By Arthur Hayes

Originally titled: Snow Forecast

The Global Liquidity Forecast: Winter is Coming (and Going)

It’s that time of year again when I don my amateur meteorologist hat. Concepts like La Niña and El Niño find their way into my lexicon, not just to predict powder days but to forecast the winds of global finance. Just as knowing the storm’s direction and snowfall dictates the best slopes, understanding macro weather patterns helps predict the ebb and flow of market liquidity.

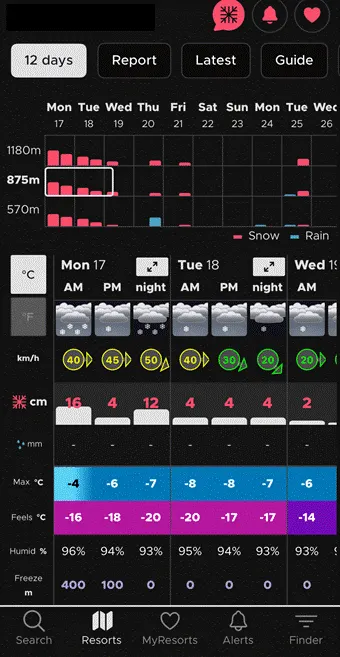

My crude knowledge of weather patterns allows me to anticipate the end of autumn and the onset of winter in Hokkaido, Japan. I find myself discussing my dream of an early powder season with fellow local ski enthusiasts. The days of constantly refreshing my favorite crypto trading app are temporarily replaced by my new obsession: Snow-Forecast.

As data points trickle in, I’m forced to make decisions with incomplete information about when to hit the slopes. Sometimes, the true weather pattern only reveals itself the day before I strap on my skis. A few seasons ago, I arrived in mid-December to find the mountains covered in mud, with a single lift serving thousands of eager skiers. The queues stretched for hours, all for a sparse, flat beginner-to-intermediate slope. Yet, the very next day, a monumental snowfall transformed my favorite tree-lined resort into one of the most epic powder days imaginable.

This dynamic mirrors the crypto market. Bitcoin, in essence, acts as a free-market weather vane for global fiat liquidity. Its price movements are dictated by expectations of future fiat supply. Sometimes reality aligns with these expectations; other times, it deviates wildly.

Money, at its core, is politics. And the ever-shifting winds of political rhetoric profoundly influence market expectations for future fiat supply. One day, a U.S. President might call for larger, cheaper injections of capital to inflate the assets of their favored supporters. The next, they might advocate for the opposite, ostensibly to combat inflation that devastates the common person.

Much like in science, in trading, it pays to hold strong convictions but maintain a flexible approach.

The Shifting Sands of Liquidity

Following the debacle of “Massive Tariff Day” on April 2, 2025, I confidently called for an “Up Only” market. My belief was that President Trump and his Treasury Secretary, “Buffalo Bill” Bessent, had learned their lesson. They would no longer attempt to rapidly overhaul the world’s financial and trade operating system. Instead, to salvage popularity, they would shower their supporters – those holding substantial financial assets like property, stocks, and cryptocurrencies – with benefits, all funded by printed money.

On April 9, Trump “Taco’d” (yielded), announcing a tariff truce. What initially seemed like the precipice of a depression transformed into the year’s prime buying opportunity. Bitcoin surged by 21%, with certain altcoins (primarily Ethereum) following suit, evidenced by Bitcoin’s dominance decreasing from 63% to 59%.

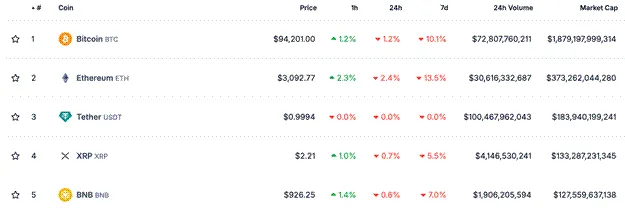

However, more recently, the implied U.S. Dollar liquidity forecast for Bitcoin has deteriorated. Since its all-time high in early October, Bitcoin has fallen by 25%, and many altcoins have been hit even harder than capitalists in a New York mayoral election.

What Triggered This Shift?

The Trump administration’s rhetoric hasn’t changed. Trump continues to rail against the Federal Reserve for keeping interest rates too high. He and his deputies still speak of inflating the real estate market through various means. Crucially, Trump has consistently conceded to China at every turn, delaying any forceful reversal of the trade and financial imbalances between these two economic giants – a level of financial and political pain too great for politicians who must face voters every two to four years.

What *has* changed, and what the market now weighs more heavily than political pronouncements, is the contraction of U.S. Dollar liquidity.

