By: Frank, PANews

On February 18, 2026, Polymarket, a leading decentralized prediction market, announced a pivotal change: the experimental introduction of taker fees in its sports markets. This initial rollout will cover major events such as NCAA (U.S. college basketball) and Italy’s Serie A, with plans for a gradual expansion across all sports offerings.

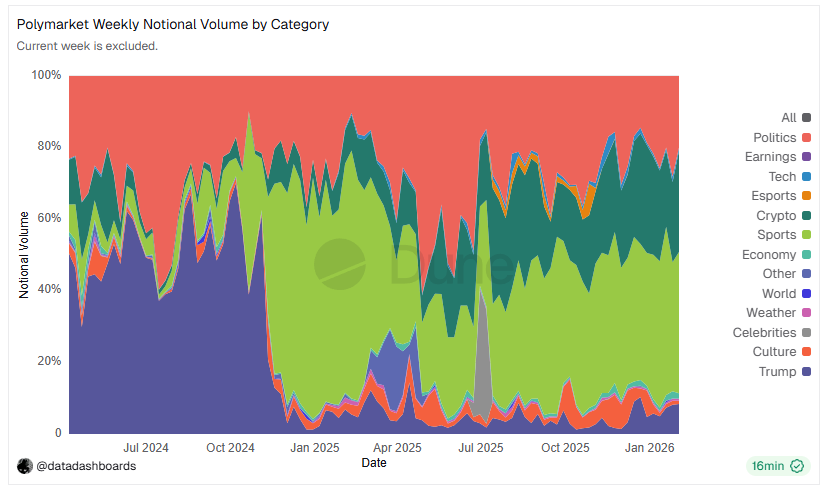

This strategic move follows an impressive revenue streak. Previously, Polymarket had already surpassed $1.08 million in weekly revenue, solely from fees on its 15-minute crypto price fluctuation markets. On-chain data further reveals that sports markets constitute nearly 40% of the platform’s total trading activity. Extrapolating from the crypto market’s fee generation, this segment alone could contribute an annualized revenue of approximately $56 million. With the significantly larger sports market now entering the fee-charging era, Polymarket is poised to potentially become the most formidable “money-printing machine” within the crypto landscape.

This in-depth analysis by PANews delves into Polymarket’s intricate fee mechanisms, robust revenue models, competitive positioning, and the highly anticipated token airdrop.

From “Zero Revenue” to Millions Weekly: A $9 Billion Giant Accelerates Its Monetization Drive

For an extended period, Polymarket operated with a “zero-revenue” model, deliberately waiving transaction fees across most of its markets. This audacious strategy fueled remarkable growth: cumulative transaction volume hit an astounding $21.5 billion throughout 2025, capturing nearly half of the global prediction market’s total volume of $44 billion. January 2026 alone saw a record-breaking monthly volume exceeding $12 billion.

