Authors: Viee, Amelia | Biteye Content Team

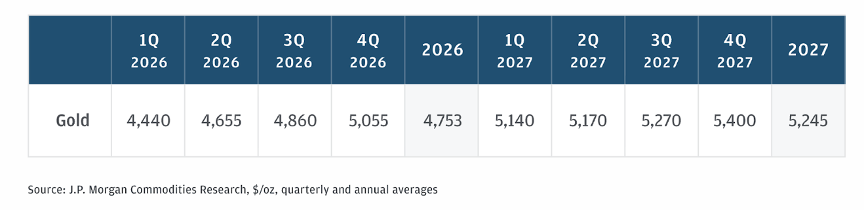

On January 29, 2026, gold experienced a dramatic single-day plunge of 3%, marking its most significant decline in recent memory. This sharp correction came just days after the precious metal had soared to a new all-time high, breaching the $5,600 per ounce mark, with silver also following suit. The start of 2026 had already far exceeded JPMorgan’s mid-December expectations for precious metals.

In stark contrast, Bitcoin remained confined to a subdued, volatile range following a recent pullback, further widening the performance gap between traditional precious metals and the leading cryptocurrency. Despite its moniker as “digital gold,” Bitcoin appears to lack the same stability, often behaving more like a risk asset during periods of inflation, geopolitical conflict, or other events that traditionally bolster gold and silver. Why does Bitcoin exhibit this counter-intuitive behavior, fluctuating with shifts in risk appetite rather than acting as a reliable safe haven?

Without a clear understanding of Bitcoin’s actual role within the current market structure, investors risk making suboptimal asset allocation decisions.

This article delves into this complex interplay, seeking to answer key questions:

- Why have precious metals surged so dramatically recently?

- What factors have contributed to Bitcoin’s notably weak performance over the past year?

- Historically, how has Bitcoin performed during periods of gold appreciation?

- In this bifurcated market environment, how should the average investor strategically position their portfolio?

I. A Cross-Cycle Confrontation: Gold, Silver, and Bitcoin’s Decade-Long Duel

From a long-term perspective, Bitcoin undeniably remains one of the highest-returning assets. However, over the past year, its performance has conspicuously lagged behind both gold and silver. The market dynamics from 2025 into early 2026 have been characterized by a pronounced divergence: the precious metals market has entered what many are calling a “supercycle,” while Bitcoin has shown signs of weakness. The following data illustrates this comparison across three critical cycles:

This pattern of divergence is not unprecedented. During the initial phase of the pandemic in early 2020, gold and silver rapidly ascended due to heightened safe-haven demand, while Bitcoin plummeted by over 30% before eventually staging a recovery. Further historical data reveals similar disparities: the 2017 bull market saw Bitcoin surge by an astonishing 1359% compared to gold’s modest 7% gain; in the 2018 bear market, Bitcoin crashed by 63% while gold only dipped 5%; and in the 2022 bear market, Bitcoin fell 57% as gold edged up 1%. These trends suggest an unstable correlation between Bitcoin and gold, positioning Bitcoin more as an asset at the crossroads of traditional and nascent finance. It exhibits characteristics of a high-growth technology asset, yet remains significantly influenced by market liquidity, making it difficult to equate with the enduring safe-haven status of gold.

Therefore, when we express surprise that “digital gold isn’t rising, but real gold is exploding,” the core question should be: Is Bitcoin truly perceived and traded as a safe-haven asset by the market? Current trading structures and institutional behavior suggest otherwise. While gold and silver have indeed outperformed Bitcoin in the short term (1-2 years), a long-term perspective (10+ years) reveals Bitcoin’s returns to be a staggering 65 times that of gold. Over an extended timeframe, Bitcoin’s 213x return demonstrates that it may not be “digital gold,” but it stands as one of the greatest asymmetric investment opportunities of our era.

II. Unpacking the Divergence: Why Gold and Silver’s Ascent Outpaced Bitcoin

The consistent record highs for gold and silver, coupled with Bitcoin’s lagging narrative, reflect more than just price divergence; they signify a profound separation in asset attributes, market perception, and underlying macroeconomic logic. We can dissect this growing chasm between “digital gold” and “traditional gold” from four key perspectives.

