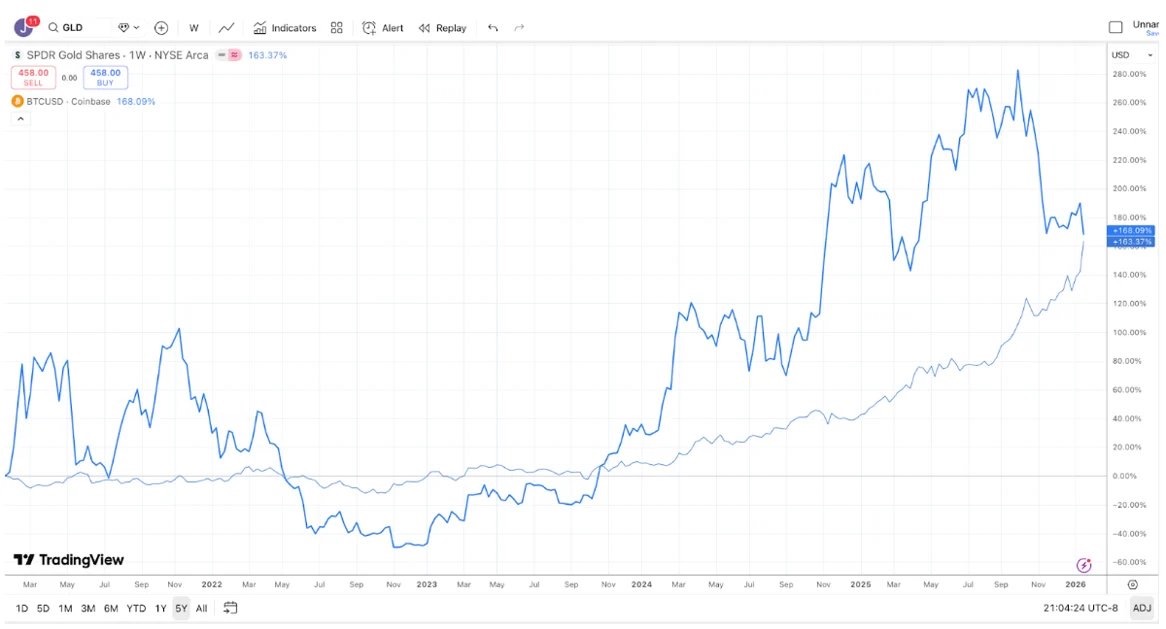

- Conversely, gold investors have recently gloated over Bitcoin’s underperformance, as gold (and similarly, silver and copper) has significantly outperformed Bitcoin over the past year.

Interestingly, over the past five years, the returns of gold and Bitcoin have been almost identical. Gold tends to be dormant for extended periods before surging when central banks and trend-followers enter the market. Bitcoin, on the other hand, typically experiences dramatic rallies followed by significant corrections, yet ultimately trends upward.

Thus, depending on your investment horizon, you could convincingly win or lose any argument comparing Bitcoin and gold.

The Misguided Pursuit of Macro Investors

Despite this, the recent strength of gold (and silver) relative to Bitcoin is undeniable. Dorman finds this situation “comical (or pathetic).” He argues that the largest companies in the crypto industry have spent the last decade catering to macro investors rather than genuine fundamental investors. The ironic outcome? These macro investors have ultimately opted for traditional safe havens like gold, silver, and copper.

Dorman has long advocated for a paradigm shift within the industry. With over 600 trillion dollars in fiduciary assets, there’s a vast pool of sticky investors who are more inclined to purchase cash-flow-generating assets. Many digital assets inherently resemble bonds and equities, issued by companies that generate revenue and conduct token buybacks. Yet, market leaders have, for some inexplicable reason, chosen to overlook this crucial sub-sector of tokens.

