By Mandy & Azuma, Odaily Planet Daily

This past weekend, battered by both internal and external pressures, the cryptocurrency market endured yet another brutal sell-off. Bitcoin (BTC) currently hovers precariously near its strategic holding cost of $76,000, while the mere sight of altcoin prices is enough to make one wince. Amidst this pervasive gloom, a critical question has repeatedly surfaced in my discussions with project teams, funds, and exchanges:

What will the cryptocurrency market truly be trading a year from now?

The more fundamental query underpinning this is: If the primary market ceases to cultivate the “future of the secondary market,” what then will the secondary market engage in, and how will exchanges evolve to meet these new demands?

The notion of “altcoins are dead” is hardly novel, yet the market has not been short on projects over the last year. Daily, new projects queue up for Token Generation Events (TGEs), and from a media perspective, we remain actively engaged in promoting numerous project teams.

(It’s important to clarify that, in this context, “projects” largely refers to “project teams” in the narrow sense—those building foundational infrastructure and decentralized applications that either benchmark Ethereum or its ecosystem, specifically “token-issuing projects.” These form the bedrock of what we consider native innovation and entrepreneurship in our industry, distinct from phenomena like Memes.)

However, a closer look at the timeline reveals an uncomfortable truth we’ve largely avoided: many of these impending TGEs are from “legacy projects.” The majority secured funding 1-3 years ago and are only now reaching their token issuance phase, often compelled by mounting internal and external pressures.

This feels akin to an “industry inventory clear-out,” or, more starkly, a procession to fulfill their lifecycle obligations, issue tokens, provide an accounting to teams and investors, and then quietly await their demise, or perhaps spend their remaining capital hoping for a miraculous turnaround.

The Erosion of the Primary Market

For industry veterans like us, who entered during the ICO era or even earlier, navigated multiple bull-bear cycles, and witnessed the transformative power of crypto’s early dividends, there’s a subconscious belief: given enough time, new cycles, new projects, new narratives, and new TGEs will inevitably emerge.

Yet, the current reality places us far outside that comfortable assumption.

Direct data paints a stark picture: over the most recent four-year cycle (2022-2025), excluding specific primary market activities such as M&A, IPOs, or public fundraising, the number of funding rounds in the crypto industry has exhibited a pronounced decline (1639 > 1071 > 1050 > 829).

The situation on the ground is even grimmer than the numbers suggest; the primary market isn’t merely shrinking in overall funding but is undergoing a structural collapse.

Over the past four years, early-stage funding rounds (including angel, pre-seed, and seed rounds)—which typically signify new industry blood—have seen a steeper decline than the overall market (dropping 63.9% from 825 to 298 rounds over four years, compared to an overall decline of 49.4%). This highlights a persistent contraction in the primary market’s ability to inject fresh capital into the industry.

