What defines “true DeFi”? When Ethereum co-founder Vitalik Buterin threw his weight behind algorithmic stablecoins, it reignited a profound debate surrounding risk, governance, and monetary sovereignty within the decentralized finance ecosystem.

A single tweet can indeed shake a multi-billion dollar narrative.

On February 9th, Vitalik Buterin articulated a powerful perspective: algorithmic stablecoins represent the essence of “true DeFi.”

This wasn’t merely a suggestion for technical fine-tuning of the current stablecoin landscape; it was an authoritative redefinition of DeFi’s foundational principles. In an era dominated by centralized stablecoins like USDT and USDC, Vitalik’s pronouncement acted like a depth charge, pulling the long-dormant algorithmic stablecoin sector back into the spotlight.

Vitalik’s “True DeFi” Standard: Risk Decoupling and De-Dollarization

Vitalik’s vision for “true DeFi” is fundamentally built upon the decoupling of risk structures, where he categorizes algorithmic stablecoins into two distinct models.

The first category involves purely native asset collateral. In this model, protocols utilize ETH and its derivatives as collateral. Even if 99% of the system’s liquidity originates from Collateralized Debt Position (CDP) holders, the inherent nature of this approach is to transfer dollar-side counterparty risk directly to market participants and market makers.

Crucially, this eliminates the possibility of frozen bank accounts or the sudden collapse of centralized institutions.

The second category focuses on highly diversified Real-World Asset (RWA) collateral. Even when protocols incorporate RWAs, as long as they mitigate single-asset failure risk through asset diversification and over-collateralization, it’s considered a significant optimization of the risk structure.

If an algorithmic stablecoin can guarantee that no single RWA constitutes more than the system’s over-collateralization ratio, then even in the event of one asset defaulting, the stablecoin holders’ principal remains secure.

A more forward-thinking aspect of Vitalik’s view is his advocacy for stablecoins to gradually move away from their peg to the US dollar. Recognizing the potential long-term devaluation risks faced by sovereign currencies, he suggests stablecoins should evolve towards more universal, diversified index-based units of account. This shift aims to reduce reliance on any single fiat currency, especially the dollar.

This also implies an evolution in the very definition of a stablecoin, moving from mere “price stability” towards “purchasing power stability.”

Following Vitalik’s definition of algorithmic stablecoins, PANews has identified projects in the market that most closely align with these standards. However, these projects generally face significant user acquisition challenges, which might be why Vitalik is once again championing their cause.

USDS: The Dragon Slayer Becomes the Dragon – Mainstream Expansion Sparks Controversy

Following Vitalik’s tweet, the protocol token MKR of MakerDAO, a pioneer in algorithmic stablecoins, saw its price surge by 18%.

Interestingly, the price of its rebranded SKY token remained largely unaffected. This divergence itself speaks volumes about market sentiment.

As one of the most iconic protocols in DeFi history, MakerDAO officially rebranded to Sky Protocol in August 2024 and launched its next-generation stablecoin, USDS, completing its “Endgame” transformation.

USDS is positioned as an upgraded version of DAI and serves as Sky’s flagship product. As of February 12th, USDS has rapidly grown to become the third-largest stablecoin in the entire crypto market, boasting a market capitalization exceeding ten billion dollars.

Superficially, this appears to be a successful evolution for a DeFi giant. However, a deeper look reveals it as a costly “coming-of-age” ritual.

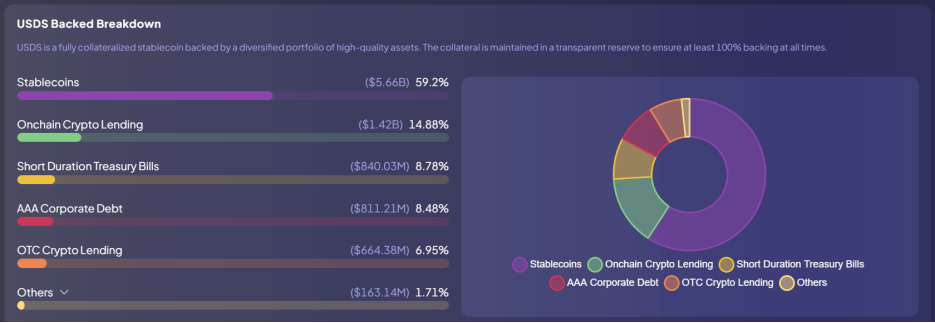

USDS’s yield primarily stems from the diversified allocation of its underlying assets. Sky, through its Star modular ecosystem (sub-DAOs), allocates collateral to RWAs, including short-term US Treasury bonds and AAA-rated corporate debt.

