Author: Nancy, PANews

Altcoin ETFs Arrive on Wall Street: Early Performance and Future Outlook

With the U.S. Securities and Exchange Commission (SEC) fast-tracking crypto ETF approvals and a clearer regulatory landscape emerging, a growing number of altcoins are vying for a coveted spot on Wall Street. Over the past month, eight altcoin ETFs have received approval. However, against a backdrop of a broader downturn in the crypto market, these products have generally encountered limited capital inflows since their launch, struggling to significantly boost token prices in the short term.

Four Major Altcoins Enter Wall Street, but Capital Attraction Remains Modest

Currently, Solana (SOL), Ripple (XRP), Litecoin (LTC), and Hedera (HBAR) have secured their “admission tickets” to Wall Street via spot ETFs. Yet, an analysis of capital flows reveals that their overall appeal remains limited. Several of these ETFs have even experienced multiple days of zero inflows, collectively attracting a net inflow of only approximately $700 million. Furthermore, the launch of these ETFs has generally coincided with a decline in the respective token prices, albeit partly influenced by the broader cryptocurrency market pullback.

Solana (SOL)

The U.S. market currently features five spot Solana ETFs, issued by Bitwise, VanEck, Fidelity, Grayscale, and Canary. Additional products from issuers like 21Shares and CoinShares are also in development.

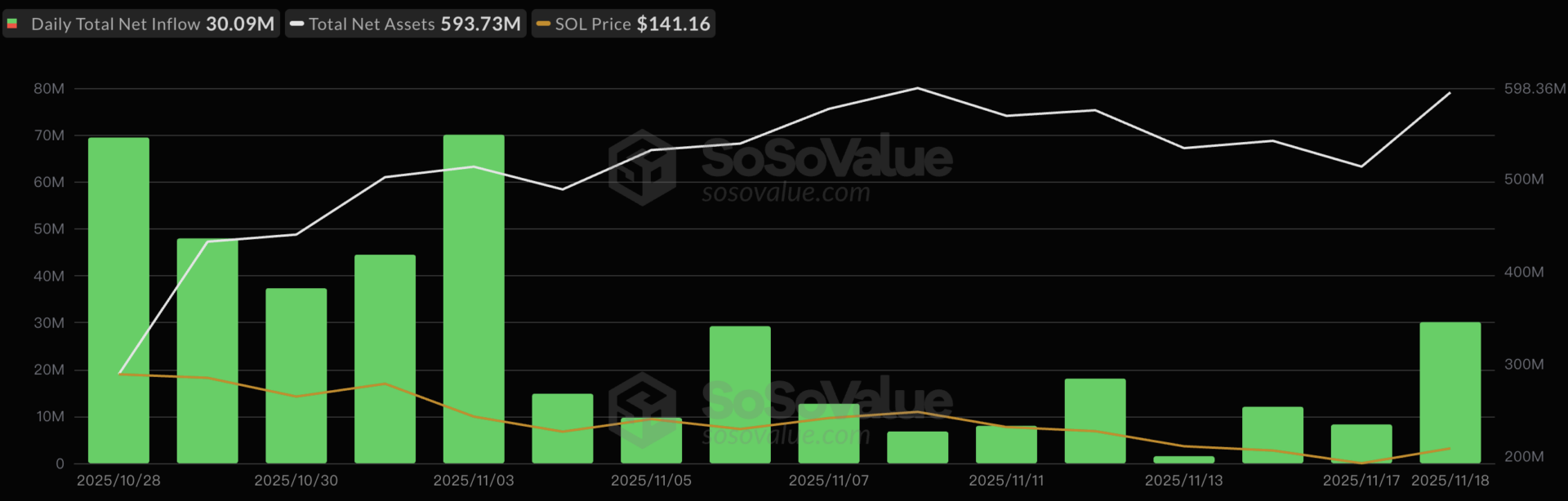

According to SoSoValue data, U.S. spot Solana ETFs have accumulated a total net inflow of approximately $420 million, with a total net asset value (NAV) of $594 million. Bitwise’s BSOL has been the primary driver of trading volume, securing cumulative inflows of $388 million over three weeks. However, a significant portion of this—nearly $230 million—came from initial investments on its first day, with subsequent inflows slowing considerably. Fidelity’s FSOL recorded a net inflow of just $2.07 million on its launch day (November 18), with a total NAV of $99.97 million. Canary’s SOLC saw no net inflow on its launch day, holding a total NAV of $820,000. Notably, all spot ETF issuers support staking functionality, a feature that could provide some underlying market demand.

