In the fast-paced world of cryptocurrency, a mere 15 minutes can be the difference between fortune and failure. While many see it as just another candlestick forming on a chart, for participants in the Bitcoin short-term prediction market, this brief window often dictates the outcome of their trades, a true “make or break” moment.

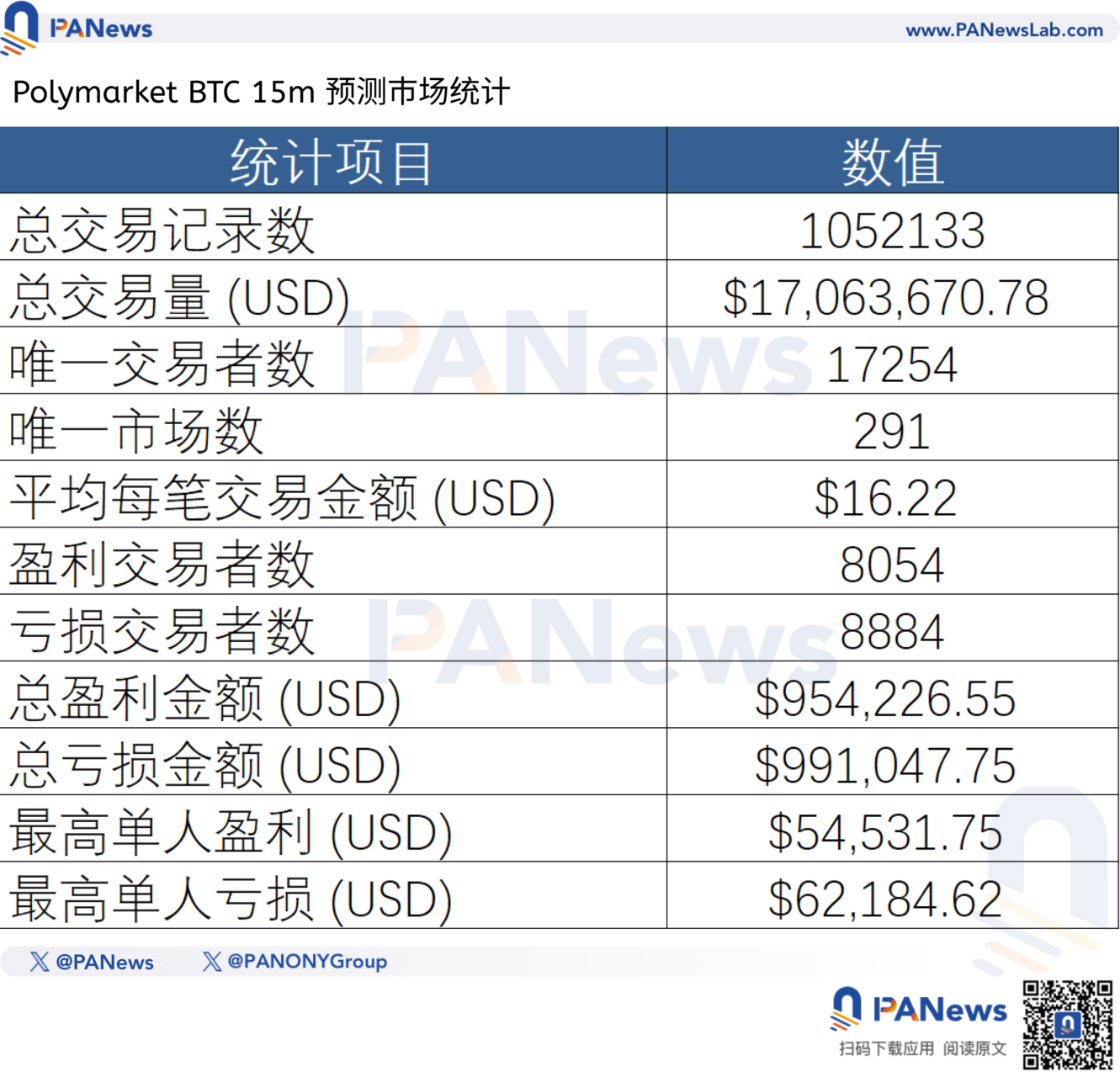

Recently, the analytical experts at PANews delved deep into the Bitcoin 15-minute price prediction market. Our comprehensive data review, spanning roughly three days, encompassed 291 distinct short-term markets and a staggering 1.05 million transactions. What emerged from this vast dataset was far more than cold statistics; it unveiled an intense, unvarnished battle between sophisticated algorithms and raw human intuition.

This market is no casual arena for the lucky; it is a complex, layered ecosystem where a minuscule 3.6% of algorithmic robots wield dominant control.

The Retail Arena: A Bustling Ant Market

At first glance, the macro data paints a picture of vibrant activity within this market.

Over the three-day analysis period, the Bitcoin 15-minute prediction market facilitated an impressive 1.05 million transactions, accumulating a total trading volume of approximately $17 million. On average, each individual market saw about $58,600 in volume. While substantial, it’s worth noting that the scale of these crypto prediction markets remains modest compared to the vast liquidity of traditional cryptocurrency exchanges.

