Beyond Branded Shards: Vitalik Buterin’s Bold New Vision for Ethereum L2s

As an individual deeply immersed in the realm of blockchain scalability research since 2015, I’ve witnessed the full evolution of technical pathways, from sharding and Plasma to application chains and the rise of Rollups. In 2021, I founded AltLayer, dedicating our efforts to app Rollups and Rollup-as-a-Service solutions, fostering close collaborations with all leading Rollup tech stacks and teams across the ecosystem. It is with this extensive background that I approached Vitalik Buterin’s recent discourse, which fundamentally redefines our understanding of Layer 2 (L2) networks. His latest article marks a pivotal moment, signaling a crucial strategic recalibration for Ethereum’s future.

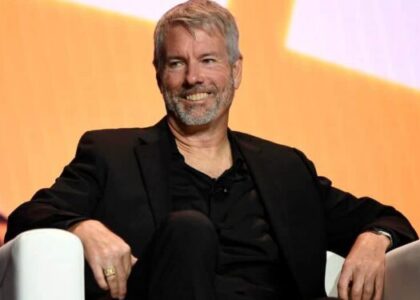

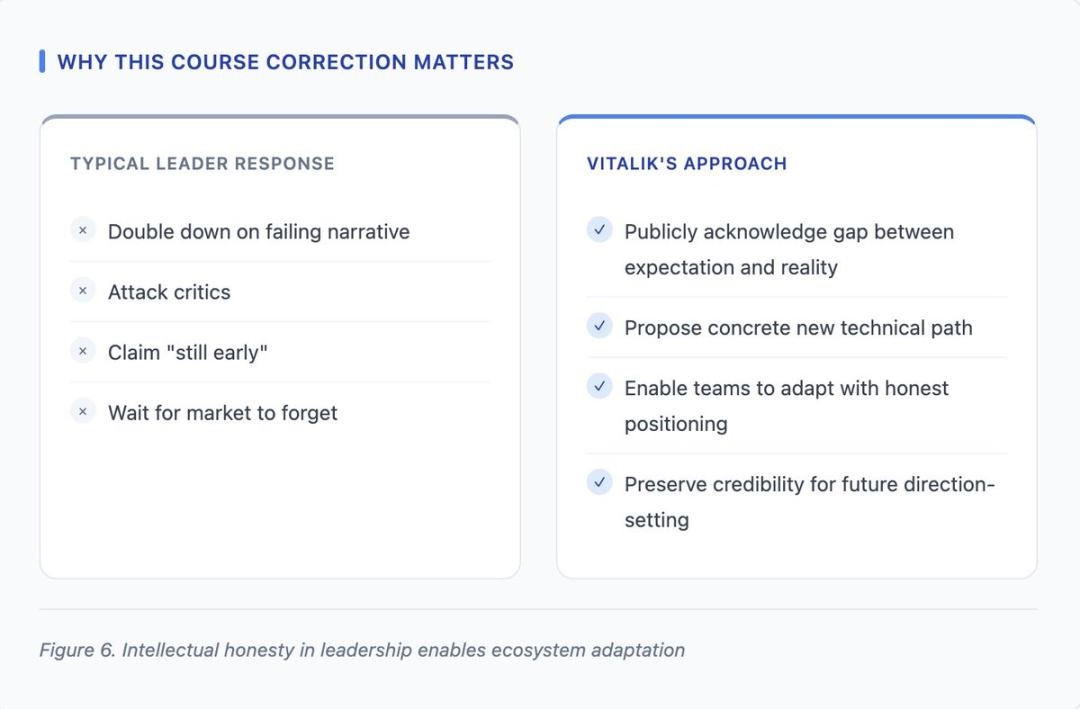

Vitalik’s move is far from easy. It takes immense courage for a leader to openly admit that core assumptions made in 2020 have not materialized as anticipated – a level of candor often absent in leadership. The original Rollup-centric roadmap was predicated on the idea that L2s would function as “branded shards” of Ethereum. However, four years of market data paint a different picture: L2s have evolved into autonomous platforms, driven by their own independent economic incentives. Concurrently, Ethereum’s Layer 1 (L1) has scaled faster than expected, rendering the initial framework increasingly detached from current realities.

It would have been simpler to cling to the old narrative, to continue pushing teams towards a vision that the market has since disproven. Yet, true leadership demands more. It requires acknowledging the disparity between expectations and reality, charting new courses, and guiding the ecosystem toward a more promising future. Vitalik’s latest insights exemplify this very responsibility.

