Jeffrey Epstein’s Shadowy Ties to Early Crypto: Bombshells from the Newly Released Files

By Cookie, BlockBeats

On January 30, the U.S. Department of Justice unveiled a significant portion of the “Epstein files,” immediately igniting global discussion and scrutiny. While much of the public’s attention focused on figures like Elon Musk’s alleged island visits, Bill Gates’ extramarital affair, or Federal Reserve nominee Kevin Warsh’s appearance on Epstein’s party lists, these newly disclosed documents also dropped a series of astonishing revelations concerning the nascent cryptocurrency industry.

The untold history of crypto may finally be emerging from the shadows, poised for a dramatic rewrite.

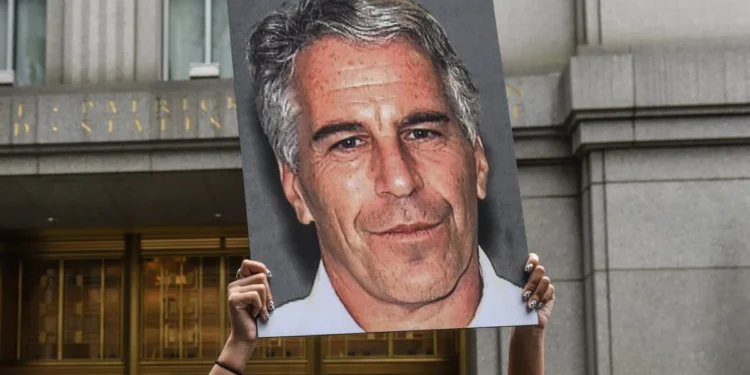

Epstein: An Unlikely Crypto Pioneer?

Remarkably, Jeffrey Epstein’s interest in Bitcoin dates back to as early as 2011. This was a pivotal year when Bitcoin’s total annual trading volume had yet to surpass $100 million, and its price, after briefly touching $30, plummeted by 90%.

An email dated June 12, 2011, near Bitcoin’s peak for that year, shows Epstein stating, “Bitcoin is a brilliant idea, but it has some serious drawbacks.” This early insight highlights his surprising awareness of the technology at a foundational stage.

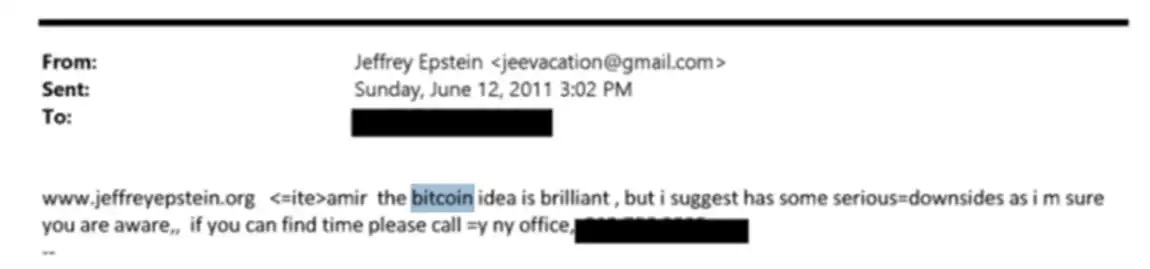

By 2013, cryptocurrency references became more frequent in Epstein’s communications.

One notable exchange involved Boris Nikolic, Bill Gates’ former chief science advisor and a beneficiary in Epstein’s will. Under the subject “Who’s still using Bitcoin now?”, they humorously and satirically discussed Ross Ulbricht, the Silk Road founder arrested that year, mocking his “foolish mistake” of using a Gmail account linked to his real name.

