Author: The Kobeissi Letter

Translated & Compiled by: Tim, PANews

Crypto Market’s $1.1 Trillion Plunge: A Structural Adjustment or Deeper Correction?

The cryptocurrency market has recently witnessed a staggering downturn, with its total market capitalization shedding an astonishing $1.1 trillion over the past 41 days—an average daily loss of $27 billion. Following the significant “October 11th Great Liquidation,” the crypto market cap now stands approximately 10% lower than its preceding levels. This analysis posits that the current downturn is not merely a temporary dip but rather a profound structural market adjustment, and we will delve into the compelling reasons why.

A Paradoxical Decline Amidst Positive Fundamentals

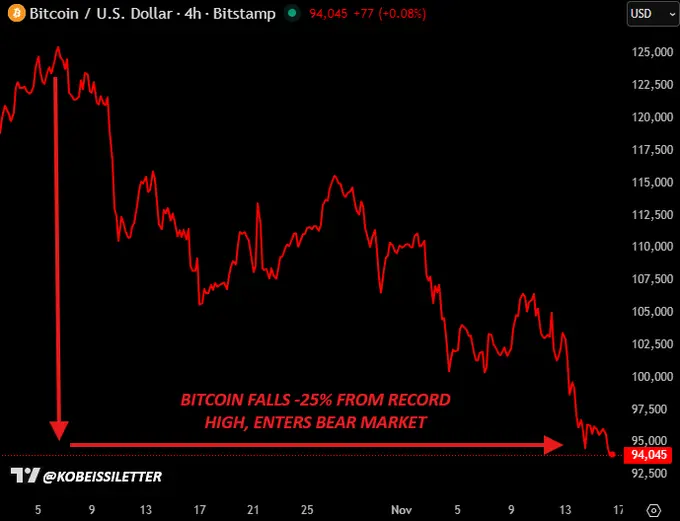

What makes this market correction particularly perplexing is its occurrence despite a notable absence of substantial negative fundamental catalysts within the cryptocurrency ecosystem. In fact, just days prior to this downturn, former President Trump underscored his commitment to positioning the United States as a global leader in the crypto space. Yet, against this backdrop, Bitcoin has plummeted by 25% within a single month.

The Genesis of the Structural Shift: Institutional Outflows and Excessive Leverage

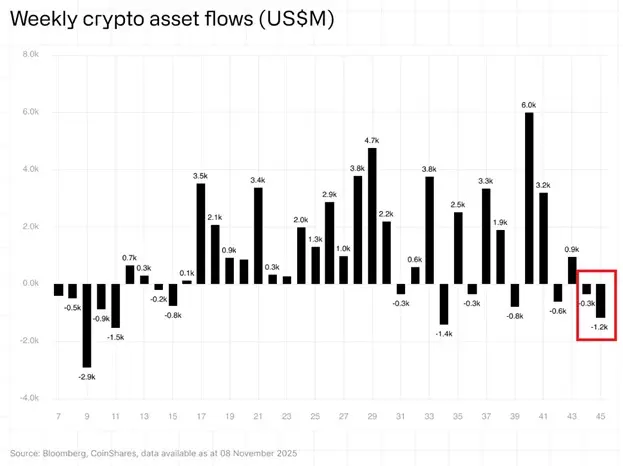

This appears to be a structurally driven decline, initiated by significant institutional capital outflows observed from mid to late October. The first week of November alone saw crypto funds register a staggering $1.2 billion in outflows. Critically, these outflows transpired at a time when market leverage was extraordinarily high, setting the stage for amplified volatility.

