Author: ARK Invest

Compiled by: Felix, PANews

The Institutionalization of Bitcoin: A 2026 Macro Perspective

ARK Invest identifies four compelling trends poised to elevate Bitcoin’s status by 2026, marking its transition from an “optional” fringe asset to an indispensable, strategic component within institutional investment portfolios. This in-depth analysis delves into the forces reshaping Bitcoin’s value proposition.

By 2025, Bitcoin has cemented its deep integration into the global financial ecosystem. The successful launch and rapid growth of Bitcoin spot ETFs in 2024 and 2025, the inclusion of digital asset-focused public companies in major stock indices, and a continuously improving regulatory landscape are collectively propelling Bitcoin from the periphery into a new asset class that ARK Invest deems essential for institutional allocation.

At the heart of this cycle, ARK Invest posits, is Bitcoin’s profound transformation: evolving from a nascent, “optional” monetary technology into a strategic allocation asset increasingly recognized by a broad spectrum of investors. This shift is underpinned by four critical trends:

- The overarching macroeconomic and policy environment fostering demand for scarce digital assets.

- Significant structural ownership trends encompassing Exchange Traded Funds (ETFs), corporate treasuries, and sovereign nations.

- Bitcoin’s dynamic relationship with gold and other traditional stores of value.

- A noticeable reduction in Bitcoin’s historical drawdowns and volatility, signaling market maturity.

Let’s explore these pivotal trends in detail.

The Evolving Macroeconomic and Policy Landscape by 2026

Monetary Conditions and Global Liquidity Shifts

The global macroeconomic environment is undergoing a significant transformation following an extended period of monetary tightening. The U.S. Federal Reserve concluded its Quantitative Tightening (QT) program last December, and its interest rate-cutting cycle remains in its nascent stages. This shift is expected to trigger a substantial rotation of capital, with over $10 trillion currently held in low-yielding money market funds and fixed-income ETFs potentially reallocating towards risk assets, including Bitcoin.

Regulatory Normalization and Institutional Clarity

Regulatory transparency stands as both a historical barrier and a powerful future catalyst for institutional adoption. Policymakers across the U.S. and globally are actively developing frameworks to clarify digital asset regulation, standardize custody, trading, and disclosure processes, and provide clear guidance for institutional investors.

For instance, the proposed U.S. “CLARITY Act,” if enacted, would significantly reduce compliance uncertainties. By assigning digital commodities to the Commodity Futures Trading Commission (CFTC) and digital securities to the Securities and Exchange Commission (SEC), it offers a clear compliance roadmap. This includes a standardized “maturity test” allowing tokens to transition from SEC to CFTC oversight post-decentralization, and a dual registration system for broker-dealers, effectively addressing the historical legal ambiguities that often pushed digital asset companies offshore.

Beyond federal efforts, the U.S. government has also addressed Bitcoin-related issues through:

- Discussions between legislators and industry leaders regarding Bitcoin’s potential inclusion in national reserves.

- Standardized management protocols for seized Bitcoin holdings, much of which is currently under federal control.

- Progressive state-level adoption, with Texas notably leading the charge by purchasing and integrating Bitcoin into its state reserves.