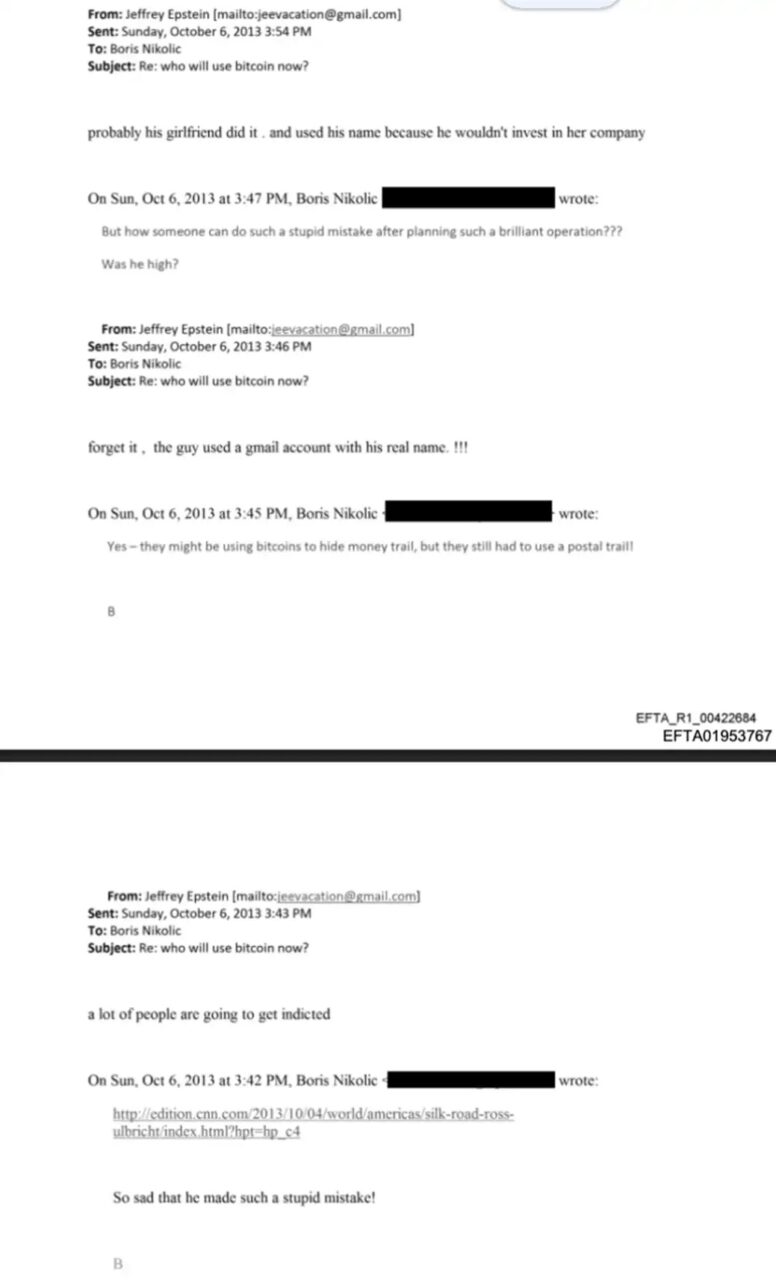

Steven Sinofsky, a board partner at a16z and former president of Microsoft’s Windows division, also emailed Epstein, boasting a 50% gain on his Bitcoin investment and sharing Timothy B. Lee’s article, “How Bitcoin Captivated Washington.”

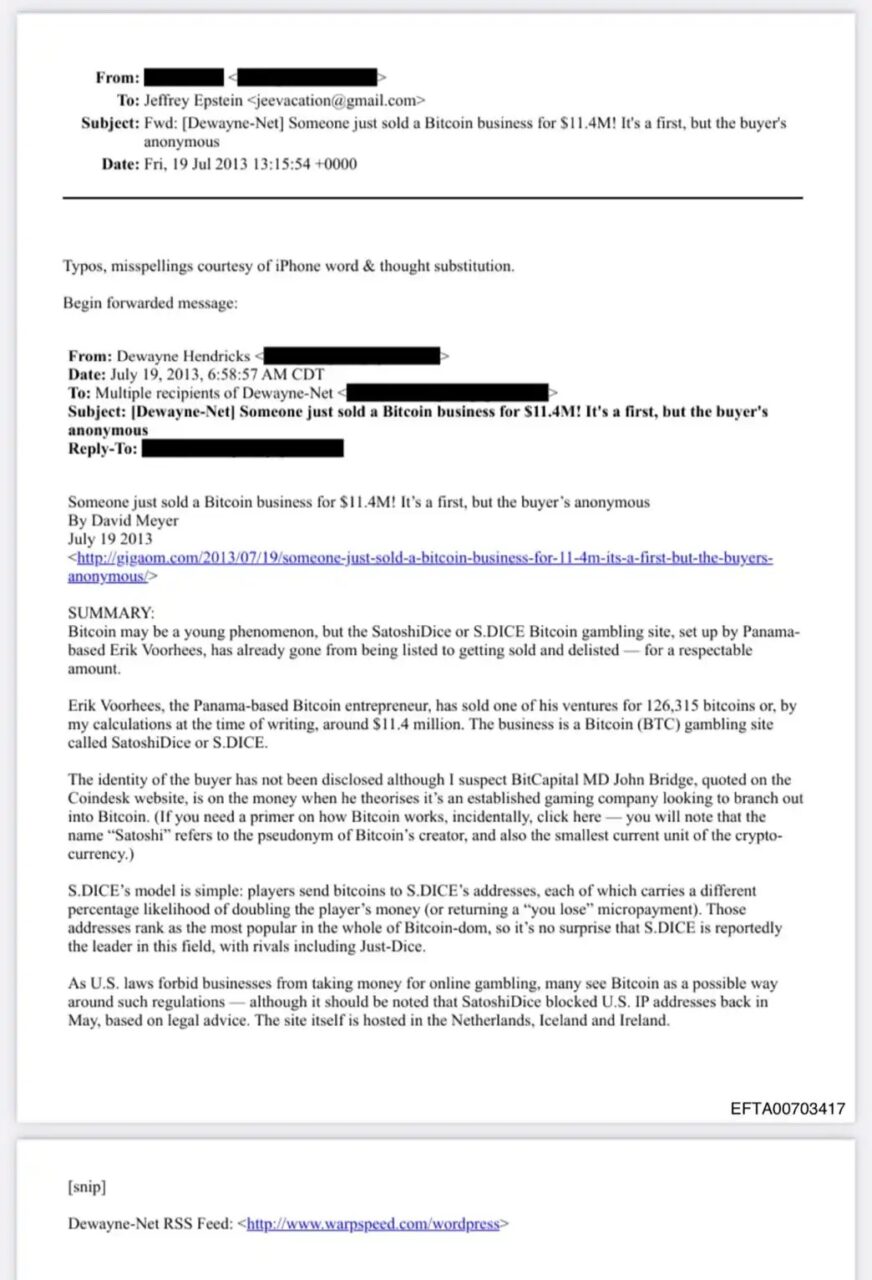

Epstein also received news about the sale of the once-prominent Bitcoin gambling site, Satoshi Dice, for $11.4 million.

