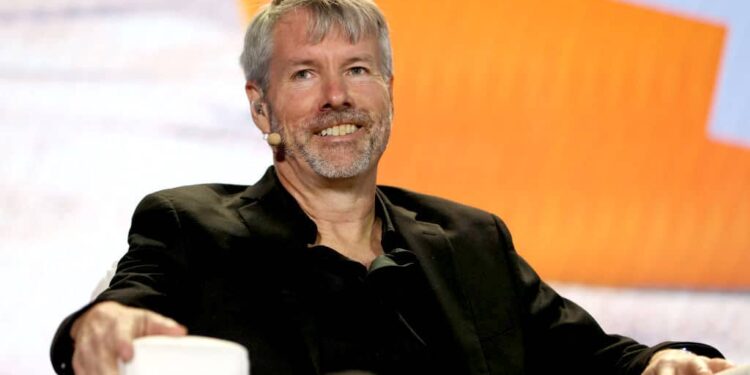

Michael Saylor Challenges Bitcoin Volatility Narrative Amidst Market Correction

The recent significant pullback in Bitcoin’s price has reignited widespread concerns that “Wall Street’s entry is disrupting and influencing crypto price trends.” However, Michael Saylor, Executive Chairman of Strategy, vehemently disagrees with this sentiment. Instead, Saylor posits that Bitcoin’s inherent volatility is consistently on a downward trajectory.

“Bitcoin’s volatility is significantly lower now than it has been in the past,” Saylor affirmed during a recent interview, directly addressing questions about the digital asset’s recent price swings.

Saylor’s Data-Driven Optimism: A Declining Volatility Trend

Despite Saylor’s conviction, recent market performance might suggest otherwise to some investors. According to CoinGecko data, Bitcoin plunged over 11% in the past week, dropping to $91,506 and effectively erasing nearly all its gains for the year.

Yet, Saylor remains steadfast, drawing on historical data from Strategy’s own extensive investment journey into Bitcoin. He recalled that when Strategy began acquiring Bitcoin in 2020, its annualized volatility hovered around 80%. Today, he notes, this figure has impressively reduced to approximately 50%, signaling a significant maturation of the asset class.

Looking ahead, Saylor offers an optimistic forecast: as the Bitcoin market continues to evolve and deepen, he anticipates its volatility could further decrease by about 5 percentage points every few years. Ultimately, he predicts Bitcoin’s volatility will converge to roughly 1.5 times that of the S&P 500, while simultaneously delivering 1.5 times its performance in terms of returns.

Market Data Presents a Contrasting View for Strategy

While Michael Saylor’s confidence in Bitcoin’s long-term trajectory is unwavering, current market metrics paint a somewhat different picture for Strategy, a prominent corporate holder of the digital asset. The company presently holds an impressive 649,870 Bitcoins, valued at approximately $59.59 billion.

However, as Bitcoin’s value has softened, Strategy’s “market cap relative to net asset value ratio (mNAV)” has experienced a notable decline. This crucial ratio, which stood at a robust 1.52x when Bitcoin reached its peak in October, has now slipped to 1.11x. This downward trend indicates a shrinking market premium that investors are currently willing to pay for Strategy’s Bitcoin-centric portfolio.

Reflecting this shift in market sentiment, Strategy’s stock closed at $206.80 on Tuesday, marking an cumulative decline of 11.50% over the preceding five trading days.

Unyielding Resilience Amidst Potential Downturns

Despite the recent decrease in the paper value of his company’s substantial Bitcoin holdings, Michael Saylor remains remarkably unfazed by potential market crashes. He asserts that even in the face of a more drastic Bitcoin downturn, he harbors no concerns:

“This company’s structure is designed to withstand an 80% to 90% drawdown and still continue to operate.”

“I believe we are almost indestructible; our leverage is currently between 10% to 15%, trending towards zero, which is very robust.”

Disclaimer: This article is provided for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views or positions of the author or BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not bear any responsibility for direct or indirect losses incurred by investor transactions.