The cryptocurrency market is currently navigating turbulent waters, marked by widespread retail investor distress and institutional capital withdrawals. Now, even the industry’s foundational “producers”—Bitcoin miners—are showing signs of unease. On-chain data from monitoring platform Arkham reveals that MARA Holdings, a leading global Bitcoin mining firm, recently transferred a significant 1,318 BTC, valued at approximately $86.89 million, to various counterparties and custodial services. This substantial movement has ignited strong market speculation and anxiety, with many fearing it signals an impending “forced sell-off” by miners to bolster dwindling cash reserves.

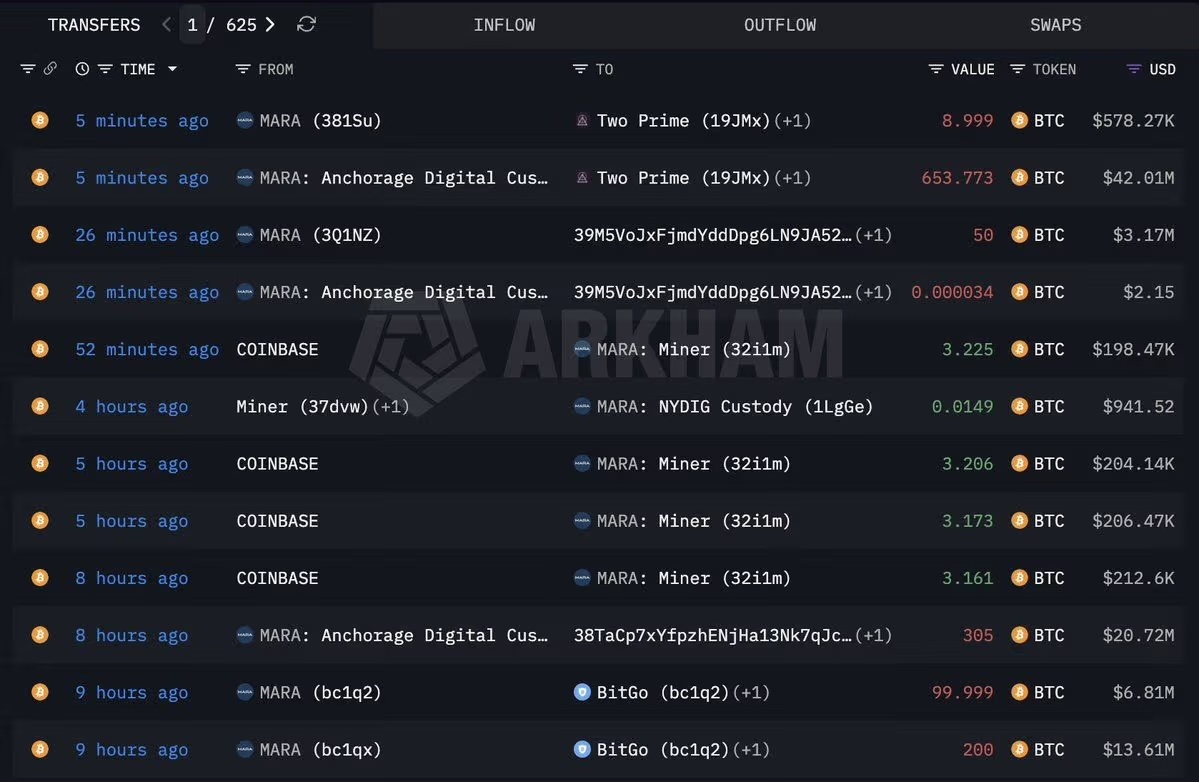

A closer examination of the transfer structure indicates that the largest portion of these funds was directed to Two Prime. On-chain records detail an initial transfer of 653.773 BTC, valued at roughly $42.01 million, followed by an additional 8.999 BTC, worth approximately $578,000, shortly thereafter.

Two Prime operates as a prominent credit and trading counterparty within the cryptocurrency ecosystem. Consequently, the precise intent behind these transfers remains unclear. It could signify the integration of these assets into a yield-generating investment strategy, or, more concerningly, a direct sale into the spot market.

Further transfers by MARA Holdings include 200 BTC and 99.999 BTC, totaling approximately $20.40 million, sent to BitGo addresses. As a leading cryptocurrency custodian, BitGo is frequently utilized for secure asset storage and various institutional-grade operations, suggesting a potential shift in asset management.

The remaining 305 BTC, valued at roughly $20.72 million, were routed to new, as-yet-unlabeled wallet addresses. The specific purpose of these transfers remains under close observation.

Why is the Market So Apprehensive? The Critical Role of Timing

While substantial transfers by miners don’t automatically equate to immediate sell-offs—they could be routine financial rebalancing, asset custody migrations, or preparations for over-the-counter (OTC) deals—the current market context amplifies concerns. In an environment characterized by severely diminished liquidity, even minor movements are often interpreted as potential supply warnings, thereby exacerbating existing market jitters.

Crucially, MARA Holdings’ substantial Bitcoin transfers coincide with a period of intense pressure across the entire mining industry.

Recent data from Checkonchain highlights the severe economic squeeze on miners: the average cost to produce one Bitcoin currently stands at an estimated $87,000. This figure starkly contrasts with Bitcoin’s current spot price, which has been oscillating around $65,000 and briefly plunged below $60,000 earlier today.

Historically, a sustained period where Bitcoin’s market price falls below its production cost is a hallmark of a bear market. Such conditions invariably force less efficient miners to power down their operations and exit the market. More critically, it can trigger a “miner capitulation” event—a scenario where miners are compelled to liquidate their Bitcoin reserves at depressed prices to cover mounting electricity bills and operational expenses, further intensifying downward price pressure.

Disclaimer: This article is intended solely to provide market information. All content and opinions are for reference only and do not constitute investment advice, nor do they represent the views or positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo shall not be held liable for any direct or indirect losses incurred by investors as a result of their trading.