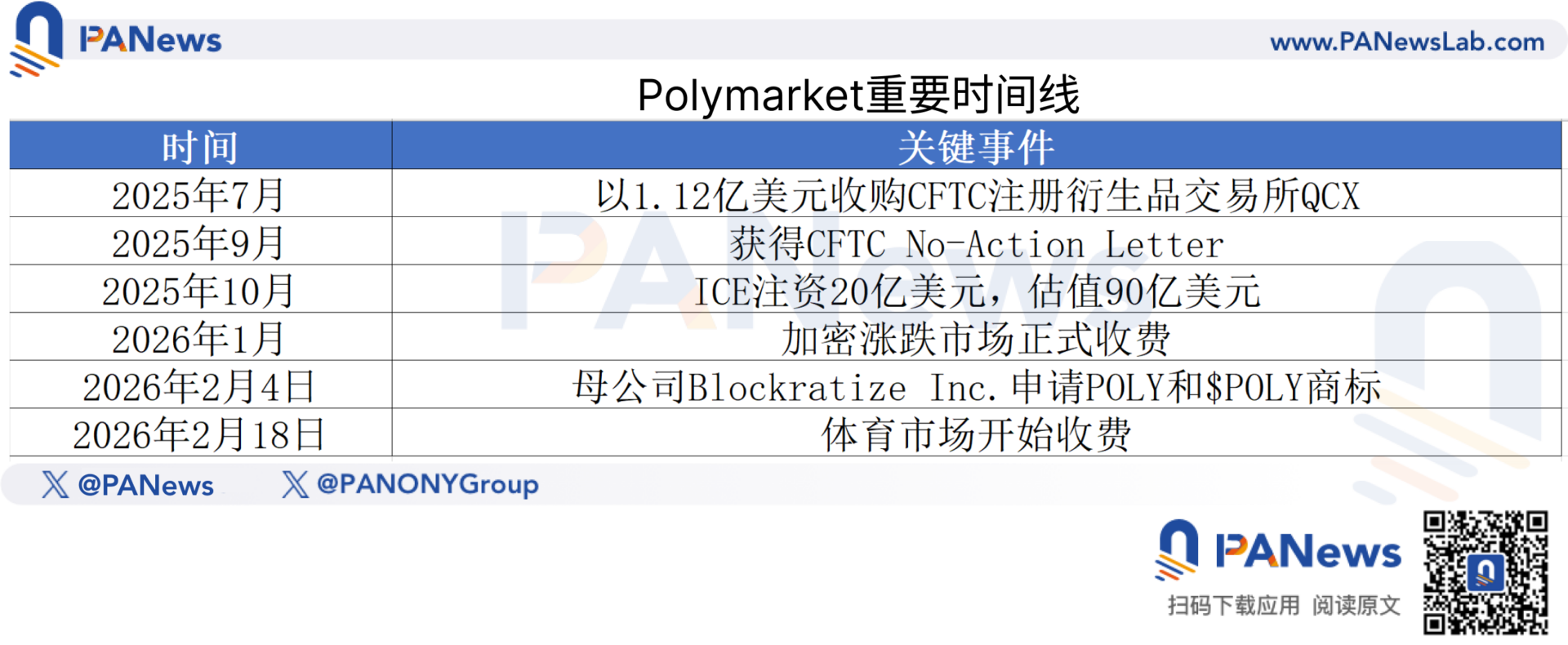

However, as the prospect of a token listing draws nearer, the zero-revenue approach became increasingly incongruous with Polymarket’s soaring valuation. The platform’s latest funding round valued it at $9 billion, notably including a $2 billion investment in October 2025 from Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange. According to PM Insights, Polymarket’s implied equity valuation on the secondary market had surged to $11.6 billion by January 19, 2026, a nearly 29% increase from its previous funding round. Whispers suggest future rounds could push valuations to an unprecedented $12 billion to $15 billion. Such stratospheric valuations necessitate a robust and corresponding revenue stream.

The turning point arrived in January 2026, signaling a clear acceleration in Polymarket’s monetization efforts.

In January, Polymarket formally introduced a “Taker Fee” (market order fee) for its high-frequency 15-minute crypto price fluctuation markets, with rates reaching up to 3%. The impact was immediate and profound: by early February 2026, weekly fee revenue soared past $1.08 million. In one particular week in January, the 15-minute crypto market alone contributed $787,000, representing 28.4% of the platform’s total prediction market fee revenue of $2.7 million during that period. To date, Polymarket has generated over $4.7 million in fees, firmly establishing its position among the top revenue-generating protocols.

The Ingenious Design Behind 0.45%: A Fee Model Beyond Mere Profit

The fee structure Polymarket is implementing for its sports markets is a meticulously crafted dynamic rate model.

