By bootly, BitpushNews

The Ethereum Foundation (EF), the non-profit organization at the heart of the Ethereum ecosystem, finds itself once again at a pivotal crossroads of leadership transition.

Tomasz Stańczak, who served as co-executive director, has announced his resignation, effective at the end of this month. This departure comes a mere 11 months after he, alongside Hsiao-Wei Wang, took the reins from long-serving executive director Aya Miyaguchi in March of last year, forming a new leadership core for the Foundation.

Stańczak’s successor will be Bastian Aue. Public information on Aue is notably scarce; his X (formerly Twitter) account, registered just eight months ago, shows almost no public activity. He will now co-lead the Foundation with Hsiao-Wei Wang, steering an organization that wields significant influence over the core resources and strategic direction of the Ethereum ecosystem.

This seemingly abrupt leadership change is, in fact, the culmination of intertwined internal tensions, external pressures, and a broader strategic re-evaluation within the Ethereum Foundation.

A Mandate in Flux: A Year of Transformation

To fully grasp the implications of Stańczak’s departure, one must revisit the turbulent period preceding his appointment.

Leading up to early 2023, the Ethereum community was grappling with palpable anxiety. While the broader cryptocurrency market surged post-U.S. elections, with Bitcoin reaching new highs and rival chains like Solana gaining significant traction, Ethereum’s price performance lagged. Consequently, the Ethereum Foundation became a focal point for criticism.

The brunt of this criticism was directed at Aya Miyaguchi, the executive director at the time. The developer community voiced concerns about a perceived disconnect between the Foundation and frontline builders, potential conflicts of interest in strategic planning, and insufficient efforts in promoting Ethereum. Some questioned if the Foundation’s “laissez-faire” approach, positioning itself as a “coordinator” rather than a decisive “leader,” was causing Ethereum to lose its competitive edge.

As the de facto “central bank” and “development authority” of Ethereum, the Foundation was urged to adopt a more proactive and assertive stance, rather than a hands-off approach.

Amidst this storm of public opinion, Miyaguchi transitioned to a board role, and Stańczak, alongside Wang, stepped into the executive leadership under a clear mandate for change.

Stańczak was not an outsider. As the founder of Nethermind, a crucial execution client and infrastructure provider within the Ethereum ecosystem, he brought deep technical understanding, entrepreneurial acumen, and a firsthand appreciation of community pain points.

He articulated his initial directive plainly: “The community was calling out – you are too chaotic; you need to be more centralized, accelerate, to cope with this critical period.”

Stańczak’s Tenure: Visible Shifts and Strategic Initiatives

The 11-month tenure of Stańczak and Wang indeed ushered in noticeable changes:

- Organizational Efficiency: The Foundation streamlined its operations by reducing staff by 19, aiming to shed its bureaucratic image.

- Strategic Focus: The emphasis shifted back to Layer 1 scaling, prioritizing the Ethereum mainnet’s expansion over fragmented Layer 2 solutions. The pace of upgrades accelerated, with Ethereum Improvement Proposals (EIPs) progressing more decisively.

- Enhanced Communication: The Foundation adopted a more outward-facing communication strategy, launching video series on social media to explain Ethereum’s technical roadmap and future vision to a broader audience, a stark contrast to its previous, more insular image.

- New Explorations: Stańczak championed new areas of research and development, including privacy protection, mitigating quantum computing threats, and integrating artificial intelligence with Ethereum. He particularly highlighted the transformative potential of “agent systems” and “AI-assisted discovery.”

- Financial Transparency: Discussions began on enhancing budget transparency and fund allocation strategies, addressing external scrutiny regarding the efficiency of the Foundation’s treasury utilization.

Vitalik Buterin himself acknowledged Stańczak’s impact, stating, “He helped significantly improve the efficiency of multiple departments within the Foundation, making the organization more agile in responding to the external world.”

The Subtleties of Departure: A Philosophical Divide?

Despite these achievements and positive assessments, Stańczak’s decision to depart after less than a year raises questions.

