Bitcoin’s Prolonged Correction: Long-Term Holders Under Pressure as Selling Intensifies

Bitcoin (BTC) continues to navigate a challenging market, with its price trajectory showing persistent weakness. According to recent data from CryptoQuant, the cryptocurrency is currently trading more than 45% below its previous all-time high of $126,000. This extended correction period is exerting significant pressure across the investor spectrum, and notably, even the typically resilient Long-Term Holders (LTHs) are now feeling the strain of these unfavorable market dynamics.

Long-Term Holders Realizing Losses: A Rare Occurrence Since 2023 Bear Market

A critical on-chain indicator, the Long-Term Holder Spent Output Profit Ratio (LTH SOPR), which measures the realized profit or loss when UTXOs (Unspent Transaction Outputs) are spent, has recently dipped into negative territory. While the annual average LTH SOPR remains relatively high at 1.87, the metric has plummeted to 0.88. This represents a critical breach below the 1.0 threshold, a level not witnessed since the conclusion of the 2023 bear market.

This decline signifies that, on average, long-term holders are currently realizing losses on their Bitcoin sales. Such behavior reflects a gradual accumulation of financial pressure within this historically steadfast investor cohort, who typically hold through market volatility, indicating a significant shift in investor sentiment.

Surge in LTH Deposits to Binance Signals Heightened Selling Pressure

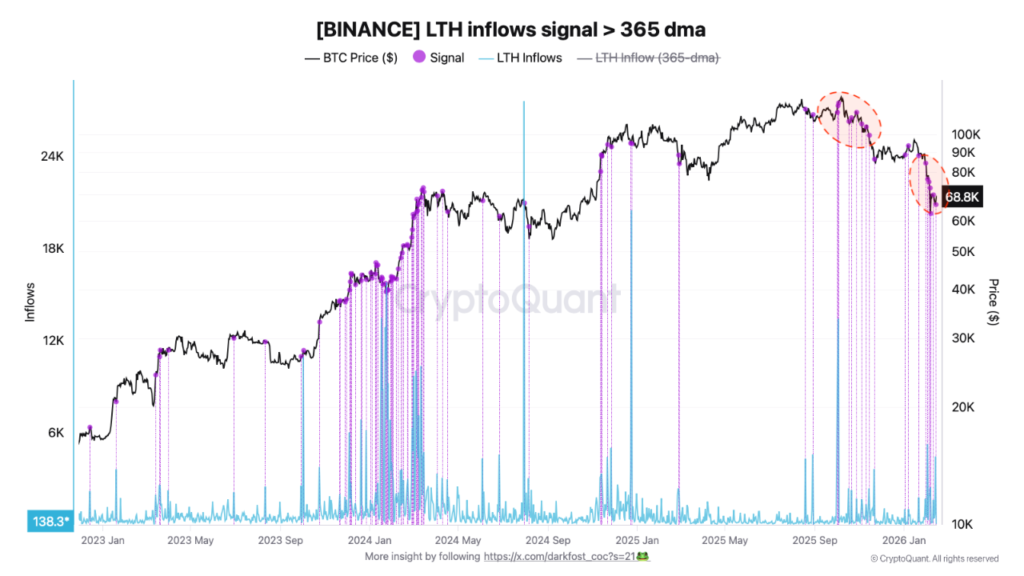

Concurrently with the increasing proportion of realized losses, a notable surge in LTH deposits to Binance has been observed in recent weeks. Data indicates periods where daily LTH deposits reached approximately twice their annual average, signaling unusually high liquidity flows and a distinct shift in investor behavior. These activity spikes suggest that a segment of long-term holders is proactively adjusting their positions in response to the prevailing market conditions.

This pattern, initially observed since the last all-time high, has notably accelerated in recent weeks. Consistent days of above-average deposit volumes point to sustained growth in LTH activity on the exchange. Given LTHs’ capacity to move substantial Bitcoin volumes, their preference for Binance’s superior market depth and liquidity to execute larger trades is unsurprising.

Market Adjustment and Risk Management by Key Investors

Against this backdrop of a continuing broader market correction, the escalating LTH deposits can be interpreted as a strong signal of intensifying selling pressure. This behavior underscores a market in a significant adjustment phase, where even long-term investors are actively managing their risk exposure. Such actions by a key investor demographic could continue to exert downward pressure on Bitcoin’s market dynamics in the short to medium term as the market seeks a new equilibrium.

Disclaimer: This article is provided for market information purposes only. All content and views expressed herein are for reference only and do not constitute investment advice. They do not represent the views or positions of the author or BlockTempo. Investors should conduct their own research and make independent investment decisions. The author and BlockTempo shall not be held liable for any direct or indirect losses incurred by investors as a result of their transactions.