Perhaps Bitcoin’s recent underperformance against precious metals will finally compel major brokers, exchanges, asset managers, and other crypto leaders to acknowledge the failure of their attempts to transform cryptocurrency into an all-encompassing macro trading tool. Instead, they might pivot to focusing on and educating that $600 trillion pool of investors who favor cash-flow-generating assets. It’s not too late for the industry to embrace quasi-equity tokens that represent revenue-producing tech businesses, including various DePIN, CeFi, DeFi projects, and token issuance platforms.

However, Dorman notes that if one simply shifts the “endpoint” of the analysis, Bitcoin remains king. Therefore, it’s more probable that nothing will change.

The Erosion of Asset Differentiation in Crypto

The “good old days” of crypto investing seem distant. In 2020 and 2021, new narratives, sectors, use cases, and token types emerged almost monthly, bringing positive returns across various market segments. While the blockchain growth engine has never been stronger—fueled by legislative progress in Washington, stablecoin growth, DeFi, and Real World Asset (RWA) tokenization—the investment environment, paradoxically, has never been worse.

Dispersion: A Sign of Market Health

A key indicator of market health is dispersion and low cross-market correlation. Investors typically expect healthcare and defense stocks to move differently from tech and AI stocks, or emerging market equities to behave independently of developed markets. Dispersion is generally considered a positive attribute.

While 2020 and 2021 are largely remembered as “everything rallies,” this wasn’t entirely accurate. It was rare to see the entire market move in lockstep. More often, one sector would surge while another declined. Gaming might rally as DeFi dipped; DeFi might pump while “dinosaur” Layer-1 tokens lagged; Layer-1s could climb as Web3 projects struggled. A diversified crypto portfolio actually smoothed returns and typically reduced overall portfolio beta and correlation. Liquidity ebbed and flowed with interest and demand, but performance was diverse and encouraging. This environment justified the significant capital inflow into crypto hedge funds in 2020 and 2021, as the investable universe expanded with differentiated returns.

