The United States is on the cusp of an unprecedented financial surge, with the 2026 tax season poised to deliver a historic wave of refunds. According to a recent analysis by Wells Fargo, an estimated $150 billion in tax refund funds is expected to inundate the market by the end of March alone. This substantial influx of capital, dubbed a “windfall,” is projected to reignite investor risk appetite, particularly benefiting volatile assets such as Bitcoin and the broader stock market.

The Wells Fargo Investment Institute (WFII), in its February 2026 report, highlighted the impending large-scale tax refunds as a significant liquidity injection that will likely propel risk assets, including equities and cryptocurrencies like Bitcoin, to new highs.

Unpacking the Unprecedented Scale of Refunds

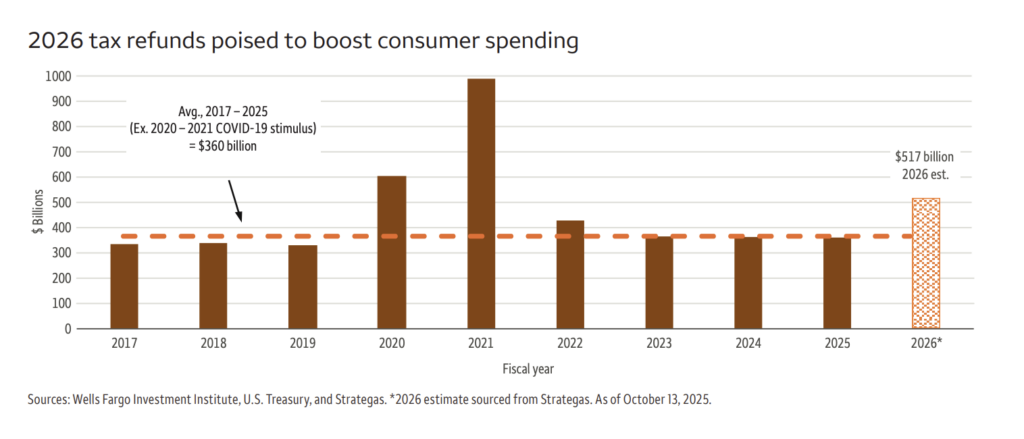

This year’s anticipated refund volume marks a new record since 2017. WFII projects that total tax refunds for the entirety of 2026 will surpass an astounding $500 billion, representing a year-over-year increase of over 30%. On average, eligible taxpayers can expect to see their refunds grow by an additional $1,000 to $2,000 compared to the previous year, a boon particularly for middle-to-high-income households and those with significant investment portfolios.

Driving Factors Behind the Refund Boom

Two primary factors are contributing to this monumental increase in tax refunds. Firstly, the tax and spending bill enacted by the Trump administration in the summer of 2025 introduced significant tax cuts. Secondly, a substantial number of taxpayers in 2025 failed to adjust their tax withholding rates in a timely manner, resulting in an aggregated overpayment of taxes throughout the year. This overpayment is now slated for a concentrated return in 2026. Kevin Hassett, Director of the White House National Economic Council, emphasized that a “large portion of this refund will be issued as early-year refunds,” underscoring the immediate impact.

Market Mania: The ‘YOLO’ Effect on Investments

Wells Fargo analysts anticipate that this wave of refunds will trigger a “YOLO” (You Only Live Once) investment mentality among retail investors. The report suggests that over 60% of these refund funds could swiftly flow into the stock and cryptocurrency markets. Bitcoin, as a quintessential risk asset, is expected to be a direct beneficiary. High-income consumers, in particular, are forecast to reinvest their newfound savings into equities, significantly bolstering investment sentiment. Furthermore, trading platforms akin to Robinhood and high-volatility technology stocks are identified as potential strong performers.

Retail Resurgence: A Boost for Consumer Spending

Beyond the financial markets, the retail sector is also poised for a substantial uplift. Warehouse membership clubs like Costco, apparel retailers, and major general merchandise stores such as Walmart are expected to benefit from the surge in disposable income. However, analysts caution that the overall increase in consumer spending may not be uniformly distributed, as lower-income households are more likely to prioritize using their refunds for debt repayment or bolstering emergency savings.

Reigniting Economic Momentum

Investment strategy analysts at Wells Fargo affirm that this nearly 30% year-over-year increase in tax refunds will “substantially boost consumption and help the US economy regain momentum in 2026.” This powerful injection of capital is expected to provide a crucial stimulus, fostering economic growth and stability.

Disclaimer: This article provides market information for reference purposes only. All content and views expressed herein are not intended as investment advice and do not necessarily reflect the opinions or positions of BlockTempo. Investors are encouraged to conduct their own due diligence and make independent investment decisions. The author and BlockTempo shall not be held liable for any direct or indirect losses incurred as a result of investor transactions.