Structural Demand: ETFs, Corporate Adoption, and Sovereign Reserves

ETFs: A New Era of Structural Buying

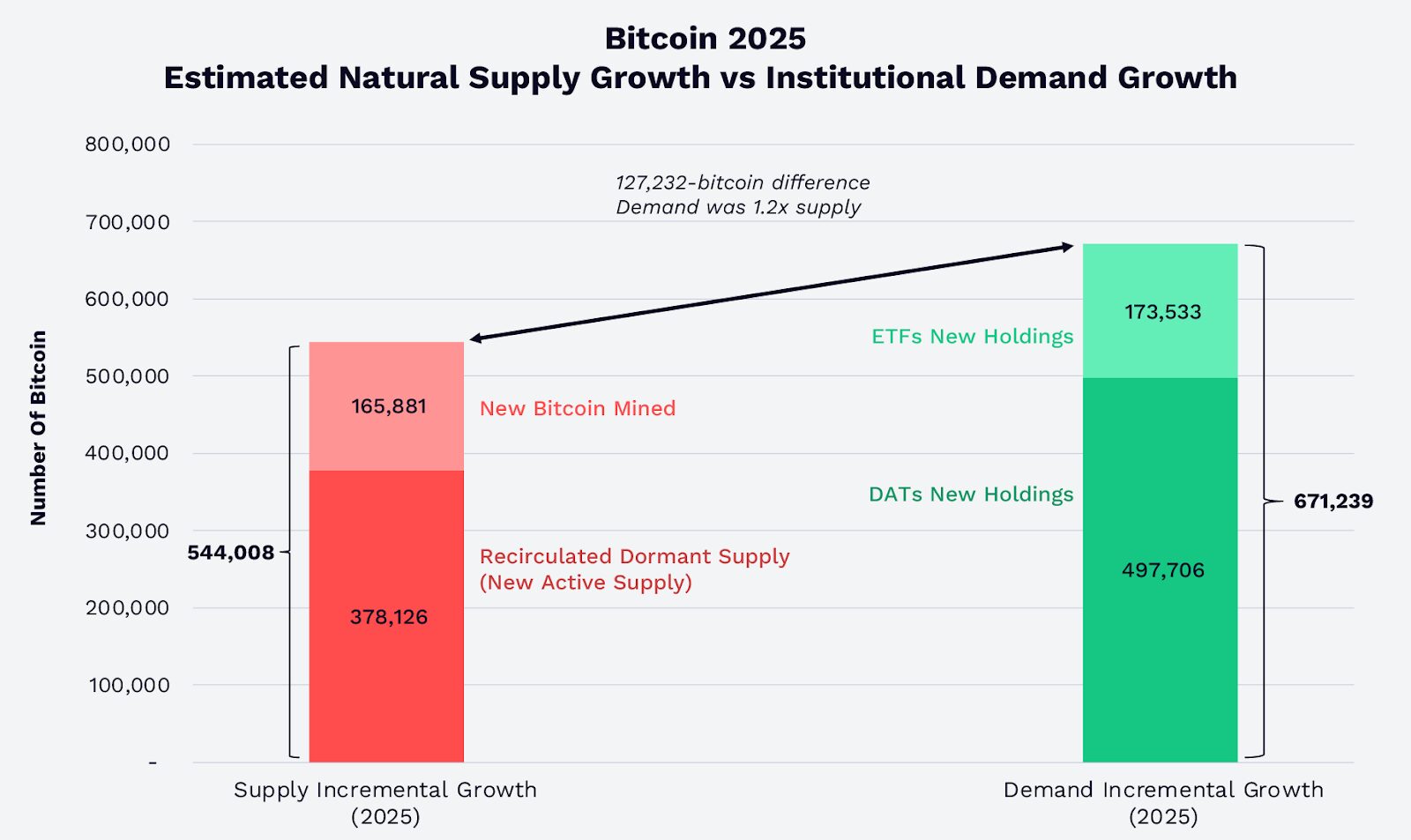

The exponential growth of spot Bitcoin ETFs has fundamentally recalibrated market supply and demand dynamics. By 2025, U.S. Bitcoin spot ETFs and Digital Asset Trusts (DATs) absorbed 1.2 times the combined total of newly mined Bitcoin and dormant Bitcoin re-entering the active supply. By the close of 2025, the aggregate Bitcoin holdings by ETFs and DATs surpassed 12% of the total circulating supply. This surge in demand, remarkably, occurred even as Bitcoin’s price experienced a temporary decline, influenced by factors such as a significant liquidation event on October 10th (triggered by a software glitch), concerns about the four-year cycle’s inflection point, and negative sentiment surrounding quantum computing threats.

The fourth quarter witnessed a pivotal moment as major financial institutions like Morgan Stanley and Vanguard integrated Bitcoin into their investment platforms. Morgan Stanley expanded client access to compliant Bitcoin products, including spot ETFs. In a surprising move, Vanguard, which had historically resisted cryptocurrencies and commodities, also added third-party Bitcoin ETFs to its platform. As these ETFs mature, they are poised to increasingly serve as crucial structural bridges, connecting the burgeoning Bitcoin market with vast traditional capital pools.