From a risk diversification perspective, this aligns with Vitalik’s second category of algorithmic stablecoins. The core issue, however, lies in the significant shift in its asset structure.

While USDS has indeed diversified its assets, stablecoins (specifically USDC) constitute nearly 60% of its reserves, far exceeding the over-collateralized portion (20%).

This implies that the fundamental value backing USDS is, in essence, highly dependent on another centralized stablecoin. Consequently, the protocol’s transformation has been consistently met with controversy.

Even more challenging for DeFi purists to accept is the protocol’s introduction of a “freeze function.” This design permits Sky to remotely freeze USDS in a user’s wallet upon receiving a legal directive or in the event of a security incident.

For Sky, this represents a pragmatic compromise in navigating global regulations: without compliance, mainstream adoption remains elusive. Technically, the USDS freeze function aims to combat illegal activities like hacking and money laundering, making it a compliant financial instrument in the eyes of regulators.

However, for staunch DeFi adherents, this is an unforgivable capitulation. Some community members believe Sky has abandoned DeFi’s original promise of censorship resistance. Once the protocol is granted the power to freeze assets, USDS effectively becomes indistinguishable from USDC.

Evidently, the protocol is drifting further away from the direction Vitalik advocates. Compared to the current Sky and USDS, the market perhaps holds a stronger nostalgia for the original MakerDAO and DAI.

LUSD/BOLD: Upholding ETH-Native Principles, Pursuing Minimal Governance

If Sky chose outward expansion, Liquity opted for deep internal innovation.

Vitalik has repeatedly praised Liquity, highlighting its pioneering “governance minimization” model, which virtually eliminates reliance on human governance in its design.

Liquity’s stablecoin, LUSD/BOLD, is entirely backed by ETH and its Liquid Staking Tokens (LSTs), making it the quintessential representative of Vitalik’s first category of algorithmic stablecoins.

Liquity V1 established its authoritative position among ETH-collateralized stablecoins through its groundbreaking 110% minimum collateral ratio and rigid redemption mechanism. However, V1 also faced trade-offs in capital efficiency and liquidity costs:

- Zero-Interest Rate: Users pay a one-time borrowing fee (typically 0.5%) when taking out a loan, without accruing interest over time. While zero interest is highly attractive to borrowers, the protocol had to continuously issue rewards (e.g., LQTY tokens) to maintain LUSD’s liquidity, a model that lacked long-term sustainability.

- 110% Minimum Collateral Ratio: Through an instant liquidation system (the Stability Pool), Liquity achieved higher capital efficiency than competitors. If the price of ETH dropped, the system prioritized using LUSD from the Stability Pool to offset bad debt and distribute collateral.

- Hard Redemption Mechanism: Any LUSD holder could redeem an equivalent value of ETH from the protocol at a fixed value of $1. This created a hard price floor for LUSD, helping it maintain its peg even during extreme market conditions.

However, the single collateral limitation proved to be a double-edged sword. Since LUSD only supported ETH collateral, users faced significant opportunity costs (i.e., inability to earn staking rewards while borrowing) amidst the rising trend of Ethereum staking. This led to a continuous contraction in LUSD’s supply over the past two years.

To address V1’s limitations, Liquity launched V2 and its next-generation stablecoin, BOLD. Its core innovation lies in the introduction of “user-set interest rates.”

In Liquity V2, borrowers can set their own borrowing interest rates based on their risk tolerance. The protocol then ranks debt positions by interest rate; the lower the interest rate on a debt position, the higher the risk of it being prioritized for “redemption” (liquidation).

- Low-Interest Strategy: Suitable for users sensitive to funding costs but willing to assume the risk of early redemption.

- High-Interest Strategy: Suitable for users who wish to hold their positions long-term and mitigate redemption risk.

This dynamic game theory mechanism allows the system to automatically find market equilibrium without manual intervention: borrowers, to avoid passively losing collateral during ETH downturns, tend to set higher interest rates. These rates flow directly to BOLD depositors, creating real yield without relying on token emissions.

Furthermore, V2 breaks the single-asset limitation by adding support for wstETH and rETH. This allows users to obtain BOLD liquidity while continuing to earn staking rewards.

More importantly, V2 also introduced a “one-click multiplier” feature, enabling users to leverage cyclical strategies to increase their ETH exposure up to 11 times, significantly boosting the system’s capital efficiency.