2.1 Central Banks Lead the Charge in a Crisis of Trust

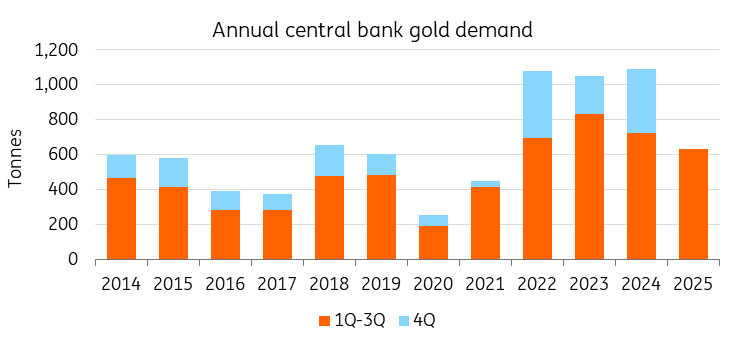

In an era marked by strong expectations of currency devaluation, the identity of consistent buyers plays a crucial role in determining an asset’s long-term trajectory. From 2022 to 2024, central banks worldwide embarked on an unprecedented gold accumulation spree, collectively net purchasing over 1,000 tons annually for three consecutive years. Whether it’s emerging economies like China and Poland, or resource-rich nations such as Kazakhstan and Brazil, gold has emerged as the primary reserve asset to hedge against U.S. dollar risk. Crucially, this buying intensified even as prices rose—a “buy more when expensive” pattern that underscores central banks’ unwavering conviction in gold as the ultimate reserve asset. Bitcoin, however, struggles to gain similar institutional recognition, a structural issue rooted in its very nature. Gold boasts a 5,000-year consensus, independent of any national credit; Bitcoin, conversely, relies on electricity, internet infrastructure, and private keys, making central banks hesitant to allocate significant reserves.

2.2 The Return to “Physical First” for Gold and Silver

As global geopolitical conflicts escalate and financial sanctions become increasingly prevalent, the security of assets transcends mere valuation to become a question of redeemability. Following the inauguration of the new U.S. administration in 2025, a wave of high tariffs and export restrictions disrupted global market order. In this environment, gold naturally assumed its role as the sole ultimate asset, independent of any nation’s credit. Simultaneously, silver’s industrial value began to shine, driven by expanding sectors like new energy, AI data centers, and photovoltaic manufacturing, leading to a surge in industrial demand and a genuine supply-demand imbalance. This confluence of speculative interest and fundamental strength has propelled silver’s gains even more aggressively than gold’s.

2.3 Bitcoin’s Structural Dilemma: From “Safe-Haven” to “Leveraged Tech Stock”

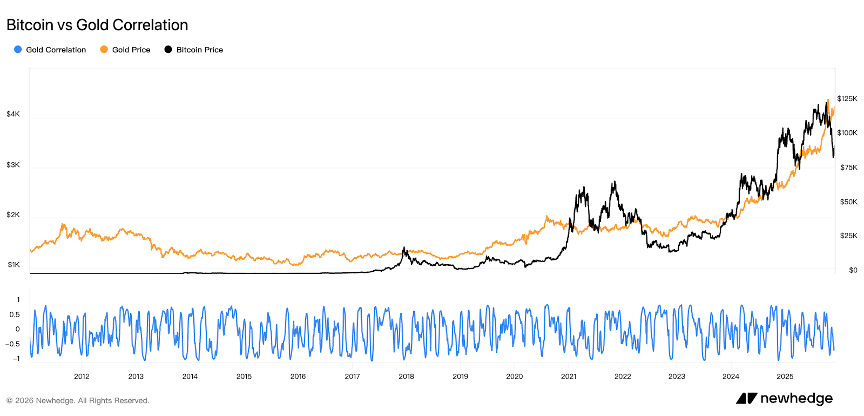

Historically, Bitcoin was often championed as a bulwark against central bank monetary expansion. However, with the approval of Bitcoin ETFs and the subsequent influx of institutional capital, its funding structure has undergone a fundamental transformation. Wall Street institutions typically integrate Bitcoin into their portfolios as a “high-elasticity risk asset.” Data from the second half of 2025 reveals an unprecedented correlation of 0.8 between Bitcoin and U.S. tech stocks, indicating that Bitcoin is increasingly behaving like a leveraged technology stock. During periods of market risk, institutions are more inclined to sell Bitcoin for cash, a behavior distinctly opposite to the flight-to-safety seen with gold.