During this timeframe, 17,254 unique addresses actively participated in trading, with an average of 881 distinct addresses per market. The average transaction size stood at a mere $16.22. This crucial detail suggests that the market’s primary drivers are not institutional giants engaging in high-stakes duels, but rather thousands of retail investors frequently placing small, speculative “lottery ticket” style bets.

Out of the total participants, 8,054 addresses registered profits, while 8,884 unique addresses incurred losses, a near 1:1.1 ratio. This balanced distribution indicates that the market avoids outright “massacres,” with most losing participants experiencing only minor setbacks. This creates a deceptive sense of “still being in the game,” effectively retaining a large user base.

However, the inherent limitations of market depth are starkly evident. Our data reveals that the most profitable address accrued a total of $54,531, while the address with the largest loss recorded a deficit of $62,184. This clearly demonstrates that the market’s liquidity constraints cap the potential for significant gains by large-volume players. Generating multi-million dollar profits from a single trade here is challenging, primarily because the counterparty’s capital reserves are simply not deep enough.

The median entry point across all addresses was 0.544, suggesting that buyers generally entered with strong conviction in either bullish or bearish movements. Yet, the median exit point plummeted to 0.247. This significant drop indicates that the vast majority of active selling was driven by “panic selling,” often resulting in an average loss of around 50% per trade. This pattern highlights a common retail investor dilemma: an inability to hold onto winning positions, coupled with frequent, often ill-advised, attempts to manage losing trades, ultimately surrendering their assets to market makers at unfavorable prices.

Algorithms vs. Humanity: The 3.6% Machine Domination

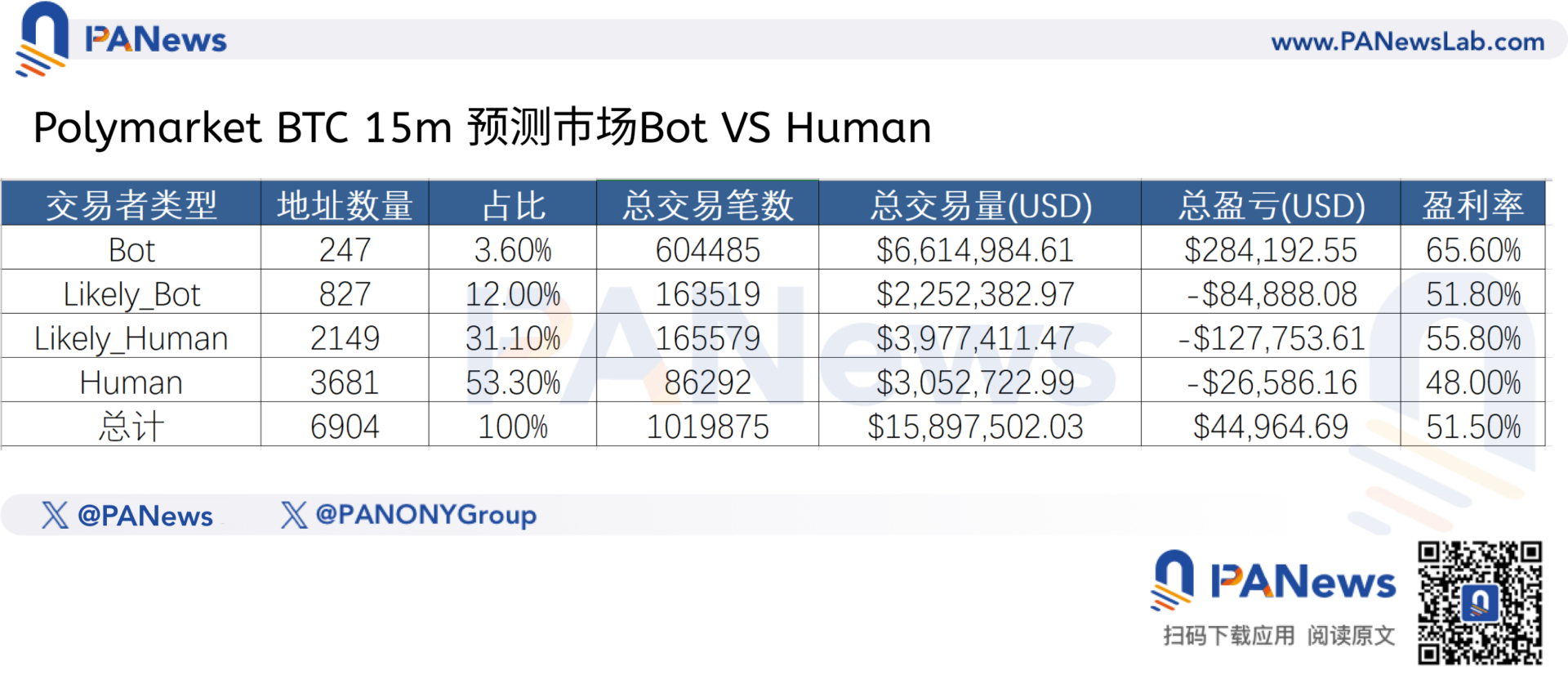

While retail investors navigate the market with psychological biases, their adversaries are engaged in a relentless, systematic algorithmic assault. Our data analysis starkly reveals a brutal truth: manual traders in this market are being comprehensively outmaneuvered by automated algorithms.