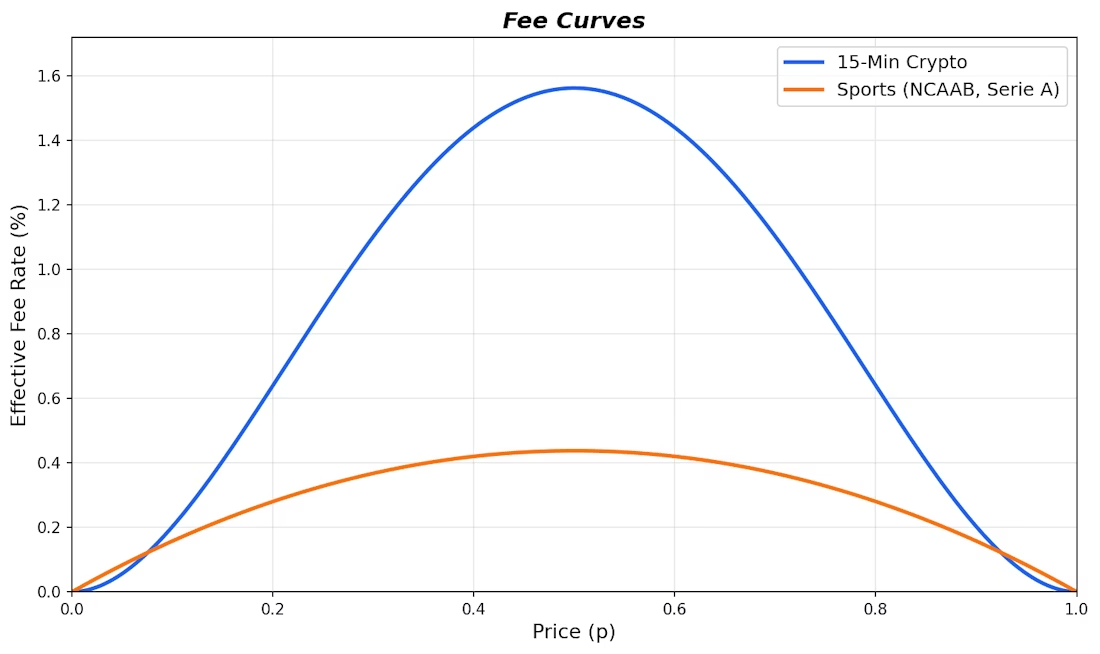

Based on official Polymarket documentation and community analysis, sports market fees will exclusively apply to market orders (Takers). Limit orders (Makers) will not only remain free but will also receive a 25% rebate of the taker fee. Mirroring the crypto market’s fee model, these rates are not static but fluctuate in response to changes in event probability:

In essence, markets with higher uncertainty incur higher fees, peaking at 0.44% for a 50% probability. Conversely, rates drop significantly to just 0.13%-0.16% when probabilities are at 10% or 90%.

While the peak fee rate for sports markets (0.45%) is considerably lower than those in the crypto markets, this does not diminish the immense revenue potential of the sports segment.

Current data indicates that sports markets account for a substantial 39% of Polymarket’s total trading activity, outperforming both political (20%) and crypto (28%) categories. More critically, as highlighted in previous PANews analysis, the average trading volume for short-term sports markets on Polymarket ($1.32 million) is an astonishing 30 times greater than that of short-term crypto markets ($44,000). This disparity strongly suggests that a full implementation of fees across sports markets will unlock monumental revenue growth.

Consider the 2026 Super Bowl as a prime example: Polymarket recorded approximately $795 million in total transaction volume across Super Bowl-related markets, encompassing predictions for game outcomes, player performances, and even halftime show events. At its peak, sports events have driven the platform’s total weekly prediction market volume to exceed $6.3 billion.