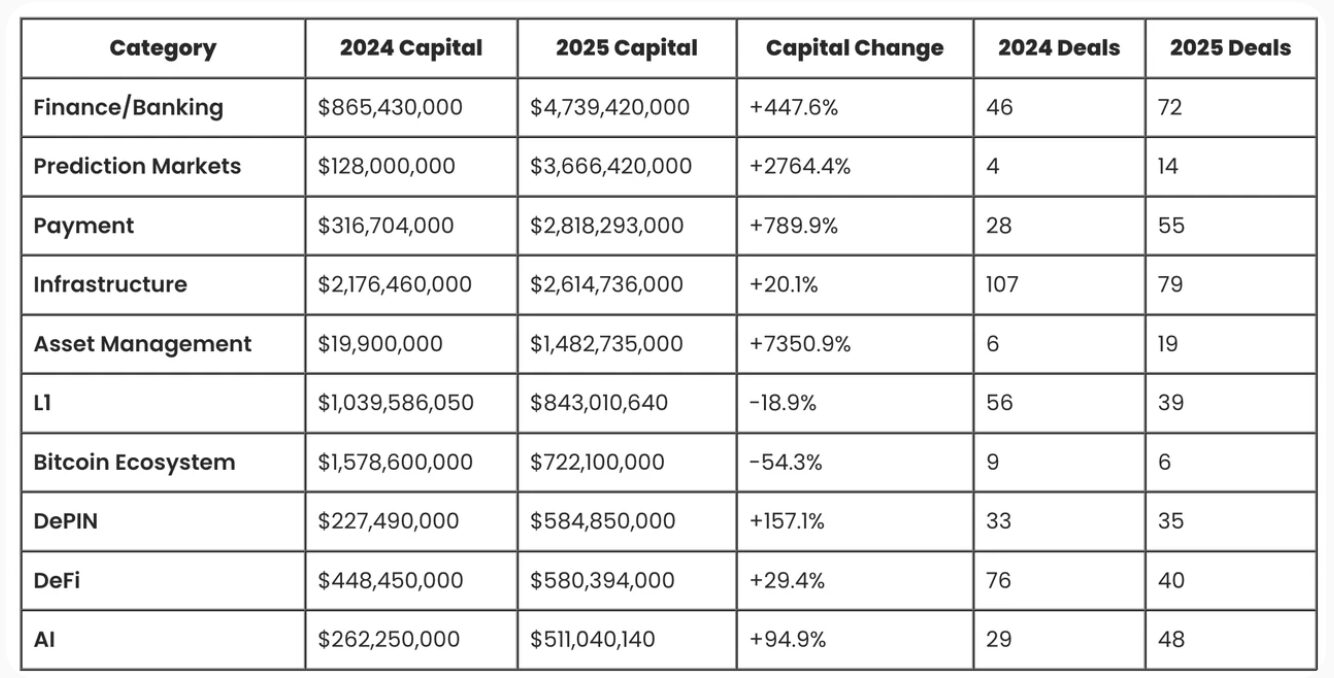

While a few sectors like financial services, exchanges, asset management, payments, and AI, which leverage crypto technology, have seen an uptick in funding rounds, their direct relevance to token-issuing projects is limited. Most, frankly, do not “issue tokens.” Conversely, funding for truly native “projects” such as L1s, L2s, DeFi, and social platforms has experienced a far more significant downturn.

A common misinterpretation of the data is the rise in average funding per round despite fewer overall deals. This anomaly is largely due to “mega-projects” attracting substantial capital from traditional finance, significantly skewing the average. Additionally, prominent VCs are increasingly concentrating their investments on a select few “super projects,” exemplified by Polymarket’s multiple nine-figure funding rounds.

This top-heavy, vicious cycle is even more pronounced when viewed from the perspective of crypto capital.

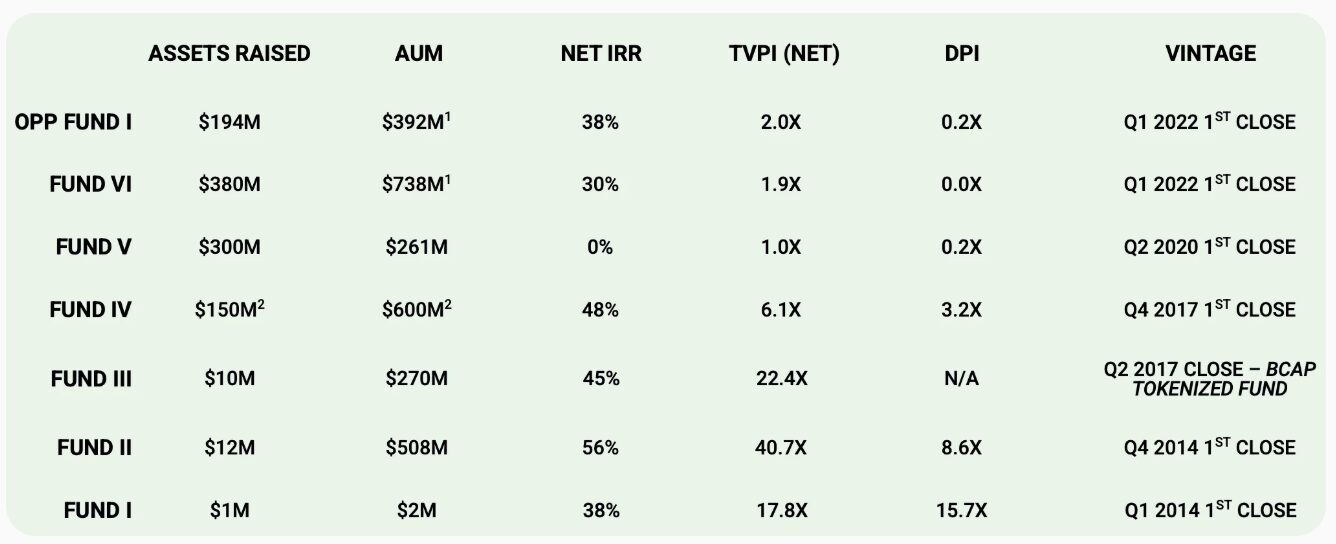

A friend outside the industry recently expressed confusion after reviewing the fundraising deck of a renowned, long-established crypto fund, questioning why their returns were “so poor.” The table below presents actual data from that deck, covering the fund’s performance from 2014-2022, without disclosing its name.

