The “Fear & Greed Index” stands as a pivotal barometer for investor sentiment within the dynamic cryptocurrency market. Designed to quantify collective psychological states, this widely utilized indicator synthesizes a range of critical factors to gauge Bitcoin-centric market emotions. Its comprehensive methodology incorporates metrics such as market volatility, momentum and trading volume, social media engagement, Bitcoin dominance, and Google search trends. By meticulously integrating these diverse components, the index offers more than just a snapshot of price action; it illuminates prevailing investor risk appetite and the overall level of market attention.

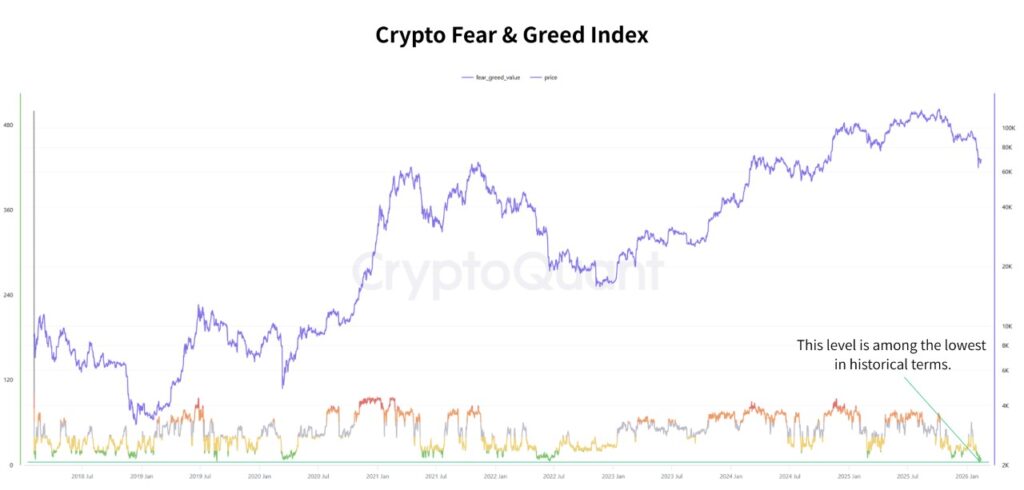

Currently, the index has plummeted to a level of “extreme fear,” a rare occurrence in historical market cycles. This deep dive into bearish territory echoes periods of immense market stress, notably seen during the 2018 bear market nadir, the seismic COVID-19 crash of March 2020, and the aftermath of the 2022 FTX collapse. Such a reading unequivocally signals that market participants are prioritizing risk aversion above all else, maintaining a heightened sense of caution regarding re-entry into the market.

From the lens of behavioral finance, this phenomenon is a clear manifestation of “Loss Aversion” and “Herd Behavior.” Following significant capital losses, investors inherently gravitate towards reducing their risk exposure and deferring market re-entry. Consequently, the psychological recovery of market sentiment typically unfolds at a much slower pace than any potential price rebound, illustrating the deep-seated impact of fear on collective decision-making.

It is crucial to understand that “extreme fear” does not necessarily serve as a harbinger of an immediate market recovery. Historically, such conditions more often denote the nascent stages of a prolonged “bottoming process” rather than the definitive commencement of a new uptrend. A genuine market resurgence typically demands a considerable period for investor confidence to rebuild and for capital flows to gradually normalize. This suggests the market is currently immersed in a “psychological reset period,” distinct from a confirmed recovery phase.

Disclaimer: This article is intended solely for the provision of market information. All content and perspectives shared herein are for reference purposes only and do not constitute investment advice. They do not represent the views or positions of the author or the publishing platform. Investors are strongly advised to conduct their own due diligence and make independent trading decisions. Neither the author nor the publishing platform shall bear any responsibility for direct or indirect losses incurred as a result of investor transactions.