The Leverage Trap: A Domino Effect in Motion

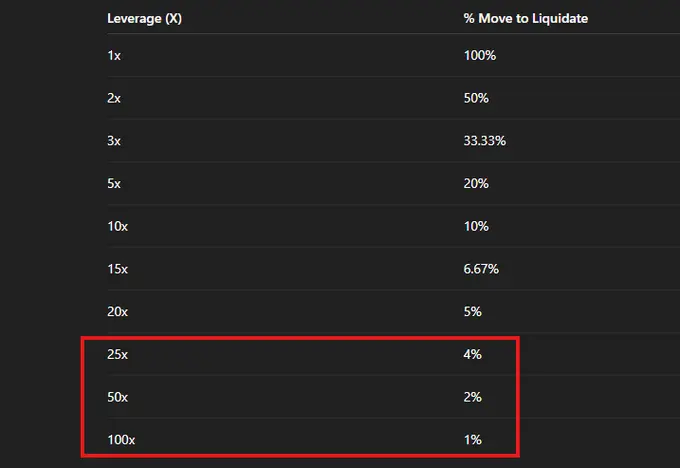

The cryptocurrency market is notorious for its aggressive use of leverage. It is not uncommon for speculative traders to employ leverage multiples of 20x, 50x, or even 100x. As illustrated in the accompanying chart, a mere 2% price fluctuation can trigger a liquidation event for positions leveraged at 100x. When millions of traders simultaneously engage with such high leverage, even minor price movements can cascade into a devastating domino effect across the market.

Consequently, when the market experiences sudden downward pressure, the volume of liquidations surges dramatically. This phenomenon was starkly evident on October 11th, when a colossal $19.2 billion liquidation frenzy contributed to Bitcoin’s unprecedented daily candle drop of $20,000. This episode vividly demonstrated how dangerously sensitive the market has become due to over-leveraging.

Persistent Volatility and Extreme Fear

The intensity of these liquidations has persisted. In the last 16 days alone, three separate days have seen single-day liquidation totals exceed $1 billion. Furthermore, daily liquidation amounts surpassing $500 million have become a regular occurrence. This aggressive deleveraging, particularly during periods of subdued trading volume, fuels extreme price swings in both directions across the crypto market.

This volatile environment has naturally led to a dramatic shift in market sentiment. The Crypto Fear & Greed Index has plunged to a reading of 10, signaling “Extreme Fear”—a level mirroring historical lows. This occurs despite Bitcoin having rallied 25% from its April lows, underscoring how leverage magnifies investor emotional responses, turning minor corrections into panic-driven sell-offs.

Divergence from Safe Havens and Altcoin Performance

For those still skeptical of a structural shift, consider the stark divergence between Bitcoin and Gold since the October 11th liquidation event. For over 12 months, both assets exhibited a strong correlation as perceived safe havens. However, since early October, Gold has demonstrably outperformed Bitcoin by a remarkable 25 percentage points, indicating a significant decoupling in investor perception.

The market’s underlying weakness is even more pronounced beyond Bitcoin. Ethereum, for instance, is currently down -8.5% year-to-date and has suffered a steep 35% decline since October 6th. This sharp drop for Ethereum stands in stark contrast to a broader rally observed across other risk assets, suggesting its downturn transcends typical bear market corrections.

Nearing the Bottom: A Macroeconomic Perspective

Stepping back, the cryptocurrency market appears to be navigating a “structural” bear phase. While fundamental improvements are evident, the dynamics influencing price are undeniably changing. As with any efficient market, these imbalances are self-correcting. Therefore, we contend that the market bottom is likely approaching.

Beyond the crypto sphere, broader macroeconomic shifts are creating compelling investment opportunities across various asset classes. Global M2 money supply has reached an unprecedented $137 trillion. Japan is on the verge of implementing an economic stimulus package exceeding $110 billion, and the anticipated $2,000 tariff bonus from former President Trump’s policies is also on the horizon. From a macro perspective, the current crypto downturn may simply represent the growing pains on an inevitable upward trajectory.

(The above content is excerpted and reproduced with authorization from partner PANews. Original Link)

Disclaimer: This article is provided for market information purposes only. All content and views are for reference only, do not constitute investment advice, and do not represent the views and positions of BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not bear any responsibility for direct or indirect losses resulting from investor transactions.