The data clearly illustrates a significant shift in the fund’s Internal Rate of Return (IRR) and Distributed to Paid-In (DPI) between 2017 and 2022. IRR reflects the fund’s annualized paper returns, while DPI represents the actual cash distributions made to Limited Partners (LPs).

Examining different vintage years reveals a distinct “cycle discontinuity” in fund returns: Funds established between 2014 and 2017 (Fund I, II, III, IV) significantly outperformed, with Total Value to Paid-In (TVPI) typically ranging from 6x to 40x, Net IRR maintained between 38% and 56%, and robust DPI figures. This indicates not only substantial paper gains but also significant cash realization, capitalizing on the explosive growth of early crypto infrastructure and leading protocols.

In stark contrast, funds launched after 2020 (Fund V, VI, and the 2022 Opportunity Fund) show a marked decline. Their TVPI largely hovers between 1.0x and 2.0x, with DPI near zero or extremely low. This signifies that most returns remain on paper, failing to translate into tangible exits. This trend reflects a landscape of inflated valuations, intensified competition, and a decline in the quality of project supply, preventing the primary market from replicating the outsized returns previously driven by “new narratives and new asset classes.”

The underlying truth is that post-DeFi Summer 2019, crypto-native protocols saw inflated primary market valuations. When these projects eventually issued tokens two years later, they often faced narrative fatigue, industry contraction, exchanges wielding disproportionate power, and even last-minute term sheet alterations. Consequently, performance has been largely underwhelming, with many projects trading below their initial valuations (market cap inversions), leaving investors in a vulnerable position and funds struggling to exit profitably.

Despite these challenges, cyclically misaligned capital could still create an illusion of localized prosperity. However, the grim reality of the data only became truly apparent when some massive, high-profile funds began their recent fundraising efforts.

The fund I referenced, managing nearly $3 billion, serves as a poignant mirror for the industry cycle: success or failure is no longer merely a matter of individual project selection; the broader tide has turned.

While established funds now face arduous fundraising journeys, many can still survive by maintaining status quo, collecting management fees, or pivoting towards AI investments. However, a significant number of other funds have already ceased operations or redirected their focus to the secondary market.

For instance, Mr. Yilihua, now hailed as the “Ethereum King” in the Chinese market, was not long ago a leading figure in the primary market, investing in over a hundred projects annually.

Meme is Not the Altcoin Successor

While we discuss the depletion of crypto-native projects, the explosion of Memes often serves as a counter-argument.

For the past two years, a recurring industry assertion has been: Meme coins are the alternative to altcoins.

However, in retrospect, this conclusion has been largely disproven.

In the nascent stages of the Meme wave, we approached them with the same analytical rigor applied to “mainstream altcoins”—sifting through countless Meme projects for supposed fundamentals, community quality, and narrative coherence, hoping to unearth the next long-term survivor, the next Doge, or even “the next Bitcoin.”

Today, if someone advises you to “HODL a Meme coin,” you’d likely question their sanity.

Contemporary Memes represent an instant monetization mechanism for fleeting popularity: a dynamic interplay of attention and liquidity, often mass-produced by developers and AI tools.

They embody an asset class characterized by an extremely short lifecycle but a continuous, high-volume supply.

Their objective is no longer “survival” but rather to be seen, be traded, and be exploited.

Our team includes several consistently profitable Meme traders who, notably, focus not on a project’s future but on market rhythm, diffusion speed, emotional structures, and liquidity pathways.

Some claim Memes are no longer viable, but in my view, the “final cut” following events like Trump’s engagement has paradoxically allowed Memes, as a distinct asset class, to truly mature.

Meme coins were never intended as substitutes for “long-term assets.” Instead, they represent a return to the core principles of attention finance and liquidity games. They have become purer, more brutal, and ultimately less suitable for the majority of ordinary traders.

Seeking External Solutions: A New Frontier for Crypto Trading

Asset Tokenization: Bridging Traditional Finance

So, as Memes professionalize, Bitcoin institutionalizes, altcoins languish, and the pipeline for new crypto-native projects dwindles, what avenues remain for the average, value-seeking, analytically-minded speculator—one who isn’t merely a high-frequency gambler but desires sustainable engagement?