The Evolving Reality of L2s

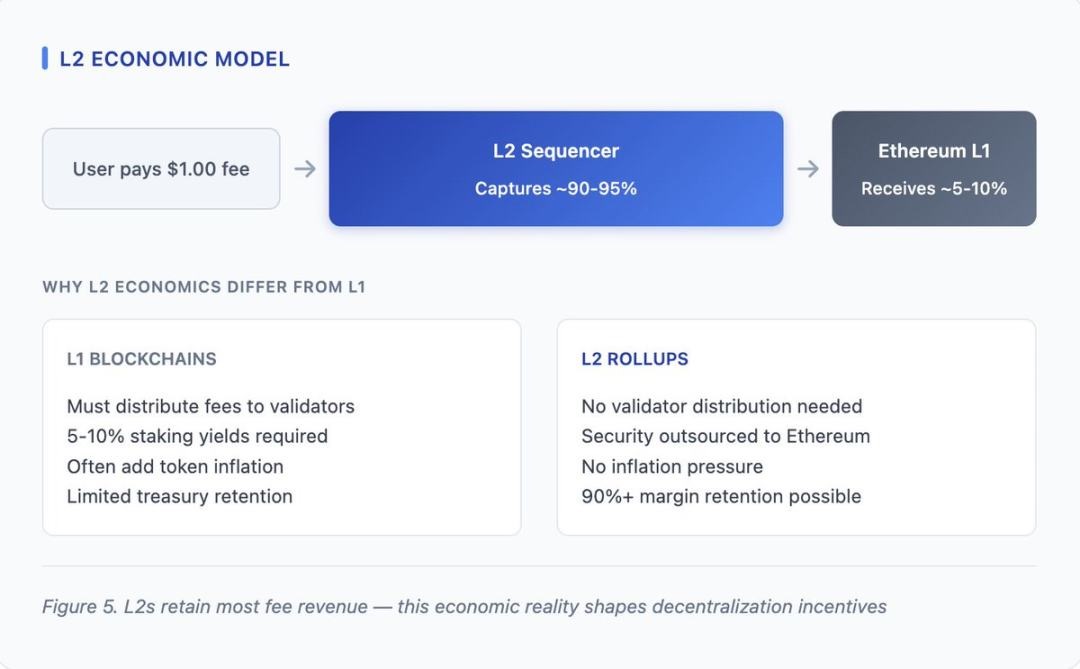

Vitalik’s analysis highlights two interconnected realities that necessitate this strategic pivot. Firstly, the decentralization of L2s has progressed slower than anticipated. Currently, only three major L2s – Arbitrum, OP Mainnet, and Base – have achieved Stage 1 decentralization. Furthermore, some L2 teams have explicitly stated that, due to regulatory imperatives or limitations inherent in their business models, they may never pursue full decentralization. This isn’t a moral failing but rather a reflection of the economic realities, where sequencer revenue serves as a primary business model for L2 operators.

Secondly, Ethereum’s L1 has achieved substantial scaling. Transaction fees are currently low, the Pectra upgrade has doubled data block capacity, and further increases to the gas limit are expected before 2026. The initial Rollup roadmap was conceived during a period of high L1 fees and congestion, a premise that no longer holds true. Today, L1 can process a significant volume of transactions at a reasonable cost, fundamentally altering the value proposition of L2s: they are transitioning from a “necessity for guaranteed availability” to an “optional choice for specific use cases.”