Bitcoin-Related Companies in Indices and Corporate Reserves

Corporate adoption of Bitcoin has transcended early adopters, becoming a mainstream phenomenon. Companies like Coinbase and Block have seen their stocks included in prestigious indices such as the S&P 500 and Nasdaq 100, effectively embedding Bitcoin-related exposure into conventional investment portfolios. MicroStrategy, a prominent DAT entity, has amassed a substantial Bitcoin position, representing 3.5% of the total supply. Collectively, Bitcoin DAT companies now hold over 1.1 million BTC, accounting for 5.7% of the supply (valued at approximately $89.9 billion as of late January 2026). Critically, these corporate reserves largely signify long-term conviction rather than short-term speculation.

Sovereign Nations and Strategic Bitcoin Reserves

Following El Salvador’s pioneering move, the year 2025 saw the U.S. government, under the Trump administration, establish its own Strategic Bitcoin Reserve (SBR) using seized Bitcoin. This reserve now holds an estimated 325,437 BTC, representing 1.6% of the total supply, with a value of $25.6 billion. This development underscores a growing recognition of Bitcoin’s potential as a strategic national asset.

Bitcoin and Gold: The Digital Gold Standard

Is Gold a Leading Indicator for Bitcoin?

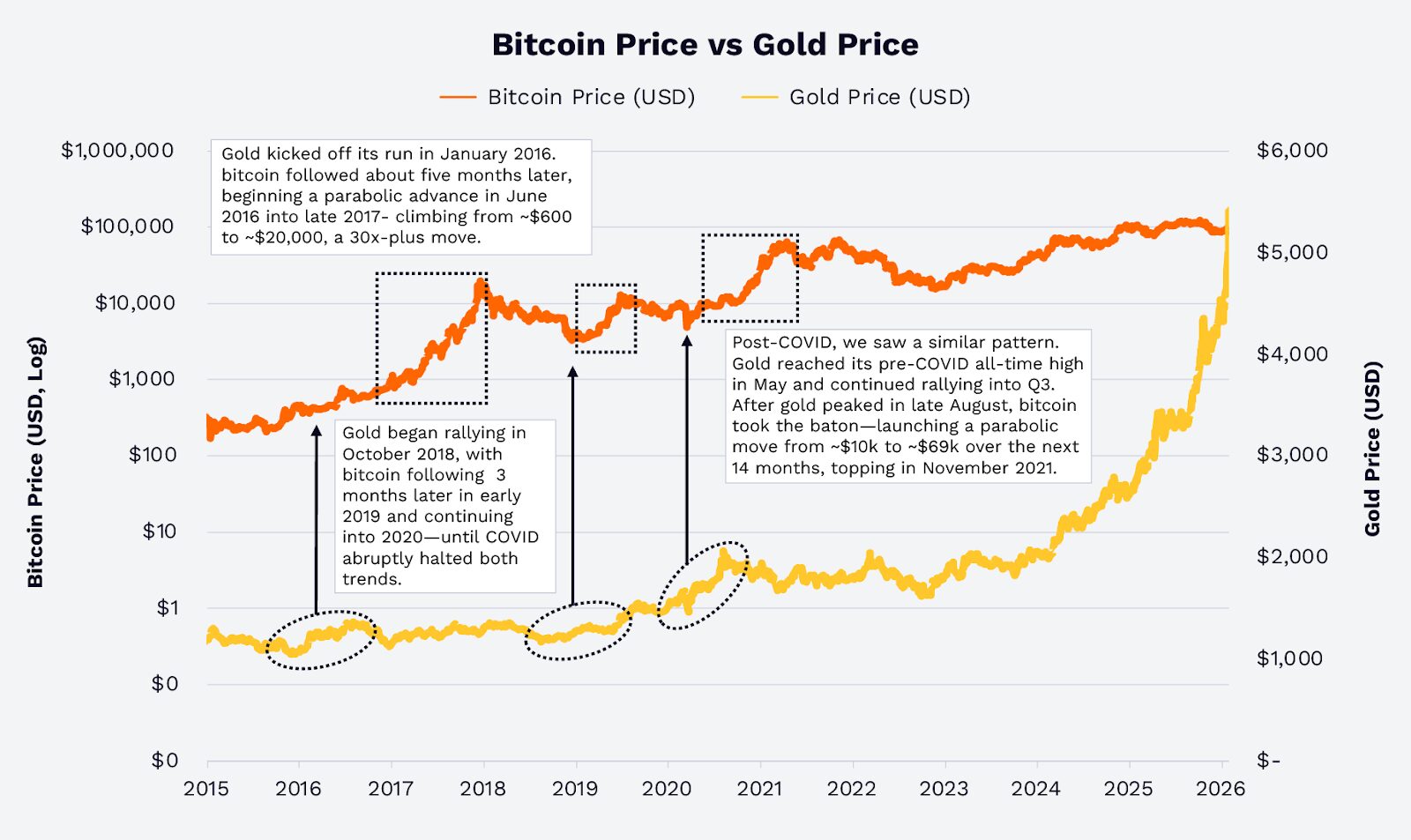

While both gold and Bitcoin are often viewed as hedges against currency debasement, negative real interest rates, and geopolitical instability, their responses to these macro narratives have diverged in recent years. In 2025, gold prices soared by 64.7% amidst inflation concerns and fiat currency devaluation. Counter-intuitively, Bitcoin prices experienced a 6.2% decline during the same period—a divergence not without historical precedent.

Historically, gold price surges have often preceded Bitcoin rallies, notably in 2016 and 2019. The early 2020 COVID-19 pandemic also saw a surge in fiscal and monetary liquidity drive gold prices higher, foreshadowing Bitcoin’s subsequent ascent. This “gold-Bitcoin” pattern was particularly pronounced in 2017 and 2018.

Given this historical relationship, Bitcoin can be viewed as a high-beta, digitally native extension of the same macroeconomic logic that has long underpinned gold’s value. The question remains: will history repeat itself?

Given this historical relationship, Bitcoin can be viewed as a high-beta, digitally native extension of the same macroeconomic logic that has long underpinned gold’s value. The question remains: will history repeat itself?