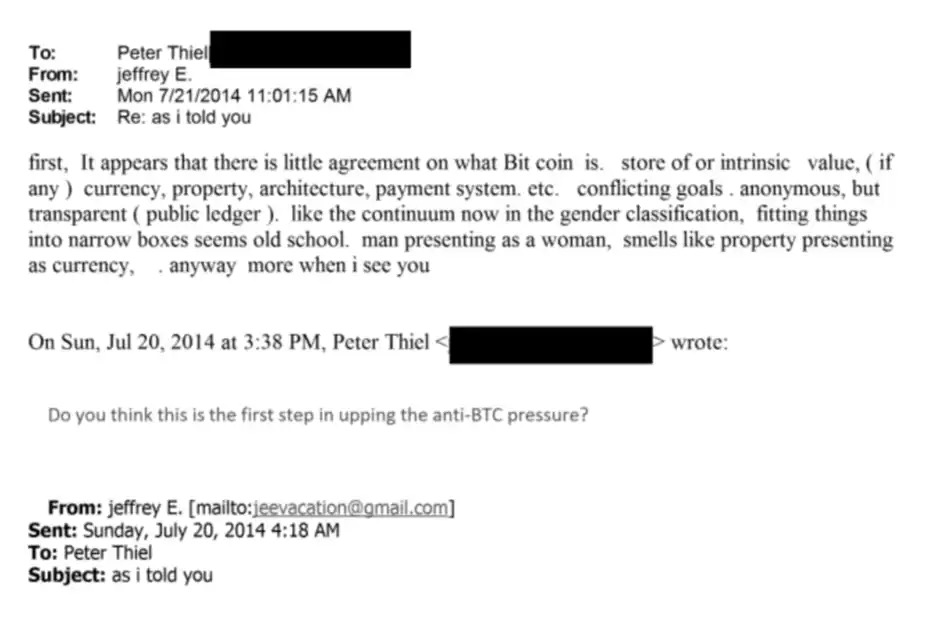

In 2014, Epstein engaged in a profound discussion with PayPal co-founder Peter Thiel regarding the fundamental nature of Bitcoin.

“There’s no consensus on what Bitcoin truly is—a store of value, a currency, or property… like a man pretending to be a woman, or property disguised as currency.”

This provocative analogy demonstrates Epstein’s familiarity with the ideological debates surrounding Bitcoin’s essence during its early stages, even drawing parallels to gender identity.

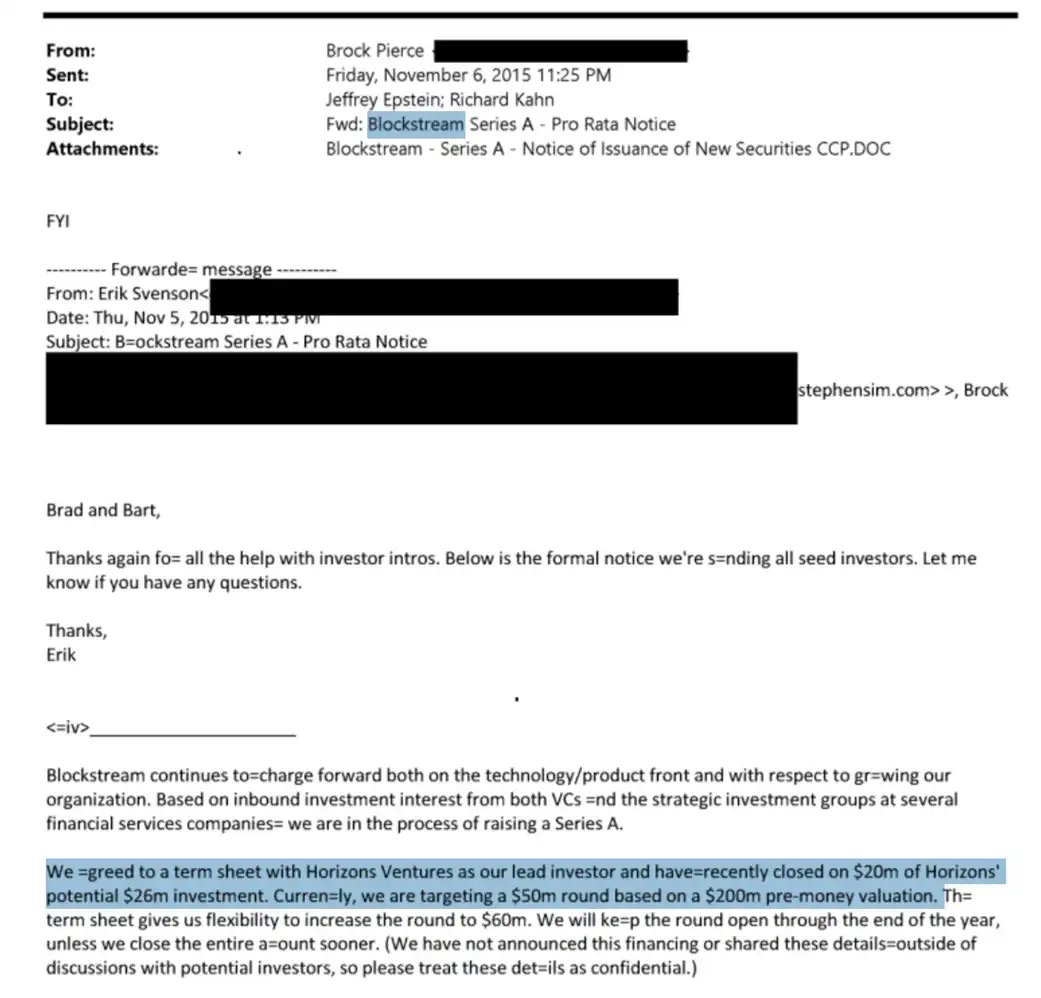

Further correspondence reveals Epstein’s participation in the seed funding round for Blockstream, a Bitcoin infrastructure company. Of the $18 million raised, Epstein’s initial $50,000 investment eventually grew to $500,000.