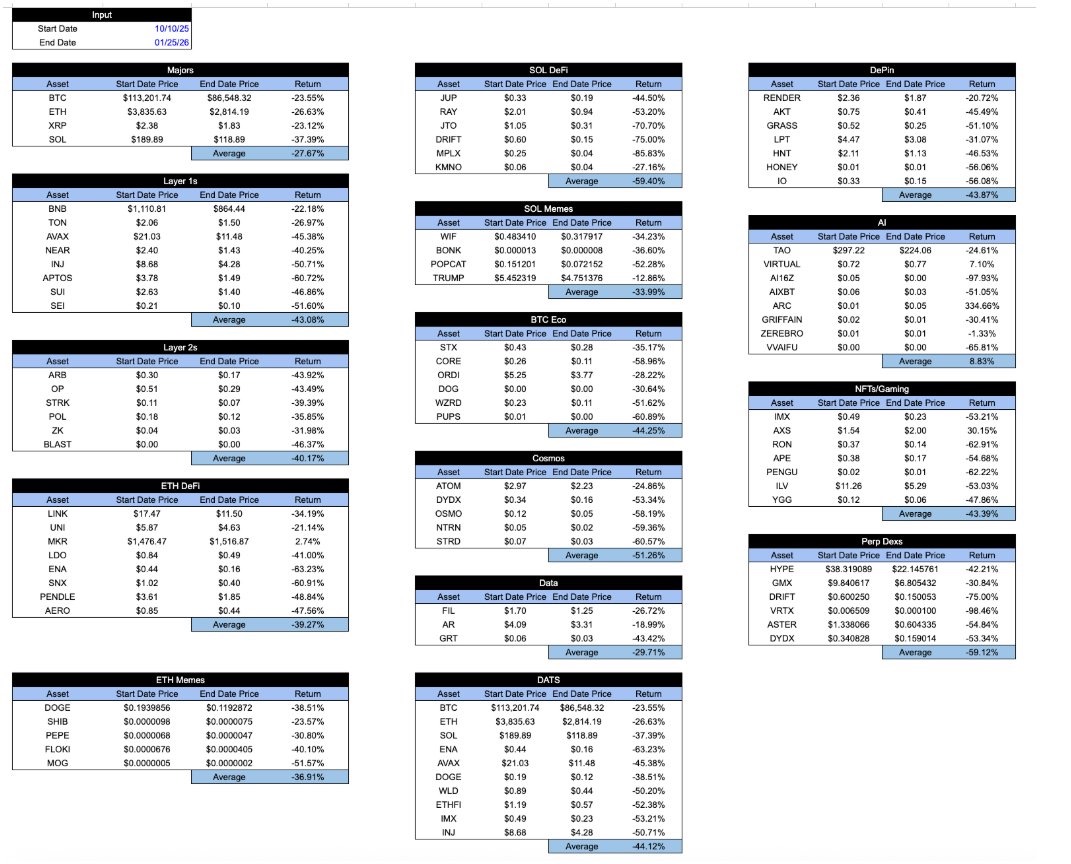

The Current State: Unsettling Correlation

Fast forward to today, and the returns of all “crypto-wrapped” assets appear remarkably similar. Since the flash crash on October 10th, the downturn across sectors has been almost indistinguishable. Regardless of the token, its economic value capture mechanism, or the project’s trajectory, returns have been largely uniform. This is profoundly disheartening.