ETF Asset Under Management: Bitcoin’s Rapid Ascent

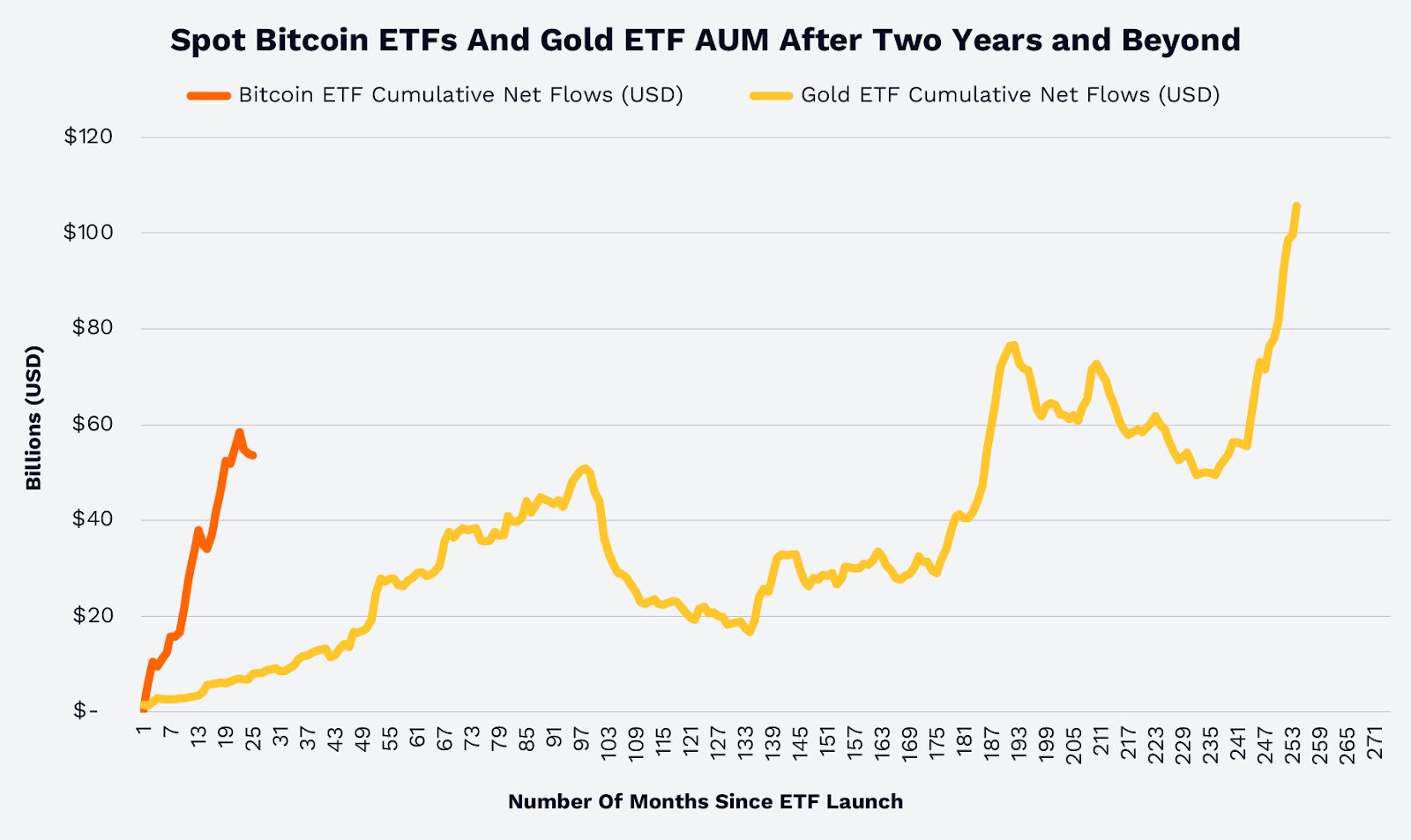

A comparison of cumulative ETF net inflows reveals another compelling dimension of Bitcoin’s growth relative to gold. According to data from Glassnode and the World Gold Council, spot Bitcoin ETFs achieved in under two years what gold ETFs took over 15 years to accomplish.

This rapid adoption suggests that financial advisors, institutional investors, and retail participants are increasingly acknowledging Bitcoin’s multifaceted role as a store of value, a potent diversification tool, and a transformative new asset class.

This rapid adoption suggests that financial advisors, institutional investors, and retail participants are increasingly acknowledging Bitcoin’s multifaceted role as a store of value, a potent diversification tool, and a transformative new asset class.