This isn’t a question solely for retail investors.

It equally challenges exchanges, market makers, and platforms. After all, the market cannot indefinitely rely on escalating leverage and increasingly aggressive derivatives to maintain activity.

Indeed, as the traditional market logic began to falter, the industry proactively sought external solutions.

The prevailing direction under discussion is the repackaging of traditional financial assets into on-chain tradable instruments.

Tokenized stocks and precious metal assets are rapidly becoming a strategic imperative for exchanges. From established centralized exchanges to decentralized platforms like Hyperliquid, this path is seen as crucial for breaking the current deadlock. Market response has been notably positive: during last week’s fervent precious metals trading, Hyperliquid’s single-day silver trading volume briefly surged past $1 billion, with tokenized stocks, indices, and precious metals dominating the top ten trading volumes.

Admittedly, current aspirations like “offering new, low-barrier options for traditional investors” remain premature and largely unrealistic for now.

However, from a crypto-native perspective, tokenization offers a potent solution to an internal crisis: When the supply of native assets and compelling narratives slows, old coins stagnate, and new projects dry up, what fresh trading impetus can cryptocurrency exchanges provide to the market?

Tokenized assets offer a familiar entry point for many. Historically, our research focused on public chain ecosystems, protocol revenue, tokenomics, unlock schedules, and narrative potential.

Now, the analytical lens is shifting towards macroeconomic data, financial reports, interest rate expectations, industry cycles, and policy variables—many of which, of course, we’ve already begun to scrutinize.

Fundamentally, this represents a migration of speculative logic, not merely an expansion of asset categories.

The listing of tokenized gold and silver isn’t just about adding more symbols; it’s a deliberate attempt to introduce new trading narratives—to integrate the volatility and rhythms traditionally confined to conventional financial markets directly into the cryptocurrency trading ecosystem.

Prediction Markets: Trading Uncertainty Itself

Beyond bringing “external assets” onto the blockchain, another compelling direction involves introducing “external uncertainties” on-chain: prediction markets.