Blockstream CEO Adam Back recently issued a statement denying any direct or indirect financial ties between the company and Epstein or his estate. He clarified that Epstein was a limited partner in a fund that held a minority stake in Blockstream but has since fully divested.

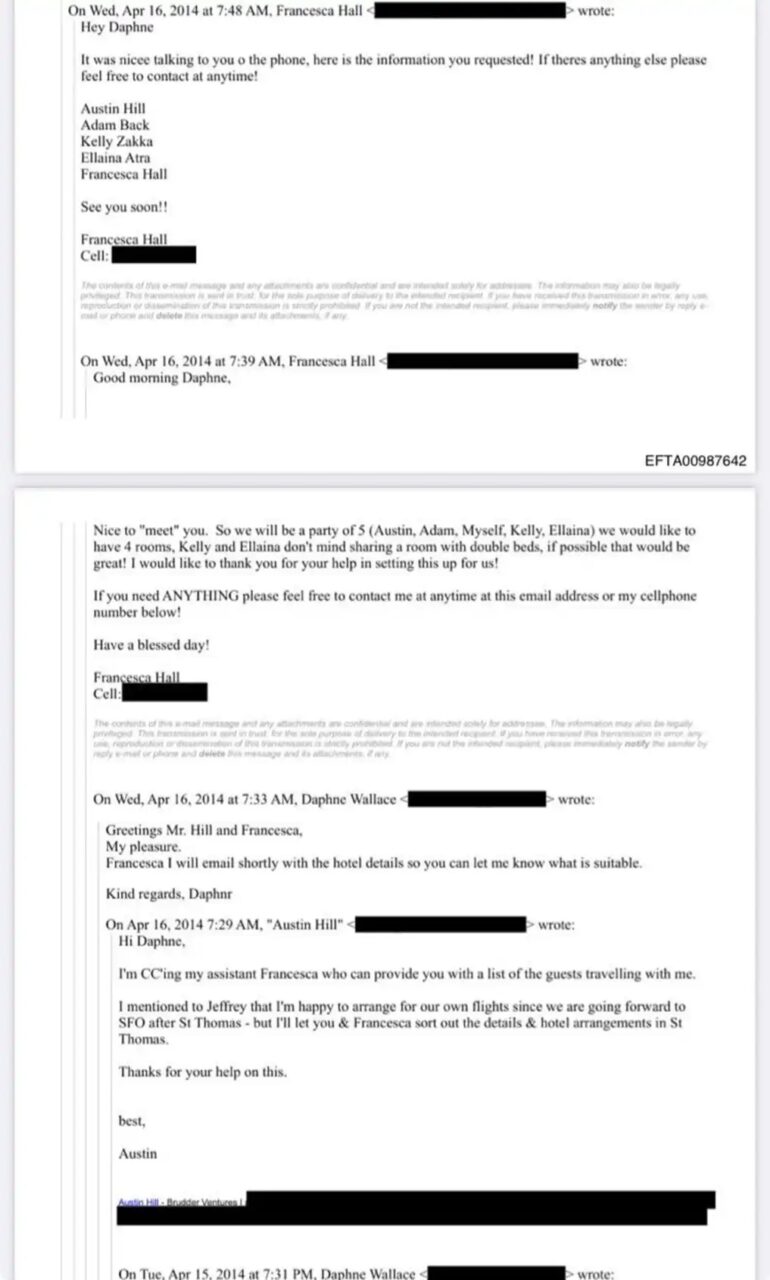

However, the names of Adam Back and Austin Hill (Blockstream co-founder) conspicuously appeared in travel arrangements for St. Thomas Island, located approximately two miles from “Epstein Island.”