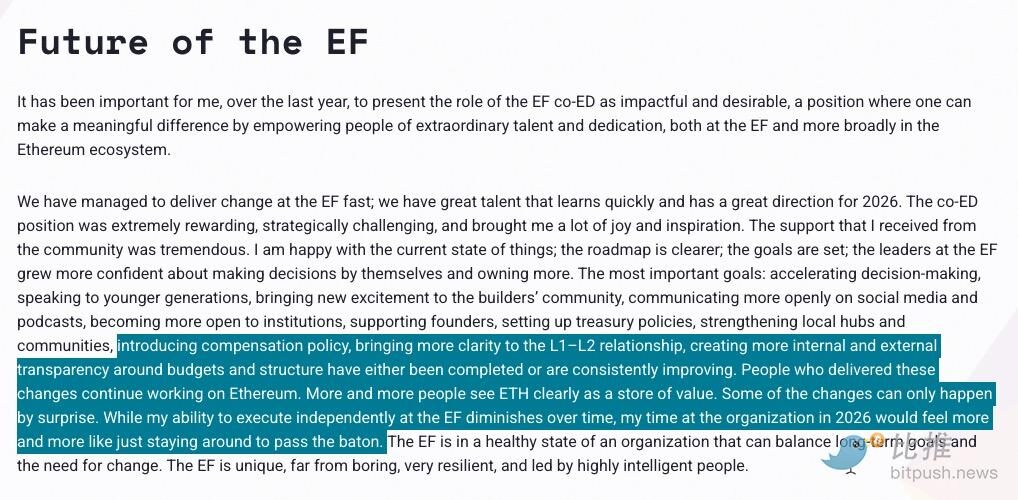

His resignation statement was remarkably candid, offering several revealing insights:

- He believes the Ethereum Foundation and the broader ecosystem are “in a healthy state,” signaling a belief that his mission was accomplished and it was time to “pass the baton.”

- He expressed a desire to return to being a “hands-on product builder,” specifically focusing on the intersection of AI and Ethereum, echoing his entrepreneurial spirit from when he founded Nethermind in 2017.

- Most tellingly, Stańczak stated: “The Foundation’s leadership is increasingly confident in making its own decisions and controlling more matters. Over time, my ability to execute independently within the Foundation has diminished. If I were to stay, by 2026, I would mostly just be ‘waiting to pass the baton’.”

This last point suggests a growing autonomy within the Foundation’s core leadership, potentially leading to a reduced scope for Stańczak’s direct influence. For an individual with a strong entrepreneurial drive, this shift could be a significant factor.

He further added, “I know many ideas about agentic AI might be immature, even useless, right now, but it’s this kind of playful experimentation that defined the early innovative spirit of Ethereum.” This remark subtly hints at a potential tension between the Foundation’s evolving “maturity” and the raw, experimental ethos that characterized Ethereum’s early days.

Stańczak’s departure, while a personal choice, underscores a perennial challenge for the Ethereum Foundation. From its inception, the EF has grappled with an inherent paradox: theoretically, Ethereum champions decentralization, suggesting the Foundation should not be a central command. Yet, it manages substantial funds, key developer resources, and plays a crucial role in ecosystem coordination, effectively acting as both a “central bank” and a “development authority.”

This identity crisis has long placed the Foundation in a dilemma: over-involvement draws accusations of centralization, while inaction leads to criticism of inefficiency. Miyaguchi’s era, characterized by a “coordinator” role, faced accusations of being too passive. Stańczak’s push towards an “executor” role boosted efficiency but, as his statement implies, may have inadvertently centralized decision-making and reduced individual autonomy within the leadership.

New Leadership, New Direction?