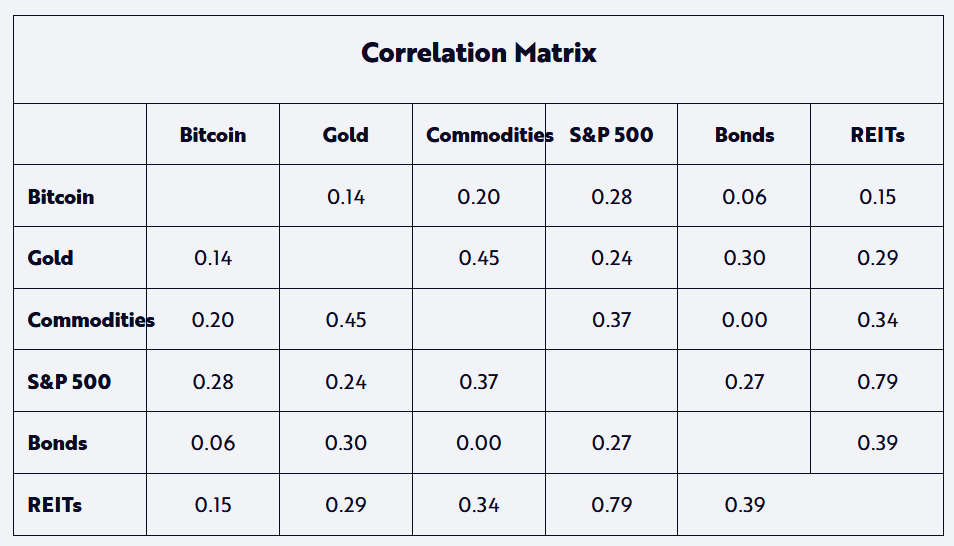

Interestingly, despite perceived similarities, the correlation between Bitcoin and gold returns in the previous cycle has been notably low since 2020.

This low correlation further strengthens the argument for Bitcoin’s diversification benefits and reinforces the notion that gold may serve as a leading indicator for Bitcoin’s price movements.

This low correlation further strengthens the argument for Bitcoin’s diversification benefits and reinforces the notion that gold may serve as a leading indicator for Bitcoin’s price movements.