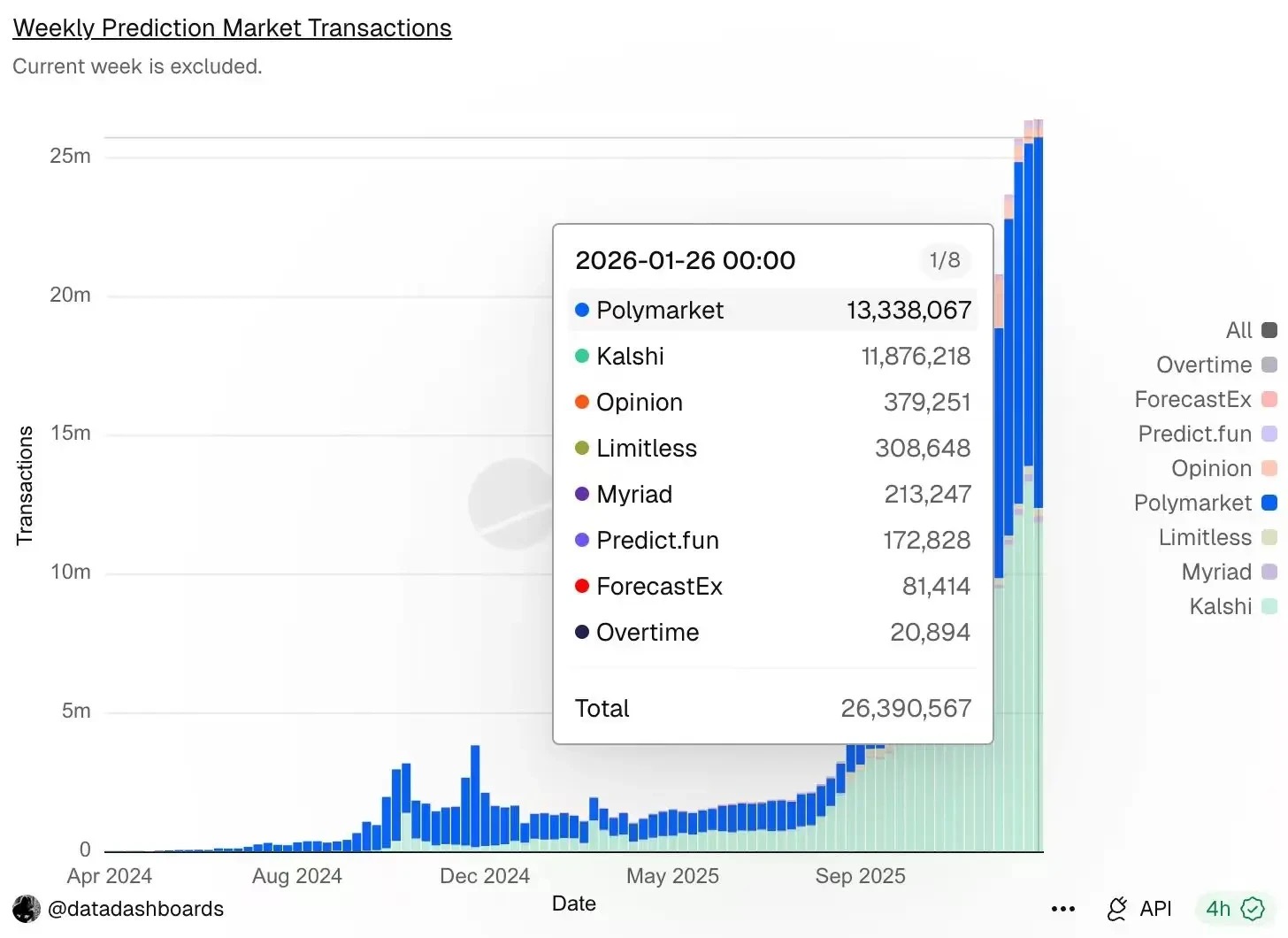

According to Dune data, despite the crypto market’s sharp decline last weekend, prediction market activity not only held steady but surged, with weekly transactions hitting a new all-time high of 26.39 million. Polymarket led with 13.34 million transactions, closely followed by Kalshi with 11.88 million.

The extensive potential and projected scale of prediction markets are topics we won’t delve deeply into here, as Odaily has been publishing multiple analyses daily; readers are encouraged to explore these resources independently.

Instead, I want to address why crypto users engage with prediction markets. Is it simply because we are all inherent gamblers?

Undoubtedly, yes.

For a considerable period, altcoin traders were not primarily betting on technological advancements but on specific events: whether a coin would be listed, official partnership announcements, impending token launches, new feature deployments, favorable regulatory news, or the ability to capture the next narrative wave.

Price was merely the outcome; the event was the catalyst.

Prediction markets, for the first time, unbundle this “implicit variable within the price curve” into a directly tradable object.

You no longer need to indirectly speculate on an outcome by purchasing a token; you can directly wager on the occurrence of the event itself.

Crucially, prediction markets are exceptionally well-suited to the current environment characterized by “a dwindling supply of new projects and narrative scarcity.”

As the availability of new tradable assets diminishes, market attention naturally gravitates towards macroeconomics, regulation, politics, the actions of influential figures, and significant industry milestones.

In essence, while tradable “targets” are becoming scarcer, the universe of tradable “events” is not shrinking; in fact, it’s expanding.

This explains why nearly all the significant liquidity generated by prediction markets in the past two years has originated from non-crypto-native events.

It fundamentally involves importing the uncertainties of the external world into the internal cryptocurrency trading system. From a user experience perspective, it is also highly accessible to existing crypto traders:

The core problem is distilled into two straightforward questions: Will this outcome happen? And, is the current probability priced fairly?

Unlike Meme trading, the barrier to entry for prediction markets lies not in execution speed but in informed judgment and structural comprehension.

Framed this way, it suddenly feels much more approachable, doesn’t it?

Conclusion

The “crypto circle” as we know it may well be on an inevitable path towards obsolescence. Yet, before its demise, we continue to innovate and adapt. As “new coin-driven trading” gradually recedes, the market will invariably seek new speculative vehicles—ones with low entry barriers, compelling narrative potential, and sustainable development.

In essence, the market won’t disappear; it will merely migrate. When the primary market no longer generates future opportunities, the secondary market’s true trading focus will pivot to two key elements: the inherent uncertainties of the external world, and tradable narratives that can be continually reimagined and reconstructed.

Our task, perhaps, is to proactively adapt to this impending shift in speculative paradigms.

(The content above is an authorized excerpt and reprint from our partner PANews. Original Link | Source: Odaily Planet Daily)

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only and do not constitute investment advice. They do not represent the views and positions of Blockcast. Investors should make their own decisions and trades. The author and Blockcast will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.