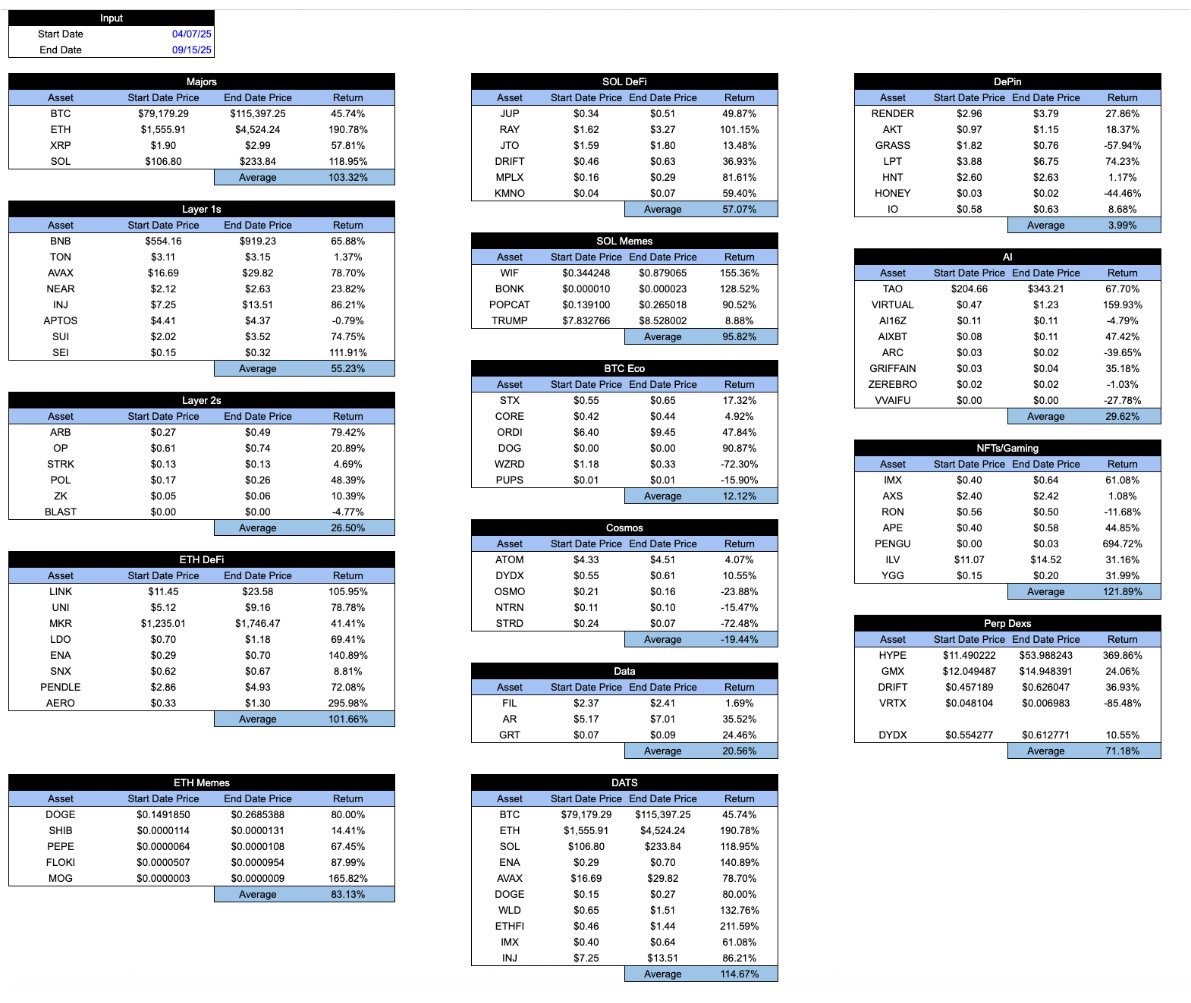

During bull markets, this chart might look slightly more encouraging, with “good” tokens outperforming “bad” ones. However, a healthy system should ideally show the opposite: good tokens performing better even during downturns, not just during rallies. Below is the same chart from the April 7th low to the September 15th high:

The Neglect of Token Nuance

Intriguingly, in crypto’s infancy, market participants actively sought to differentiate between various types of crypto assets. For instance, Dorman recalls an article he published in 2018, classifying crypto assets into four categories:

- Cryptocurrencies/Money

- Decentralized Protocols/Platforms

- Asset-Backed Tokens

- Pass-Through Securities

At the time, this classification was groundbreaking and attracted significant investor interest. It highlighted the evolution of crypto assets beyond mere Bitcoin, encompassing smart contract protocols, asset-backed stablecoins, and quasi-equity pass-through securities. Researching diverse growth areas was a primary source of alpha, as investors aimed to understand the various valuation techniques required for different asset types. Back then, most crypto investors weren’t even aware of unemployment data releases or FOMC meeting schedules, and rarely looked to macro data for signals.

Even after the 2022 crash, these distinct asset types still exist; their fundamental nature hasn’t changed. However, the industry’s marketing approach has undergone a dramatic shift. “Gatekeepers” decided that only Bitcoin and stablecoins mattered; the media seemed interested only in TRUMP tokens and other memecoins. In recent years, not only has Bitcoin outperformed most other crypto assets, but many investors have seemingly forgotten the existence of these other asset types and sectors. While the underlying business models of companies and protocols haven’t become more correlated, the assets themselves have, driven by investor flight and market maker dominance.

