National Security Breach: Israeli Military Indicts Reservist for Wartime Insider Trading on Polymarket

Author: Azuma, Odaily Planet Daily

Prediction markets, designed to aggregate collective wisdom, often grapple with the ethical quandary of insider information. While past incidents, such as the anomalous odds surrounding the U.S. military’s pursuit of Venezuelan President Maduro on platforms like Polymarket, have been debated as potential insider activity, a recent development leaves no room for doubt: an insider has been definitively unmasked within the sensitive realm of national security.

The Unmasking of a “Ghost” in the IDF

On February 12, Israel’s leading English daily, The Jerusalem Post, brought to light a startling case. The Tel Aviv District Court has formally indicted an Israeli civilian and an Israel Defense Forces (IDF) reservist. Their alleged crime? Leveraging classified military intelligence to place profitable bets on Polymarket. This revelation, disclosed by the court on Thursday, underscores a grave concern: such actions during wartime pose severe operational security risks to the nation.

The prosecution’s statement confirmed that the arrests were the result of a coordinated effort by the Israel Security Agency (Shin Bet), the Ministry of Defense Security Agency’s investigative unit, and the Israel Police. Investigators had strong suspicions that certain reservists were exploiting their access to confidential military information, specifically regarding the timing of military operations, for personal financial gain.

Following a meticulous investigation, prosecutors declared they had amassed sufficient evidence of misconduct against both individuals. Consequently, they face serious charges including “severe security crimes,” as well as bribery and obstruction of justice. The court has been requested to extend their detention until the trial concludes, emphasizing the gravity of the alleged offenses. While the public has been informed of these indictments, further specifics—including the identities of the accused, the precise nature of their bets, and the intricate flow of classified information—remain under strict legal restriction.

