Standard Chartered Strategist Declares Bitcoin Correction Over, Eyes Year-End Rebound and $500K Long-Term

Standard Chartered’s Head of Digital Asset Research, Geoffrey Kendrick, has announced that Bitcoin’s recent price correction appears to have concluded. Kendrick anticipates a significant rebound for the leading cryptocurrency by the end of the year, signaling renewed optimism for the market.

The Case for a Market Bottom

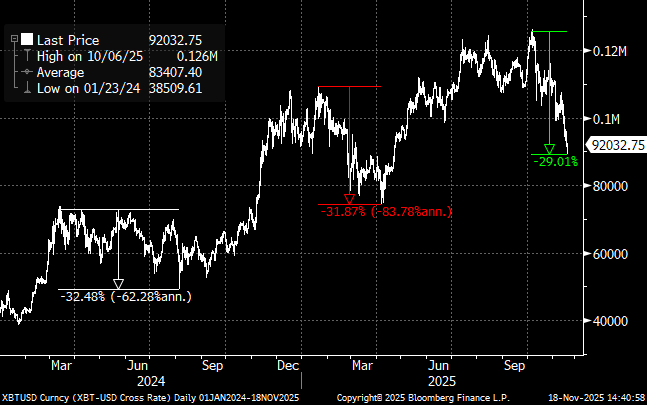

In a report issued on Tuesday, Kendrick highlighted that while Bitcoin’s latest downturn was swift and intense, it aligns perfectly with the characteristics of the “third major sell-off wave” observed during the current bull cycle. Chart patterns reveal that the magnitude of this pullback is strikingly similar to the preceding two corrections.

“This argument sounds simple, but often the simplest logic is the most effective,” Kendrick emphasized.

Kendrick further elaborated that several critical market indicators have reset to “extreme levels,” strongly suggesting a market bottom. A particularly noteworthy metric is Strategy’s “market cap relative to net asset value ratio (mNAV),” which recently plummeted back to “1.0.” This level implies that the company’s stock price merely reflects the value of its Bitcoin holdings, with no additional market premium.

Describing this as a “reset to zero” value, Kendrick firmly believes it indicates a market floor has been reached. He stated:

“I believe this is sufficient proof that the sell-off is over, and it’s enough to refute those who still believe in the ‘Bitcoin halving cycle theory.’ My base case prediction is that Bitcoin will see a rebound by year-end.”

Navigating Recent Volatility and Challenged Predictions

Kendrick’s current outlook comes after a period of significant market turbulence. Last month, he had confidently predicted that, given a continuation of positive political and economic conditions, Bitcoin would likely “never” fall below $100,000 again. However, the market swiftly defied this forecast. Last week, Bitcoin plunged from above $105,000 to below $90,000, effectively erasing nearly all its year-to-date gains. Just yesterday, it touched a low of $89,368 – its lowest point since February – before stabilizing around $92,000.

Adding to the cautious sentiment, Nicolai Sondergaard, an analyst at blockchain data analytics firm Nansen, pointed out that market depth has sharply decreased by approximately 30% since the “largest liquidation event in history” on October 10th. Sondergaard warned:

“With such thin liquidity, it doesn’t take much capital to move the market. Coupled with the leverage effect, severe volatility is naturally unavoidable.”

Other analysts echo these concerns, suggesting that if Bitcoin fails to reclaim the crucial $95,000 to $100,000 range, the market structure remains vulnerable to further deterioration. This risk is exacerbated by increasing on-chain pressure and persistent outflows from Bitcoin ETFs.

Long-Term Optimism Persists

While Kendrick had previously projected Bitcoin could reach $200,000 by year-end, he declined to comment when asked earlier today if he still maintained that ambitious target price.

Nevertheless, his long-term outlook remains resolutely optimistic. Kendrick reiterated his earlier prediction that, driven by increasing investment accessibility and moderating volatility, Bitcoin is poised to surge to an impressive $500,000 by 2028.

Disclaimer: This article is provided for market information purposes only. All content and views are for reference only and do not constitute investment advice, nor do they represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not be held responsible for any direct or indirect losses incurred by investors’ transactions.