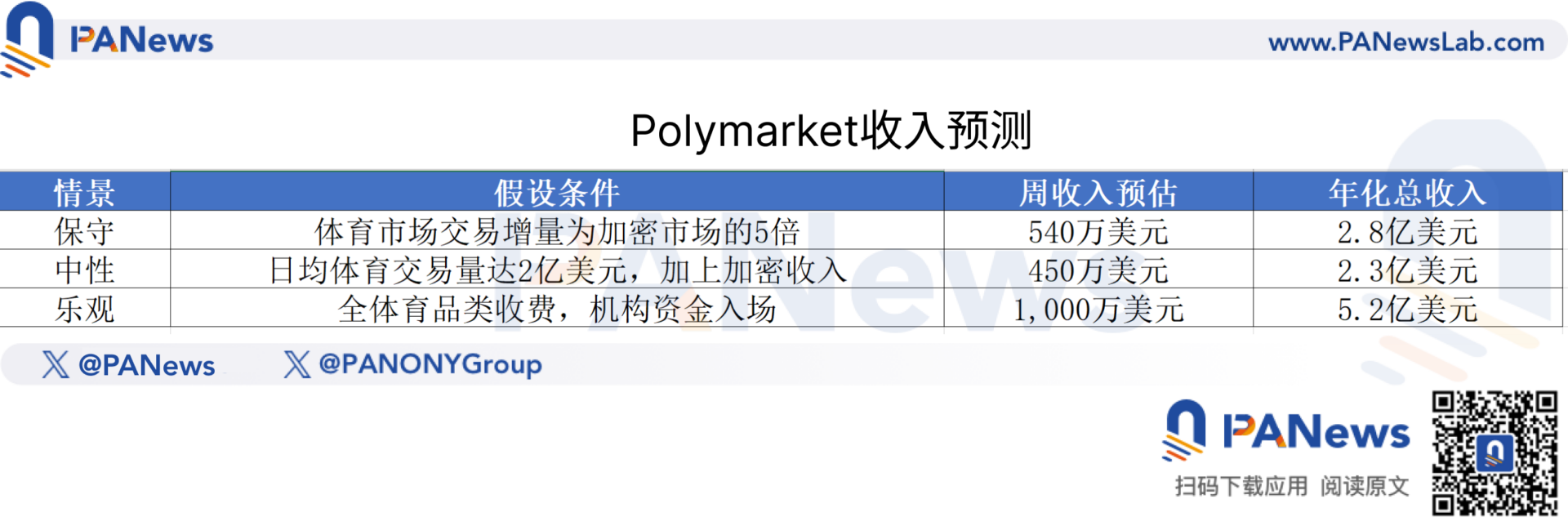

Leveraging existing data, PANews has developed three profit projection scenarios (assuming an average effective fee rate of 0.25% for sports markets, factoring in probability distribution and free limit orders):

Even under the most conservative estimates, Polymarket’s annualized revenue, once fees are fully implemented, is projected to surpass $200 million. This places it firmly among the highest-earning protocols in the Web3 ecosystem.

While it may be unrealistic to rival the colossal treasury interest income of Tether or the gas fees of the Ethereum mainnet, Polymarket possesses a compelling potential to claim the title of “most profitable dApp” at the application layer. Its exceptional user retention rate of 85%, significantly higher than typical DeFi protocols, underscores the quality and stickiness of its user base, translating into more sustainable and valuable revenue streams.

The POLY Token and Airdrop: A Multi-Million Dollar “Wealth Feast” Awaits?

Polymarket’s impressive valuation and expansive user base position its token airdrop as one of the most eagerly anticipated events of 2026.

Matthew Modabber, Polymarket’s Chief Marketing Officer, has explicitly confirmed: “There will be a token, there will be an airdrop.” Market sentiment predicts a 62%-70% probability of Polymarket launching its token before December 31, 2026. Given the momentum of its U.S. operations restart, the Token Generation Event (TGE) is highly likely to occur by mid-2026.

Further fueling speculation, Blockratize Inc., Polymarket’s parent company, filed for “POLY” and “$POLY” trademarks on February 4, 2026—a move widely regarded by the industry as a critical precursor to a TGE. Historically, the crypto industry typically sees a 3-6 month window between trademark registration and the actual TGE.

Airdrop Scale Potentially Exceeding Hyperliquid: The Era of Volume Farming Concludes