A prime example of this shift was the dramatic liquidation event on October 10, 2025, which saw $19 billion in leveraged positions wiped out. Far from exhibiting safe-haven properties, Bitcoin experienced a cascading collapse due to its highly leveraged structure.

2.4 Why Bitcoin’s Recent Underperformance?

Beyond its structural reclassification, Bitcoin’s recent slump can be attributed to three deeper, interconnected factors:

- Ecosystem Challenges and AI Competition: The cryptocurrency ecosystem’s development has lagged significantly. While the AI sector attracts immense capital and innovation, the crypto space’s “innovation” often revolves around meme coins. A lack of killer applications and genuine utility, coupled with an overreliance on pure speculation, has diverted attention and capital.

- The Shadow of Quantum Computing: The threat posed by quantum computing is not merely theoretical. While a full-scale quantum attack on current cryptographic standards may still be years away, the narrative itself is already deterring some institutional investors. Google’s Willow chip has demonstrated quantum advantage, and while the Bitcoin community is actively researching post-quantum signature schemes, upgrades require broad community consensus, which slows adoption but also ensures network robustness.

- Early Adopter (OG) Sell-Offs: A significant number of early Bitcoin holders are liquidating their positions. They perceive Bitcoin as having “lost its way”—transforming from a decentralized, idealistic currency into a speculative tool for Wall Street. Following ETF approvals, the perceived spiritual core of Bitcoin seems to have eroded. With entities like MicroStrategy, BlackRock, and Fidelity accumulating increasingly large holdings, Bitcoin’s price is no longer solely dictated by retail sentiment but by institutional balance sheets. This institutionalization is a double-edged sword, offering enhanced liquidity but potentially sacrificing its original ethos.

III. A Historical Lens: The Elusive Link Between Bitcoin and Gold

A retrospective analysis of Bitcoin’s historical relationship with gold reveals that their price correlation during major economic events has been remarkably limited, often demonstrating divergent paths. The persistent “digital gold” narrative, therefore, might stem not from Bitcoin’s inherent resemblance to gold, but rather from the market’s need for a familiar frame of reference.

Firstly, the connection between Bitcoin and gold was never one of synchronous safe-haven behavior from its inception. In its early days, Bitcoin was largely confined to niche tech circles, with negligible market capitalization and public awareness. During the 2013 Cypriot banking crisis, which saw the implementation of capital controls, gold prices paradoxically fell by approximately 15% from their peak. Concurrently, Bitcoin surged past $1,000. While some interpreted this as capital flight and a rush to Bitcoin as a safe haven, hindsight suggests that Bitcoin’s 2013 rally was primarily driven by speculation and nascent enthusiasm, with its safe-haven attributes not yet widely recognized. The significant decline in gold alongside Bitcoin’s surge that year resulted in an extremely low correlation—a monthly return correlation of just 0.08, virtually zero.

Secondly, genuine synchronization between the two assets only materialized during periods of abundant liquidity. Following the COVID-19 pandemic in 2020, central banks globally unleashed unprecedented monetary easing. Investors, increasingly concerned about fiat currency debasement and inflationary pressures, saw both gold and Bitcoin strengthen. In August 2020, gold reached a then-all-time high (surpassing $2,000), while Bitcoin broke above $20,000 by late 2020, accelerating its ascent to over $60,000 in 2021. Many observers posited that during this period, Bitcoin began to embody its “anti-inflationary” digital gold characteristics, benefiting from expansive monetary policies akin to gold. However, it’s crucial to note that while the loose monetary environment provided a common tailwind for both, Bitcoin’s volatility remained significantly higher (an annualized volatility of 72% versus gold’s 16%).