The U.S. Dollar Liquidity Index (white line) has fallen by 10% since April 9, 2025, while Bitcoin (gold line) climbed by 12%. This divergence was partly fueled by the Trump administration’s positive liquidity rhetoric. It was also due to retail investors interpreting Bitcoin ETF inflows and Digital Asset Trust (DAT) mNAV premiums as undeniable proof of institutional demand for Bitcoin exposure.

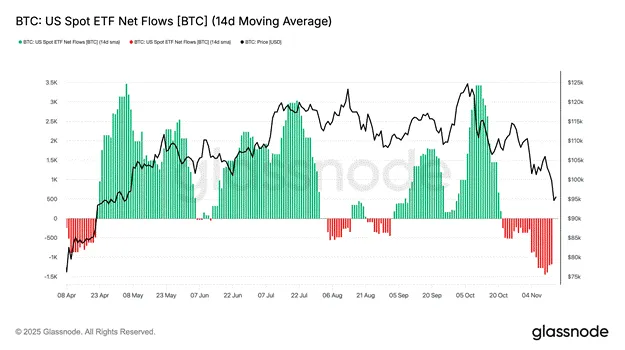

The prevailing narrative was that institutional investors were pouring into Bitcoin ETFs. As shown, net inflows between April and October provided sustained buying pressure for Bitcoin, even as U.S. Dollar liquidity declined. However, a critical caveat accompanies this chart: the largest holders of the biggest ETF (BlackRock IBIT US) are utilizing the ETF as part of a basis trade; they are not inherently bullish on Bitcoin.

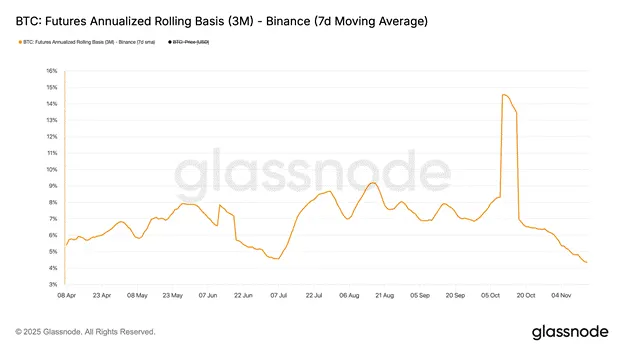

These sophisticated players profit by shorting CME-listed Bitcoin futures contracts while simultaneously buying the ETF, capturing the spread between the two. This strategy is highly capital-efficient, as their brokers typically allow them to use the ETF as collateral, offsetting their short futures position.

These are the five largest holders of IBIT US – predominantly major hedge funds or proprietary trading desks at investment banks like Goldman Sachs.

The chart above illustrates the annualized basis yield these funds generated by buying IBIT US and selling CME futures contracts. While the exchange shown is Binance, the annualized basis on CME is essentially identical. When the basis significantly exceeds the federal funds rate, hedge funds flock to execute this trade, creating substantial and consistent net inflows into the ETFs. This creates an illusion for those unfamiliar with market microstructure, suggesting immense institutional interest in holding Bitcoin exposure, when in reality, they care nothing for Bitcoin. They are merely playing in our sandbox to earn a few percentage points above the federal funds rate. When the basis declines, they rapidly exit their positions. Recently, as the basis has fallen, the ETF complex has recorded massive net outflows.

Now, retail investors, believing these institutions have lost interest in Bitcoin, are caught in a negative feedback loop, driving further selling, which further reduces the basis, leading to even more institutional ETF dumping.

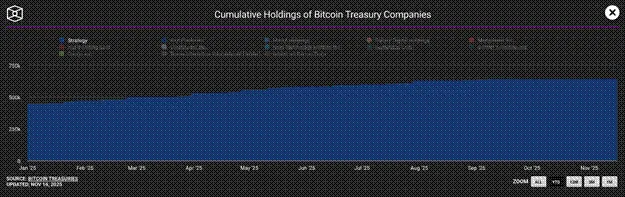

Digital Asset Trust (DAT) companies offer another avenue for institutional investors to gain Bitcoin exposure. Strategy (ticker: MSTR US) stands as the largest DAT holding Bitcoin. When its stock trades at a significant premium to its Bitcoin holdings (known as mNAV), the company can issue stock and other financing to acquire Bitcoin at a discount. As this premium has now turned into a discount, Strategy’s pace of Bitcoin acquisition has naturally slowed.

This chart depicts cumulative holdings, not the rate of change, but it clearly shows that as Strategy’s mNAV premium evaporated, the growth rate of its holdings decelerated.