Liquity’s evolution represents a solid step for algorithmic stablecoins from idealism towards practical utility.

RAI: An Industrial-Thought-Driven Monetary Experiment, High Opportunity Cost for Holders

If Liquity is pragmatic, then Reflexer is an uncompromising idealist.

The stablecoin RAI, issued by the protocol, is not pegged to any fiat currency. Its price is regulated by a PID (Proportional-Integral-Derivative) algorithm derived from industrial control systems.

RAI does not aim for a fixed $1 price, but rather extremely low price volatility.

When RAI’s market price deviates from its internal “redemption price,” the PID algorithm automatically adjusts the redemption rate, which is the effective interest rate within the system.

-

Positive Deviation: Market price > Redemption price → Redemption rate becomes negative → Redemption price decreases → Borrower debt reduces, incentivizing them to mint and sell RAI for profit.

-

Negative Deviation: Market price < Redemption price → Redemption rate becomes positive → Redemption price increases → Borrower debt increases, incentivizing them to buy back RAI in the market to close positions.

Despite receiving multiple commendations from Vitalik, RAI’s development path has been fraught with challenges.

- User Cognitive Barrier: RAI is colloquially known as the “bleeding coin” because its persistent negative interest rates often cause the asset value of RAI holders to continuously shrink over time.

- Liquidity Scarcity: Due to not being pegged to the US dollar, RAI struggles to achieve widespread adoption in payment and trading scenarios. Its use as collateral is largely confined to a narrow niche of tech enthusiasts.

- Computational Complexity: Compared to Liquity’s constant $1 peg, RAI’s PID adjustment model makes it difficult for investors to build predictive models.

RAI demonstrates the theoretical elegance of algorithmic stablecoins but also exposes the harsh realities of user adoption.

Nuon: The Flatcoin Pegged to a Purchasing Power Index, Highly Reliant on Oracles

As global inflationary pressures intensify, a more radical stablecoin paradigm, Flatcoins, may emerge. These stablecoins aim not to peg to a single fiat currency, but rather to anchor to the real cost of living or purchasing power.

The purchasing power of traditional stablecoins (USDT/USDC) diminishes in an inflationary environment. Assuming the dollar’s purchasing power declines by 5% annually, users holding traditional stablecoins implicitly incur a capital loss. In contrast, Flatcoins dynamically adjust their face value by tracking an independent Cost of Living Index (CPI).

Taking Nuon, the first Flatcoin protocol based on the Cost of Living, as an example, it dynamically adjusts its peg target by accessing real-time, on-chain verified inflation data.

- Target Asset: A basket of consumer indices including food, housing, energy, and transportation.

- Purchasing Power Parity: If index data shows the US cost of living has risen by 5%, Nuon’s target price will also rise by 5% accordingly, ensuring that one Nuon held by its owner can still buy the same quantity of goods and services in the future.

- Mechanism Logic: Nuon employs an over-collateralization mechanism. When the inflation index changes, the algorithm automatically adjusts the minting/burning logic to protect the real value of holders from erosion.

For residents in high-inflation countries like Turkey or Argentina, while traditional dollar stablecoins can alleviate the pressure of local currency depreciation, they still cannot escape the “hidden tax” of dollar inflation. Flatcoins offer a new, non-dollar, decentralized alternative for combating inflation and preserving purchasing power.

Despite the highly forward-looking design philosophy of Flatcoins, their practical implementation carries significant technical risks. The composition of the cost of living index is complex, and the veracity of its data largely depends on the robustness of the oracle system.

However, the on-chain integration process for inflation data could become a breeding ground for attackers. Any minor manipulation of data sources could directly lead to the instant evaporation of Flatcoins holders’ purchasing power.

Furthermore, the dynamic equilibrium of Flatcoins requires ample liquidity support. It remains to be seen whether arbitrageurs will be willing to maintain a continuously rising peg target during extreme market conditions.

Flatcoins represent a bold leap in the algorithmic stablecoin narrative, but a deep chasm of technology and finance lies between concept and widespread adoption.

From Liquity’s steadfast adherence to core principles, to Reflexer’s ambitious monetary experiments, and Flatcoins’ radical attempts, the landscape of algorithmic stablecoins is unfolding with unprecedented diversity and intellectual depth.

Currently, algorithmic stablecoins are still constrained by capital efficiency, insufficient liquidity, and user experience hurdles. However, the ideals they represent—risk decoupling, governance minimization, and monetary sovereignty—remain the holy grail of DeFi.

The path to algorithmic stablecoin resurgence has only just begun.