The evidence is undeniable: robot addresses consistently and overwhelmingly outperform human participants in terms of profitability.

Despite their minuscule representation—just 247 robot addresses, accounting for a mere 3.6% of all participants—these automated entities executed over 600,000 transactions, comprising more than 60% of the total trading activity. This dominance underscores a critical dynamic: a select few algorithms dictate pricing and liquidity, while the vast majority of retail investors serve as a continuous source of capital, essentially becoming market “consumables.”

Interestingly, the transaction value generated by robots and real users was relatively comparable, indicating that while humans are numerous, their individual trade sizes might be larger on average, or robots are simply more efficient at capturing value from smaller trades.

However, the robots’ superiority in earnings is pronounced. Over the three-day period, pure robot addresses collectively amassed approximately $284,000 in profit. In stark contrast, all other categories—including semi-robot, semi-human, and purely human trading addresses—recorded overall negative earnings. Real traders, in particular, suffered a collective loss of $154,000. This pattern illustrates that virtually every instance of excess profit within this market is a direct transfer from the pockets of human participants to the accounts of algorithmic entities. Manual trading, when pitted against high-frequency algorithms, faces an almost insurmountable disadvantage.

The disparity extends to success rates as well: robot addresses boasted an average win rate of about 65.5%, significantly higher than the 51.5% achieved by real users.

This analysis unequivocally demonstrates that the crypto short-term prediction market is currently structured as a machine-driven harvesting ground for human traders. The performance gap between manual trading and high-frequency algorithmic strategies is immense. Conversely, this also provides compelling evidence that strategic algorithm optimization can indeed yield substantial, abnormal returns within these prediction markets.

Decoding Smart Money: Precision Over Pace

Despite the algorithmic dominance, it would be a grave error to assume that simply deploying a script or a bot guarantees effortless profits. Our examination of the top-earning addresses revealed a counter-intuitive phenomenon: even within the realm of robots, there’s a significant divergence in strategies. High frequency does not automatically equate to high profitability.

Consider address 0x5567…a7b1, which executed the highest number of transactions across all participants—over 33,700 trades, averaging more than 67 transactions per hour. Yet, its total profit was a relatively modest $4,989, translating to an average of just $0.14 per trade.

This isn’t an isolated incident. Data indicates that among ultra-high-frequency addresses, those executing over 50 trades per hour, only 40% managed to turn a profit. The average return for this entire group was a dismal -10%. In an environment plagued by rising gas fees, slippage, and intense competition, robots that blindly prioritize speed often find themselves merely enriching network miners rather than their operators.

In contrast, address 0x0ea5…17e4, another robot, secured the top spot in overall profitability. Interestingly, its trading frequency was considerably lower, averaging only 22 transactions per hour, and it participated in just 61% of the available markets. This suggests a highly selective trading logic: this bot doesn’t place orders every second but instead operates based on specific, predefined screening conditions, only engaging when the market aligns with its precise criteria. This calculated approach yielded an impressive 72% win rate and a total profit of approximately $54,500.

Risk Management: The Human Trader’s Achilles’ Heel

Despite the overwhelming algorithmic advantage, our data analysis offers a glimmer of hope for human traders.

We observed that addresses engaging in extremely low-frequency trading (less than one transaction per hour) achieved an average win rate of 55%. This figure significantly surpasses that of high-frequency robots that blindly churn out trades. This suggests that, without the sophisticated backing of top-tier algorithms, human manual judgment, driven by market intuition and logical analysis, can actually yield a higher win rate than many algorithm-driven bots.

So, where do humans falter? The data points to a critical flaw: risk management.

Low-frequency human traders (1-5 transactions per hour) recorded the highest average loss per trade, approximately $47, across all address categories. Human traders often possess the ability to correctly identify market direction, but the inherent weaknesses of human psychology lead them to stubbornly hold onto losing positions while failing to capitalize on winning ones. Ultimately, this detrimental “small gains, big losses” profit-loss ratio becomes the most significant impediment for human traders in this market.

The analysis of 1.05 million transactions and $17 million in liquidity unveils a harsh reality:

The Bitcoin 15-minute prediction market is far from a retail investor’s ATM. Instead, it operates as a sophisticated food chain where elite algorithms prey on less effective algorithms, which in turn prey on human traders.

For the average participant, the data delivers an unequivocally stark recommendation: either evolve into a top-tier sniper with a 72% win rate, or adopt the disciplined approach of an extremely restrained, low-frequency hunter. Any other strategy—any frequent operation, any attempt to bridge a technical gap through sheer “diligence”—will ultimately relegate you to merely supplying profits to this vast, complex ecosystem.