Crypto Whale’s $250M Ethereum Bet Wipes Out Months of Gains After Legendary Shorting Success

A prominent figure in the cryptocurrency world, once lauded as the “Prophet Whale” for astutely shorting Bitcoin and Ethereum to net an astonishing $200 million last October, has faced a devastating reversal of fortune. Recent bullish bets have crumbled, leading to a near-total wipeout of accumulated profits.

According to meticulous tracking by on-chain data platform Arkham, as Ethereum’s price plunged, this high-profile trader was compelled to liquidate all his long ETH positions on Hyperliquid. This forced exit resulted in a staggering loss of approximately $250 million, leaving his account balance at a mere $53 and erasing months of significant paper gains.

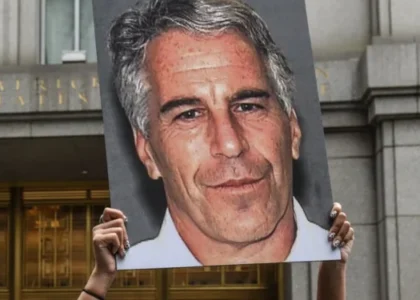

HYPERLIQUIDATED: HYPERUNIT WHALE [GARRETT JIN]

The Hyperunit whale, linked to Garrett Jin, has just sold HIS ENTIRE ETH POSITION, realizing a COMPLETE loss of $250 MILLION.

He has $53 left in his Hyperliquid account. pic.twitter.com/0qZBOoeqoI

— Arkham (@arkham) January 31, 2026

The “Prophet Whale’s” substantial losses coincide with a sharp downturn in Ethereum’s market value. CoinGecko market data indicates that Ethereum is currently trading around $2,246, marking a significant 21.5% decline over the past week. Analysts had previously issued warnings last week, highlighting the precarious nature of the whale’s extensive positions. As crypto prices steadily eroded throughout January, his unrealized losses swelled to $130 million, culminating in a forced liquidation amidst widespread market panic.

From Legendary Shorts to Controversial Longs

The “Prophet Whale” first captured global attention last October. Just moments before former U.S. President Donald Trump announced a 100% tariff increase on Chinese goods, the trader established over $1 billion in Bitcoin and Ethereum short positions. When the tariff news broke, the market reacted with a dramatic crash, triggering over $18 billion in liquidations across the network. From this volatility, the whale reportedly reaped approximately $200 million in profits.

What made this feat particularly striking was the timing: the final top-up of these massive short positions occurred precisely one minute before Trump’s tariff tweet. This uncanny timing fueled widespread speculation of potential “inside information,” adding a layer of intrigue to the trader’s identity and methods.

Further deepening the controversy, on-chain analyst Eye uncovered an indirect connection between the whale’s wallet and Garrett Jin, co-founder of the now-defunct cryptocurrency exchange BitForex. While Jin later clarified that “the funds are not mine, they are clients’,” he conceded knowing the individual behind the trades. This ambiguous relationship has only intensified market scrutiny on the whale’s activities.

Following his October triumph, the whale pivoted from shorting to aggressively longing the market. By mid-January, he had accumulated an astonishing $730 million in Ethereum long positions on Hyperliquid. Including Solana (SOL) and Bitcoin holdings, his total market exposure briefly exceeded $900 million. However, even this colossal bet proved insufficient to withstand the relentless downturn in the cryptocurrency market, ultimately forcing the “Prophet Whale” to completely unwind his positions.

Yet, Arkham’s data offers a crucial perspective: this devastating loss does not represent the entirety of the whale’s wealth. The data reveals that he still holds an estimated $2.7 billion worth of cryptocurrencies across other wallets. While the $250 million loss is undoubtedly painful, for this enigmatic trader, it may ultimately serve as an expensive, albeit significant, “stop-loss” lesson in the volatile world of crypto trading.

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of the author or BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not be liable for any direct or indirect losses incurred by investors’ transactions.