Reconceptualizing the Trust Spectrum

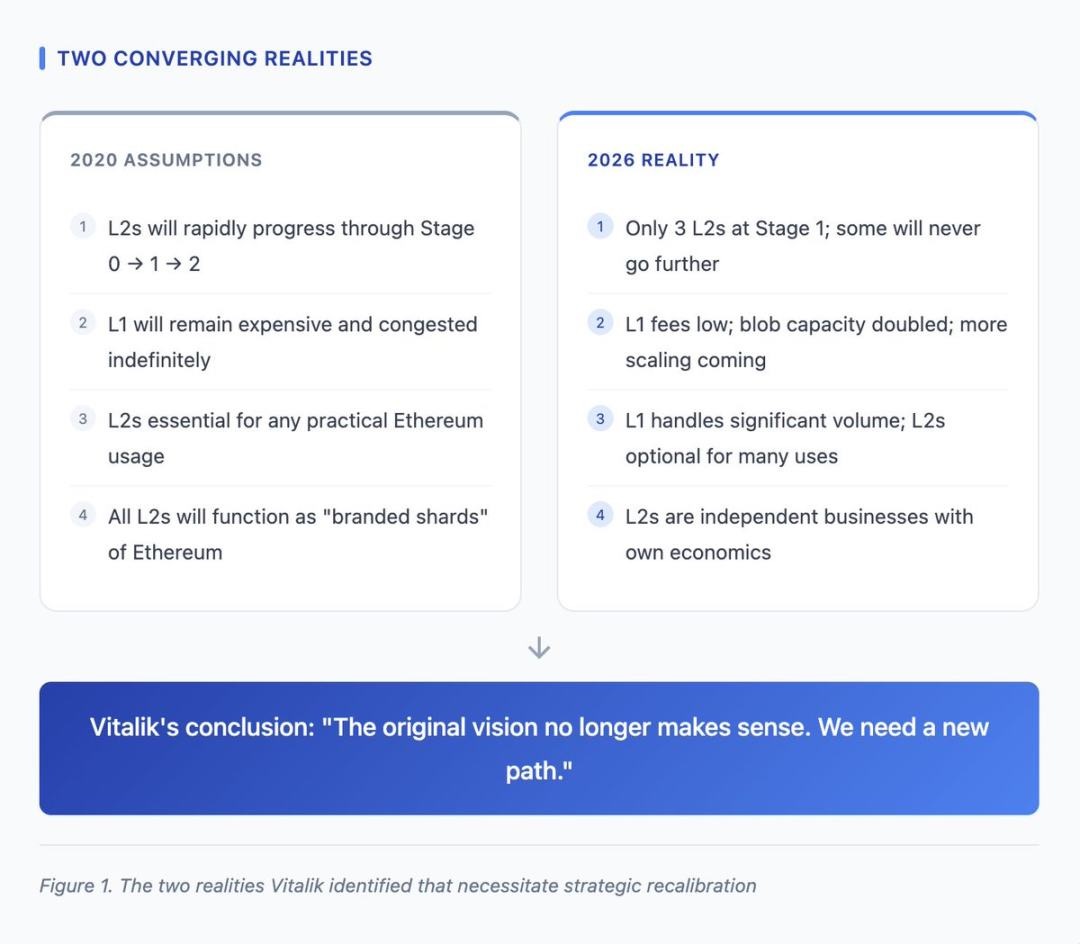

Vitalik’s most significant theoretical contribution is his redefinition of L2s as existing on a continuous spectrum of trust, rather than as a monolithic category with uniform obligations. The “branded shard” metaphor previously suggested that all L2s should aspire to Stage 2 decentralization, operating as direct extensions of Ethereum’s security and value. The new framework, however, acknowledges that diverse L2s serve distinct objectives. For projects with specialized requirements, achieving Stage 0 or Stage 1 decentralization can be a perfectly legitimate and reasonable endpoint.

This reconceptualization carries profound strategic implications. It effectively removes the implicit judgment that an L2 failing to pursue full decentralization is inherently flawed. For instance, a regulated L2 designed for institutional clients requiring asset freezing capabilities is not an incomplete version of Arbitrum; it is a differentiated product tailored for a distinct market segment. By legitimizing this spectrum of existence, Vitalik empowers L2s to honestly position themselves, freeing them from making decentralization promises that lack economic incentive or practical viability.

Technical Innovation: Native Rollup Precompiles

At the technical heart of Vitalik’s article lies the proposal for native Rollup precompiles. Currently, each L2 develops its own bespoke system for proving state transitions back to Ethereum. Optimistic Rollups employ fraud proofs with a 7-day challenge period, while ZK Rollups rely on validity proofs generated from custom circuits. Each of these implementations demands independent auditing, may harbor hidden vulnerabilities, and requires synchronous upgrades whenever an Ethereum hard fork modifies EVM behavior. This fragmentation introduces significant security risks and maintenance overhead for the entire ecosystem.

Native Rollup precompiles envision EVM execution validation functions directly embedded within Ethereum itself. This would liberate individual Rollups from maintaining custom proving systems; instead, they could simply invoke this shared, foundational infrastructure. The advantages are compelling: replacing dozens of disparate implementations with a single, audited codebase, automatically ensuring compatibility with future Ethereum upgrades, and potentially allowing for the phased removal of security council mechanisms once the precompile functionality is robustly battle-tested.