Despite the ETF launches, CoinGecko data indicates that the price of SOL has fallen by 31.34% since the first Solana spot ETF went live on October 28.

XRP (XRP)

In the U.S. spot XRP ETF market, Canary’s XRPC is currently the sole listed product. Related offerings from CoinShares, WisdomTree, Bitwise, and 21Shares are in various stages of preparation.

SoSoValue data shows that XRPC has accumulated net inflows exceeding $270 million since its inception. Its first day of trading saw $59.22 million in volume but no net inflow. The following day, it achieved a substantial net inflow of $243 million through cash or in-kind subscriptions, alongside a trading volume of $26.72 million.

CoinGecko data reveals that the price of XRP has declined by approximately 12.71% since the first Ripple spot ETF was listed on November 13.

Litecoin (LTC)

At the end of October, Canary Capital officially launched LTCC, the first U.S. ETF to track Litecoin. CoinShares and Grayscale are also preparing related products, expected to follow suit.

SoSoValue data indicates that as of November 18, LTCC had accumulated approximately $7.26 million in net inflows. Daily net inflows have generally been modest, often in the hundreds of thousands of dollars, with several days recording zero inflows.

CoinGecko data shows that the price of LTC has dropped by about 7.4% since the first Litecoin spot ETF launched on October 28.

Hedera (HBAR)

The first U.S. ETF tracking HBAR, named HBR, was also introduced by Canary Capital late last month. SoSoValue data as of November 18 shows HBR with cumulative net inflows of approximately $74.71 million. Nearly 60% of this capital flowed in during the first week, after which net inflows significantly decreased, with some days experiencing zero activity.

According to CoinGecko data, HBAR’s price has fallen by approximately 25.84% since the first Hedera spot ETF went live on October 28.

Beyond these projects, spot ETFs for other crypto assets such as DOGE, ADA, INJ, AVAX, BONK, and LINK are currently in progress. Bloomberg analyst Eric Balchunas, for instance, anticipates Grayscale’s Dogecoin ETF to launch around November 24.

Crypto ETF Expansion Cycle Commences, Yet Listing Performance Faces Headwinds

According to incomplete statistics from Bloomberg, the crypto market has seen 155 Exchange Traded Product (ETP) applications covering 35 digital assets, including Bitcoin, Ethereum, Solana, XRP, and LTC. This signals a rapid, land-grab-like expansion. With the resolution of the U.S. government shutdown, the approval process for these ETFs is expected to accelerate.

The progressively clearer U.S. regulatory environment is poised to trigger a new wave of crypto ETF applications. The SEC has already approved general listing standards for crypto ETFs and recently issued new guidance to expedite the effectiveness of ETF filings. Furthermore, in its latest annual fiscal year review focus document, the SEC notably removed the previously standard chapter dedicated to cryptocurrency projects. This marks a stark contrast to the tenure of former Chair Gary Gensler, when cryptocurrencies, particularly spot Bitcoin and Ethereum ETFs, were explicitly highlighted as review priorities.

Moreover, the introduction of staking functionality is expected to stimulate institutional investor demand, thereby attracting more issuers to the ETF application queue. Research from Swiss crypto bank Sygnum indicates that despite recent market corrections, institutional confidence in crypto assets remains robust. Over 80% of institutions expressed interest in crypto ETFs beyond Bitcoin and Ethereum, with 70% stating they would initiate or increase investments if ETFs offered staking yields. Positive signals regarding ETF staking have also emerged at the policy level; U.S. Treasury Secretary Scott Bessent recently announced collaboration with the IRS to update guidance, providing regulatory support for staking-enabled cryptocurrency ETPs. This measure is anticipated to potentially accelerate the approval of Ethereum staking ETPs and pave the way for multi-chain staking products across networks like Solana, Avalanche, and Cosmos.

However, altcoin ETFs currently face insufficient capital attraction due to a confluence of factors, including market size, liquidity, volatility, and prevailing market sentiment.