Maturing Market Dynamics and Investor Behavior

Decreasing Drawdowns, Volatility, and Market Maturity

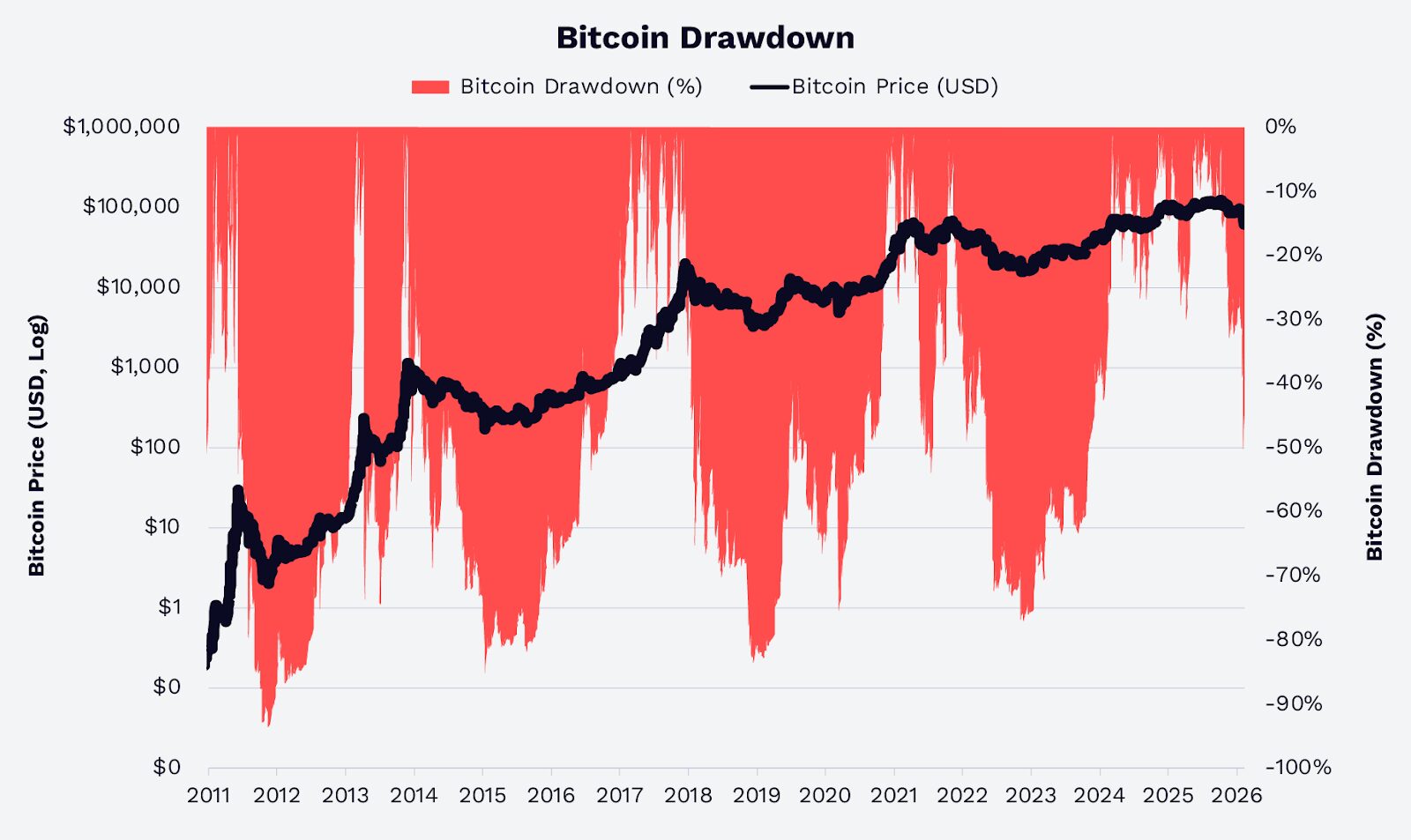

While Bitcoin remains a volatile asset, the magnitude of its drawdowns has demonstrably decreased over time. Previous cycles frequently saw peak-to-trough declines exceeding 70-80%. In the current cycle, spanning from 2022 to early 2026, drawdowns from historical highs have not surpassed approximately 50%.

This indicates a more robust market performance, even in the face of significant corrections (such as the adjustment witnessed in the first week of February 2026), attributed to increased market participation and deepening liquidity.

This indicates a more robust market performance, even in the face of significant corrections (such as the adjustment witnessed in the first week of February 2026), attributed to increased market participation and deepening liquidity.

These observations collectively suggest that Bitcoin is evolving from a purely speculative asset into a globally tradable macro-financial instrument. This evolution is characterized by an increasingly diverse holder base, supported by a sophisticated and robust infrastructure for trading, liquidity, and custody.