Technical Innovation: Synchronous Composability

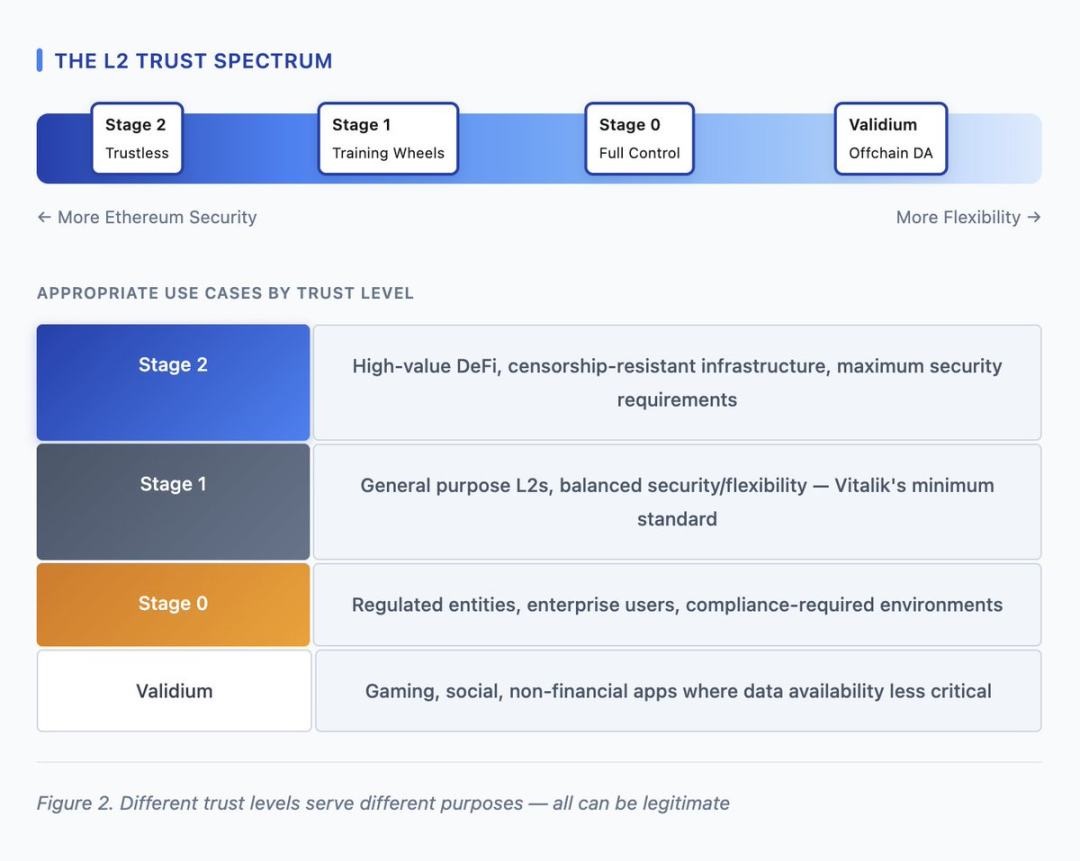

Further details on achieving synchronous composability between L1 and L2 are outlined in a post on ethresear.ch. Presently, transferring assets or executing logic across L1 and L2 boundaries necessitates a waiting period for finality (7 days for Optimistic Rollups, several hours for ZK Rollups) or reliance on fast cross-chain bridges that introduce counterparty risk. Synchronous composability aims to enable transactions to atomically call L1 and L2 states, facilitating cross-chain read-write operations within a single transaction. This guarantees that a transaction either fully succeeds across both layers or fully reverts, ensuring data integrity.

The proposal introduces three distinct block types: regular sequencer blocks for low-latency L2 transactions, boundary blocks to mark the conclusion of a slot, and “based blocks” which permit permissionless construction after a boundary block. Within this specific window, any builder would be able to create blocks that interact simultaneously with both L1 and L2 states.