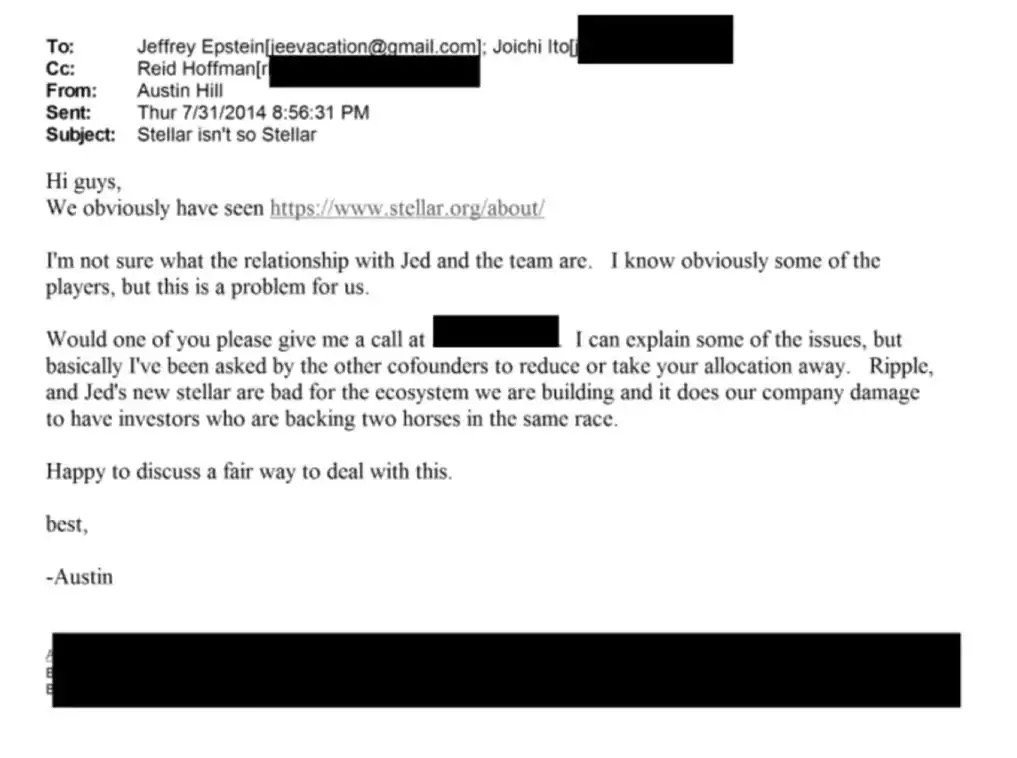

In 2014, Austin Hill also emailed Epstein and Joi Ito (former director of MIT Media Lab, through whose fund Epstein invested in Blockstream). Hill expressed concern that Ripple ($XRP) and Stellar (a new project by Ripple founder Jed McCaleb after leaving Ripple) were “causing harm” because their investors were “backing two horses in a single race.”

Interpretations of this email vary within English-speaking circles. However, context suggests that Epstein might have also invested in Ripple/Stellar at the time, which displeased Blockstream. This potential conflict led Austin Hill to state in the email, “I’ve been asked by other co-founders to reduce or even cancel your share.”

While Ripple and Stellar ultimately flourished, this incident raises a chilling question: how many other promising cryptocurrency projects, unknown to us, might have been stifled in their infancy due to similar behind-the-scenes pressures?