Tracing the Digital Footprints: The “Rundeep” Enigma

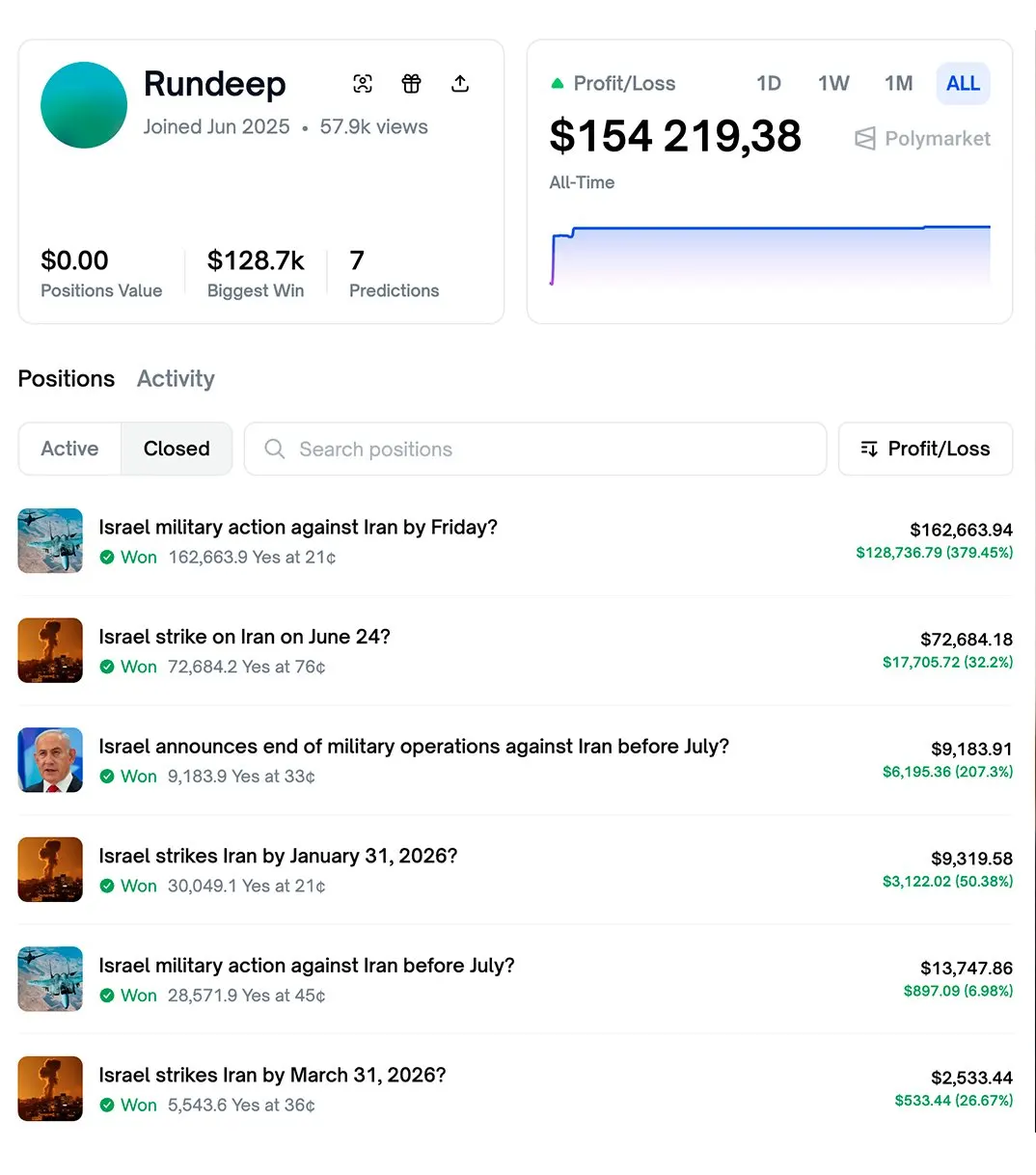

Although the official identities of the alleged insiders remain undisclosed, the vigilant X (formerly Twitter) community had already flagged an account on Polymarket exhibiting highly suspicious activity. The Jerusalem Post’s report further corroborated these suspicions by featuring a screenshot of this account’s remarkable profit history.

The user, identified as “Rundeep,” reportedly joined Polymarket in June 2025. What followed was an astonishing display of predictive accuracy: a perfect 100% win rate across six distinct prediction markets related to Israeli military operations. Even more striking, five of these successful wagers were placed when the initial probability of the outcome was below 50%, indicating an extraordinary, almost prescient, insight. Cumulatively, Rundeep’s activities yielded profits exceeding $150,000.

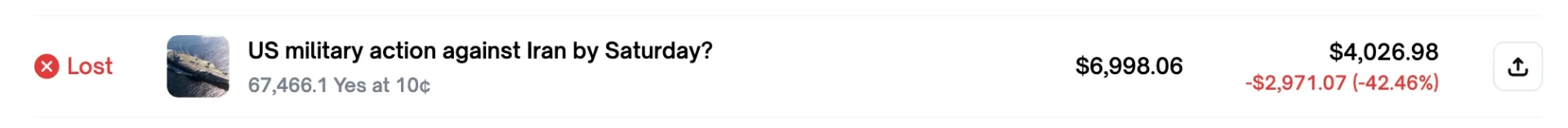

Further investigation by Odaily Planet Daily revealed Rundeep’s impeccable record was marred by only one loss. Intriguingly, this sole misstep occurred in a market unrelated to Israel: “Will the U.S. military take action against Iran before Saturday (June 21, 2025)?” This singular failure, juxtaposed with consistent success in Israeli-centric markets, strongly suggests a specific, localized intelligence advantage rather than generalized market acumen. It implies that allied intelligence, in this context, proved less reliable than direct military insights.

Prediction Markets: A Dangerous Intersection of Finance and National Security

Polymarket’s inherent design—open and permissionless—paradoxically creates a fertile ground for the “monetization of information advantage.” In a system where anyone can participate, the lure of profit can be irresistible for those privy to privileged data. This makes the emergence of “insiders” almost an inevitable consequence.

While insider activities in conventional domains like sports or entertainment might be contained, their occurrence in sensitive spheres such as politics or, more critically, wartime military operations, raises profoundly disturbing questions. The potential for catastrophic real-world consequences is immense. Imagine an adversary leveraging insider betting patterns on Polymarket to anticipate the precise timing or direction of an Israeli military maneuver. Such intelligence could drastically alter the course of events, providing a strategic advantage that could cost lives and compromise national security. While empathy for Israel might vary, the chilling reality is that such a vulnerability could expose any nation or entity.

The Regulatory Tightrope: A Future of Scrutiny?

Historically, traditional betting markets have imposed stringent restrictions on wagers concerning public affairs like political elections, legislative outcomes, and military conflicts. The current incident involving Polymarket highlights a critical gap in the burgeoning prediction market landscape. The question now looms: will these decentralized platforms face similar regulatory oversight? This incident could mark the beginning of a prolonged “regulatory game,” as authorities grapple with how to govern these powerful, yet potentially perilous, new financial instruments.

(This content is an authorized excerpt and reprint from our partner PANews, original link | Source: Odaily Planet Daily)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not bear any responsibility for direct or indirect losses resulting from investor transactions.