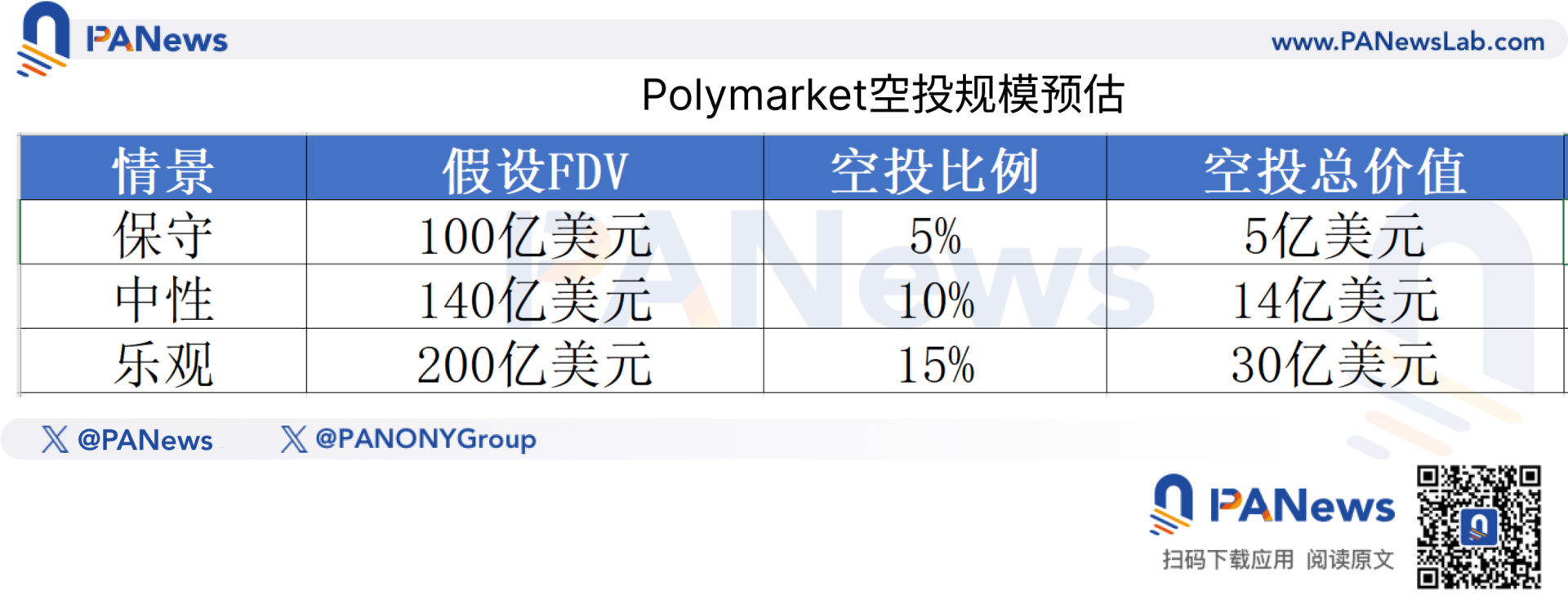

Drawing comparisons to the airdrop allocations of recent top-tier projects like Arbitrum, Jupiter, and Hyperliquid, community shares typically range between 5% and 15% of the total supply. PANews has conducted calculations based on various valuation assumptions:

Should the total airdrop amount reach $1.4 billion, and assuming 500,000 eligible active addresses, the average airdrop value per account could approximate $2,800. However, adhering to the “80/20 rule,” top-tier users could potentially see gains in the hundreds of thousands or even millions of dollars, while general retail participants should temper their expectations accordingly.

A particularly noteworthy development is Polymarket’s introduction of a 4% annualized Holding Rewards program, launched concurrently with the fee implementation. These rewards are distributed daily based on hourly snapshots. This mechanism clearly signals the project’s strategic preference: the duration for which funds are held on the platform is prioritized far above mere trading frequency, emphasizing long-term engagement and capital retention.

Moats and Concerns: Navigating the Risks for This “Money Printing Machine”

The introduction of fees inevitably means additional costs for users. So, what underpins Polymarket’s ability to successfully implement and sustain these charges?

Polymarket’s competitive advantages, or “moats,” are distinctly clear:

- Unrivaled Liquidity Depth: The platform boasts unparalleled liquidity in the prediction market sector, a critical factor for large-volume traders seeking efficient execution.

- Overwhelming Cost Advantage: Compared to the 5%-10% rake of traditional sportsbooks and Kalshi’s 1%-3.5% fees, Polymarket’s peak fee rate of 0.45% still presents a formidable cost benefit to users.

- Strategic ICE Partnership: The involvement of ICE not only injected substantial capital but also brought formidable data distribution capabilities. ICE’s plans to integrate Polymarket’s real-time prediction data into its global institutional client network establishes a potent “second growth curve” beyond transaction fees.

However, potential risks must also be acknowledged:

- Short-Term Trading Volume Volatility: Polymarket’s monthly transaction volume has historically shown fluctuations, dropping from a peak of $1.026 billion in November 2025 to $543 million in December. The question remains whether the introduction of fees will exacerbate such trends. Nevertheless, drawing on the positive effects observed after the introduction of Maker Rebates—such as increased market depth and reduced spreads—long-term trading volume could potentially see an upward trajectory.

- Intensifying Competitive Landscape: Kalshi maintains a first-mover advantage in the compliant U.S. market (reporting approximately $260 million in revenue in 2025). Meanwhile, Hyperliquid is actively attempting to penetrate the prediction market space through “Outcome Trading” (with an FDV of approximately $16 billion), and Predict.fun attracts users by layering DeFi yields.

- Regulatory Uncertainty: Despite securing a No-Action Letter from the CFTC and acquiring the compliant exchange QCX, the evolving U.S. regulatory environment remains a persistent “Sword of Damocles” hanging over all prediction markets.

Conclusion

From a free-to-use model to a fee-based structure, and from crypto price fluctuation markets to global sports events, Polymarket is orchestrating a meticulously planned business model transformation. The crypto market alone demonstrates its capacity to generate millions weekly, and now, the sports market—a colossal segment accounting for nearly 40% of the platform’s trading volume and boasting 30 times the liquidity of its crypto counterpart—is just beginning its monetization journey. Polymarket’s narrative offers a profound insight: a platform’s true value may not solely reside in its current earnings, but in its demonstrated confidence and capability to “charge when it chooses to.” When the market pie is sufficiently large and the competitive moats are deep, opening the floodgates to fees becomes an inevitable progression.

This “money printing machine,” now in its warm-up phase, merely pressed its ignition key on February 18th.