Despite the contraction in U.S. Dollar liquidity from April 9 to the present, Bitcoin ETF inflows and DAT purchases allowed Bitcoin to climb. That era has now concluded. The basis is no longer attractive enough to sustain continuous institutional ETF buying, and most DATs are trading at a discount to mNAV, causing investors to shun these Bitcoin derivative securities. Without these masking flows to obscure the negative liquidity backdrop, Bitcoin must decline to reflect current short-term concerns that U.S. Dollar liquidity will contract or grow slower than politicians promised.

The Political Imperative: Show Me The Money

It’s time for Trump and Bessent to put up or shut up. Either they possess the power to override the Federal Reserve, engineer another housing bubble, distribute more stimulus checks, and so on, or they are merely impotent charlatans.

Complicating matters, Blue Democrats have (unsurprisingly) discovered that campaigning on various affordability themes is a winning strategy. Whether the opposition party can deliver on promises like free bus passes, abundant rent-controlled apartments, and government-run grocery stores is beside the point. The core issue is that American voters want to be heard and, at the very least, self-deceive themselves into believing someone is looking out for them. They don’t want Trump and his MAGA supporters to gloss over the inflation they witness and feel daily with “fake news.”

They want to be heard, just as Trump told them in 2016 and 2020 that he would crack down on and deport “people of color” so their high-paying jobs would magically reappear.

For those with a multi-year outlook, these short-term pauses in fiat creation rates are irrelevant. If Red Republicans fail to print enough money, equity and bond markets will crash, forcing even the most dogmatic members of both parties back into the satanic cult of money printing.

Trump is a shrewd politician, much like former President Biden – who faced similar grievances about inflation sparked by COVID stimulus. He will publicly pivot, blaming the Fed as the culprit for the inflation plaguing ordinary voters. But rest assured, Trump won’t forget the wealthy asset holders who fund his campaigns. “Buffalo Bill” Bessent will receive strict orders to print money in creative ways incomprehensible to the average person.

Remember this photo from 2022? Our favorite sycophantic Fed Chair, Powell, was being “schooled” by former President “Slow Joe” Biden and U.S. Treasury Secretary “Bad Gurl” Yellen. Biden explained to his supporters that Powell would crush inflation. Then, because he needed to boost the financial assets of the rich who put him in power, he told Yellen to, by any means necessary, undo all of Powell’s rate hikes and balance sheet shrinkage.

Yellen issued more Treasury bills than notes or bonds, siphoning $2.5 trillion from the Fed’s Reverse Repo Program from Q3 2022 to Q1 2025, thereby inflating stocks, housing, gold, and crypto.

To the average voter – and some readers here – what I just wrote might as well be hieroglyphics, and that’s precisely the point. The inflation you feel in your bones is being engineered by the very politicians who claim to care about solving the common person’s affordability crisis.

“Buffalo Bill” Bessent must now conjure similar magic. I am 100% confident he will engineer a similar outcome. He is one of the greatest masters of money market plumbing and monetary arbitrage in history.

The Current Market Setup: A Repeat Performance?

The market setup in the latter half of 2023 and 2025 bears striking similarities. The debt ceiling disputes concluded in mid-summer (June 3, 2023, and July 4, 2025), compelling the Treasury to rebuild its General Account (TGA), thereby drawing liquidity from the system.

2023:

2025:

“Bad Gurl” Yellen delivered for her boss. Can “Buffalo Bill” Bessent find his “BB” and employ Bismarckian means to reshape markets, ensuring Red Republicans secure the votes of financially asset-holding constituents in the 2026 midterm elections?

To dispel any notion that they would allow credit to contract, the market will present a Hobson’s Choice. Once investors realize that money printing is off the table in the short term, equity and bond prices will plummet. At this juncture, politicians will face a stark dilemma: either print money to rescue the highly leveraged fiat financial system that supports the broader economy, thereby re-accelerating inflation; or allow credit to contract, which would decimate wealthy asset holders and lead to mass unemployment as over-leveraged businesses slash output and jobs.

Historically, the latter is usually the politically more palatable option, as 1930s-style unemployment and financial distress are always electoral losers, while inflation is a silent killer that can be masked by subsidies for the poor, funded by – you guessed it – more printing.

Just as I have absolute faith in Hokkaido’s “snow-making machine,” I am 100% confident that Trump and Bessent, desiring to keep their Red Republicans in power, will find a way to simultaneously appear tough on inflation while printing the necessary money to continue propping up the Keynesian “fractional reserve banking” scam that underpins the U.S. and global economic status quo.

In the mountains, arriving too early can sometimes mean skiing on mud. In financial markets, before we return to “Up Only,” as Nelly would say, the market must first “Drop Down and Get Their Eagle On.” (They don’t make music videos like they used to, by the way.)