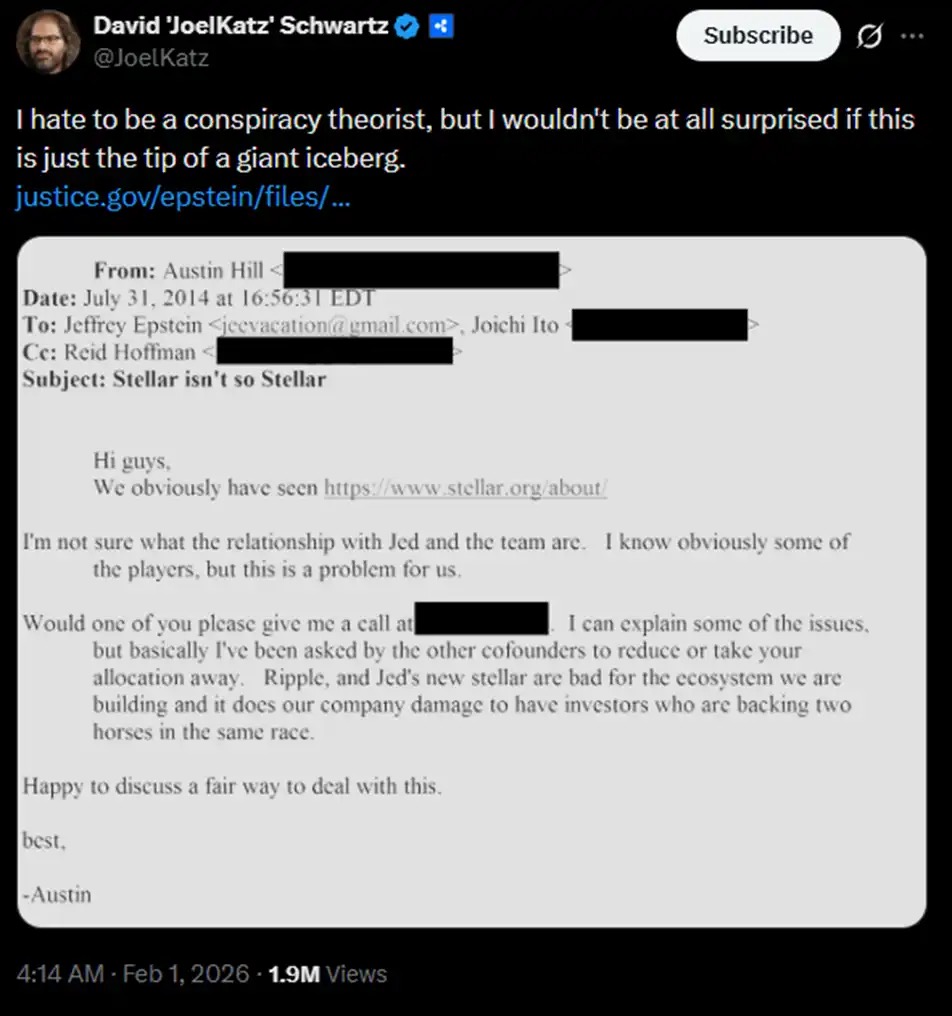

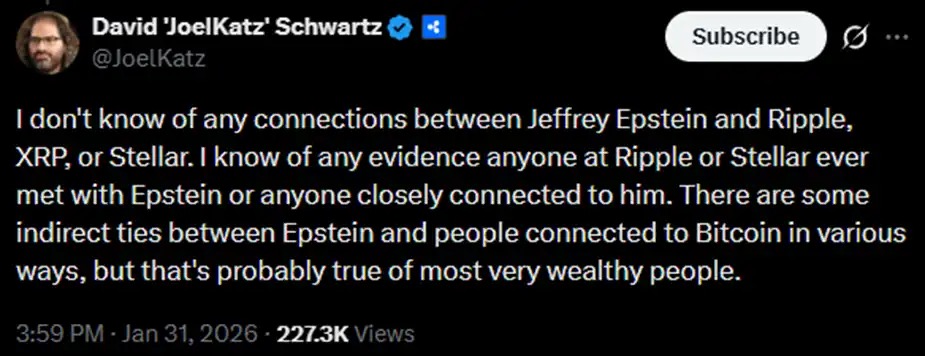

Responding to these revelations, former Ripple CTO David Schwartz tweeted, “I don’t want to be a conspiracy theorist, but I wouldn’t be surprised if this is just the tip of the iceberg.”

Yet, does this imply Epstein’s malevolence infiltrated the crypto space? Schwartz also offered a pragmatic perspective, noting that for most ultra-wealthy individuals, an association with Bitcoin was likely “very common” during its early growth.

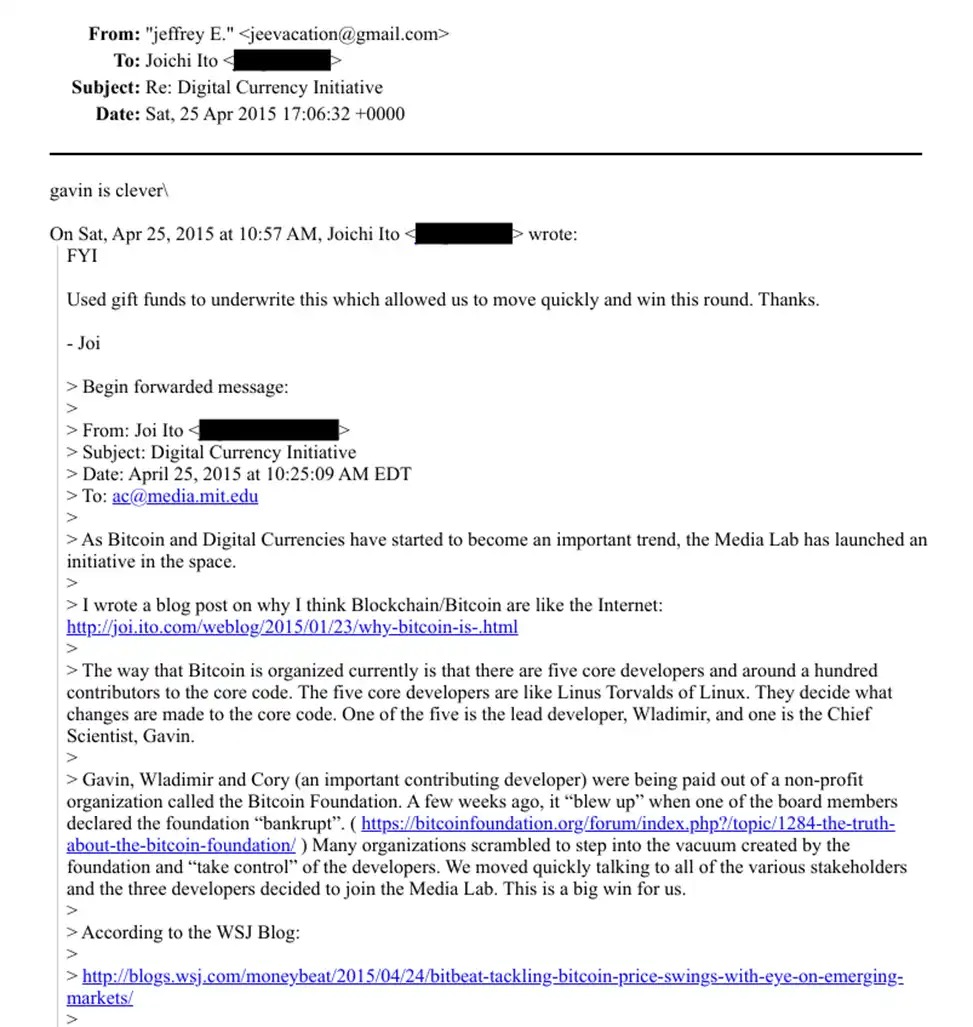

Further illustrating this intricate web, between 2014 and 2015, the collapse of the Bitcoin Foundation left Bitcoin Core developers without stable salaries. The MIT Media Lab’s Digital Currency Initiative (DCI) stepped in, offering compensation to several developers, including Gavin Andresen, Wladimir van der Laan, and Cory Fields, who subsequently joined the lab.

At the time, Epstein’s anonymous donations to the MIT Media Lab were unknown to the public, and his scandal had not yet broken. Joi Ito, then director of the Media Lab, emailed Epstein expressing gratitude. He not only explained Bitcoin’s development operations but also credited Epstein’s funding for enabling the lab to “move quickly and achieve great victories,” as “many organizations wanted to take advantage of the vacuum to control Bitcoin developers.” Epstein’s brief reply to Ito was a simple compliment for Andresen: “Gavin is smart.”