The Power of Long-Term Holding Over Market Timing

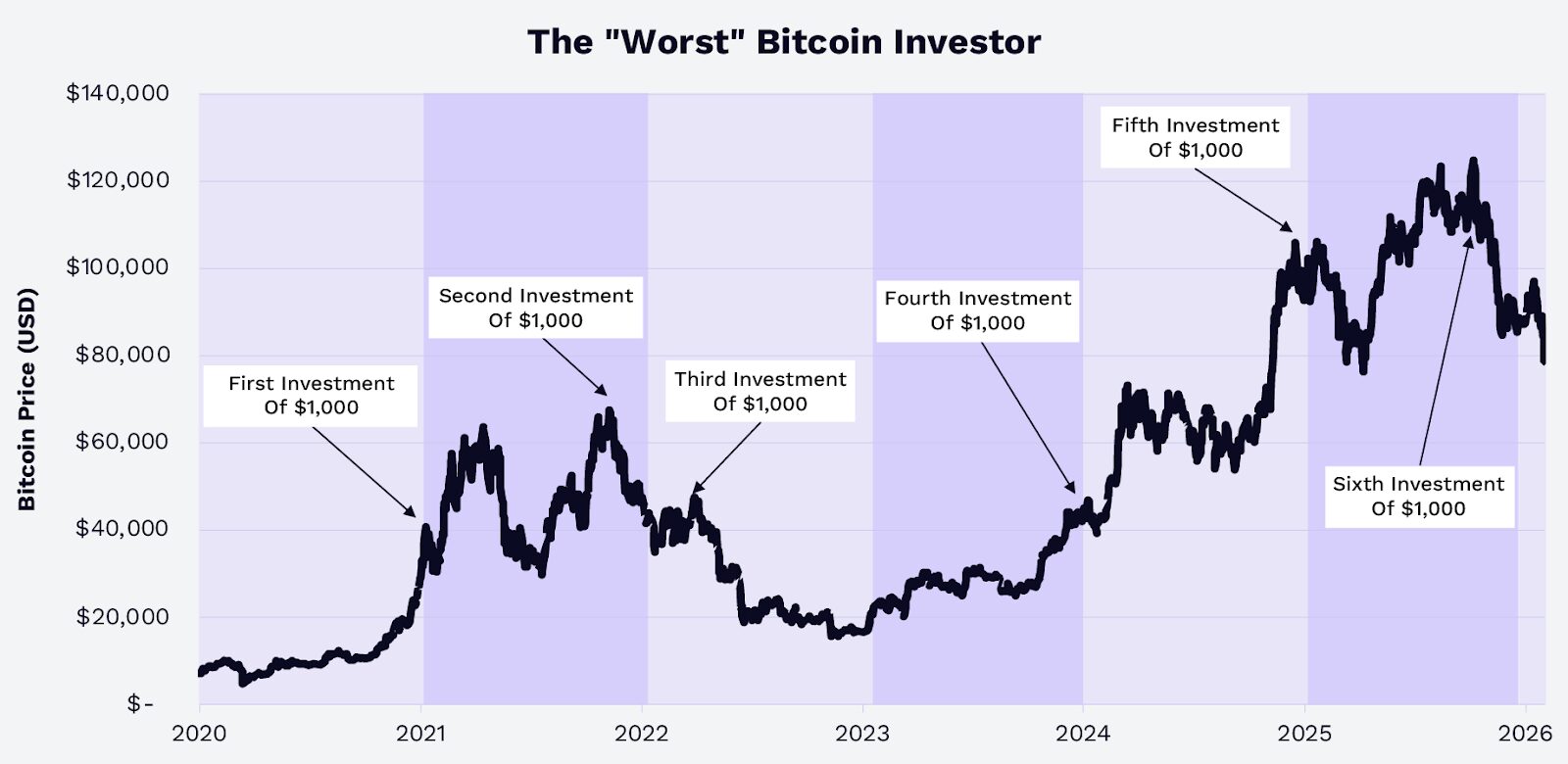

Analysis of Glassnode data highlights the enduring value of long-term conviction. Consider a hypothetical “worst-luck” Bitcoin investor who, from 2020 to 2025, invested $1,000 annually at Bitcoin’s absolute highest price each year. Their total investment of approximately $6,000 would have grown to roughly $9,660 by December 31, 2025, and about $8,680 by January 31, 2026, yielding returns of approximately 61% and 45% respectively.

Even accounting for the pullback in early February 2026, this investment would still stand at $7,760 by February 8th, representing a 29% return.

Even accounting for the pullback in early February 2026, this investment would still stand at $7,760 by February 8th, representing a 29% return.

This compelling data underscores a crucial insight: since 2020, the holding period and position size have proven more impactful than attempts at precise market timing. The market consistently rewards investors who prioritize Bitcoin’s fundamental value proposition over its short-term volatility.

Bitcoin’s Strategic Imperative by 2026

By 2026, the narrative surrounding Bitcoin has unequivocally shifted from a question of its “survival” to its strategic role within a diversified investment portfolio. Bitcoin now stands as:

- A scarce, non-sovereign asset, uniquely positioned against a backdrop of evolving global monetary policies, persistent government deficits, and widening trade imbalances.

- A high-beta, digitally native extension of traditional store-of-value assets, most notably gold.

- A globally liquid macroeconomic tool, now readily accessible through regulated investment vehicles.

As regulatory clarity advances and infrastructure matures, lowering historical barriers to entry, a growing cohort of long-term holders—including ETFs, corporations, and sovereign entities—have absorbed a significant portion of the new Bitcoin supply. Historical data further substantiates that allocating to Bitcoin has the potential to enhance portfolio risk-adjusted returns, primarily due to its low correlation with other asset classes, including gold, and the observed reduction in its volatility and drawdowns over complete market cycles.

ARK Invest concludes that as investors evaluate this transformative asset class in 2026, the pertinent question is no longer “whether” to allocate to Bitcoin, but rather “how much” and “through what optimal channels” to integrate it into their strategic portfolios.

(The above content is an excerpt and reproduction authorized by partner PANews, original link)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice, nor do they represent the views and positions of the publisher. Investors should make their own decisions and trades. The author and the publisher will not be liable for any direct or indirect losses incurred by investors’ transactions.