Thirdly, the correlation between Bitcoin and gold has historically been unstable, leaving the “digital gold” narrative still largely unverified. Data consistently shows that the correlation between gold and Bitcoin has fluctuated widely and remains generally unstable. Particularly post-2020, despite occasional synchronized price increases, their correlation has not significantly strengthened; in fact, negative correlations have frequently emerged. This indicates that Bitcoin has not consistently functioned as “digital gold,” with its price movements often driven by independent market logic.

This historical review underscores that gold is a historically validated safe-haven asset, whereas Bitcoin behaves more like an unconventional hedging tool whose efficacy is contingent on specific narratives. When genuine crises emerge, the market consistently prioritizes certainty over speculative potential.

IV. Bitcoin’s True Nature: Not Digital Gold, But Digital Liquidity

Perhaps a re-evaluation of Bitcoin’s fundamental role is in order: What purpose is it truly meant to serve? Was it genuinely conceived to be “digital gold”?

Firstly, Bitcoin’s foundational attributes inherently differentiate it from gold. Gold’s scarcity is physical, requiring no internet or reliance on complex systems, making it a true “doomsday asset.” In the event of a geopolitical crisis, gold can be physically delivered and exchanged, serving as the ultimate safe haven. Bitcoin, conversely, is built upon the pillars of electricity, internet connectivity, and computational power (hash rate); its ownership relies on private keys, and its transactions depend entirely on network access.

Secondly, Bitcoin’s market performance increasingly aligns with that of a high-elasticity technology asset. During periods of ample liquidity and rising risk appetite, Bitcoin often leads market rallies. However, in environments of increasing interest rates and heightened risk aversion, institutional investors tend to reduce their Bitcoin exposure. The prevailing market sentiment suggests that Bitcoin has not yet definitively transitioned from a “risk asset” to a “safe-haven asset.” It embodies both the adventurous side of high growth and high volatility, and a hedging aspect against uncertainty. This “risk-safe-haven” ambiguity likely requires more market cycles and crises for its true nature to be unequivocally validated. Until then, the market largely continues to view Bitcoin as a high-risk, high-reward speculative asset, correlating its performance closely with technology stocks.

Perhaps only when Bitcoin demonstrates a stable store-of-value capability akin to gold can this perception truly shift. Yet, Bitcoin’s long-term value remains intact; it retains its inherent scarcity, global transferability, and the institutional advantages of decentralization. Its current market positioning, however, is more intricate, serving simultaneously as a pricing anchor, a trading asset, and a speculative instrument.

Defining the Roles: Gold acts as an inflation-hedging safe haven, while Bitcoin functions as a growth asset with strong return potential. Gold is ideal for preserving value during economic uncertainty, characterized by low volatility (16%) and minimal maximum drawdowns (-18%), serving as a portfolio’s “ballast.” Bitcoin, conversely, is best suited for periods of abundant liquidity and rising risk appetite, offering high annualized returns (up to 60.6%) but also high volatility (72%) and significant maximum drawdowns (-76%). This is not an either/or proposition, but rather a strategic combination within an asset allocation framework.

V. Expert Perspectives: Voices on the Macro Repricing

In this ongoing macroeconomic repricing, gold and Bitcoin are clearly assuming distinct roles. Gold is increasingly seen as a “shield,” designed to defend against external shocks such as war, inflation, and sovereign risk. Bitcoin, on the other hand, acts more like a “spear,” poised to seize value-creation opportunities driven by technological innovation.

OKX CEO Star Xu (@star_okx) emphasizes that gold is a product of old trust systems, while Bitcoin represents a new foundational credit for the future, suggesting that choosing gold in 2026 is akin to betting on a failing system. Bitget CEO Gracy Chen (@GracyBitget) acknowledges inevitable market volatility but asserts that Bitcoin’s long-term fundamentals remain unchanged, expressing continued optimism for its future performance. KOL @KKaWSB references Polymarket prediction data, forecasting that Bitcoin will outperform both gold and the S&P 500 in 2026, confident that its inherent value will eventually be realized.