Did Epstein Ever Meet Satoshi Nakamoto?

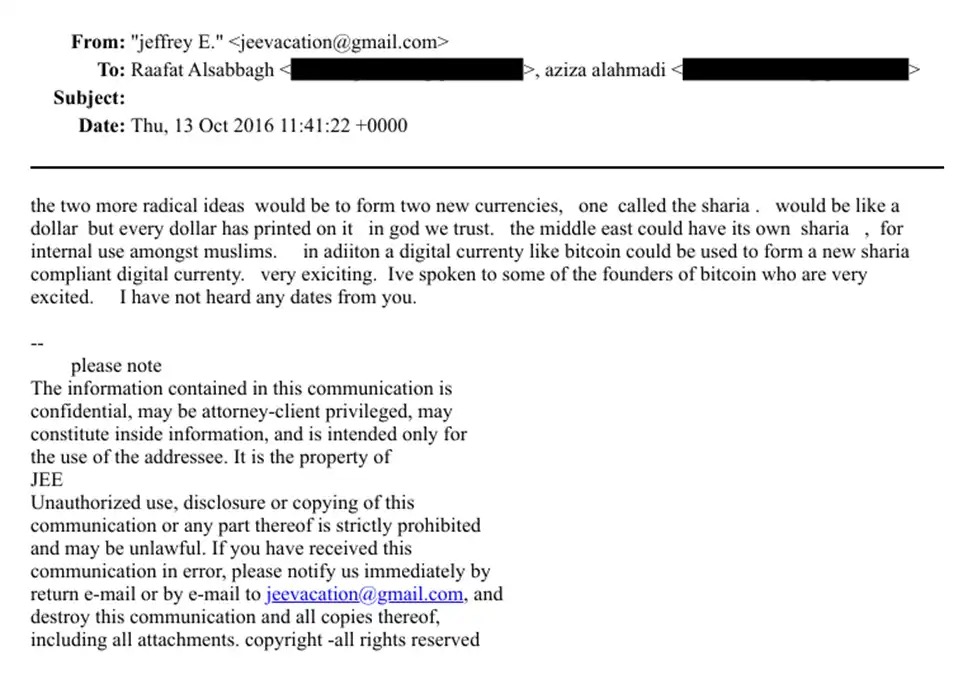

In 2016, Epstein proposed two “radical ideas for creating new currencies” in emails to Raafat AlSabbagh, an advisor to the Saudi Royal Court, and Aziza Al Ahmadi, an advisor to the Abu Dhabi Department of Culture and Tourism. One concept was a “Sharia-compliant yuan” for the Middle East, echoing “In God We Trust” on U.S. dollar bills. The other was a Sharia-compliant digital currency akin to Bitcoin.

It was after outlining this second idea that Epstein casually dropped a bombshell, almost as an aside:

“I have already spoken with some of the Bitcoin creators, and they are very excited.”

While Epstein’s primary intent might have been to flaunt his connections and bolster his image, this statement has the potential to fundamentally rewrite the history of Bitcoin and the entire cryptocurrency industry. “Some Bitcoin creators”—does this imply that Satoshi Nakamoto is not a single individual, but a team? If so, many enduring mysteries surrounding Satoshi would suddenly find plausible explanations.

This revelation prompts even more chilling questions: Who constitutes this team? What were their true motivations for creating Bitcoin? If Epstein genuinely met them, how did he initially identify and establish contact with them? And if even Epstein knew the creators of Bitcoin, could the U.S. government have been unaware? What motivations might have driven the U.S. government to maintain its silence on this matter for so long?

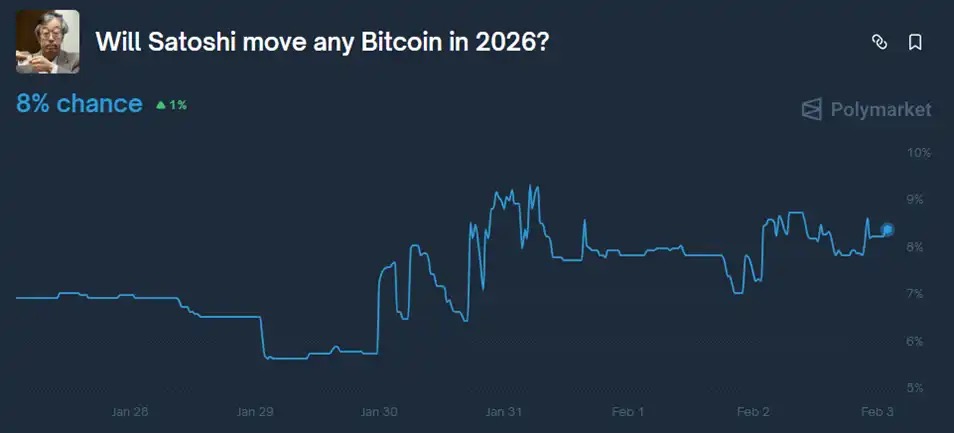

Following the latest disclosures of the Epstein files, the probability on the prediction market Polymarket for “Satoshi Nakamoto’s Bitcoin address showing activity in 2026” briefly surged from approximately 6% to 9.3%, currently stabilizing around 8%.