The Ecosystem’s Diverse Responses

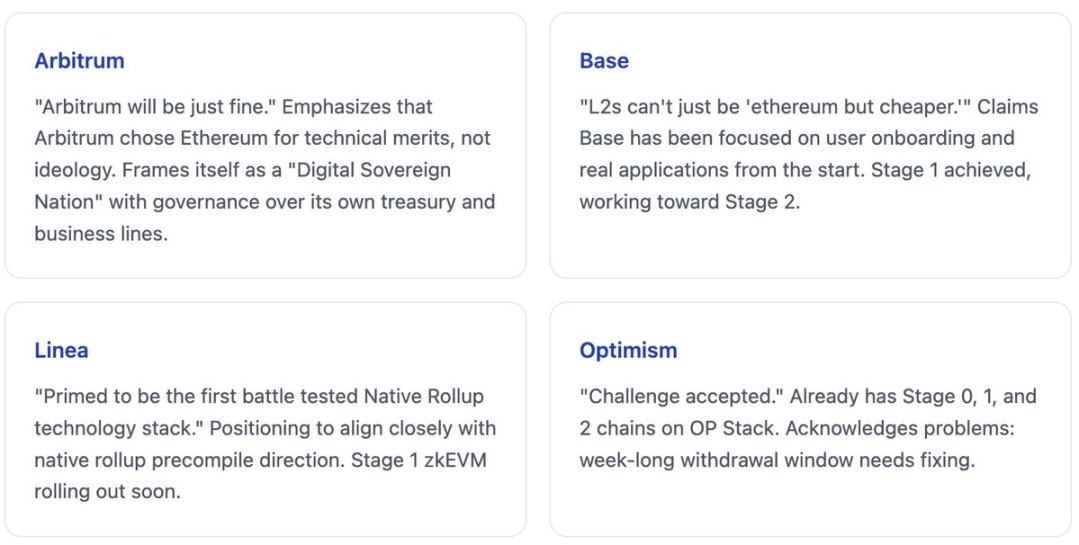

Major L2 teams responded to Vitalik’s insights within hours, and their reactions showcased a healthy strategic diversification. This outcome precisely aligns with the intent of Vitalik’s trust spectrum framework: enabling different teams to pursue distinct positioning strategies without the need to artificially project an image of “everyone heading towards the same ultimate destination.”

These varied responses are indicative of a robust and healthy market. Arbitrum, for instance, emphasizes its role as an independent and autonomous ecosystem. Base focuses intensely on applications and user experience. Linea aligns closely with Vitalik’s direction for native Rollups, while Optimism, acknowledging existing challenges, continues to highlight its progress and ongoing improvements. There is no single “right” or “wrong” in these strategic choices; rather, they represent differentiated strategies targeting distinct market segments – a legitimacy now explicitly granted by the trust spectrum framework.

Vitalik’s Deep Acknowledgment of Economic Realities

One of the most profound insights in Vitalik’s article is his implicit acknowledgment of the L2 economic model. When he observes that some L2s, influenced by “regulatory demands” and “ultimate control” considerations, “may never advance beyond Stage 1,” he is essentially recognizing that L2s, as commercial entities, possess legitimate economic interests. These interests fundamentally diverge from the idealized “branded shard” model. Sequencer revenue is a tangible business imperative, and regulatory compliance is an unavoidable reality. To expect L2s to forgo these interests for the sake of ideological consistency is, frankly, commercially illogical.

Charting the Path Forward: Vitalik’s Constructive Guidance

Crucially, Vitalik’s discourse is constructive, moving beyond mere diagnosis to offer concrete directions. He outlines several specific pathways for L2s that aspire to maintain and enhance their value amidst the backdrop of continuous L1 scaling. These are not prescriptive mandates but rather differentiated development suggestions, empowering L2s to forge their unique advantages when the simple selling point of “cheaper Ethereum” no longer suffices.

Conclusion: Adaptive Leadership for Ethereum’s Future

Vitalik Buterin’s article, published in February 2026, marks a pivotal strategic recalibration for Ethereum’s L2 approach. Its core revelation is that L2s have evolved into independent platforms with legitimate economic interests, moving beyond the initial concept of obligatory “branded shards” of Ethereum. Rather than resisting this trend, Vitalik advocates for embracing this new reality by: establishing a trust spectrum that validates diverse developmental paths, providing native Rollup infrastructure to enhance L1-L2 integration for those who require it, and designing synchronous composability mechanisms for seamless cross-layer interaction.

The L2 ecosystem’s response has demonstrated a healthy and encouraging diversity. Arbitrum champions its independence, Base focuses on application and user experience, Linea aligns with the native Rollup direction, and Optimism, while candid about its challenges, continues to drive improvements. This strategic pluralism is precisely the intended outcome of the trust spectrum framework: allowing different teams to pursue varied strategies without the pretense that everyone is on an identical journey.

For Ethereum, this roadmap correction bolsters its credibility by acknowledging present realities instead of rigidly defending outdated assumptions. The technical proposals are feasible, especially given the ongoing maturity of ZK-EVM technology. More importantly, the strategic proposals create fertile ground for the healthy evolution of the entire ecosystem. This embodies adaptive leadership in the technology sector: recognizing shifts in the environment and proposing new, forward-looking paths, rather than stubbornly adhering to old strategies after the market has already made its preferences clear.

Having spent a decade deeply involved in scalability research and four years operating a Rollup infrastructure company, I’ve witnessed countless crypto leaders refuse to adapt when reality diverged from their initial expectations. The outcomes were universally unfavorable. What Vitalik has done is undeniably difficult—publicly admitting that the 2020 vision needed significant adjustment. Yet, it is unequivocally the right decision. Clinging to a narrative that cannot keep pace with market dynamics benefits no one. The path forward is becoming clearer with each passing day, and this clarity itself is an invaluable asset.