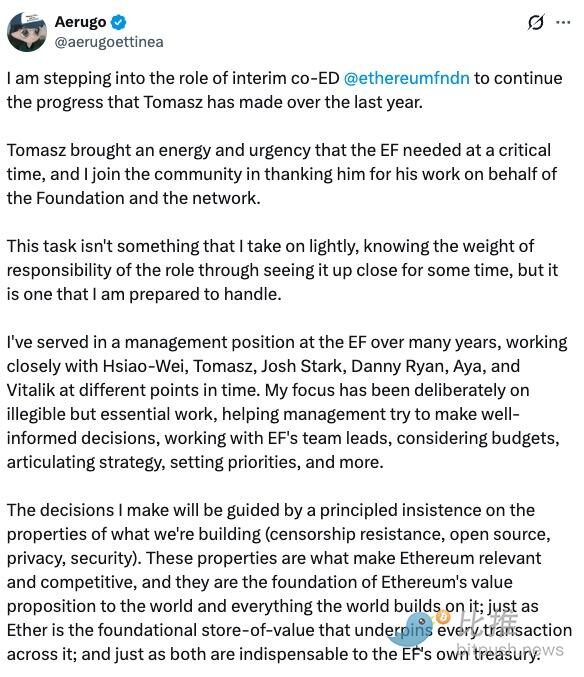

Bastian Aue, Stańczak’s successor, presents a contrasting profile. With minimal public presence, his self-description on X indicates a focus on “hard-to-quantify but crucial work” within the Foundation, including management support, team communication, budget oversight, and strategic prioritization. This low-key approach stands in stark contrast to Stańczak’s entrepreneurial flair.

Aue’s inaugural statement offers a glimpse into his philosophy: “My decisions are based on a principled adherence to certain properties of what we are building. The Foundation’s mission is to ensure that truly permissionless infrastructure – with the core being the cypherpunk spirit – can be built.”

This language resonates more with the “coordinator” ethos prevalent during Miyaguchi’s time, emphasizing core principles and the cypherpunk spirit over aggressive, centralized execution. It remains to be seen whether this signals a recalibration of the Foundation’s direction, potentially shifting from “aggressive execution” back towards “principled coordination.”

Ethereum’s Uncertain Path Ahead

Stańczak’s resignation coincides with a critical period for Ethereum, which is actively debating several significant proposals. He revealed that the Foundation is poised to release key documents, including specific plans for “Lean Ethereum” – a proposal jokingly dubbed “Ethereum’s weight loss era” by some, aiming to simplify the protocol and enhance mainnet efficiency – along with a future development roadmap and a DeFi coordination mechanism.

These foundational documents will profoundly shape Ethereum’s evolution in the coming years. A change in core executive leadership at such a pivotal moment undoubtedly introduces an element of uncertainty regarding the implementation and momentum of these crucial initiatives.

The broader landscape presents multifaceted challenges for Ethereum: intense competition from high-performance Layer 1 chains like Solana, the persistent issue of Layer 2 fragmentation, emerging narratives around AI and blockchain integration, and the pervasive impact of volatile crypto market sentiment on ecosystem funding and developer attention.

Notably, on the very day Stańczak announced his departure, ETH briefly dipped into the $1,800 range. Should it fall further, a stark reality could emerge: the cumulative return for holding ETH might dip below traditional U.S. dollar cash interest rates.

To illustrate this sobering point: ETH first reached $1,400 in January 2018. Adjusting that $1,400 for compounded U.S. CPI inflation, it would be equivalent to approximately $1,806 by February 2026.

This implies that an investor who bought ETH in 2018 and simply held it without staking might, after eight years, find themselves not only without profit but having underperformed simply keeping U.S. dollars in a savings account. For the dedicated “E-guards” (staunch Ethereum supporters), the real question may not be about the “roadmap battle,” but rather: how much longer can this conviction endure?

One thing remains clear: the core organization overseeing one of the crypto world’s most vital ecosystems continues its quest for identity and optimal operational strategy within a rapidly evolving industry. This journey, undoubtedly, will be anything but tranquil.

(This content is excerpted and reproduced with authorization from our partner PANews. Original Link | Source: )

Disclaimer: This article provides market information only. All content and views are for reference purposes and do not constitute investment advice. They do not represent the views or positions of BlockTempo. Investors should make their own decisions and conduct their own transactions. The author and BlockTempo will not be held responsible for any direct or indirect losses incurred by investors’ transactions.