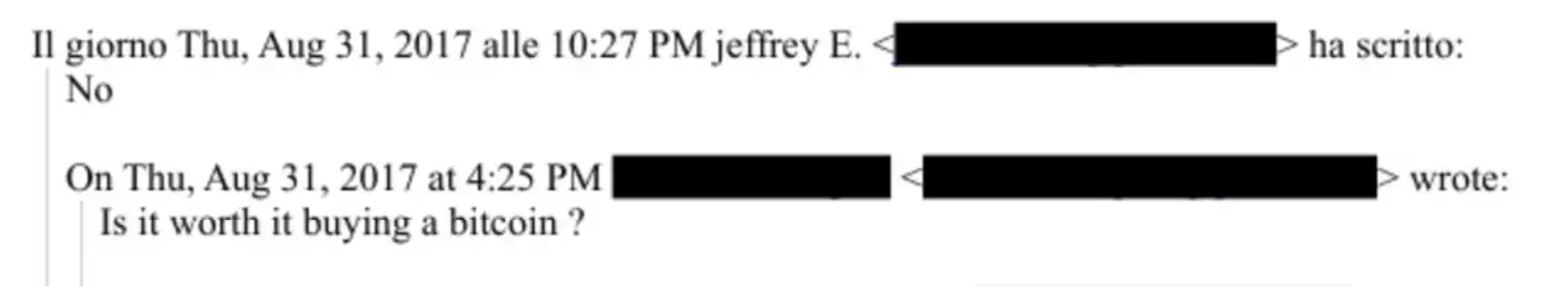

If Epstein indeed met Satoshi Nakamoto, it appears he wasn’t swayed by their vision. In an email exchange on August 31, 2017, when asked if it was “worth buying a Bitcoin,” Epstein curtly replied, “No.” At that time, a single Bitcoin was trading for less than $5,000.

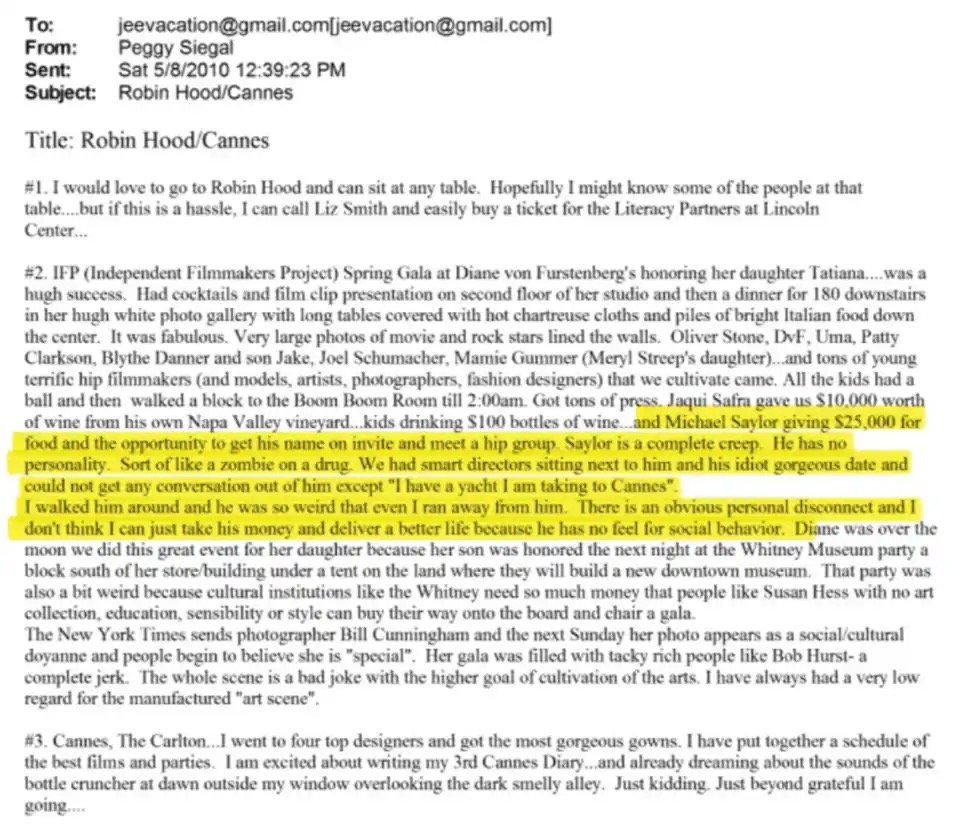

While the question of Epstein’s encounter with Satoshi remains unanswered, we do know he met one of today’s most prominent Bitcoin maximalists: Michael Saylor, CEO of MicroStrategy.

Saylor’s unwavering commitment to buying and holding Bitcoin has become legendary, but in 2010, he was not yet known for this identity. That year, Saylor paid $25,000 to attend a party hosted by Epstein’s publicist, Peggy Siegal. It was there that he first displayed what Siegal described as “autistic” traits:

“This guy is a total freak, utterly charmless, like an overdosed zombie. We had brilliant directors at our party, sitting next to him and his pretty, idiotic girlfriend, and there was no conversation beyond ‘I have a yacht and I’m going to Cannes.’ I showed him around, but he was so bizarre I just had to run. He had no personality, no social skills, I couldn’t figure out how to make money with him.”

To be labeled a “freak” by a publicist working for Epstein speaks volumes about Saylor’s peculiar demeanor. Perhaps only a groundbreaking innovation like Bitcoin could accommodate such an eccentric personality, allowing him to forge a remarkable empire.