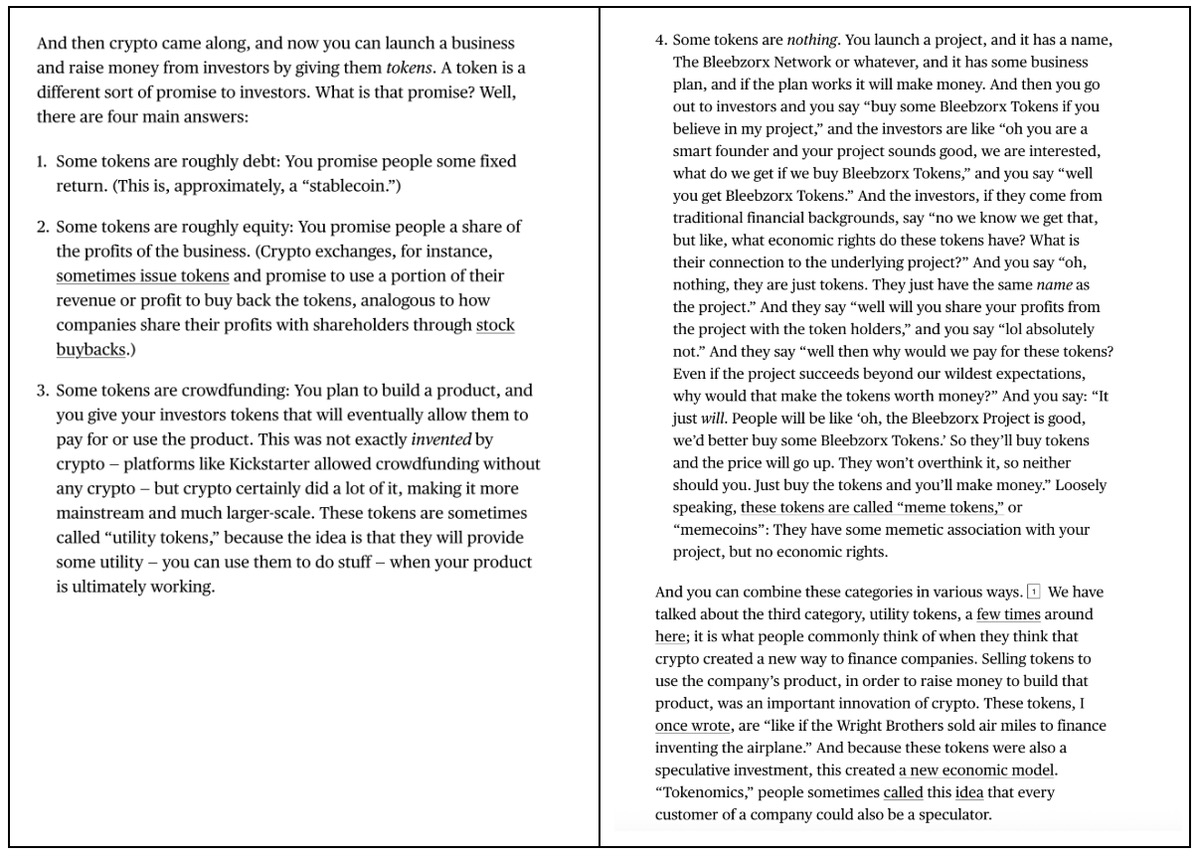

This is why Matt Levine’s recent article on tokens was so surprising and well-received. In just four paragraphs, Levine accurately described the differences and nuances between various tokens, offering a glimmer of hope that such analysis is still viable.

Leading crypto exchanges, asset managers, market makers, OTC desks, and pricing services still label everything outside of Bitcoin as an “Altcoin.” They seem to exclusively publish macro research reports, bundling all “cryptocurrencies” together as one vast asset. Consider Coinbase, for instance: their research team appears to be small, led by a primary analyst (David Duong) whose focus is predominantly macro. Dorman states he has no issue with Mr. Duong—his analysis is excellent. But who goes to Coinbase specifically for macro analysis?

Imagine if leading ETF providers and exchanges only wrote generic articles about ETFs, stating things like “ETFs are down today!” or “ETFs react negatively to inflation data.” They would be ridiculed out of business. Not all ETFs are alike, simply because they use the same “wrapper,” and those who sell and promote ETFs understand this. What’s inside the ETF wrapper is what truly matters, and investors are seemingly able to intelligently differentiate between various ETFs, largely because industry leaders help their clients understand these distinctions.

Similarly, a token is merely a “wrapper.” As Matt Levine eloquently described, what’s inside the token is what matters. The type of token, its sector, and its attributes (inflationary or amortizing) are all crucial.

Perhaps Levine isn’t the only one who grasps this, but he’s doing a better job explaining the industry than those who stand to profit most from it.

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only and do not constitute investment advice. They do not represent the views or positions of the author or BlockBeats. Investors should make their own decisions and transactions. The author and BlockBeats will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.