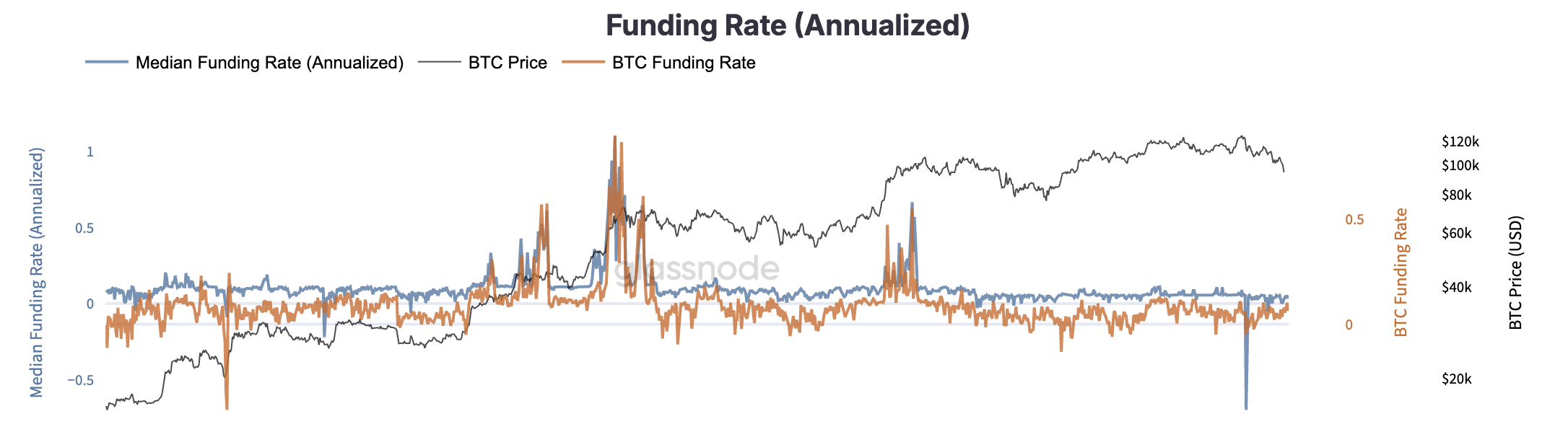

Firstly, altcoins inherently possess limited market size and liquidity. CoinGecko data as of November 18 shows Bitcoin accounting for nearly 60% of the total market capitalization. Excluding Ethereum and stablecoins, other altcoins collectively represent only 19.88%. This results in poorer liquidity for the underlying assets of altcoin ETFs. Furthermore, compared to Bitcoin and Ethereum, altcoins are more susceptible to short-term narratives, exhibit higher volatility, and are generally considered high-risk Beta assets. Glassnode data reveals that since the beginning of the year, altcoin realized profits have largely fallen into deep capitulation zones, showcasing a significant divergence from Bitcoin—a pattern rarely seen in previous cycles. Consequently, altcoin ETFs, especially single-token ETFs, struggle to attract large-scale investors. In the future, investors may lean towards diversified, basket-style altcoin ETF strategies to mitigate risk and enhance potential returns.

Secondly, altcoins confront risks related to market manipulation and transparency. Many altcoins suffer from insufficient liquidity, making them prone to price manipulation. The net asset value (NAV) estimation of an ETF relies on the underlying asset’s price; if an altcoin’s price is manipulated, it directly impacts the ETF’s value, potentially leading to legal risks or regulatory investigations. Additionally, some altcoins may be classified as unregistered securities. The SEC is currently advancing its token classification initiative to distinguish whether cryptocurrencies fall under securities regulations.

Finally, the uncertainty of the macroeconomic environment exacerbates investor risk aversion. In a climate of generally low confidence, investors tend to favor traditional assets like U.S. stocks and gold. Moreover, altcoin ETFs lack the brand recognition and market acceptance enjoyed by Bitcoin or Ethereum spot ETFs, particularly the endorsement of major institutions like BlackRock. The distribution networks, brand effects, and market trust brought by leading issuers are difficult to replicate, further diminishing the appeal of altcoin ETFs in the current environment.

(The above content is an authorized excerpt and reprint from our partner PANews, original link)

Disclaimer: This article is for market information purposes only. All content and views are for reference only, do not constitute investment advice, and do not represent the views or positions of the author or BlockCast. Investors should make their own decisions and trades. The author and BlockCast will not be liable for any direct or indirect losses incurred by investors’ transactions.