KOL @BeiDao_98 offers an intriguing technical perspective: Bitcoin’s Relative Strength Index (RSI) against gold has once again fallen below 30, a historical signal that has often preceded a Bitcoin bull market. Renowned trader Vida (@Vida_BWE) focuses on short-term market sentiment, noting that after gold and silver’s explosive rally, the market is actively searching for the next “dollar alternative.” Consequently, Vida has taken a small Bitcoin position, betting on FOMO-driven capital rotation within weeks.

KOL @chengzi_95330 proposes a broader narrative arc. He suggests that traditional hard assets like gold and silver must first absorb the credit shock stemming from currency devaluation. Only after they fulfill this role will it be Bitcoin’s turn to enter the spotlight. This “traditional first, then digital” pathway may well be the unfolding story of the current market.

VI. Strategic Guidance: Three Recommendations for Retail Investors

Faced with the divergent performance of Bitcoin, gold, and silver, a common question among retail investors is: “Which one should I invest in?” There is no universal answer, but here are four practical recommendations:

- Understand Asset Positioning and Allocation Goals: Gold and silver retain strong “safe-haven” characteristics during macroeconomic uncertainty, making them suitable for defensive allocations. Bitcoin, currently, is better suited for periods of rising risk appetite and when technology growth narratives dominate. Resist the urge to chase quick riches with gold. For inflation hedging and risk aversion, consider gold. For long-term high returns, consider Bitcoin (but be prepared for potential -70% drawdowns).

- Temper Expectations: Bitcoin Won’t Always Outperform: Bitcoin’s growth stems from its technological narrative, market consensus, and institutional breakthroughs, not a linear return model. It will not outperform gold, Nasdaq, or oil every single year. However, its decentralized asset attributes hold significant long-term value. Avoid dismissing it entirely during short-term pullbacks, and equally, refrain from blindly going “all in” during rapid surges.

- Construct a Diversified Portfolio, Embrace Cyclicality: Accept that different assets will perform optimally in different market cycles. If you have a lower sensitivity to global liquidity dynamics or a limited risk tolerance, a combination of gold ETFs and a smaller Bitcoin allocation can help navigate various macroeconomic scenarios. For those with a higher risk appetite, consider integrating emerging assets like Ethereum, AI-focused projects, or Real World Assets (RWA) into a more volatile, growth-oriented portfolio.

- Consider Entry Points: Caution Against Chasing Highs in Gold/Silver: From a long-term perspective, gold, favored by global central banks, and silver, with its dual industrial and investment appeal, both retain significant allocation value in turbulent times. Short-term, however, their recent gains have been substantial, suggesting technical pullback pressure—the 3% single-day drop in gold on January 29 is a prime example. If you are a long-term investor, consider waiting for pullbacks to gradually accumulate, perhaps when gold is below $5,000 or silver below $100. Short-term speculators must be mindful of market timing, avoiding impulsive entries when market sentiment is at its peak. Conversely, while Bitcoin has underperformed, an improvement in future liquidity expectations could present an opportune window for lower-entry positioning. Focusing on market rhythm and avoiding chasing highs or panic selling remains a crucial defensive strategy for most investors.

Final Thoughts: Understanding Your Position is Key to Survival

When gold rallies, it doesn’t diminish Bitcoin’s intrinsic value. Similarly, Bitcoin’s declines do not unilaterally declare gold as the sole answer. In an era where value anchors are being reshaped, no single asset can fulfill all investment needs.

While gold and silver have led the charge in 2024-2025, extending the timeframe to 12 years reveals Bitcoin’s 213x return, proving that it may not be “digital gold,” but it stands as the greatest asymmetric investment opportunity of our time. Gold’s recent sharp decline could signify the end of a short-term adjustment, or perhaps the precursor to a more significant pullback.

For the average investor, the true imperative lies in comprehending the distinct roles and positioning of different assets, thereby forging a resilient investment logic to navigate and thrive across market cycles.

(The above content is an authorized excerpt and reprint from our partner PANews. Original link | Source: Biteye)

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only and do not constitute investment advice, nor do they represent the views or positions of BlockTempo. Investors should make their own decisions and trades, and the author and BlockTempo will not bear any responsibility for direct or indirect losses resulting from investor transactions.