Addressing the Bull Case

The counter-argument to my negative U.S. Dollar liquidity thesis posits that with the U.S. government resuming operations post-shutdown, the TGA will rapidly reduce by $100 billion to $150 billion to meet its $850 billion target, thereby injecting liquidity into the system. Furthermore, the Federal Reserve is expected to halt its balance sheet reduction on December 1 and soon resume balance sheet expansion through Quantitative Easing (QE).

Initially, I was optimistic about risk assets post-shutdown. However, upon deeper examination of the data, I noted that approximately $1 trillion in U.S. Dollar liquidity, according to my index, has evaporated since July. An additional $150 billion is welcome, but what comes after that?

While several Fed governors have hinted at the necessity of resuming QE to rebuild bank reserves and ensure smooth money market operations, this remains mere talk. We will only know they are serious when the Fed’s “whisperer,” Nick Timiraos of The Wall Street Journal, announces the green light for QE. But we’re not there yet. In the interim, the Standing Repo Facility will be utilized to print tens of billions of dollars to ensure money markets can cope with massive Treasury issuance.

Theoretically, Bessent could reduce the TGA to zero. Unfortunately, because the Treasury must roll over tens of billions of dollars in Treasury bills weekly, they must maintain a substantial cash buffer, just in case. They cannot risk defaulting on maturing T-bills, which precludes an immediate injection of the remaining $850 billion into financial markets.

The privatization of government-sponsored mortgage giants Fannie Mae and Freddie Mac will undoubtedly occur, but not within the next few weeks. Banks will also fulfill their “duty” to lend to those manufacturing bombs, nuclear reactors, semiconductors, and so forth, but again, this will unfold over a longer time horizon, and this credit will not immediately flow into the veins of U.S. Dollar money markets.

The bulls are correct; the printing press will indeed “chug-a-lug” over time. But first, the market must retrace its gains since April to better align with liquidity fundamentals.

Finally, before I discuss Maelstrom’s positioning, I do not acknowledge the validity of a “four-year cycle.” Bitcoin and certain altcoins will only achieve new all-time highs after the market has capitulated sufficiently to accelerate the pace of money printing.

Maelstrom’s Strategic Positioning

Last weekend, I increased our U.S. Dollar stablecoin position, anticipating lower cryptocurrency prices. In the short term, I believe the only cryptocurrency poised to outperform the negative U.S. Dollar liquidity situation is Zcash ($ZEC).

With the relentless advancement of artificial intelligence, Big Tech, and Big Government, privacy across much of the internet has all but perished. Zcash and other privacy-focused cryptocurrencies utilizing zero-knowledge proof cryptography represent humanity’s sole opportunity to push back against this new reality. This is why figures like Balaji and others believe the privacy grand narrative will drive crypto markets in the coming years.

As a disciple of Satoshi Nakamoto, I find it offensive that the third, fourth, and fifth largest cryptocurrencies are a U.S. Dollar derivative, a coin doing nothing on a do-nothing chain, and CZ’s centralized computer. If, after 15 years, these remain the largest cryptocurrencies after Bitcoin and Ethereum, what exactly are we doing?

I hold no personal animosity towards Paolo, Garlinghouse, or CZ; they are masters at creating value for their token holders. Founders, take note. But Zcash, or a similar privacy-centric cryptocurrency, should be hot on Ethereum’s heels.

I believe the grassroots crypto community is awakening to the realization that what we tacitly endorse by granting such high market capitalizations to these types of coins or tokens is contradictory to a decentralized future where we, as flesh-and-blood humans, retain agency in the face of technology, government, and AI giants.

Therefore, as we await Bessent to rediscover his money-printing rhythm, Zcash or another privacy-focused cryptocurrency will enjoy a prolonged price appreciation.

Maelstrom remains long-term bullish, and if I have to buy back at higher prices (as I did earlier this year), so be it. I proudly accept my failures because having fiat reserves on hand allows me to make bold, winning bets that truly matter. Being liquid during a repeat of the April 2025 scenario determines your entire cycle’s profit and loss more than having to give back earned scraps to the market due to a losing trade.

Bitcoin’s drop from $125,000 to the low $90,000s, while the S&P 500 and Nasdaq 100 hover at all-time highs, signals to me that a credit event is brewing. My observation of the U.S. Dollar Liquidity Index’s decline since July confirms this perspective.

If my thesis holds true, a 10% to 20% correction in equity markets, coupled with 10-year Treasury yields approaching 5%, will generate sufficient urgency to compel the Federal Reserve, the Treasury, or another U.S. government agency to unveil some form of money-printing scheme.

During this period of weakness, Bitcoin could absolutely dip to $80,000 to $85,000. If broader risk markets implode and the Fed and Treasury accelerate their money-printing charade, then Bitcoin could surge to $200,000 or $250,000 by year-end.